Remuneration Policy

- The remuneration of the Managing Director, Executive Directors, Key Managerial Personnel of the Company and CEOs of certain significant subsidiaries is reviewed and recommended by the Nomination and Remuneration Committee, based on criterias such as industry benchmarks, the Company's performance visà-vis the industry, responsibilities shouldered, performance/track record, macro-economic review on remuneration packages of heads of other organisations and is decided by the Board of Directors. The Company pays remuneration by way of salary, perquisites and allowances (fixed component), incentive remuneration and/or commission (variable components) to its Managing Director and Executive Directors. Annual increments are decided by the Nomination and Remuneration Committee within the salary scale approved by the Members and are effective from April 1, every year.

- A sitting fee of Rs.20,000/- for attendance at each meeting of the Board, Audit Committee, Executive Committee, Nomination and Remuneration Committee; Rs.5,000/- for attendance at each meeting of Stakeholder Relationship Committee, Ethics and Compliance Committee and Rs.10,000/- for attendance at each meeting of Safety, Health and Environment Committee, the Sub-Committee of the Audit Committee and Special need based committees, is paid to its Members (excluding Managing Director and Executive Directors) and also to Directors attending as Special Invitees. The sitting fees paid/payable to the non Whole-time directors is excluded whilst calculating the limits of remuneration in accordance with Section 197 of the Act, corresponding to Section 198 of the Companies Act, 1956. The Company also reimburses out-of-pocket expenses to Directors attending meetings held at a city other than the one in which the Directors reside.

- The remuneration by way of Commission to the non-executive directors is decided by the Board of Directors and distributed to them based on their participation and contribution at the Board and certain Committee meetings as well as time spent on matters other than at meetings. The Members had, at the Annual General Meeting held on August 21, 2013, approved the payment of remuneration by way of commission to the Non whole-time directors of the Company, of a sum not exceeding 1% per annum of the net profits of the Company, calculated in accordance with the provisions of the Companies Act, 1956, for a period of 5 years commencing from April 1, 2013.

- Remuneration of employees largely consists of basic remuneration, perquisites, allowances and performance incentives. The components of the total remuneration vary for different employee grades and are governed by industry patterns, qualifications and experience of the employee, responsibilities handled by them, their individual performances, etc. The annual variable pay of senior managers is linked to the Company's performance in general and their individual performance for the relevant year is measured against specific major performance areas which are closely aligned to the Company's objectives.

The Company does not have any Employee Stock Option Scheme.

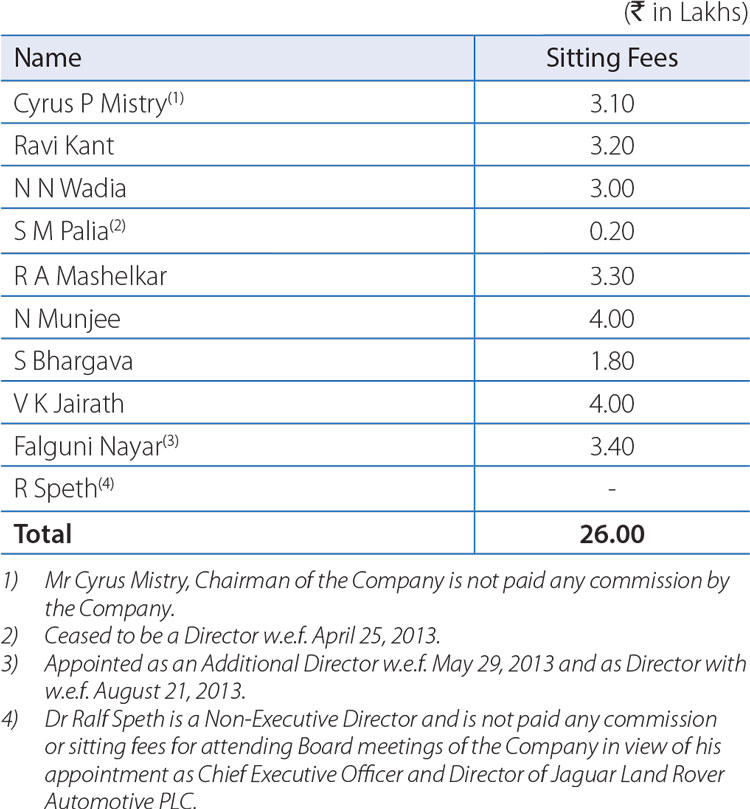

The Directors' remuneration and sitting fees paid/payable by the Company in respect of the Financial Year 2013-14, are given below:

Non-Executive Directors

No Commission was paid to any Non-Executive Director for FY 2013-14 in the view of inadequacy of profits.

