- OTHER INFORMATION

- Reasons of loss or inadequate profits:

For Fiscal 2016 the Consolidated revenue from operation (net of Excise Duty) and Profit After Tax was Rs. 2,75,561 crores and Rs. 11,024 crores respectively as against the Consolidated revenue and Profit After Tax of Rs. 2,63,159 crores and Rs. 13,986 crores respectively, for the corresponding period of the previous years. The Standalone revenue from operation (net of Excise Duty) and Profit After Tax for Fiscal 2016 was Rs. 42,370 crores and Profit After Tax was Rs. 234 crores respectively as against the Standalone revenue and Loss After Tax of Rs. 36,302 crores and Rs. 4,739 crores respectively for the corresponding period of the previous year. The loss as calculated under Section 198 of the Act for FY 2015-16 was Rs. 456 crores.

The Indian economic environment has been very challenging in the last few years i.e. from FY 2012-13 to FY 2014-15 and the downturn during this period has been one of the sharpest, particularly the auto industry which shrunk by more than (8%), within which, commercial vehicles (which account for more than 60% of the Company's turnover), shrunk by 30%.

The Company was more severely impacted in view of certain sectors performing more adversely, which impacted segments in which the Company had larger volumes and higher market shares. Small commercial vehicles wherein the Company has a market share of more than 70% was severely challenged during this period and is yet to show a recovery. The Company's Passenger Vehicle business was also impacted by lack of new products in the market and delays in product launches. The Financial Year 2015-16 has seen a recovery of certain segments, noticeably the M&HCV where the industry has grown by 9.6% in Fiscal 2016. However, there is still low capacity utilization due to large installed capacity and its impact is continuing to be felt in the financial performance. In general, due to low capacity utilization amongst automotive players and lower demand, there has been aggressive competition in pricing, with marketing and selling cost increasing substantially, thereby creating further pressure on the margins and profitability.

It may be worthwhile to note that Tata Motors' Standalone financial performance reflects positive results as compared to previous year's loss as stated above under Section 198 of the Act, signifying a turnaround in the Company's performance. Tata Motors' Consolidated financial performance continues to show improvements (except for Q2FY15-16 due to weaker sales in China and product mix and JLR vehicles being damaged due to explosion at Tianjin port).

- Steps taken or proposed to be taken for improvement:

- The Company has taken various initiatives, to maintain its leadership, improve market share and financial performance. It has been aggressively pursuing and implementing its strategies to improve volumes and reduce costs through launch of new products, (particularly in passenger vehicles planned since July 2014) coupled with sale, service, marketing campaigns and customer engagement programs.

- The Company has taken steps to strengthen its business fundamentals through focused network engagements, enhancing customer experience, thrust on rural programs and improving working capital management. On the International front, the Company proposes to aggressively pursue its traditional markets as also enter recently opened markets. The results of these initiatives are likely to be felt in the coming years.

- Mr Guenter Butschek alongwith the Executive Directors will be leading the Company in a major strategic and operational transformation for significant and sustained improvement in the overall business and financial performance. This transformation initiative under their leadership will comprehensively cover all areas of the Company's operations in the Company like Company strategy, platform and product strategy, manufacturing, supply chain, employee and managerial productivity, cost reduction & efficiency improvements, improved effectiveness in sales & marketing and customer satisfaction / relationships and breakthrough improvements in achieving world class quality standards.

- The Company, under their leadership, will be drawing on the 8 pillars of transformation initiatives under the following categories for setting the agenda and targets:

- Enhancing the brand perception of Tata Motors- A comprehensive exercise is being initiated to develop the brand purpose and positioning of Tata Motors as a brand. This will be then executed seamlessly across the value chain to provide consistent and credible experience to the stakeholders aligned to the Company's brand promise.

- Providing unique and delightful customer experience- Multiple initiatives right from pre-sales stage to after sales have been identified to deliver high customer Satisfaction performance.

- Excellence in delivery of new products- The initiatives under this imperative focus on benchmarking with world class new product development processes in order to ensure consistency and adherence to the planned time, cost and quality.

- Delivering reliable and high quality products with focus on world-class quality processes- There are several projects initiated to deliver high quality products by improving internal process capabilities and supplier processes.

- World-class manufacturing – This stream's focus is to improve the productivity performance and delivery versus schedule. There are additional projects undertaken to reduce manufacturing related costs and yield improvement. The Company believes that this initiative will enable it to support and strengthen the 'Make in India Campaign', for encouraging India to become a key center for global manufacturing.

