OTHER COMMITTEES

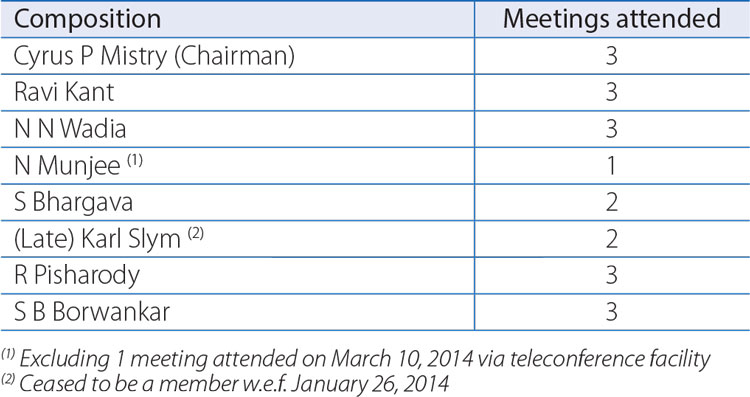

The Executive Committee of the Board reviews capital and revenue budgets, long-term business strategies and plans, the organizational structure of the Company, real estate and investment transactions, allotment of shares and/or debentures, borrowing and other routine matters. The Committee also discusses the matters pertaining to legal cases, acquisitions and divestment, new business forays and donations. During the year under review, three Committee meetings were held on July 4, 2013, January 9, 2014 and March 10, 2014. The Executive Committee of Board comprises three Independent Directors, two Non-Executive Directors and two Executive Directors. The composition of the Executive Committee of Board and attendance at meetings is given hereunder:

The Executive Committee of the Board had constituted a Donations Committee in 2003, however no meetings of the Donations Committee were held during the year under review.

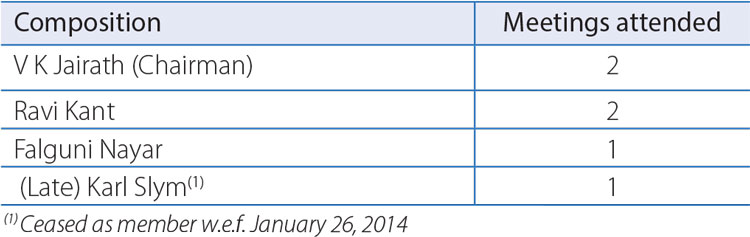

The Ethics and Compliance Committee was constituted to formulate policies relating to the implementation of the Tata Code of Conduct for Prevention of Insider Trading (the Code), take on record the monthly reports on dealings in securities by the "Specified Persons" and decide penal action in respect of violations of the applicable regulations/the Code. During the year under review, two meetings of the Committee were held on August 21, 2013 and March 28, 2014. The composition of the Ethics and Compliance Committee and attendance at meetings, is given hereunder:

Mr C Ramakrishnan, Chief Financial Officer, acts as the Compliance Officer under the said Code.

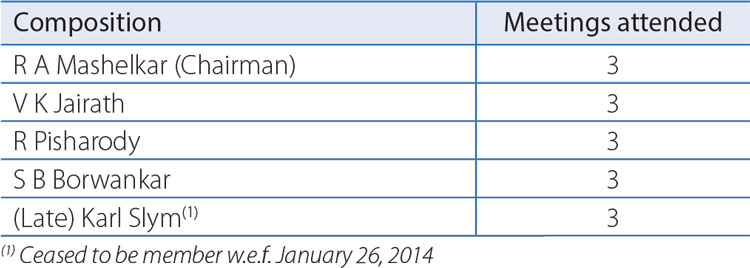

The Safety, Health and Environment (SHE) Committee was constituted by the Board of Directors on February 14, 2013, with the objective of reviewing Safety, Health and Environment practices. During the year under review, three meetings of the Committee were held on June 5, 2013, November 7, 2013 and January 16, 2014. The composition of the SHE Committee and attendance at the meetings is given hereunder:

Corporate Social Responsibility (CSR) Committee: The Executive Committee of the Board had earlier constituted a CSR Committee in 2003. The Board of Directors had at its meeting held on November 8, 2013 reconstituted the CSR Committee in accordance with the provisions of Section 135 of the Act. The terms of reference of the Committee are to:

- Formulate and recommend to the Board, a Corporate Social Responsibility Policy which shall indicate the activities to be undertaken by the Company as specified in Schedule VII;

- Recommend the amount of expenditure to be incurred on the activities referred to in clause (a); and

- Monitor the Corporate Social Responsibility Policy of the Company from time to time.

