In respect of proposals at Resolution Nos. 7 and 8

- The proposals for the re-appointment of Mr Ravindra Pisharody, Executive Director (Commercial Vehicles) for a tenure from July 1, 2016 to November 24, 2020 and Mr Satish Borwankar, Executive Director (Quality) for a tenure from July 1, 2016 to July 15, 2017 and payment of remuneration, including minimum remuneration to them on terms similar to the Ordinary Resolutions passed by the Members at the Annual General Meeting held on August

10, 2012, except for the following changes in the terms of appointment and remuneration:

- The tenure of appointment (which was upto June 2017 for both the Executive Directors) has been changed so as to be co-terminus with their respective dates of retirement - completion of 65 years as under:

- Mr Pisharody – July 1, 2016 to November 24, 2020

- Mr Borwankar – July 1, 2016 to July 15, 2017.

- The salary scale of the Executive Directors has been changed as under:

- Mr Pisharody - upto a maximum of Rs. 10 lakhs per month(from Rs. 7 lakhs earlier)

- Mr Borwankar - upto a maximum of Rs. 7 lakhs per month(unchanged).

Commission which was previously uncapped, now has a limit of 400% of salary as under:

Commission would be within the applicable limits under Section 197 of the Companies Act but will in any case not exceed 400% of the basic salary.

Incentive Remuneration which was previously uncapped, now has a limit of 200% of salary as under:

Incentive remuneration would be paid in case of inadequacy of profits/losses in any financial year which shall not exceed 200% of the basic salary.

- The tenure of appointment (which was upto June 2017 for both the Executive Directors) has been changed so as to be co-terminus with their respective dates of retirement - completion of 65 years as under:

- Despite adverse macro-economic market conditions, the Company made a recovery in the second half of Fiscal 2016 and recorded profits for the said Fiscal under the able stewardship at that time, of the said two executive directors of its Senior Management.

The Company showcased a line-up of cutting edge new products in the Auto Expo 2016. The passenger vehicle line-up comprised Tiago, Hexa SUV, Kite 5 compact sedan and Nexon compact SUV which received an overwhelming response from all market participants, including the potential customer base. The GenX-Nano and Safari Storme 400Nm from the existing platform launched during the year too were well received.

The commercial vehicle line-up at the Auto Expo 2016, comprising SIGNA range of M&HCV Trucks, Tata ULTRA 1518 Sleeper, ACE MEGA XL, MAGIC IRIS ZIVA – gearless, clutchless with futuristic hydrogen fuel cell technologies for zero emission, ULTRA 1415 4X4–A 4X4, STARBUS HYBRID – World's first commercially produced CNG Hybrid Bus, using Electric & CNG modes (BS IV compliant) as fuel, ULTRA ELECTRIC bus – First fullelectric bus with zero emission and noiseless operations received immense enthusiasm from the customers and dealer fraternity.

- The leadership team, including the CEO and MD and the two executive directors would drive the operational transformation through initiaives identified under the said 8 critical success factors. The Company expects this journey of transformation to take 2 to 3 years and will help the Company achieve significant growth, improve market share in all segments, be amongst the top in India in terms of quality through cost efficient operations and a highly motivated and engaged team.

- Mr Pisharody aged 61, is a B. Tech (Elec.), PG Diploma in Management (Marketing), with wide and varied experience in business and the automobile industry. Mr Pisharody is the Executive Director (Commercial Vehicles) since June 21, 2012 having joined the Company in 2007 as Vice President, Sales and Marketing. Before joining the Company, he worked with Castrol Ltd., a subsidiary of British Petroleum and with Philips India in various roles. He is responsible for the Commercial Vehicle Business Unit of the Company involving product design and development, manufacturing, sales and marketing functions. Since the time he took over as the Head of Commercial Vehicles, he has held the business strong in the midst of intensifying competition in every product segment. Under his able leadership the Company has maintained a strong and innovative product pipeline, pioneered novel customer service initiatives and restructured network management bringing end-to-end accountability. Mr Pisharody has charted out the Company's long-term strategy for preserving the Company's lead position in the commercial vehicle segment in the Indian automobile market and concurrently increasing market penetration in international markets. His effective leadership coupled with his multi-industry experience and stellar academic record makes him a valuable resource for the Company and would be best suited for delivering the vision of the Company. During Fiscal 2016, he was the Chairman of the Board of Tata Cummins Pvt. Ltd., Tata Daewoo Commercial Vehicles Co. Ltd., Tata Marcopolo Motors Ltd. and Tata Motors SA (Pty) Ltd. It is worthy to note that the Company or these subsidiaries (except Tata Daewoo Commercial Vehicles Ltd. in view of his significant contributions as its Board Member, to its improved performance) do not additionally compensate him, in any manner, for these additional activities. For detailed information on Mr Pisharody's profile and achievements, please refer to Mr Pisharody's profile given in the "Statement containing Additional Information" as part of the Explanatory Statement.

- Mr Borwankar aged 63, is a B. Tech (Hons.) Mech, with wide experience in automobile industry, particularly in manufacturing and quality functions. Having started his career with the Company in 1974, as a Graduate Engineer Trainee, he has worked in various executive positions, for overseeing and implementing product development, manufacturing operations and quality control initiatives of the commercial vehicle business unit of the Company. He has played a significant role in setting up Greenfield projects of the Company. Mr Borwankar is the Executive Director (Quality) since June 21, 2012 and is responsible for the quality function for the Company for both commercial and passenger vehicles. He also shoulders responsibility for reviewing and overseeing the implementation of Safety, Health and Environment related practices of the Company and the Tata Business Excellence Model (TBEM) guidelines. Also "Sankalp" a suppliers' improvement project, mentored by him, is expected to transform the Company's supplier quality standards. The Company's future strategy emphasises on Quality Excellence as an important pillar for achieving its Vision. Mr Borwankar, with several years of multi-functional experience spanning across the Company's value chain, has consistently delivered exceptional results throughout his career. As a Director, nominated on the Board of certain subsidiary companies, he provides valued direction and insight. It is worthy to note that the Company or these subsidiaries (except Tata Daewoo Commercial Vehicle Company for his significant contribution as its Board member) do not compensate him, in any manner, for these additional activities undertaken by him. He is an ideal candidate to help fructify the Vision of achieving par-excellence in product and process quality. For detailed information on Mr Borwankar's profile and achievements, please refer to Mr Borwankar's profile given in the "Statement containing Additional Information" as part of the Explanatory Statement.

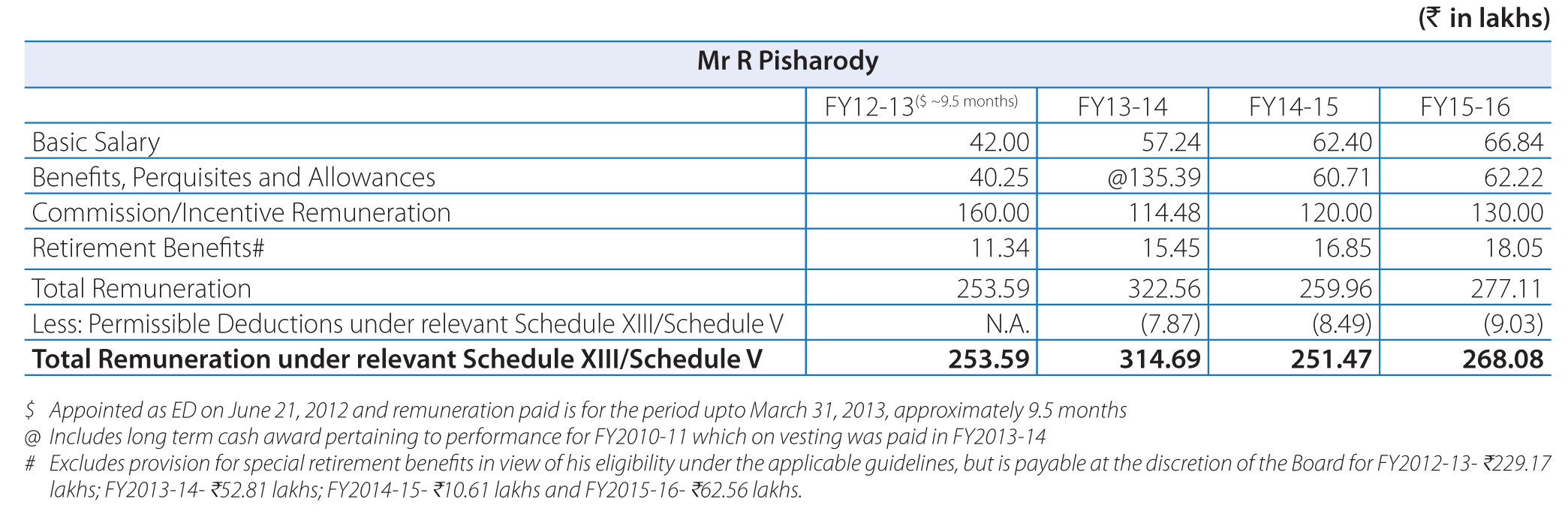

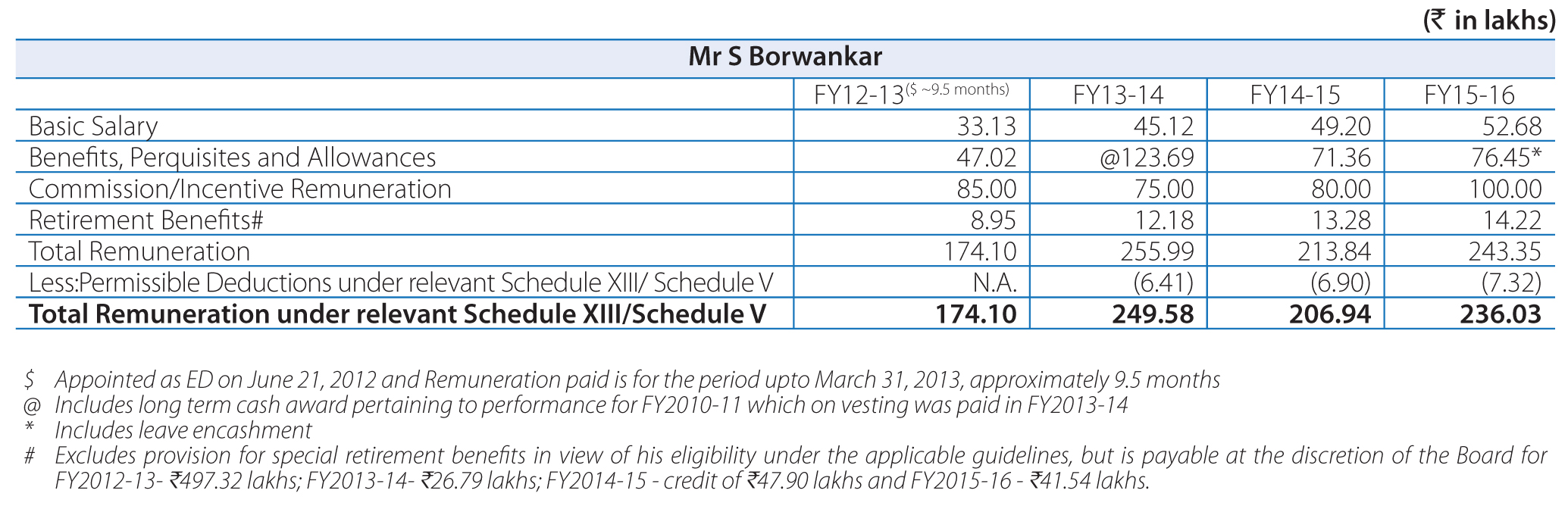

- While details on remuneration of Mr Pisharody and Mr Borwankar have been stated in the Resolutions at Item No. 7 and 8 of the

Notice respectively, the remuneration in monetary terms since their appointment as Executive Directors is as under:

It may be seen from the tables of remuneration and benchmarks that in view of the muted fi nancial performance of the Company on a standalone basis since FY 2013-14, the Company had signifi cantly reduced the variable portion of the two EDs remuneration, viz incentive remuneration. The salary increments too in these years were on the lower side as compared to the industry benchmarks and took into consideration the Company’s performance and growth plans but with a view to retain talent.

