OUTSTANDING SECURITIES

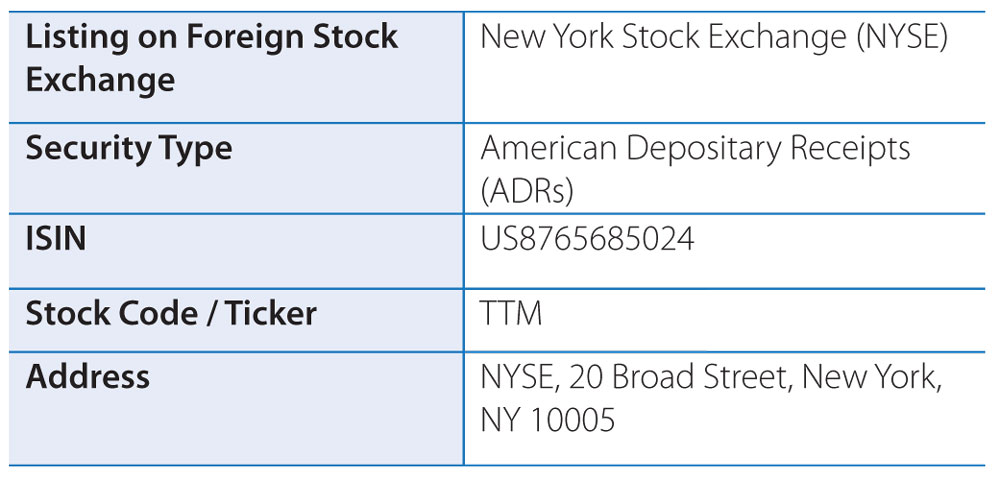

Outstanding Depositary Receipts/Warrants or Convertible instruments, conversion / maturity date and likely impact on equity as on March 31, 2016 are as follows:

Depositary Receipts: The Company has 98,392,840 ADSs listed on the New York Stock Exchange as on March 31, 2016. Each Depository Receipt represents 5 underlying Ordinary Shares of Rs. 2/- each.

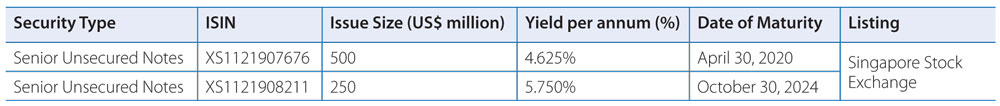

- Senior Unsecured Notes: In October 2014, the Company issued a dual tranche of Senior Unsecured Notes aggregating US$ 750 million, details of which are given hereunder:

- There are no outstanding warrants or any other convertible instruments issued by the Company.

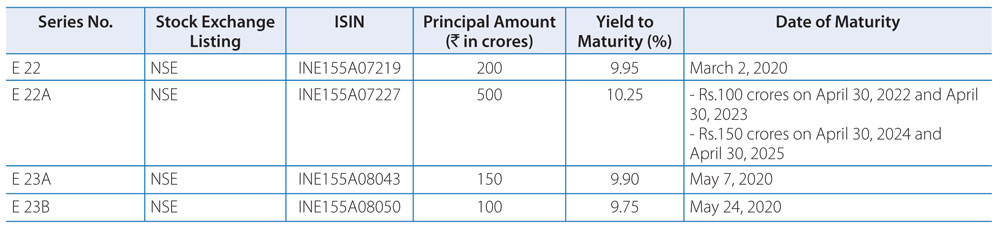

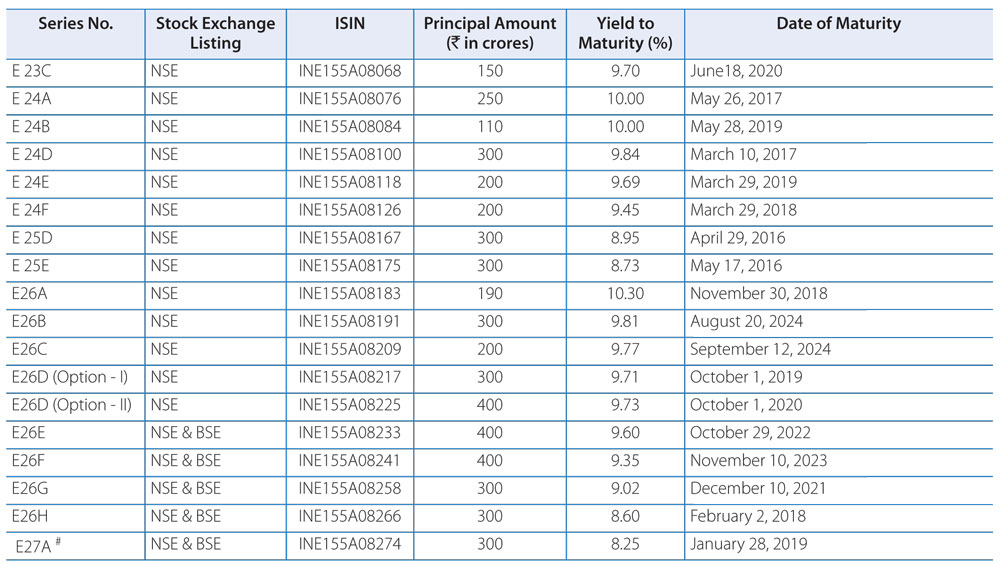

- The following Non-Convertible Debentures (NCDs) are listed on NSE and BSE under the Debt Market segment*:

*Detailed information on the above debentures is included in the 'Notes to Accounts'.

Vijaya Bank, Merchant Banking Division, Head Office, 41/2, M.G. Road, Trinity Circle, Bangalore – 560 001 are the Trustees for all the debenture series mentioned above except for E27A Series. They may be contacted at Tel. : +91 80 25584066 (Ext. 867), 25584603, Fax : +91 80 25584764, Email id: [email protected].

# Debenture Trustee for the E27A series of NCDs : IL&FS Trust Company Limited The IL&FS Financial Centre, 7th Floor, East Quadrant, Plot C- 22, G Block, Bandra Kurla Complex, Bandra (E), Mumbai 400 051 debenture trustees for the E27A series of NCDs. They may be contacted at Tel.: +91 22 26593612, Fax : + 91 22 2653 3297, Email id: [email protected].