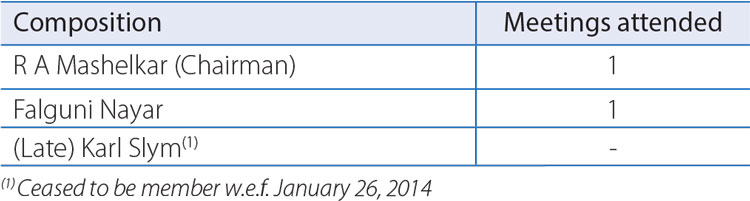

During the year under review, one meeting of the Committee was held on March 14, 2014. The composition of the CSR Committee and attendance at its meeting is given hereunder:

Need Based Committees: Apart from the above, the Board of Directors also constitutes Committee(s) of Directors and/or Executives with specific terms of reference, as it deems fit. In this regard the following two Committee were constituted:

- Sub Committee of the Audit Committee was constituted, comprising of two members Mr N Munjee, Chairman and Ms Falguni Nayar. During the year under review a meeting of the Committee was held on December 10, 2013, attended by both its members.

- Fund Raising Committee of the Board was constituted, comprising of three members Mr Cyrus Mistry, Chairman, Mr N Munjee and Ms. Falguni Nayar. During the year under review a meeting of the Committee was held on March 25, 2014, attended by all its members.

Code of Conduct: Whilst the Tata Code of Conduct is applicable to all Whole-time Directors and employees of the Company, the Board has also adopted a Code of Conduct for Non-Executive Directors, both of which are available on the Company's website. All the Board members and Senior Management of the Company as on March 31, 2014 have affirmed compliance with their respective Codes of Conduct. A Declaration to this effect, duly signed by the Executive Director is annexed hereto.

SUBSIDIARY COMPANIES

The Company does not have any material non-listed Indian subsidiary company and hence, it is not required to have an Independent Director of the Company on the Board of such subsidiary company, in terms of Clause 49 (III) of the Listing Agreement. Mr Munjee, an Independent Director of the Company is also on the Board of Jaguar Land Rover Automotive Plc and Tata Motors Finance Limited. The Audit Committee also has a meeting wherein the CEO and CFO of the subsidiary companies make a presentation on significant issues in audit, internal control, risk management, etc. Significant issues pertaining to subsidiary companies are also discussed at Audit Committee meetings of the Company. Apart from disclosures made in the Directors' Report, there were no strategic investments made by the Company's non-listed subsidiaries during the year under review.

The minutes of the subsidiary companies are placed before the Board of Directors of the Company and the attention of the Directors is drawn to significant transactions and arrangements entered into by the subsidiary companies. The performance of its subsidiaries is also reviewed by the Board periodically.

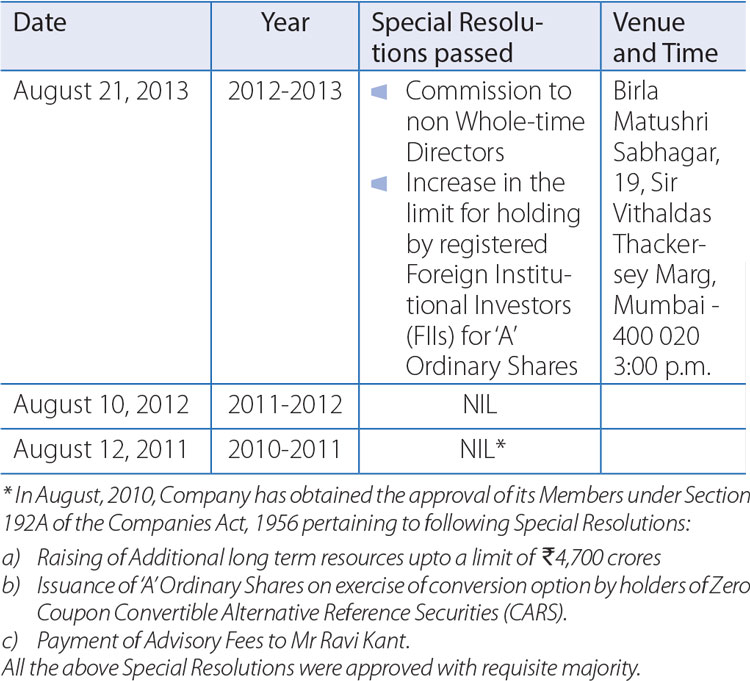

GENERAL BODY MEETINGS

All resolutions moved at the last Annual General Meeting were passed by a show of hands by the requisite majority of Members attending the meeting. None of the items to be transacted at the ensuing meeting is required to be passed by postal ballot.

Postal Ballot

Approval of the Members has been sought vide Postal Ballot Notice dated May 22, 2014, under Section 110 of the Act, pertaining to:-

- Resolution No. 1: Approval for payment of minimum remuneration to Mr Ravindra Pisharody, Executive Director (Commercial Vehicles) incase of inadequacy of profits and ratification of the excess remuneration paid for the financial year ended March 31, 2014

- Resolution No. 2 : Approval for payment of minimum remuneration to Mr Satish Borwankar, Executive Director (Quality) in case of inadequacy of profits and ratification of the excess remuneration paid for the financial year ended March 31, 2014

- Resolution No. 3: Approval and ratification of the excess remuneration paid to (late) Mr Karl Slym, Managing Director/his legal heir in view of inadequacy of profits for the financial year ended March 31, 2014

- Resolution No. 4: Borrowing powers of the Board

- Resolution No. 5: Creation of charge on Company's properties

- Resolution No. 6: To offer or invite for subscription of Non-Convertible Debentures on private placement basis

An E-voting facility was also made available to the Members. The Board of Directors of the Company, appointed Ms Shirin Bharucha, Advocate, as the Scrutinizer for conducting the postal ballot voting process. The results of the Postal Ballot via postal ballot forms and e-voting facility will be announced on June 30, 2014 at the Registered Office of the Company as per the Scrutinizer's Report.

