DISCLOSURES

- Details of relevant related party transactions entered into by the Company are included in the Boards' Report and in he Notes to Accounts. The Company has in place a Policy on Related Party Transactions setting out (a) the materiality thresholds for related parties and (b) the manner of dealing with transactions between the Company and related parties, including omnibus approvals by the Audit Committee based on the provisions of the Act and Regulation 23 of the SEBI Listing Regulations. During the year, there were no materially significant transactions with related parties, as per the Policy adopted by the Company that have potential conflict with the interests of the Company at large. All transactions with related parties entered into by the Company were in the normal course of business on an arm's length basis and were approved by the Audit Committee.

- The Company has complied with various rules and regulations prescribed by the Stock Exchanges, Securities and Exchange Board of India or any other statutory authority relating to the capital markets during the last 3 years. No penalties or strictures have been imposed by them on the Company.

- In accordance with the provisions of the Act and Regulation 22 of the SEBI Listing Regulations the Company has in place a Vigil Mechanism and a Whistle-Blower Policy duly approved by the Audit Committee which provides a formal mechanism for all Directors and employees of the Company to approach the Management of the Company (Audit Committee in case where the concern involves the Senior Management) and make protective disclosures to the Management about unethical behaviour, actual or suspected fraud or violation of the Company's Code of Conduct or Ethics policy. The disclosures reported are addressed in the manner and within the time frames prescribed in the Policy. The Company affirms that no director or employee of the Company has been denied access to the Audit Committee.

- The Company has complied with all the mandatory requirements of corporate governance including those specified in sub-paras (2) to (10) of Part C of Schedule V of the SEBI Listing Regulations.

- The Company also fulfilled the following non-mandatory requirements as specified in Regulation 27(1) read with Part E of the Schedule II of the SEBI Listing Regulations:

- The Board: The Non-Executive Chairman maintains a separate office, for which the Company does not reimburse expenses.

- Shareholder Rights: Details are given under the heading "Means of Communications".

- Modified opinion in Audit Report: During the year under review, there was no audit qualification in the Auditors' Report on the Company's financial statements. The Company continues to adopt best practices to ensure a regime of unqualified financial statements.

- Separate posts of Chairman and CEO: The post of the Non-Executive Chairman of the Board is separate from that of the CEO and Managing Director.

- Reporting of Internal Auditor: The Chief Internal Auditor reports to the Audit Committee of the Company, to ensure independence of the Internal Audit function.

- Commodity price risk or foreign exchange risk and hedging activities:

During the FY 2015-16, the Company had managed the foreign exchange risk and hedged to the extent considered necessary. The Company enters into forward contracts for hedging foreign exchange exposures against exports and imports. The details of foreign currency exposure are disclosed in Note No. 37 to the Annual Accounts.

- The Company is in compliance with the disclosures required to be made under this report in accordance with Regulation 34(3) read together with Schedule V(C) to the SEBI Listing Regulations.

