AUDIT

Statutory Audit

M/s B S R & Co. LLP, Chartered Accountants (ICAI Firm No. 101248W/W–100022), the Statutory Auditors of the Company, hold office until the conclusion of Seventy Seventh AGM to be held in the year 2022. Pursuant to Section 141 of the Act, the Auditors have represented that they are not disqualified and continue to be eligible to act as the Auditor of the Company.

The Report of the Statutory Auditor forming part of the Annual Report, does not contain any qualification, reservation, adverse remark or disclaimer. The observations made in the Auditor’s Report are self-explanatory and therefore do not call for any further comments.

The Statutory Auditor of the Company has not reported any fraud as specified under the second proviso to Section 143(12) of the Act.

Branch Audit

Members' approval is being sought vide item No. 5 of the Notice, for authorizing the Board of Directors to appoint Branch Auditors for the purpose of auditing the accounts maintained at the Branch Offices of the Company abroad.

Secretarial Audit

Pursuant to the provisions of Section 204 of the Act and the Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014, the Board of Director appointed M/s Parikh & Associates, a firm of Company Secretaries in Practice to conduct the Secretarial Audit of the Company for year ended March 31, 2019. The Report of the Secretarial Audit is annexed herewith as Annexure - 5. The said Secretarial Audit Report does not contain any qualification, reservations, adverse remarks and disclaimer.

Cost Audit

As per Section 148 of the Act, the Company is required to have the audit of its cost records conducted by a Cost Accountant. The Board of Directors of the Company has on the recommendation of the Audit Committee, approved the appointment of M/s Mani & Co., a firm of Cost Accountants in Practice (Registration No.000004) as the Cost Auditors of the Company to conduct cost audits for relevant products prescribed under the Companies (Cost Records and Audit) Rules, 2014 for the year ending March 31, 2020. The Board on recommendations of the Audit Committee have approved the remuneration payable to the Cost Auditor subject to ratification of their remuneration by the Members at the forthcoming AGM. M/s Mani & Co. have, under Section 139(1) of the Act and the Rules framed thereunder furnished a certificate of their eligibility and consent for appointment.

M/s Mani & Co. have, under Section 139(1) of the Act and the Rules framed thereunder furnished a certificate of their eligibility and consent for appointment.

The cost accounts and records of the Company are duly prepared and maintained as required under Section 148(1) of Act.

OTHER DISCLOSURES

PARTICULARS OF CONTRACTS OR ARRANGEMENTS WITH RELATED PARTIES

All contracts/ arrangements/ transactions entered by the Company during the FY 2018-19 with related parties were on an arm’s length basis and in the ordinary course of business. There were no material related party transactions (RPTs) undertaken by the Company during the year that require shareholders’ approval under Regulation 23(4) of the SEBI Listing Regulations or Section 188 of the Act. The approval of the Audit Committee was sought for all RPTs. All the transactions were in compliance with the applicable provisions of the Act and SEBI Listing Regulations.

Given that the Company does not have any RPTs to report pursuant to Section 134(3)(h) of the Act read with Rule 8(2) of the Companies (Accounts) Rules, 2014 in Form AOC-2, the same is not provided. The details of RPTs during FY 2018-19, including transaction with person or entity belonging to the promoter/ promoter group which hold(s) 10% or more shareholding in the Company are provided in the accompanying financial statements.

During the FY 2018-19, the Non-Executive Directors of the Company had no pecuniary relationship or transactions with the Company other than sitting fees, commission and reimbursement of expenses, as applicable.

The Policy on Related Party Transactions was amended during the year in line with amendment to the Act and SEBI Listing Regulations. The Revised Policy is available on the Company's website URL: https://investors.tatamotors.com/pdf/rpt-policy.pdf

PARTICULARS OF LOANS, GUARANTEES OR INVESTMENTS

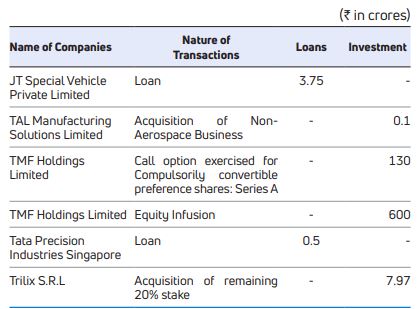

The details of Loans and Investments made during FY 2018-19 are given below:

During FY 2018-19, the Company has not given guarantee to any of its subsidiaries, joint ventures and associate companies.

SECRETARIAL STANDARDS

The Company has devised proper systems to ensure compliance with the provisions of all applicable Secretarial Standards issued by the Institute of Company Secretaries of India and that such systems are adequate and operating effectively.

DIVIDEND DISTRIBUTION POLICY

Pursuant to Regulation 43A of SEBI Listing Regulations, the Board of Directors of the Company have formulated a Dividend Distribution Policy ('the policy'). The Policy was amended by the Board to make it more dynamic yet simple.

The amended policy is annexed to this Report as Annexure - 6 and is also available on the Company's website URL: https://investors. tatamotors.com/pdf/dividend-distribution-policy.pdf

SIGNIFICANT & MATERIAL ORDERS PASSED BY THE REGULATORS OR COURTS OR TRIBUNALS

There are no significant material orders passed by the Regulators or Courts or Tribunal, which would impact the going concern status of the Company and its future operation. However, Members attention is drawn to the Statement on Contingent Liabilities and Commitments in the Notes forming part of the Financial Statement.

DIRECTORS’ RESPONSIBILITY STATEMENT

Based on the framework of internal financial controls and compliance systems established and maintained by the Company, work performed by the internal, statutory, cost, secretarial auditors and external agencies, including audit of internal financial controls over financial reporting by the Statutory Auditors and the reviews performed by Management and the relevant Board Committees, including the Audit Committee, the Board is of the opinion that the Company’s internal financial controls were adequate and effective during FY 2018-19.

Accordingly, pursuant to Section 134(5) of the Act, the Board of Directors, to the best of their knowledge and ability, confirm that:- in the preparation of the accounts for the financial year ended March 31, 2019, the applicable accounting standards have been followed and that there are no material departures;

- we have selected such accounting policies and have applied them consistently and made judgments and estimates that are reasonable and prudent, so as to give a true and fair view of the state of affairs of the Company at the end of the financial year and of the profit of the Company for that period;

- proper and sufficient care for the maintenance of adequate accounting records in accordance with the provisions of the Act, for safeguarding the assets of the Company and for preventing and detecting fraud and other irregularities;

- the annual accounts have been prepared on a going concern basis;

- proper internal financial controls were laid down and that such internal financial controls are adequate and were operating effectively*; and

- proper systems were devised to ensure compliance with

the provisions of all applicable laws and such systems are

adequate and operating effectively.

*please refer to the Section “Internal Control Systems and their Adequacy" in the Management Discussion and Analysis.

ACKNOWLEDGEMENTS

The Directors wish to convey their appreciation to all of the Company’s employees for their contribution towards the Company’s performance. The Directors would also like to thank the shareholders, employee unions, customers, dealers, suppliers, bankers, Governments and all other business associates for their continuous support to the Company and their confidence in its management.

On behalf of the Board of Directors

N CHANDRASEKARAN

Chairman

(DIN: 00121863)

Mumbai,

May 20, 2019