- Agile and Cost-effective Supply Chain- This stream's focus will be to improve the supply-chain processes like Material Requirement Planning, strengthen relationship with Strategic suppliers, rationalize the supplier base for agility, improve manufacturing and quality processes and information systems. Considering the size and scale of the Company's operations and the vast supply chain relationships, this will again strengthen and support the Government's aim under the 'Make in India Campaign'.

- Cost competitiveness – There are more than 50 initiatives, addressing each and every cost element for cost competitiveness, with clear targets in cost areas like Direct Material, Marketing, Fixed Cost, Variable Conversion Cost, Product Development Costs, etc. These projects will help in signifi cantly reducing the Company's cost structure. It will be relevant to add that this cost reduction initiative will help not only the Company, but the entire value chain, including hundreds of vendors and other partners, providing further strength and support to the 'Make in India Campaign'.

People processes and organization structure- In this initiative, projects have been undertaken to drive high performance culture, improve functional competencies, improve employee engagement, achieve benchmark levels of employee productivity and build a pipeline of talented workforce

It will be worthwhile to note that under the above eight pillars, the Company has over a 100 individual initiatives on which various cross functional teams of high performers across the organization have been identified and deployed. To support the Company in the pursuit of above initiatives, the leadership team is also drawing upon and will be drawing upon their vast international experience, benchmark processes and approach, as well as drawing upon their vast experience and expertise in leading transformational programs.

The Company expects this journey of transformation to take 2 to 3 years and will help the Company achieve significant growth, improve market share in all our segments, be amongst the top in India in terms of quality through cost efficient operations and a highly motivated and engaged team.

- Expected increase in productivity and profits in measurable terms:

Coinciding with the improvements in the macro economic scenario and as may be seen from the Company's financial results, the Company has posted EBITDA Rs. 2,740 crores in Fiscal 2016 as compared to negative EBITDA of Rs. 800 crores in the previous FY2014-15. New product launches have been stepped up, particularly in the Passenger Vehicle business with the launch of Bolt and Zest in FY2015-16 and the Tiago in early FY2016-17. Further, in order to deleverage the Company to reduce the borrowing costs, the Company has raised equity from the Shareholders (including Promoters) to the extent of about Rs. 7,498 crores in May 2015. This helped curtail the borrowings and reduce interest costs. With more and improved products in the pipeline and the number of initiatives/actions underway, the Company expects to significantly step up its operating and financial performance in the next few quarter sand in the coming financial years.

With Mr Butschek and the Senior Leadership Team's broad functional, general management skills and wide international experience, they would provide Tata Motors with profound knowledge in complex restructuring/turnaround programmes, provide inputs on robust world-class process know-how in operations and accelerate transformation to a high performance culture by onboarding employees and creating ownership in the organization. The Board is of the view, that this leadership creates international, multinational teams and fosters a culture of cross-functional teamwork, agility and accountability.

The Nomination and Remuneration Committee currently comprising of three independent directors [viz. Mr N Wadia (as Chairman of the Committee), Mr S Bhargava and Dr R A Mashelkar] and Mr Cyrus P Mistry, Non-Executive Chairman of the Board, reviews and recommends the changes in the remuneration on a yearly basis. This review is based on the Balance Score Card that includes the performances of the Company and the individual director on certain defined qualitative and quantitative parameters such as volumes, EBITDA, cash flows, cost reduction initiatives, safety, strategic initiatives and special projects as decided by the Board vis-à-vis targets set in the beginning of the year. This review also takes into consideration the benchmark study undertaken by reputed independent HR agencies on comparative industry remuneration and practices. The decisions taken at the Nomination and Remuneration Committee and the Board are within the broad framework of remuneration as approved by the Members.

The Company remains committed to pursue the long term interest of all stakeholders, including the Company's Members and employees. It is necessary to balance this with recruiting and retaining industry proven management team through the long term. This involves ensuring that the Company's leadership and talent base is appropriately remunerated, not withstanding cyclical phases. This is particularly important when the Company has ongoing significant turnaround and growth strategies under execution.

Taking into consideration the above and the terms of appointment (including payment of Minimum Remuneration) agreed with the Mr Butschek, Mr Pisharody and Mr Borwankar and based on the recommendation of the Nomination and Remuneration Committee, the Board of Directors have on May 30, 2016, accorded their approval to the said proposals and in the interest of the Company have recommended the aforesaid resolutions set out at Item Nos. 5 to 8 in this Notice for the approval of the Members.

None of the Directors, Key Managerial Personnel of the Company and their relatives is in any way concerned or interested in the said Resolutions, except for Mr Butschek, Mr Pisharody and Mr Borwankar in the respective Resolutions at Item Nos. 5 to 8 of the Notice.

Item No. 9

Pursuant to Section 148 of the Act read with the Companies (Cost Records and Audit) Rules, 2014 as amended from time to time, the Company is required to have the audit of its cost records for specified products conducted by a Cost Accountant in Practice. Based on the recommendation of the Audit Committee, the Board had on May 27, 2016, approved the appointment and remuneration of M/s Mani & Co., the Cost Auditors (ICAI Firm Registration No 000004) to conduct the audit of the Cost records maintained by the Company, pertaining to the relevant products prescribed under the aforesaid Rules, for the Financial Year ending March 31, 2017 at a remuneration of Rs. 5,00,000/- (Rupees Five Lakhs) plus service tax, out-of-pocket, travelling and living expenses.

It may be noted that the records of the activities under Cost Audit is no longer prescribed for "Motor Vehicles and certain parts and accessories thereof". However, based on the recommendations of the Audit Committee, the Board has also approved the appointment of M/s Mani & Co. for submission of reports to the Company on cost records pertaining to these activities for a remuneration of Rs. 15,00,000 (Rupees Fifteen Lakhs) for the said financial year.

In accordance with the provisions of Section 148 of the Act read along with Rule 14 of the Companies (Audit and Auditors) Rules, 2014, as amended from time to time, ratification for the remuneration payable to the Cost Auditors to audit the cost records of the Company for the said financial year by way of an Ordinary Resolution is being sought from the Members as set out at Item No. 9 of the Notice.

M/s Mani & Co have furnished a certificate dated May 6, 2016 regarding their eligibility for appointment as Cost Auditors of the Company.

The Board commends the Ordinary Resolution set out at Item No. 9 of the Notice for approval by the Members.

None of the Directors, Key Managerial Personnel or their relatives are, in any way, concerned or interested, financially or otherwise, in the resolution set out at Item No. 9 of the Notice.

Item No. 10

The Non-Convertible Debentures ("NCDs") issued on private placement basis is one of the cost effective sources of long term borrowings raised by the Company. The Company had obtained the approval of the Members vide Postal Ballot on June 27, 2014 to borrow from time to time any sum(s) of monies which, together with monies already borrowed by the Company (apart from temporary loans obtained or to be obtained from the Company's Bankers in the ordinary course of business) upto an amount not exceeding €30,000 crores. The borrowings of the Company as at March 31, 2016 aggregate approximately Rs. 15,887.25 crores, of which outstanding NCDs aggregate to Rs. 5,550 crores. The Company's Net Debt-Equity ratio (on stand-alone basis) as at March 31, 2016 is 0.61:1 and the Company believes that the aggregate borrowings would be well within acceptable levels. Further, the Company had obtained Members' approval for borrowing up to Rs.4,400 crores by way of NCDs at the Annual General Meeting held on August 13, 2015, which is valid for a period of one year from date of the said approval. The Company has borrowed r600 crores by way of unsecured NCDs up to May 2016, in accordance with the aforesaid Members' approval.

In continuation of its efforts to strengthen its capital structure, the Company intends to augment the resources through a mix of internal accruals and long term borrowings. Accordingly, it is proposed to issue NCDs and/or Rupee Denominated Non-Convertible Foreign Currency Bonds on a private placement basis aggregating upto Rs. 3,000 crores, in one or more series/tranches during the 12 month period from the date of this Annual General Meeting, with an intention to finance, inter alia the repayment of certain NCDs/term loans from Banks and to fund part of the ongoing capital expenditure during the next 12 months as also for general corporate purposes. The Company intends to raise NCDs on face value (at par) for tenors ranging between 2 to 10 years and expects the coupon rate of NCDs to be lower than 1 year MCLR rate of State Bank of India (prevailing at 9.15% p.a. as on June 1, 2016) plus a spread of 50 bps, considering the current credit rating of the Company of AA by ICRA and AA+ by CARE.

Under Rule 14 of the Companies (Prospectus and Allotment of Securities) Rules, 2014 ("Rules"), a company making a private placement of its securities is required to obtain the approval of the Members by way of a Special Resolution for each offer or invitation before making such offer. However, incase of offer for NCDs, it shall be sufficient if the Company passes a previous Special Resolution only once in a year for all the offers or invitation for such debentures during the year.

Considering the above, the Company proposes to obtain shareholders' approval for borrowings up to Rs. 3,000 crores by way of secured / unsecured NCDs and / or Rupee Denominated Foreign Currency Bonds for tenors ranging between 2 to 10 years. This would be an enabling Resolution authorizing the Board of Directors to make specific issuances based on the Company's requirements, market liquidity and appetite at the opportune time.

The above proposal as set out in Item No. 10 of the Notice is in the interest of the Company and your Directors commend the same for approval by the Members.

None of the Directors, Key Managerial Personnel or their relatives are in any way concerned or interested, financially or otherwise in the resolution set out at Item No. 10 of the Notice.

| By Order of the Board of Directors | |

| H K SETHNA | |

| Mumbai | Company Secretary |

| May 30, 2016 | FCS No.: 3507 |

Registered Office:

Bombay House, 24, Homi Mody Street, Mumbai 400 001

Tel: +91 22 6665 8282; Fax: +91 22 6665 7799

Email: [email protected]; Website: www.tatamotors.com

CIN - L28920MH1945PLC004520

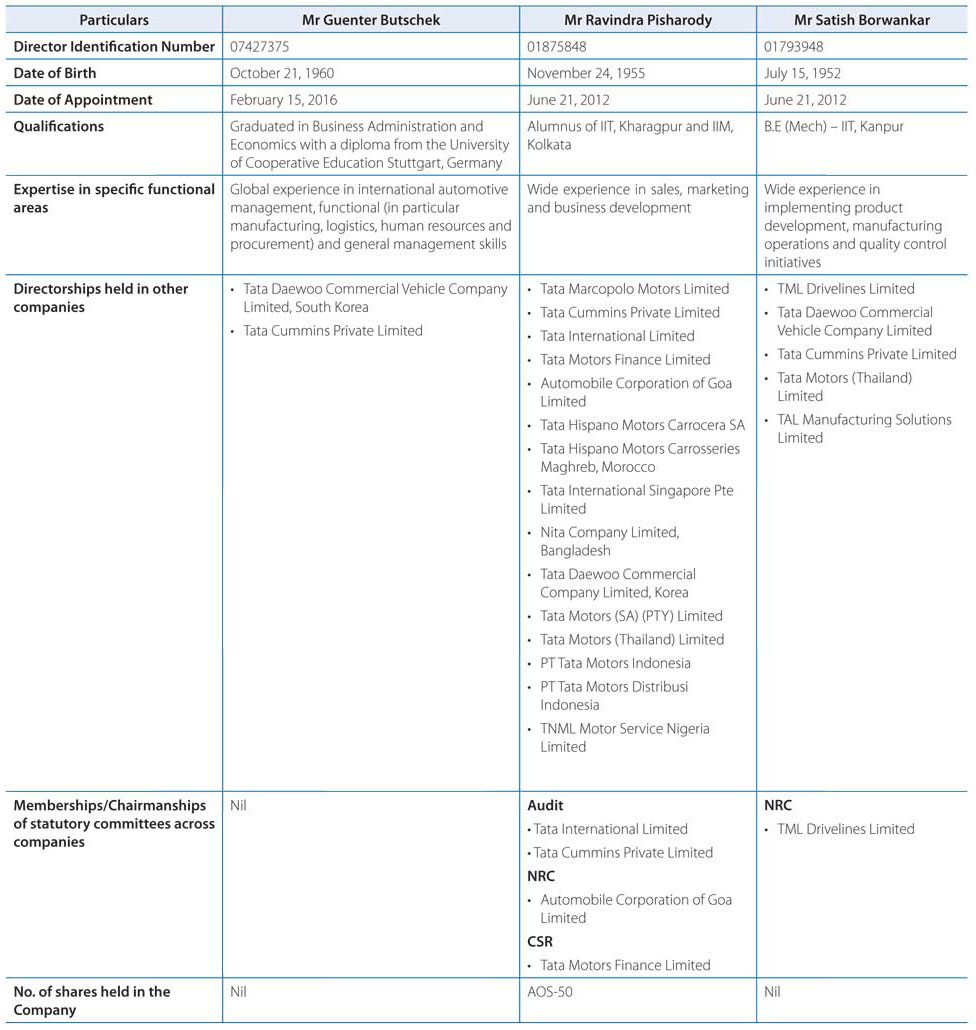

Details of Directors seeking appointment and re-appointment at the Annual General Meeting Pursuant to SEBI Listing Regulations and Secretaial Standard - 2 on General Meetings

For other details, such as number of meetings of the Board attended during the year, remuneration drawn and relationship with other directors and key managerial personnel in respect of the above directors please refer to the Board’s Report and the Corporate Governance Report.