SHARE TRANSFER SYSTEM

Securities lodged for transfer at the Registrar's address are normally processed within 15 days from the date of lodgment, if the documents are clear in all respects. All requests for dematerialization of securities are processed and the confirmation is given to the depositories within 15 days. The Executives of the Registrar are empowered to approve transfer of shares and debentures and other investor related matters. Grievances received from investors and other miscellaneous correspondence on change of address, mandates, etc. are processed by the Registrars within 15 days. The following compliances pertain to share transfers, grievances, etc.:

1. Pursuant to Regulation 7(3) of the SEBI Listing Regulations, certificates are filed with the stock exchanges on half yearly basis by the Compliance Officer and the representative of the Registrar and Share Transfer Agent for maintenance of an appropriate share transfer facility.2. Pursuant to Regulation 13(2) of the SEBI Listing Regulations, a statement on pending investor complaints is filed with the stock exchanges and placed before the Board of Directors on a quarterly basis.

3. A Company Secretary-in-Practice carried out a Reconciliation of Share Capital Audit on a quarterly basis to reconcile the total admitted capital with the depositories viz National Securities Depository Limited (NSDL) and Central Depository Services Limited (CDSL) and the total issued and listed capital. The audit confirms that the total issued/paid up capital is in agreement with the aggregate of the total number of shares in physical form and the total number of shares in dematerialized form (held with NSDL and CDSL).

4. Pursuant to Regulation 61(4) read together with Regulation 40(9) of the SEBI Listing Regulations, a Company Secretary-in- Practice certificate is filed with the stock exchanges within one month from the end of each half of the financial year, certifying that all certificates are issued within thirty days of the date of lodgement for transfer, sub-division, consolidation, renewal, exchange or endorsement of calls/ allotment monies

Action required for non-receipt of dividends, proceeds of matured deposits and interest and redeemed debentures and interest thereon:

- Pursuant to Sections 205A and 205C of the Companies Act, 1956, (Section 124 and 125 of the Act) or as amended or re-enacted, all unclaimed/unpaid dividend, application money, debenture interest and interest on deposits as well as principal amount of debentures and deposits pertaining to the Company and erstwhile Tata Finance Limited (TFL) remaining unpaid or unclaimed for a period of 7 years from the date they became due for payment, have been transferred to the Investors Education and Protection Fund (IEPF) established by the Central Government.

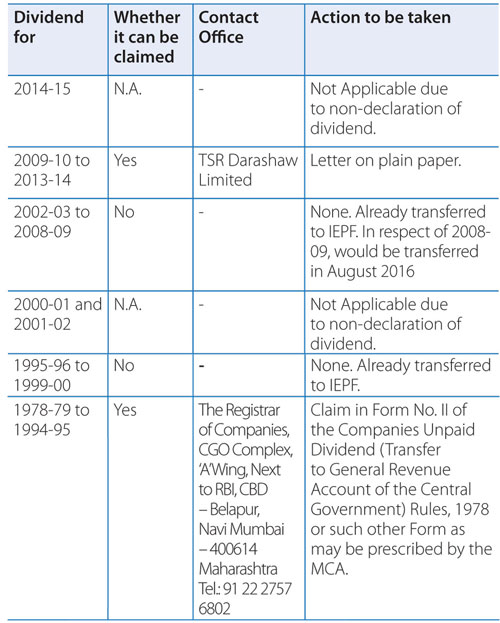

- In case of non-receipt/ non encashment of the dividend warrants, Members are requested to correspond with the Company's Registrars/the Registrar of Companies, as mentioned hereunder:

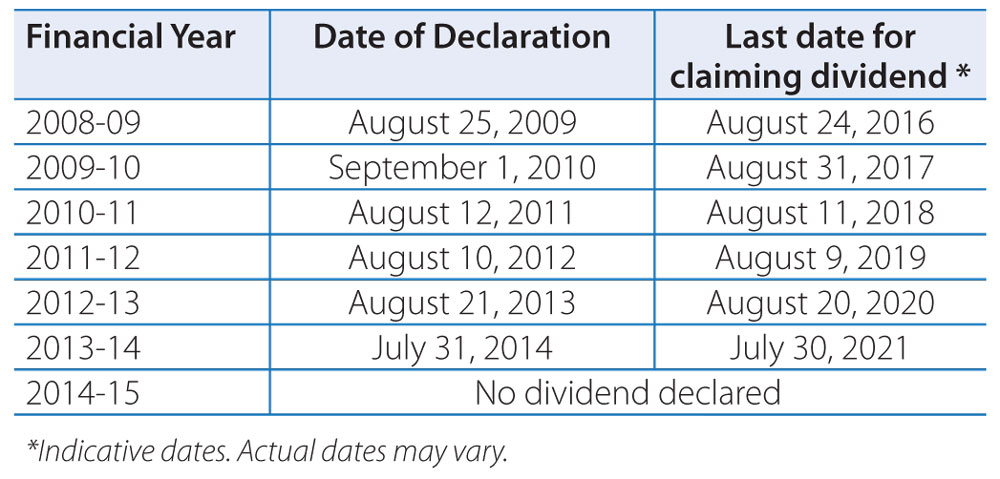

- Following table gives information relating to outstanding dividend accounts and due dates for claiming dividend:

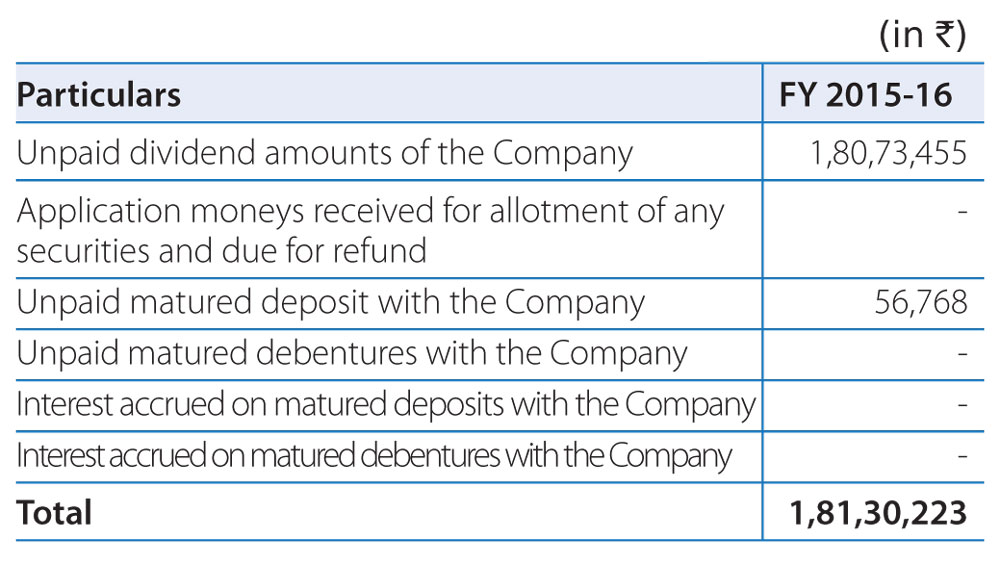

- As of March 31, 2016, the Company transferred Rs. 21,47,41,667.34 to IEPF, including the following amounts during the year.

- While the Company's Registrar has already written to the Members, Debenture holders and Depositors informing them about the due dates for transfer to IEPF for unclaimed dividends/interest payments, attention of the stakeholders is again drawn to this matter through the Annual Report. The data on unpaid / unclaimed dividend and other unclaimed monies is also available on the Company's website under the head (http://www.tatamotors.com/investor/iepf/)

Investors of the Company who have not yet encashed their unclaimed/unpaid amounts are requested to do so at the earliest.