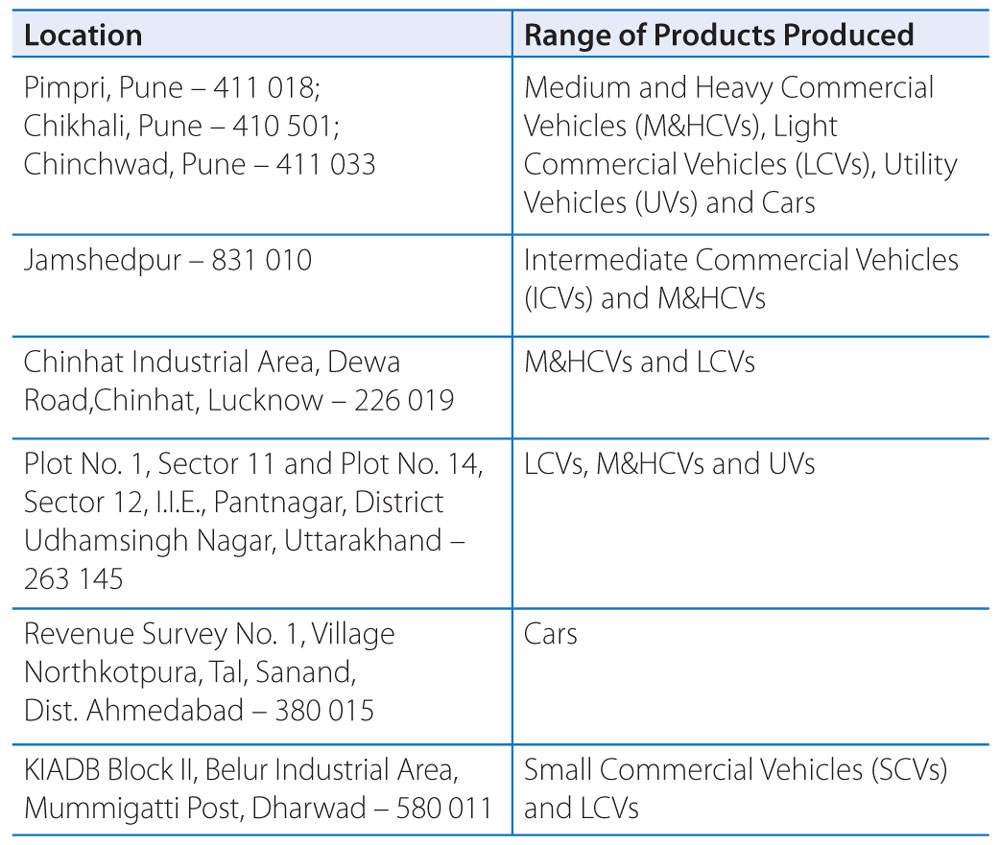

PLANT LOCATIONS

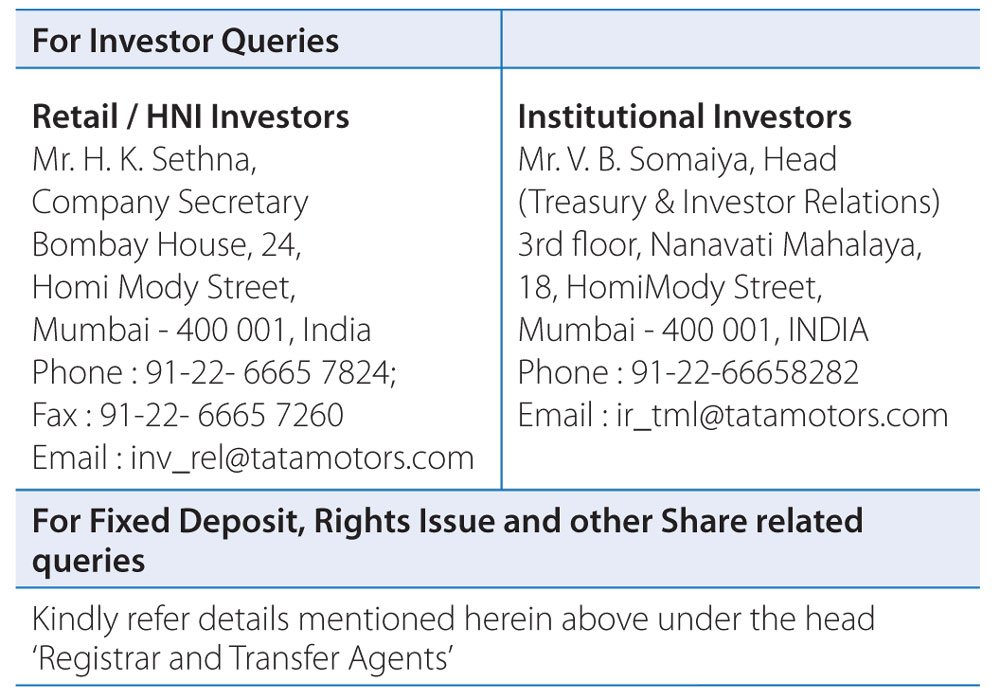

ADDRESS FOR CORRESPONDENCE

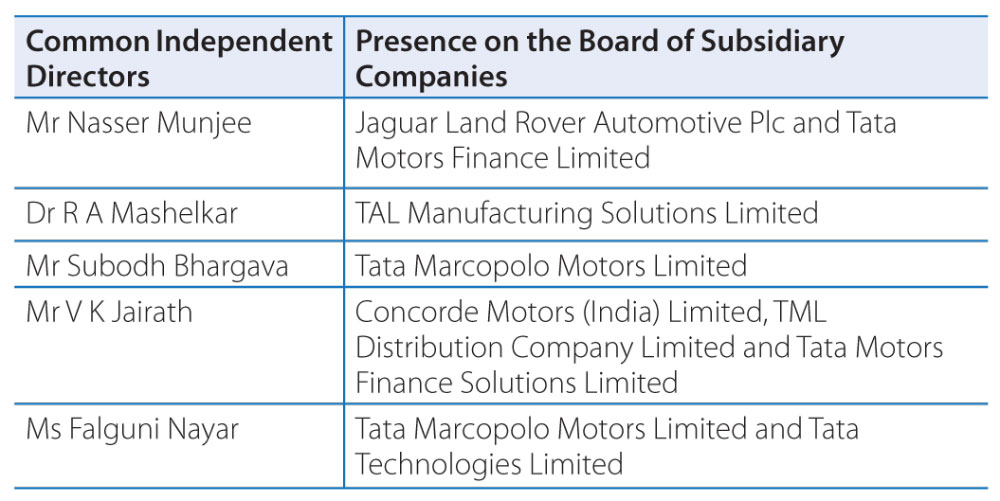

SUBSIDIARY COMPANIES

The Company does not have any material non-listed Indian subsidiary company and hence, it is not required to have an Independent Director of the Company on the Board of such subsidiary company. However, the following Independent Directors of the Company, are also present in an independent capacity, on the Board of the below mentioned subsidiary companies:

The Company adopted a Policy for Determining Material Subsidiaries of the Company, pursuant to Regulation 16(1)(c) of the SEBI Listing Regulations. This policy is available on the Company's website pursuant to Regulation 46(2) of the SEBI Listing Regulations.

The Audit Committee also has a 2-day meeting wherein the CEO and CFO of subsidiary companies make a presentation on significant issues in audit, internal control, risk management, etc. Significant issues pertaining to subsidiary companies are also discussed at Audit Committee meetings of the Company.

The minutes of the subsidiary companies are placed before the Board of Directors of the Company and the attention of the Directors is drawn to significant transactions and arrangements entered into by the subsidiary companies. The performance of its subsidiaries is also reviewed by the Board periodically.