TML CV and PV

THE TURNAROUND 2.0 STORY

With the launch of Turnaround 2.0, TML intends to drive its journey towards Competitive, Consistent and Cash-accretive growth. TML has been successfully navigating the headwinds in the Indian automotive market with its Turnaround 2.0 plan. The broader objectives of the plan are: ‘Win Decisively’ in CV, ‘Win Sustainably’ in PV, ‘Win Proactively’ in EV and ‘Embed the turnaround culture’. The roadmap to meeting these objectives is guided by the six identified strategic focus areas that underpin the Turnaround 2.0 plan.

3.8% (+330bps)

EBIT GROWTH (Y-O-Y)

+Rs.1,539 crore

POSITIVE FREE CASH FLOW IN SECOND SUCCESSIVE YEAR

+20.3%

REVENUE GROWTH (Y-O-Y)

Strategic focus areas of Turnaround 2.0

To continue the Turnaround 2.0 success, TML has identified six focus areas:

- Volume growth ahead of industry

- Pricing ahead of net inflation; ensuring secure mix

- Reduce business breakeven, through aggressive savings

- Drive efficiencies for best-in-class cash conversion cycles

- Prudent and proactive capex to drive cash accretive growth

- Stress test plan to deliver value even in downturns

+17.2%

VOLUME GROWTH (WHOLESALE DOMESTIC)

| +12% MHCV |

+23% ILCV |

| +24% SCV AND PUs |

+4% CV PASSENGER VEHICLE |

22.6%

RETAIL EXPANSION

+11%

STABLE EBITDA MARGINS

+61

NET PROMOTER SCORE (AS COMPARED TO +57 IN FY 2016-17)

88

SALES SATISFACTION INDEX (AS COMPARED TO 83 IN FY 2016-17)

WIN DECISIVELY IN CV

The success of the Turnaround 2.0 initiatives is evident in the CV space, where CV continued to deliver strong margins while upholding the EBITDA margins in challenging market conditions. All the four segments of TML’s CV business – MHCV, ILCV, SCV and PUs, and CV Passenger Vehicles – saw improved performance driven by all-round execution. Market share was gained across three of the four segments: MHCV at 55% (70bps growth year on year), ILCV at 45.4% (50bps growth year on year) and SCV and PUs at 40.1% (70bps growth year on year).

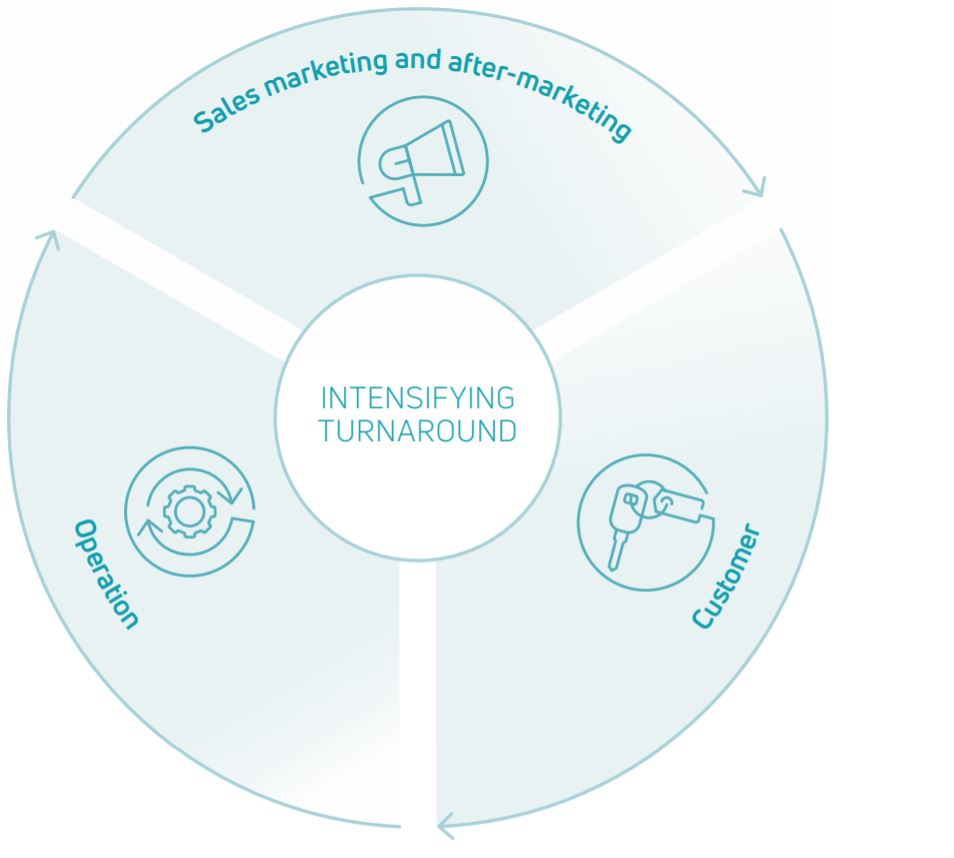

Intensifying turnaround

The turnaround in the CV segment is intensifying with enhanced sales productivity and market activation. This is driven by TML's ‘Dealer Centre of Excellence’ in SCV and ‘Go to Market Excellence’ initiatives. A slew of focused marketing initiatives will further strengthen the brand. There is also an accelerated focus on dealer performance and profitability to become the most attractive franchise. In addition, TML is undertaking a multitude of actions to improve customer experience, like improving last-mile service networks. TML plans to improve the CV after-market share and drive sustainable and profitable growth, particularly in parts and aggregates. Leveraging digital at the front end and delivering impactful products for its customers are some of its other priorities, along with intensified cost reduction efforts and maintaining world-class quality.

WIN SUSTAINABLY IN PV

The PV business is on track to ‘Win Sustainably’ by getting the basics right. TML’s PV business continued to gain market share. In the year under review, market share improved, and volume growth was ahead of the industry average. This has been mainly driven by TML’s relentless focus on strengthening its business fundamentals. TML was able to overcome the seasonality of the PV market through new product launches. Within 51 days during the festival season, TML introduced Tiago NRG, Nexon KRAZ, Tigor Refresh and Tiago/Tigor JTP. These interventions helped to attract additional set of customers and sustain market buzz.

Another significant development was the adoption of ‘Impact’ design, which supports best-in-class features and user experiences, which, in turn, improve brand perception. In the PV segment, TML's focus has been on adoption of best-in-class designs, safety features and closer engagement with dealers.

Overall market share stood at 6.3%, a 60bps growth year on year and breakeven was achieved with regard to EBITDA.

+13.9% VOLUME GROWTH (WHOLESALE DOMESTIC) |

9 QUARTERS OF INDUSTRY OUTPERFORMANCE |

+4.4% RETAIL EXPANSION |

5 EXCITING PRODUCTS LAUNCHED IN 51 DAYS |

NEXON BECOMES THE FIRST CAR TO ACHIEVE 5-STAR GNCAP RATING |

EBITDA BREAKEVEN ACHIEVED |

2ND RANK JD POWER CUSTOMER SATISFACTION FOR THE 2ND CONSECUTIVE YEAR |

+20 NET PROMOTER SCORE (AS COMPARED TO -1 IN FY 2014-15) |

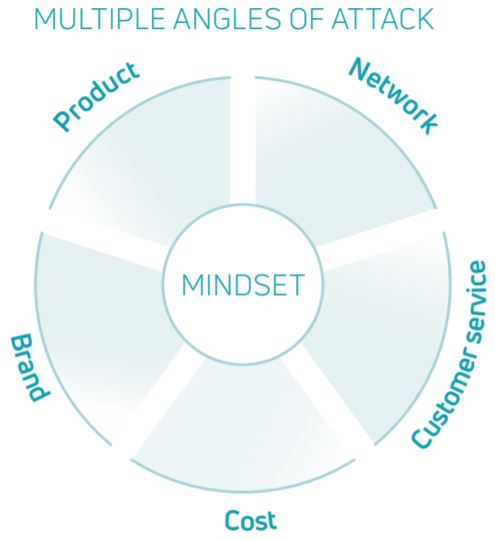

Intensifying turnaround

To intensify focus as well as counter the near-term headwinds in the industry, TML has launched ‘multiple angles of attack’. These include:

- Leveraging new architecture (Alpha and Omega), gaining more from less

- Improving brand resilience

- Driving rigorous cost reductions

- Aiming to be the most customer caring company with a focus on quality of service, personnel training and equipment

- Bringing about a paradigm shift in the mindset from wholesale to retail

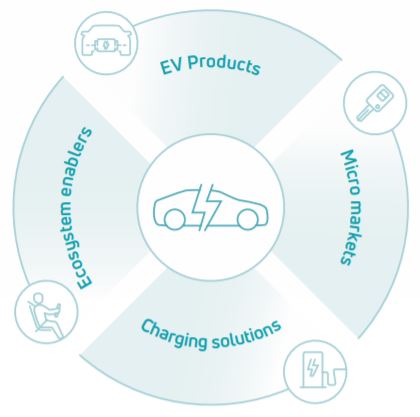

WIN PROACTIVELY IN E-MOBILITY

TML's approach to ‘Win Proactively’ in e-mobility broadly encompasses four aspects:

- Providing full ecosystem solutions;

- Building a comprehensive range in EV to create excitement among consumers;

- Delivering a compelling value proposition that breaks barriers; and

- Leveraging partnerships and new business models.

‘FUTUREADY’: STEPPING UP THE GAME

The Turnaround continues as TML is getting FutuReady with a roadmap for sustainable growth. The new rule of the game – ‘Aspiring leadership’ by decoding the Indian growth story – will require being globally competitive, providing solutions for the Indian customer and staying ahead of the curve. In order to drive volume growth, improve market share and enrich branding, the TML's strategy will include five key levers.

- Developing products of global design standards with Impact 2.0

- Increasing scale while focusing on productivity through modularity, using common platforms for different products and driving volume growth

- Focusing on cost competitiveness through faster, better and cost-effective products manufactured leveraging new architectures

- Leading on the technology front and remaining ahead of competitors

- Encouraging ‘digital first’ thinking across the value chain

KEY FOCUS AREAS

Preparedness for BS VI emission norms

- Full portfolio migration commencing from January 2020

- In-house capability to build, test and accredit new homologations

- Differentiated BS VI solutions

- Ready with BS VI compliant engines across the board

- Unbeatable powertrains for multiple applications

Key capital trade-offs and interlinkages of the Turnaround 2.0 plan

Enhanced Intellectual Capital in terms of introduction of new designs, manufacturing platforms, and new products, led to an improvement in Social and Relationship Capital with better-quality customer perception of the brand. This, in turn, augmented Financial Capital. At the same time, operational efficiency measures also improved Financial Capital