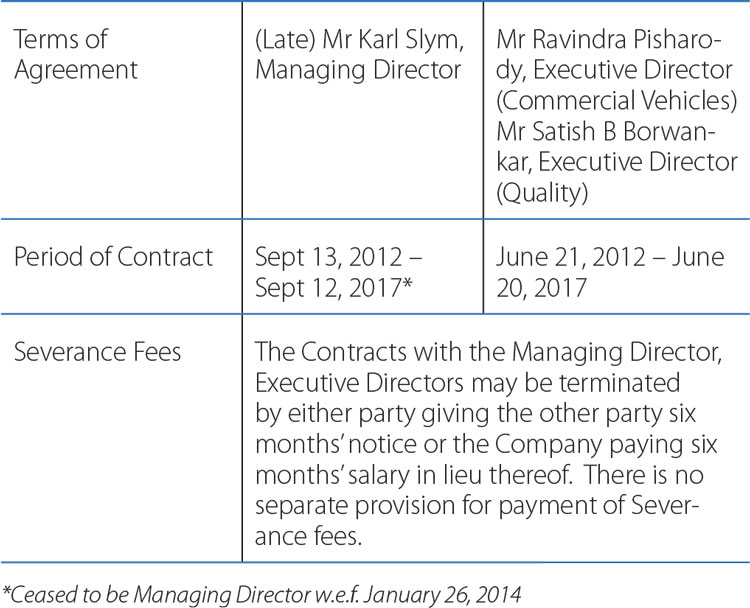

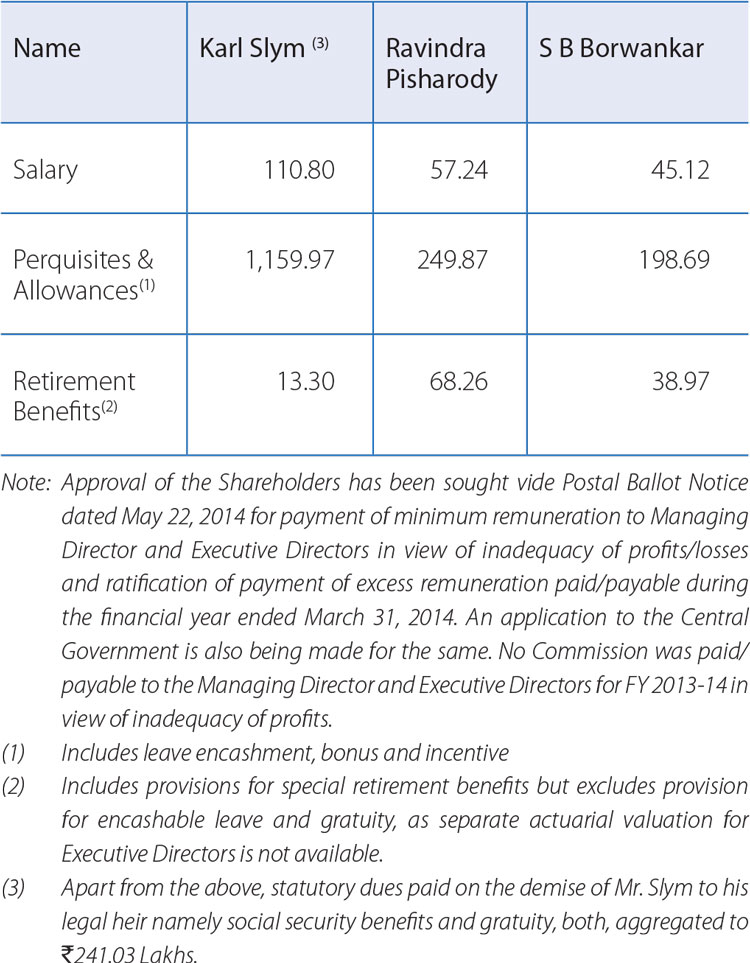

Managing and Executive Directors

Terms of appointment and remuneration

The Remuneration paid/payable to the Managing Directors and Executive Directors in FY 2013-14 is as under:

Retirement Policy for Directors

The Company has adopted the Guidelines for retirement age wherein Managing and Executive Directors retire at the age of 65 years. The Executive Directors, who have been retained on the Company's Board beyond the age of 65 years as Non-Executive Directors for special reasons may continue as Directors at the discretion of the Board but in no case beyond the age of 70 years. The retirement age for Independent Directors is 75 years. The Company has adopted a Policy for Managing and Executive Directors which has been approved by the Members of the Company, offering special retirement benefits including pension, ex-gratia and medical. In addition to the above, the retiring Managing Director is entitled to residential accommodation or compensation in lieu of accommodation on retirement. The quantum and payment of the said benefits are subject to an eligibility criteria of the retiring director and is payable at the discretion of the Board in each individual case on the recommendation of the Nomination and Remuneration Committee.

Based on the requirements of the Act, an Independent Director shall hold office for a term of upto five consecutive years on the Board of a Company and would not be liable to retire by rotation. An Independent Director would be eligible to be re-appointed for another five years on pasing of a Special Resolution by the Company. However no Independent Director shall hold office for more than two consecutive terms but would be eligible for appointment after the expiration of three years of ceasing to become an Independent Director. Provided that during the said period of three years, he/she is not appointed in or be associated with the Company in any other capacity, either directly or indirectly.

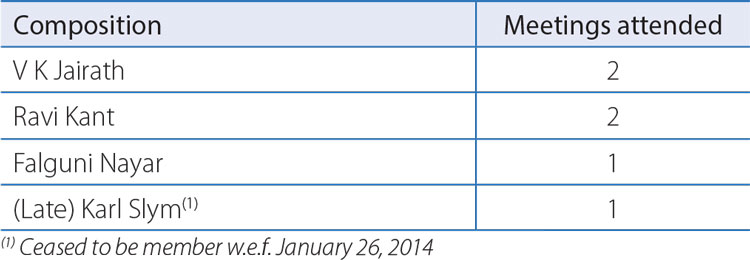

Stakeholder Relationship Committee

Pursuant to Section 178(5) of the Act the Company renamed the erstwhile Investors' Grievance Committee as the Stakeholder Relationship Committee with effect from November 8, 2013. The Committee comprises of two Independent Directors and one Non-Executive Director. The Stakeholder Relationship Committee of the Board is empowered to oversee the redressal of investors' complaints pertaining to share/debenture transfers, non-receipt of annual reports, interest/dividend payments, issue of duplicate certificates, transmission (with and without legal representation) of shares and debentures, matters pertaining to Company's fixed deposit programme and other miscellaneous complaints. During the year under review, two Committee meetings were held on August 21, 2013 and March 28, 2014. The composition of the Stakeholder Relationship Committee and attendance at its meeting is as follows:

Compliance Officer

Mr H K Sethna, Company Secretary, who is the Compliance Officer, can be contacted at:

Tata Motors Limited, Bombay House, 24, Homi Mody Street, Mumbai - 400 001, India.

Tel: 91 22 6665 8282, 91 22 6665 7824 / Fax: 91 22 6665 7260

Email: [email protected].

Complaints or queries relating to the shares and/or debentures can be forwarded to the Company's Registrar and Transfer Agents – M/s TSR Darashaw Pvt. Ltd. at [email protected], whereas complaints or queries relating to the public fixed deposits can be forwarded to the Registrars to the Fixed Deposits Scheme – M/s TSR Darashaw Pvt. Ltd. at [email protected].

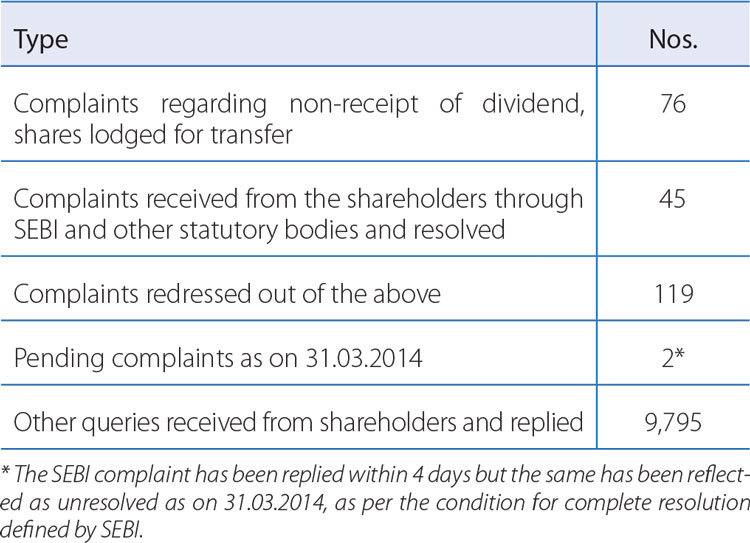

The status on the total number of investors' complaints during FY 2013-14 is as follows:

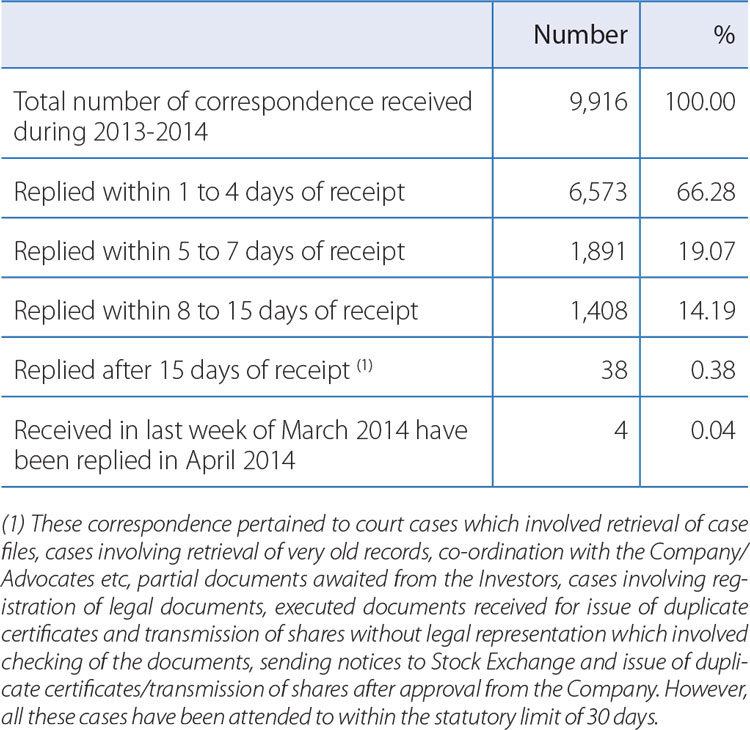

All letters received from the investors are replied to and the response time for attending to investors' correspondence during FY 2013-14 is shown in the following table:

There were no pending share transfers pertaining to the Financial Year ended March 31, 2014. Out of the total number of complaints mentioned above, 53 complaints pertained to letters received through Statutory/Regulatory bodies and those related to Court/ Consumer forum matters, fraudulent encashment and non-receipt of dividend amounts.

TSR Darashaw Private Limited (TSRDPL), the Company's Registrar and Transfer Agents, are also the Registrar for the Company's Fixed Deposits Scheme (FD). TSRDPL is the focal point of contact for investor services in order to address various FD related matters mainly including repayment / revalidation, issue of duplicate FD receipts / warrants, TDS certificates, change in bank details/address and PAN corrections. In view of increase in the correspondence, TSRDPL have increased their investor interface strength (telephone and counter departments) and have taken other steps for rendering speedy and satisfactory services to the FD holders.

On recommendations of the Stakeholder Relationship Committee (erstwhile Investors' Grievance Committee), the Company has taken various investor friendly initiatives like organising Shareholders' visit to Company Works at Pune, sending reminders to investors who have not claimed their dues, sending nominations forms etc.