GOVERNANCE GUIDELINES

The Company has approved of Governance Guidelines on Board Effectiveness. The Governance Guidelines cover aspects related to composition and role of the Board, Chairman and Directors, Board diversity, definition of independence, Director term, retirement age and Committees of the Board. It also covers aspects relating to nomination, appointment, induction and development of Directors, Director remuneration, Subsidiary oversight, Code of Conduct, Board Effectiveness Review and Mandates of Board Committees.

Selection and procedure for nomination and appointment of Directors

The Nomination and Remuneration Committee is responsible for developing competency requirements for the Board based on the industry and strategy of the Company. The Board composition analysis reflects in-depth understanding of the Company, including its strategies, environment, operations, financial condition and compliance requirements.

The Nomination and Remuneration Committee conducts a gap analysis to refresh the Board on a periodic basis, including each time a Director's appointment or re-appointment is required. The Committee is also responsible for reviewing and vetting the CVs of potential candidates vis-�-vis the required competencies, undertake a reference and due diligence and meeting potential candidates, prior to making recommendations of their nomination to the Board. At the time of appointment, specific requirements for the position, including expert knowledge expected, is communicated to the appointee.

Criteria for Determining Qualifications, Positive Attributes and Independence of a Director

The Nomination and Remuneration Committee has formulated the criteria for determining qualifications, positive attributes and independence of Directors in terms of provisions of Section 178 (3) of the Act and Clause 49 of the Listing Agreement, which is annexed as Annexure-4.

REMUNERATION POLICY

The Company has in place a Remuneration Policy for the Directors, Key Managerial Personnel and other employees, pursuant to the provisions of the Act and Clause 49 of the Listing Agreement, the same is annexed as Annexure-5.

BOARD EVALUATION

Pursuant to the provisions of the Act and the corporate governance requirements as prescribed by SEBI under Clause 49 of the Equity Listing Agreement, the Board of Directors ("Board") has carried out an annual evaluation of its own performance, and that of its Committees and individual Directors.

The performance of the Board and individual Directors was evaluated by the Board seeking inputs from all the Directors. The performance of the Committees was evaluated by the Board seeking inputs from the Committee Members. The Nomination and Remuneration Committee ("NRC") reviewed the performance of the individual Directors. A separate meeting of Independent Directors was also held to review the performance of Non-Independent Directors; performance of the Board as a whole and performance of the Chairperson of the Company, taking into account the views of Executive Directors and Non-Executive Directors. This was followed by a Board meeting that discussed the performance of the Board, its Committees and individual Directors.

The criteria for performance evaluation of the Board included aspects like Board composition and structure; effectiveness of Board processes, information and functioning etc. The criteria for performance evaluation of Committees of the Board included aspects like composition of Committees, effectiveness of Committee meetings etc. The criteria for performance evaluation of the individual Directors included aspects on contribution to the Board and Committee meetings like preparedness on the issues to be discussed, meaningful and constructive contribution and inputs in meetings etc. In addition the Chairperson was also evaluated on the key aspects of his role.

FAMILIARISATION PROGRAMME FOR INDEPENDENT DIRECTORS

The details of the programme for familiarisation of the Independent Directors with the Company in respect of their roles, rights, responsibilities in the Company, nature of the industry in which Company operates, business model of the Company and related matters are put up on the website of the company (URL:www.tatamotors.com/investors/pdf/familiarisation-programme-independent-directors.pdf).

BOARD MEETINGS

A calendar of Meetings is prepared and circulated in advance to the Directors. During the year under review, ten Board Meetings were convened and held.

Details of the composition of the Board and its Committees and of the Meetings held, attendance of the Directors at such Meetings and other relevant details are provided in the Corporate Governance Report.

VIGIL MECHANISM

The Company has adopted a Whistle Blower Policy establishing vigil mechanism, to provide a formal mechanism to the Directors and employees to report their concerns about unethical behaviour, actual or suspected fraud or violation of the Company's Code of Conduct or ethics policy. The Policy provides for adequate safeguards against victimization of employees who avail of the mechanism and also provides for direct access to the Chairman of the Audit Committee. It is affirmed that no personnel of the Company has been denied access to the Audit Committee. The policy of vigil mechanism is available on the Company's website (URL: www.tatamotors.com/investors/pdf/whistleblower-policy.pdf).

PARTICULARS OF EMPLOYEES

The information on employees who were in receipt of remuneration of not less than Rs. 60 lakhs during the year or Rs. 5 lakhs per month during any part of the said year as required under Section 197 (12) of the Act read with Rule 5 of the Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014 is provided in the Annexure forming part of the Report. In terms of proviso to Section 136(1) of the Act, the Report and Accounts are being sent to the shareholders excluding the aforesaid Annexure. The said statement is also open for inspection at the registered office of the Company. Any member interested in obtaining a copy of the same may write to the Company Secretary.

Disclosure pertaining to remuneration and other details as required under Section 197(12) of the Act read with Rule 5(1) of the Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014 are Annexed to the report as Annexure-6.

CORPORATE SOCIAL RESPONSIBILITY INITIATIVES

The brief outline of the Corporate Social Responsibility (CSR) Policy of the Company and the initiatives undertaken by the Company on CSR activities during the year are set out in Annexure-7 of this report in the format prescribed in the Companies (CSR Policy) Rules, 2014. The Policy is available on the Company's website (URL: www.tatamotors.com/investors/pdf/csr-policy-23july14.pdf).

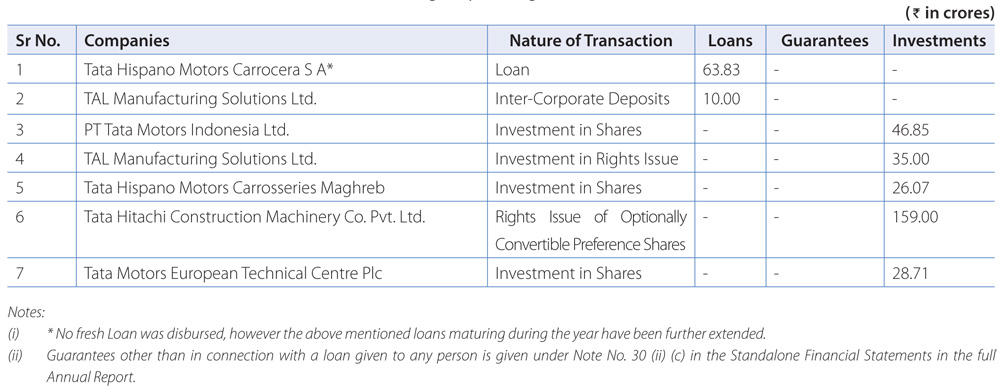

PARTICULARS OF LOANS, GUARANTEES OR INVESTMENTS BY THE COMPANY

The details of Loans, Guarantees or Investments made during the year are given below:

PARTICULARS OF CONTRACTS OR ARRANGEMENTS WITH RELATED PARTIES

All contracts/arrangements/transactions entered by the Company during the financial year with related parties were on an arm's length basis, in the ordinary course of business and were in compliance with the applicable provisions of the Act and the Listing Agreement. There are no materially significant Related Party Transactions made by the Company with Promoters, Directors, Key Managerial Personnel or other designated persons which may have a potential conflict with the interest of the Company at large.

All Related Party Transactions are placed before the Audit Committee comprising Mr N Munjee, Chairman, Dr R A Mashelkar, Mr V K Jairath and Ms Falguni Nayar being the Independent Directors of the Company, for its approval. A statement of all Related Party Transactions is placed before the Audit Committee for its review on a quarterly basis, specifying the nature, value and terms and conditions of the transactions.

The Company has adopted a Related Party Transactions Policy. The Policy, as approved by the Board, is uploaded on the Company's website (URL:www.tatamotors.com/investors/pdf/rpt-policy.pdf).

There have been no materially significant related party transactions between the Company and Directors, the management, subsidiaries or relatives.

During the Fiscal 2015 there are no material transactions between the Company and the related parties as defined under Clause 49 of the Listing Agreement. Further, all transactions with related parties have been conducted at an arm's length basis and are in ordinary course of business. Accordingly there are no transactions that are required to be reported in Form AOC-2 and as such does not form part of the Report.

AUDIT

In the last Annual General Meeting (AGM) held on July 31, 2014, M/s. Deloitte Haskins & Sells LLP, (DHS), Chartered Accountants have been appointed Statutory Auditors of the Company for a period of 3 years. Ratification of appointment of Statutory Auditors is being sought from the Members of the Company at this AGM. Further, DHS have, under Section 139(1) of the Act and the Rules framed thereunder furnished a certificate of their eligibility and consent for appointment.

Further, the report of the Statutory Auditors alongwith notes to Schedules is enclosed to this report. The observations made in the Auditors' Report are self-explanatory and therefore do not call for any further comments.

The Auditor's Report does not contain any qualification, reservation or adverse remark.

COST AUDIT

As per Section 148 of the Act, the Company is required to have the audit of its cost records conducted by a Cost Accountant in practice. The Board of Directors of the Company has on the recommendation of the Audit Committee, approved the appointment of M/s Mani & Co. having registration No.000004 as the cost auditors of the Company to conduct cost audits pertaining to relevant products prescribed under the Companies (Cost Records and Audit) Rules, 2014 as amended from time to time for the year ending March 31, 2016, at a remuneration of Rs. 5 lakhs plus out of pocket expenses.

M/s Mani & Co., have vast experience in the field of cost audit and have conducted the audit of the cost records of the Company for the past several years under the provisions of the erstwhile Companies Act, 1956.

SECRETARIAL AUDIT

Pursuant to the provisions of Section 204 of the Act and The Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014, the Company has appointed M/s Parikh & Associates, a firm of Company Secretaries in practice to undertake the Secretarial Audit of the Company. The Report of the Secretarial Audit is annexed herewith as Annexure-8. The Secretarial Audit Report does not contains any qualifications, reservation or adverse remarks.

DIRECTORS' RESPONSIBILITY STATEMENT

Based on the framework of internal financial controls and compliance systems established and maintained by the Company, work performed by the internal, statutory, cost, external agencies and secretarial auditors and the reviews performed by Management and the relevant Board Committees, including the Audit Committee, the Board is of the opinion that the Company's internal financial controls were adequate and effective during the financial year 2014-15.

Accordingly, pursuant to Section 134(5) of the Act, the Board of Directors, to the best of their knowledge and ability, confirm that:

- in the preparation of the annual accounts, the applicable accounting standards have been followed and that there are no material departures;

- they have selected such accounting policies and applied them consistently and made judgments and estimates that are reasonable and prudent so as to give a true and fair view of the state of affairs of the Company at the end of the financial year and of the loss of the Company for that period;

- they have taken proper and sufficient care for the maintenance of adequate accounting records in accordance with the provisions of this Act for safeguarding the assets of the Company and for preventing and detecting fraud and other irregularities;

- they have prepared the annual accounts on a going concern basis;

- they have laid down internal financial controls to be followed by the Company and that such internal financial controls are adequate and were generally operating effectively*; and

- they have devised proper systems to ensure compliance with the provisions of all applicable laws and that such systems are adequate and operating effectively.

* Please refer to the Section "Internal Control Systems and their Adequacy in the Management Discussion and Analysis.

ACKNOWLEDGEMENTS

The Directors wish to convey their appreciation to all of the Company's employees for their enormous personal efforts as well as their collective contribution to the Company's performance. The Directors would also like to thank the employee unions, shareholders, customers, dealers, suppliers, bankers, Government and all the other business associates for the continuous support given by them to the Company and their confidence in its management.

On behalf of the Board of Directors

CYRUS P MISTRY

Chairman

Mumbai, May 26, 2015