DISCLOSURES

- Details of related party transactions entered into by the Company are included in the Notes to Accounts. Material individual transactions with related parties are in the normal course of business on an arm's length basis and do not have potential conflict with the interests of the Company at large. Transactions with related parties entered into by the Company in the normal course of business are placed before the Audit Committee.

- The Company has complied with various rules and regulations prescribed by the Stock Exchanges, Securities and Exchange Board of India or any other statutory authority relating to the capital markets during the last 3 years. No penalties or strictures have been imposed by them on the Company.

- The Audit Committee has established a Vigil Mechanism and adopted a Revised Whistle-Blower Policy at its meeting held on May 29, 2014, which provides a formal mechanism for all Directors and employees of the Company to approach the Management of the Company (Audit Committee in case where the concern involves the Senior Management) and make protective disclosures to the Management about unethical behaviour, actual or suspected fraud or violation of the Company's Code of Conduct or ethics policy. The disclosures reported are addressed in the manner and within the time frames prescribed in the Policy. The Company affirms that no director or employee of the Company has been denied access to the Audit Committee.

The status of compliance in respect of each of the non-mandatory requirements under Clause 49 of Listing Agreement is as follows:

The Board: The Non-Executive Chairman maintains a separate office, for which the Company does not reimburse expenses.

As per the Guidelines regarding retirement age of Directors as adopted by the Board of Directors at its meeting held on July 13, 2012, tenure of 9 years may be considered a threshold for granting further tenure for independent directors based, inter alia, on the merit and contribution of each Director. In line with best practice to continuously refresh the Board's membership, the Board is encouraged to seek a balance between change and continuity. Ex-Managing Directors/Executive Directors may be invited to rejoin the Board as Non-Executive Directors, but preferably after an interval of 3 years. The Nomination and Remuneration Committee takes into consideration criteria such as qualifications and expertise whilst recommending induction of Non-Executive Directors on the Board as also recommending to the shareholders re-appointment of eligible directors retiring by rotation.

Remuneration Committee: Details are given under the heading "Nomination and Remuneration Committee".

Shareholder Rights: Details are given under the heading "Means of Communications".

Audit Qualifications: During the year under review, there was no audit qualification in the Auditors' Report on the Company's financial statements. The Company continues to adopt best practices to ensure a regime of unqualified financial statements.

Training of Board Members: The Directors interact with the management in a very free and open manner on information that may be required by them. Orientation and factory visits are arranged for new Non-Executive Directors. The Independent Directors are encouraged to attend training programmes that may be of relevance and interest to the Directors in discharging their responsibilities to the Company's stakeholders.

Mechanism for evaluating non-executive Board members: The performance evaluation of non-executive members is done by the Board annually based on the criteria of attendance and contributions at Board/Committee Meetings as also for the role played other than at Meetings.

Whistle Blower Mechanism: The Company has adopted a Whistle-Blower Policy. Please refer to 'DISCLOSURES' given above.

MEANS OF COMMUNICATION

The Quarterly, Half Yearly and Annual Results are regularly submitted to the Stock Exchanges in accordance with the Listing Agreement and are generally published in the Indian Express, Financial Express and the Loksatta (Marathi). The information regarding the performance of the Company is shared with the shareholders every six months through a half yearly communiqué and the Annual Report. The official news releases, including on the quarterly and annual results and presentations made to institutional investors and analysts are also posted on the Company's website (www.tatamotors.com) in the 'Investors' sections. A brief profile of Directors is also on the Company's website and on the website of Indian Boards. Members also have the facility of raising their queries/complaints on share related matters through a facility provided on the Company's website.

The Annual Report, Quarterly Results, Shareholding Pattern, Press Releases, Intimation of the Board Meeting and Issuance of shares and other required details of the Company are posted through Corporate Filing and Dissemination System (CFDS) and NSE Electronic Application Processing System (NEAPS), portals to view information filed by listed companies.

Green Initiative:

In support of the "Green Initiative" undertaken by Ministry of Corporate Affairs, the Company had during the year 2013-14 sent various communications including intimation of dividend and Half Yearly Communiqué by email to those shareholders whose email addresses were made available to the depositories or the Registrar and Transfer Agents. Physical copies were sent to only those shareholders whose email addresses were not available.

The Company has dispatched Abridged Annual Reports to its Members. The Unabridged Annual Report is available on the Company's website and a copy would be furnished to the Members on request.