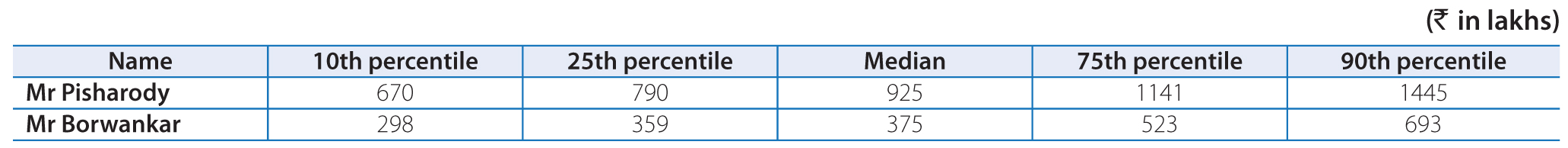

- Remuneration paid/payable to EDs in particular for FY 2015-16 is commensurate with industry standards and Board level positions held

in similar sized companies, taking into consideration the individual responsibilities shouldered by them. The tables below illustrate the

comparative data:

[Data Source: Aon Hewitt Compensation Study, Positions similar to Mr Pisharody (Business Heads with P&L responsibility) and Mr Borwankar (Business Heads with a functional responsibility) in companies with Revenues in excess of Rs. 10,000 crores for FY 2015-16. The value represented above refers to Cost to Company, which includes basic salary, all allowances, benefits valuations, performance bonuses / commissions and Long term incentives.]

Note: A percentile is a measure used in statistics, indicating the value under which a given percentage of observations in a group of observations fall. For example, the 25th percentile is the value (or score) under which 25% of the observations may be found.

- Considering the various business cycles wherein the Company may have a situation of inadequate profits as calculated under the provisions of Section 198 of the Act in any financial year during a period of 3 years w.e.f. April 1, 2016, the approval for the payment of remuneration being sought would include the payment of minimum remuneration as per the terms stated in the Resolution No. 7 and 8.

- It is in this context that the Board, based on the recommendations of the NRC, approved of the reappointment of the 2 Executive Directors on the said revised terms of appointment and remuneration.

In respect of proposals at Resolution Nos. 5 to 8

- Pursuant to the provisions of Section 197 of the Act, the remuneration payable to any one managing director or wholetime director shall not exceed 5% of its profits as calculated under Section 198 of the Act and if there is more than one such director then the remuneration to them shall not exceed 10% of such profits. In case of loss or inadequacy of profits as per Section 198 of the Act, a company may pay remuneration within the limits prescribed under Schedule V of the Act based on its effective capital, subject to shareholders' approval vide a Special Resolution which would be valid for a period of 3 years. Further, any sums paid in excess of the said statutory limits become refundable to the company and is held in trust for the company by the said director, unless the company waives the recovery of the said amount by way of a special resolution passed by the Members and such waiver is approved by the Central Government.

- The Company recorded a net profit of Rs. 11,023.75 crores on a consolidated basis and Rs. 234.23 crores on a standalone basis for the financial year ended March 31, 2016. However, as per the provisions of Section 198 of the Act, the Company on a standalone basis, had a loss of Rs. 465.05 crores for the said financial year. Further, whilst the Company has improved its performance in Fiscal 2016, it may be likely that the Company may have a scenario wherein there are inadequacy of profits under the said provisions of the Act in any of the financial years during the 3 years' period from the date of their appointment. As a matter of abundant caution Members' approval is being sought for payment of minimum remuneration as defined in the said resolutions.

- Based on the Company's Effective Capital of Rs. 10,169.76 crores as at March 31, 2015, the Company is permitted to pay, on an individual basis, the Executive Directors a maximum remuneration of Rs. 3.18 crores and in respect of the CEO & MD Rs. 40 lacs (pro-rated for period from February 15, 2016 to March 31, 2016) for FY 2015-16. Based on the Company's Effective Capital of Rs. 14,411.75 crores as at March 31, 2016, the Company would be permitted to pay Rs. 4.02 crores per director for FY 2016-17 in case if the Company has inadequate profits in the financial year. The Executive Directors remuneration would be within the said limits in case of no/inadequacy of profits during their said tenure. Considering that Mr Butschek's remuneration would exceed the said limits in case of no/inadequacy of profits in any financial year and that he is a German citizen and non-resident of India, the approval of the Central Government is being sought.

- The Company remains committed to pursue the long term interest of all stakeholders, including the Company's Members and employees. It is necessary to balance this with recruiting and retaining industry proven management team through the long term. This involves ensuring that the Company's leadership and talent base is appropriately remunerated, notwithstanding cyclical phases. This is particularly important when the Company has ongoing significant turnaround and growth strategies under execution. It is in this context that the Board have recommended the Resolution Nos. 5 to 8 for approval by the Members.