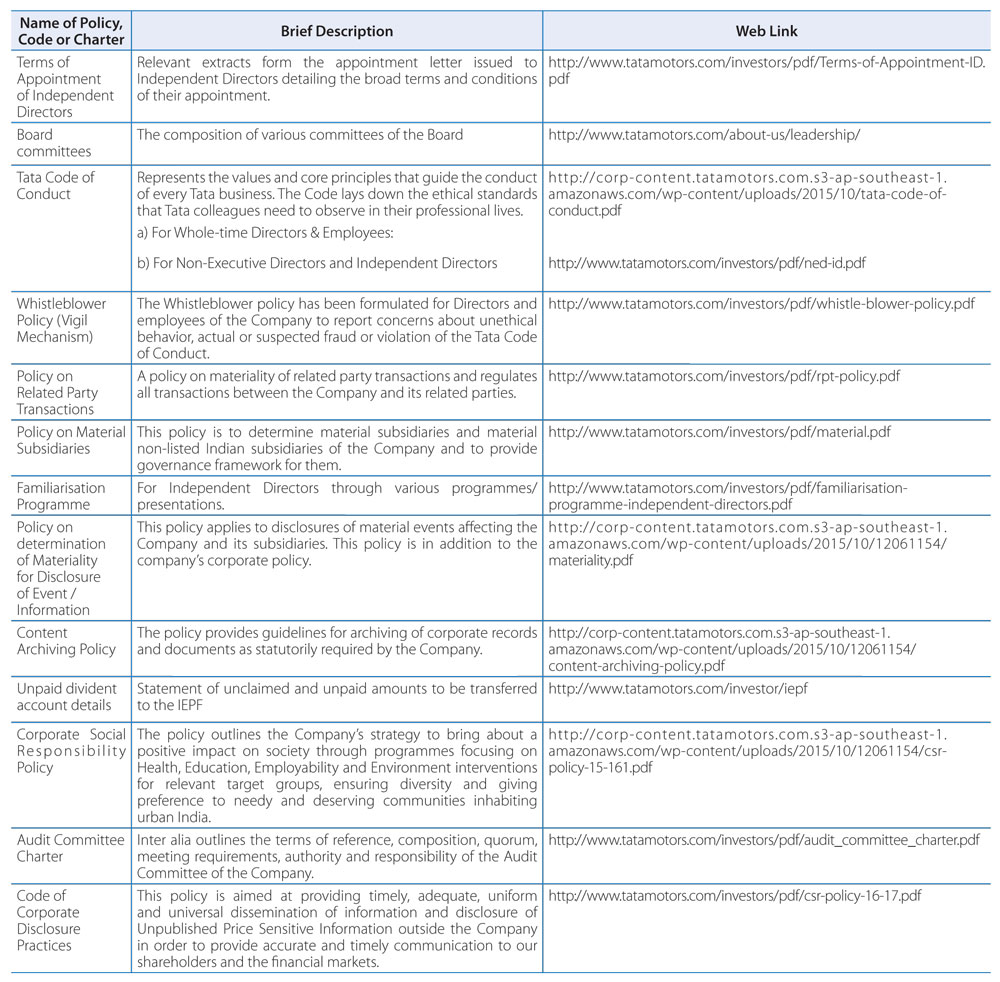

- Disclosures on compliance with corporate governance requirements specified in Regulations 17 to 27 have been included in the relevant sections of this report. Appropriate information has been placed on the Company's website pursuant to clauses (b) to (i) of sub-regulation (2) of Regulation 46 of the Listing Regulations.

Information on the Company's website including key policies, codes and charters, adopted by the Company are given below:

On behalf of the Board of Directors

CYRUS P MISTRY

Chairman

Mumbai,

May 30, 2016

DECLARATION BY THE CEO UNDER REGULATION 26(3) READ WITH PARA D OF SCHEDULE V OF THE SEBI (LISTING OBLIGATIONS AND DISCLOSURE REQUIREMENTS) REGULATIONS, 2015 REGARDING ADHERENCE TO THE CODE OF CONDUCT

Pursuant to Regulation 26(3) read with Para D of Schedule V of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, the Board Members and the Senior Management personnel of the Company have affirmed compliance to their respective Codes of Conduct, as applicable to them for the Financial Year ended March 31, 2016.

For Tata Motors Limited

Guenter Butschek

CEO and Managing Director

Mumbai, May 30, 2016

PRACTISING COMPANY SECRETARIES' CERTIFICATE ON CORPORATE GOVERNANCE

TO THE MEMBERS OF TATA MOTORS LIMITED

We have examined the compliance of the conditions of Corporate Governance by Tata Motors Limited ('the Company') for the year ended on March 31, 2016, as stipulated in Clause 49 of the Listing Agreement of the Company with the Stock Exchanges ("Listing Agreement") for the period April 1, 2015 to November 30, 2015 and Regulations 17 to 27, clauses (b) to (i) of sub-regulation (2) of Regulation 46 and para C, D & E of Schedule V of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015 ("SEBI Listing Regulations") for the period December 1, 2015 to March 31, 2016.

The compliance of the conditions of Corporate Governance is the responsibility of the management. Our examination was limited to the review of procedures and implementation thereof, as adopted by the Company for ensuring compliance with the conditions of Corporate Governance. It is neither an audit nor an expression of opinion on the financial statements of the Company.

In our opinion and to the best of our information and according to the explanations given to us, and the representations made by the Directors and the management, we certify that the Company has complied with the conditions of Corporate Governance as stipulated in the Listing Agreement and the SEBI Listing Regulations applicable for the respective periods as mentioned above.

We further state that such compliance is neither an assurance as to the future viability of the Company nor of the efficiency or effectiveness with which the management has conducted the Affairs of the Company.

For Parikh & Associates

Practising Company Secretaries

P. N. PARIKH

FCS: 327 CP: 1228

Mumbai, May 30, 2016