Tata Daewoo Commercial Vehicles Company Limited

Tata Daewoo Commercial Vehicles Company Limited (TDCV) sold 11,710 vehicles, higher by 10.5% over Fiscal 2014. TDCV Domestic sales were at 6,808 vehicles, second highest in its history, registering a growth of 3.4% compared to 6,584 vehicles sold in previous year. In Export market, TDCV achieved its highest ever sales of 4,902 vehicles with a robust growth of 22.1% in spite of adverse economic and business conditions in markets like Russia, South Africa, Laos, Indonesia etc. This strong export performance was possible due to higher sales in countries like Vietnam, Philippines, UAE etc.

Tata Motors (Thailand) Limited

Tata Motors (Thailand) Limited (TMTL) sold 1,305 units in Fiscal 2015, a drop of 47.4% over Fiscal 2014. The retail sales figure were 1,417 units. The Thai Automobile Industry has witnessed the 2nd year of drop of 27% in Fiscal 2015 due to political instability and poor performance of the economy. Thailand also witnessed a slew of new pickup launches by major OEM's in the year. In spite of the slow-down, TMTL has increased its market share in "CNG and Bi-Fuel Pickups segment" by 8% (Market Share of 22.1%) to become the third largest player in the segment.

TMTL has taken the opportunity to refresh its Products, Services and Network, as well as, expand the range of offerings to the Thailand Customers. Fiscal 2016 will see the launch of the Xenon 150N Series of Pickup with a host of new features like 4x4, ABS, Airbags and Accessorized Exteriors etc. TMTL will also introduce the Tata Prima, TDCV Novus range of trucks and Super ACE Mint to supplement the existing range it offers to the Thailand consumer. It also exported the 1st batch of Pickups to Malaysia in the month of December 2014 and is exploring similar opportunities in other parts of South East Asia and neighbouring continents.

Tata Motors (SA) (Pty) Limited

Tata Motors (SA) (Pty) Ltd (TMSA) sold 839 chassis in the South Africa market in Fiscal 2015. This included the sale of 30 chassis of a tractor truck model from TDCV with the objective of expanding the TATA presence in the fastest growing (extra Heavy) segment of Commercial Vehicles in South Africa. TMSA is in the process of homologating and intorducing a range of new products including PRIMA and Ultra trucks as well as a couple of bus models for sale in South Africa.

Tata Motors Finance Limited

The vehicle financing activity under the brand "Tata Motors Finance" of Tata Motors Finance Limited (TMFL) – a wholly owned subsidiary Company.

During the year, TMFL had acquired 100% shareholding of, Rajasthan Leasing Private Limited (RLPL), an NBFC registered with the Reserve Bank of India. Subsequently, the name of RLPL has been changed to Tata Motors Finance Solutions Private Limited (TMFSPL). As a part of business restructuring, manufactured guaranteed business and used vehicles business along with employees was transferred to TMFSL on slump sale basis with effect from March 31, 2015.

Due to sluggish economic environment, total disbursements (including refinance) were declined in Fiscal 2015 by 16.6% at Rs. 7,316 crores as compared to Rs. 8,768 crores in previous year. TMFL financed a total of 1,12,788 vehicles reflecting a decline of 28.6% over the 157,886 vehicles financed in the previous year. Disbursements for commercial vehicles declined by 23.5% and were at Rs. 5,741 crores (72,853 units) as compared to Rs. 7,504 crores (123,989 units) of the previous year. Disbursements of passenger vehicles increased by 23.5% to Rs. 1,498 crores (38,444 units) from a level of Rs. 1,213 crores (32,637 units). Disbursements achieved under refinance were at Rs. 77 crores (1,491 vehicles) during the current year as against Rs. 50 crores (1,260 vehicles) in the previous year.

TMFL has increased its reach by opening limited services branches (called Spoke and collections branches) exclusively in Tier 2 & 3 towns, which has helped in reducing the turn-around-times to improve customer satisfaction. TMFL has also launched business of vendor financing and subscribing to assignment of the Company's receivables during the year amounting to Rs. 53 crores and Rs. 145 cores, respectively. TMFL has also tied up with the Company's used vehicle business for working together to improve realization value from the sale of repossessed stocks by refurbishing them and selling them through Company's dealers.