- Other facilities of interest to shareholders holding shares in physical form:

- As per Regulation 39(4) read with Schedule VI of the SEBI Listing Regulations, the Company has sent 9915 reminders in February 2013 and 8994 reminders in August 10, 2015 to those shareholders whose certificates have been returned undelivered. These certificates are currently lying with the Registrar and Transfer Agents of the Company. Members, holding the Company's shares in physical form, are requested to tally their holding with the certificates in their possession and revert in case of any discrepancy in holdings. In case there is no response after three reminders, the unclaimed shares shall be transferred to one folio in the name of "Unclaimed Suspense Account" and the voting rights on such shares shall remain frozen untill the rightful owner claims the shares.

- Nomination facility: Shareholders, who hold shares in single name or wish to make/change the nomination in respect of their shares as permitted under the Act, may submit in the prescribed form to the Registrars and Transfer Agents.

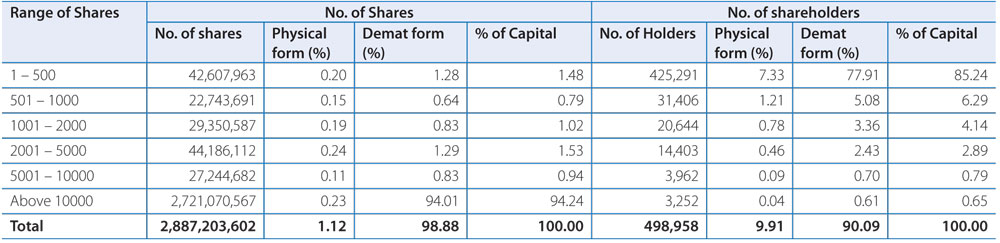

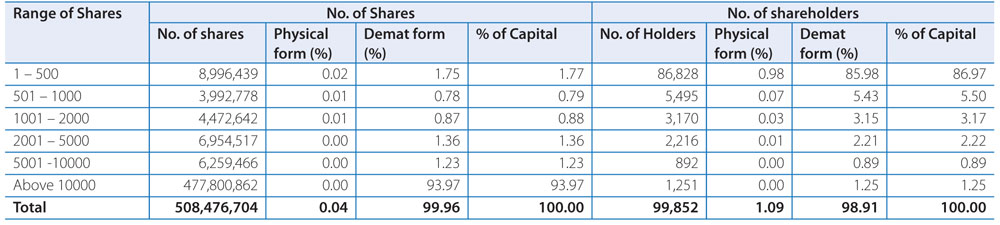

DISTRIBUTION OF SHAREHOLDING AS ON MARCH 31, 2016

Ordinary Shares

For details on the Shareholding pattern, kindly refer Form MGT-9 appended to the Boards' Report of this Annual Report.

DEMATERIALISATION OF SHARES

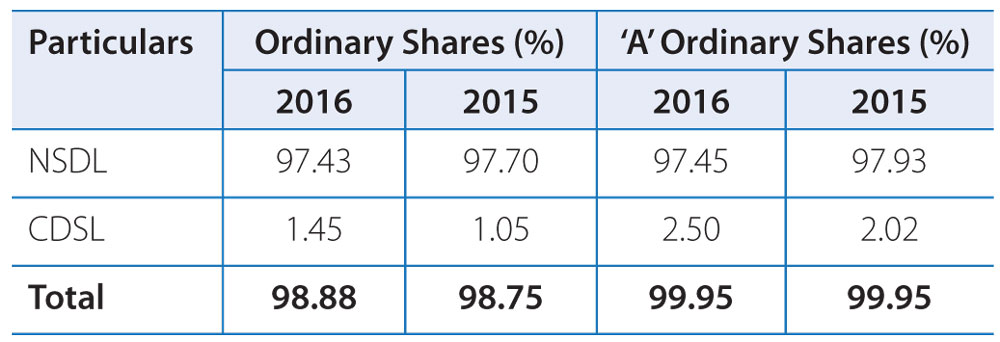

The electronic holding of the shares as on March 31, 2016 through NSDL and CDSL are as follows: