Notice

Board’s Report

Corporate Governance Report

Business Responsibility Report

Management Discussion & Analysis

165

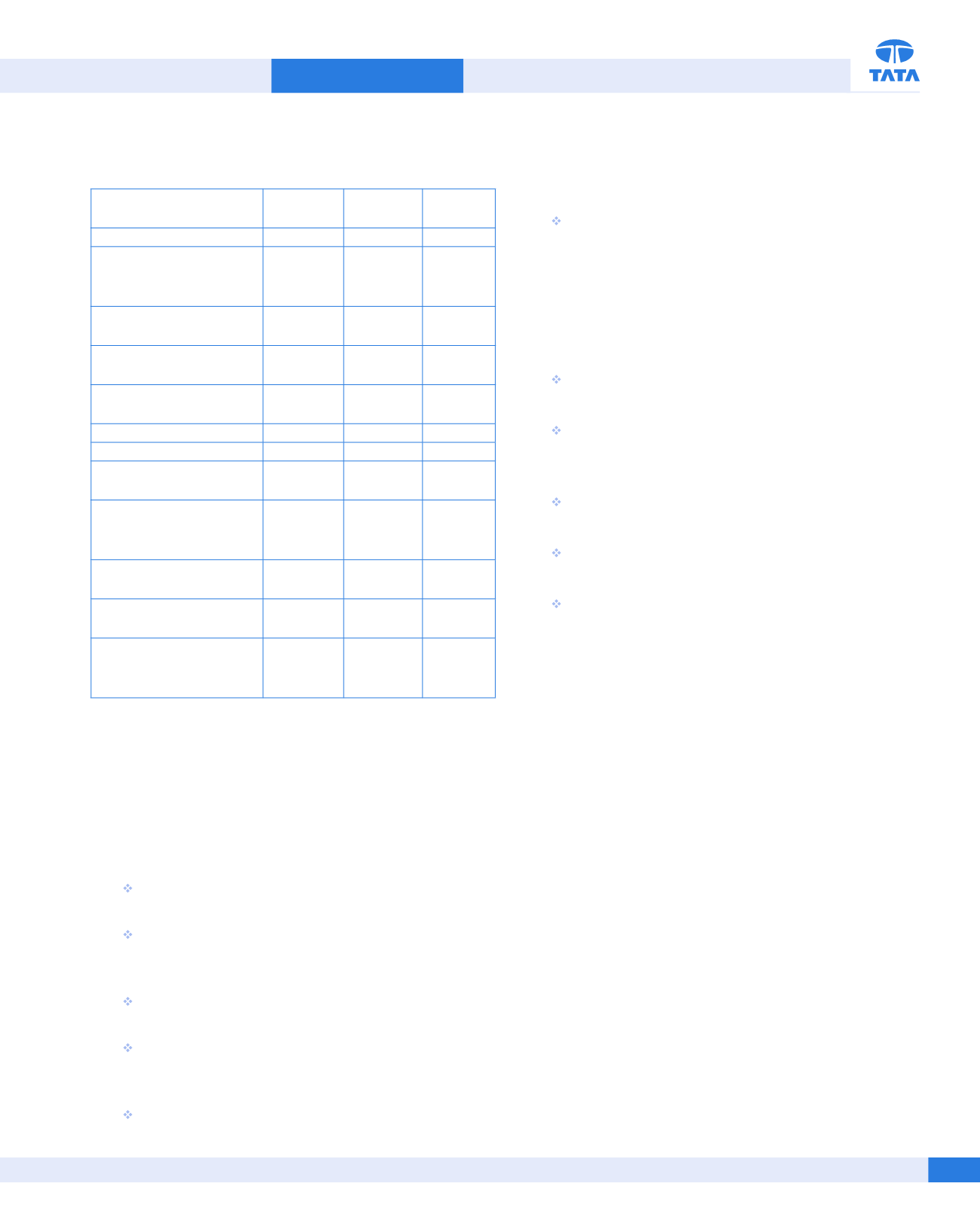

Net cash used in

investing activities

(2,737.98) (3,264.22)

526.24

Payment for Assets (net)

(3,411.58)

(3,249.21)

Net investments, short

term deposit, margin

money and loans given

(259.01)

(1,311.37)

Dividend and interest

received

932.61

1,296.36

Net Cash from/(used in)

financing activities

1,119.21

(78.87) 1,198.08

Proceeds from issue of

shares

4.55

7,433.22

Dividend Paid

(73.00)

-

Interest paid

(1,957.59)

(2,085.91)

Net Borrowings (net of

issue expenses)

3,145.25

(5,426.18)

Net increase / (decrease)

in cash and cash

equivalent

(237.30)

(640.11)

Cash and cash equivalent,

beginning of the year

427.07

1,066.47

Effect of exchange

fluctuation on cash flows

(1.38)

0.71

Cash and cash

equivalent, end of the

year

188.39

427.07

a)

Decrease in net cash from operations reflects loss in Fiscal 2017.

The cash from operations before working capital changes was

R

1,548.97 crores in Fiscal 2017 compared to

R

3,502.42 crores

in Fiscal 2016. There was net outflow of

R

73.75 crores in Fiscal

2017 towards working capital changes.

b)

The net cash used in investing activities was

R

2,737.98 crores

in Fiscal 2017 compared to

R

3,264.22 crores in Fiscal 2016,

mainly attributable to:

Investments in mutual funds in Fiscal 2017 was

R

537.40

crores as compared to

R

1,669.02 crores in Fiscal 2016.

The cash used for payments for fixed assets was

R

3,411.58

crores (net) in Fiscal 2016 compared to

R

3,249.21 crores

in Fiscal 2016.

Inflow by way of divestments in subsidiary companies

resulting in cash inflow of

R

746.90 crores in Fiscal 2016.

Inflow due to dividends and interest in Fiscal 2017 was

R

932.61 crores as compared to

R

1,296.36 crores in Fiscal

2016.

There was an inflow (net) of

R

264.29 crores in Fiscal 2017

compared to an outflow of

R

227.49 crores for Fiscal 2016

towards Fixed / restricted deposits.

There was an outflow (net) of

R

139.08 crores in

Fiscal 2017 compared to inflow of

R

613.81 crores for

Fiscal 2016 towards investments in subsidiary, joint

arrangements and associate companies.

c)

The net change in financing activity was an inflow of

R

1,119.21

in Fiscal 2017 against outflow of

R

78.87 crores in Fiscal 2016.

The outflow is attributable to:

Long-term borrowings (net) – inflow of

R

1,474.30 crores

in Fiscal 2017 as compared to outflow of

R

949.90 crores.

Short-term borrowings (net) – inflow of

R

1,670.95 crores

in Fiscal 2017 as compared to outflow of

R

4,476.28

crores.

During Fiscal 2016, the Company raised

R

7,433.22 crores

through rights issue of shares.

In Fiscal 2017, the Company paid dividend of

R

73.00

crores.

In Fiscal 2017, interest payment was

R

1,957.59 crores as

compared to

R

2,085.91 crores in Fiscal 2016.

FINANCIAL PERFORMANCE OF JAGUAR LAND ROVER (AS

PER IFRS)

The financial statements of Jaguar Land Rover are prepared in

accordance with International Financial Reporting Standards (IFRS)

applicable in the United Kingdom. This information is given to

enable the readers to understand the performance of Jaguar Land

Rover on a consolidated basis for the Jaguar Land Rover group.

Revenues for Jaguar Land Rover for Fiscal 2017 were GB£24,339

million, an increase of 9.2% compared to GB£22,286 million in Fiscal

2016, driven primarily by increased wholesale volumes and a more

favourable foreign exchange environment with the weaker pound

following Brexit.

Material and other cost of sales in Fiscal 2017 were GB£15,071

million were 12.4% higher compared to the GB£13,405 million in

Fiscal 2016 (and increased as a proportion of revenue to 61.9% in

Fiscal 2017 compared to 60.1% in Fiscal 2016) primarily driven by

the increase in sales volumes and the weaker pound.

Employee costs increased by 7.3% to GB£2,490 million in Fiscal 2017

compared to GB£2,321 million in Fiscal 2016, primarily reflecting

increased headcount in manufacturing (to support the increase in

production volumes) and product development to support Jaguar

Land Rover’s plans to launch new models.