MATERIAL CHANGES AND COMMITMENT AFFECTING THE FINANCIAL POSITION OF THE COMPANY

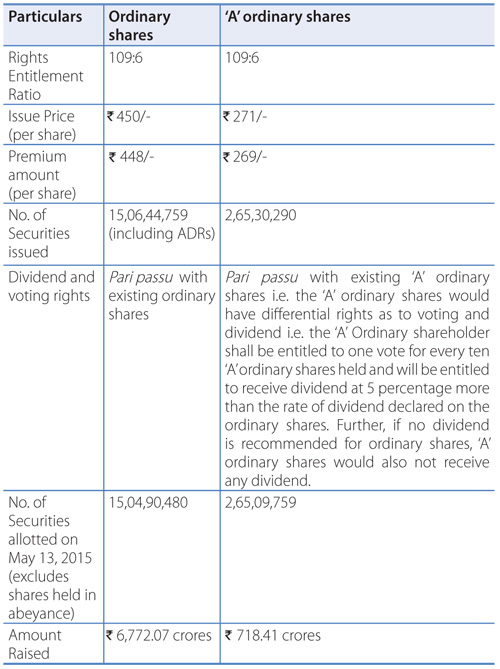

In March 2015, the Board of Directors approved issue of Ordinary Shares and 'A' Ordinary Shares on a rights basis to the eligible shareholders. The details of Rights Issue is given under the head "Share Capital". The Letter of Offer for the Rights Issue was filed with the Securities Exchange Board of India (SEBI), BSE Limited (the "BSE") and National Stock Exchange of India Limited (the "NSE") on March 30, 2015 by the Company.

Subsequent to the year ended March 31, 2015, the Company successfully completed Rights Issue and on May 13, 2015 allotted shares to the eligible shareholders. The total proceeds received from the Rights Issue aggregated to Rs. 7,490.48 crores.

Apart from the Rights Issue mentioned above, there are no material changes affecting the financial position of the Company subsequent to the close of Fiscal 2015 till the date of this report.

SHARE CAPITAL

The Board of Directors of the Company at their meeting held on March 25, 2015 approved the issue of Ordinary Shares [including the rights offering to ADR holders, and facilitated issuance of American Depositary Shares ("ADSs") each of which represents 5 ordinary shares] and 'A' ordinary shares of face value of Rs. 2/- each on rights basis to the holders of ordinary shares and 'A' ordinary shares respectively, aggregating upto Rs. 7,500 crores. The details of the Rights Issue are given hereunder:

SIGNIFICANT AND MATERIAL ORDERS PASSED BY THE REGULATORS OR COURTS OR TRIBUNALS

There are no significant material orders passed by the Regulators or Courts or Tribunal which would impact the going concern status of the Company and its future operation.

However, Members attention is drawn to the Statement on Contingent Liabilities, commitments in the notes forming part of the Financial Statement.

RISK MANAGEMENT

The Company has in October 2014 constituted a Risk Management Committee (RMC) which has been entrusted with responsibility to assist the Board in (a) Overseeing the Company's risk management process and controls, risk tolerance and capital liquidity and funding (b) Setting strategic plans and objectives for risk management and review of risk assessment of the Company (c) Review the Company's risk appetite and strategy relating to key risks, including credit risk, liquidity and funding risk, market risk, product risk and reputational risk, as well as the guidelines, policies and processes for monitoring and mitigating such risks.

The Committee has also approved and adopted Risk Committee Charter. The Company has adopted a Risk Management Policy in accordance with the provisions of the Companies Act, 2013 (hereinafter referred to as the Act) and Clause 49 of the Listing Agreement. It establishes various levels of accountability and overview within the Company, while vesting identified managers with responsibility for each significant risk.

The Board takes responsibility for the overall process of risk management in the organisation. Through Enterprise Risk Management programme, Business Units and Corporate functions address opportunities and the attendant risks through an institutionalized approach aligned to the Company's objectives. This is facilitated by internal audit. The business risk is managed through cross functional involvement and communication across businesses. The results of the risk assessment and residual risks are presented to the senior management. Prior to constituting the RMC, the Audit Committee was reviewing business risk areas covering operational, financial, strategic and regulatory risks.

INTERNAL FINANCIAL CONTROLS WITH REFERENCE TO THE FINANCIAL STATEMENT

Details of internal financial control and its adequacy are included in the Management Discussion and Analysis Report, which forms part of this Report.

HUMAN RESOURCES

The Tata Motors Group employed 73,485 permanent employees (previous year: 68,889 employees) as of the year end. The Company employed 27,997 permanent employees (previous year: 29,566 employees) as of the year end. The Tata Motors Group has generally enjoyed cordial relations with its employees and workers.

A Voluntary Retirement Scheme (VRS) was rolled out for Bargainable employees from February 28, 2015 to April 18, 2015 with the objective of addressing the wage and salary costs.

In keeping with Tata Motors' practices, a generous benefits package was offered to employees who opted for the scheme, including a monthly payout (Basic + DA) that begins at the date of separation till the employee turns 60 years of age, thus ensuring an assured monthly income as opposed to just a one-time payment of a single amount. A unique feature of the offer is also the provision of a medical insurance cover for a period of 10 years post separation.

A total of 686 employees (TML – 599 and TML Drivelines – 87) opted for the Scheme.

All employees in India belonging to the operative grades are members of labour unions except at Sanand and Dharwad plants. All the wage agreements have been renewed in a timely manner and are all valid and subsisting. Operatives and Unions support in implementation of reforms that impact quality, cost erosion and improvements in productivity across all locations is commendable.

Safety & Health – Performance & Initiatives

As part of Company's Safety Excellence Journey which aims to achieve ultimate Goal of Zero Injuries to its employees and all stakeholders associated with the Company's operations, Company provides a safe and healthy workplace focussing on creating right Safety Culture across the organization.

Company has identified four drivers which will help keep moving in this journey and attain Zero Injury. The drivers being Engagement at all Levels, Governance, Robust Safety Processes and Improving Safe Behaviours.

The Company's India operation, has achieved improved performance with Lost Time Injury Frequency Rate (LTIFR) being 0.20 for the Fiscal 2015, a reduction in injury rate by 48% over Fiscal 2014. While overall Safety Performance has improved but there were two fatalities during the year, one in Dealers workshop and one involving Driver in Bus parking area of a plant.

All India Manufacturing Plants in India are certified to ISO 14001 - Environment Management Systems. All CV and PV Manufacturing Plants in India are also certified to OHSAS 18001 – Occupational Health & Safety Management System. All CV Manufacturing Plants in India are certified to ISO 50001 - Energy Management System. The Company at all plants level has undertaken several initiatives for resource conservation such as re-cycling of treated effluents back to process, energy and material recovery from hazardous wastes and rainwater harvesting. Plants also generate in-house renewable power and source off-site green power where available.

Senior Leadership is fully committed and engaged in this journey and has set up a very robust Governance and Engagement model at various level right from having Safety Health and Environment Committee at Board, Business, Site, Corporate, Sub-committees and Factory Implementation Committees.

Company continued Campaign 'i-drive safe' – a Tata Motors initiative on building a safe driving culture amongst its employee and associates and have trained on Defensive Driving Training, in excess of 15,808 employees & associates till date under this campaign initiated few years ago.

In health area Company under the 'Health Plus Because you matter!' initiative engaged employees on various subject of Health Series of initiatives like awareness sessions, mailers, etc. have been conducted under this initiative.

The Jaguar Land Rover business drives its health and safety ambition through its campaign - Destination Zero – A Journey to Zero Harm. This is overseen by the statements on the Jaguar Land Rover, 'Blueprint for Lasting Success' with the overall commitment that states 'Our most valuable asset is our people, nothing is more important than their safety and wellbeing. Our co-workers and families rely on this commitment. There can be no compromise". The business maintains its accreditation to the external standard of OHSAS18001 with zero major non-compliances being recorded after a series of external assessments during the last year. During Fiscal 2015, Jaguar Land Rover achieved reduction in recorded lost time cases of 47% over the previous year. The activities deployed to deliver this ambition of Zero Harm are underpinned with everyone being encouraged to understand and take responsibility for their own and their fellow workers safety and well-being. During the last quarter the business has launched the Wellbeing Charter – a framework to deliver excellence in wellbeing activities and strategies. This is a journey Jaguar Land Rover is embarking on, to achieve and sustain excellence in this subject.

TDCV Korea achieved an improvement in Safety Index to 1.45 from 2.74 in Fiscal 2015. There has been continued leadership commitment and engagement with focus in areas Safety Communication, Risk Assessment, improving capabilities of employees for Emergency Situations. TMTL, Thailand and TMSA, South Africa continued good performance in area of Safety and Health during the Fiscal 2015.

Prevention of Sexual Harassment

The Company has zero tolerance for sexual harassment at workplace and has adopted a Policy on prevention, prohibition and redressal of sexual harassment at workplace in line with the provisions of the Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Act, 2013 and the Rules thereunder for prevention and redressal of complaints of sexual harassment at workplace. The Company is committed to providing equal opportunities without regard to their race, caste, sex, religion, colour, nationality, disability, etc. All women associates (permanent, temporary, contractual and trainees) as well as any women visiting the Company's office premises or women service providers are covered under this policy. All employees are treated with dignity with a view to maintain a work environment free of sexual harassment whether physical, verbal or psychological.

During Fiscal 2015, the Company has received three complaints on sexual harassments, which have been substantiated and appropriate actions were taken. 41 workshops or awareness program were carried out against sexual harassment. There were no complaints pending for more than 90 days during the year.

Similar initiatives on Prevention of Sexual Harassment are in place accross the Tata Motors Group of Companies.