ANNEXURE 4

Details of Remuneration of Directors, KMPs and Employees and comparatives

[Pursuant to Section 197 and Schedule V of the Companies Act, 2013 and Regulation 34(3) and Schedule V of SEBI Listing Regulations]

- The information pursuant to Section 197 of the Companies Act read with Rule 5(1) of the Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014 are given below:

-

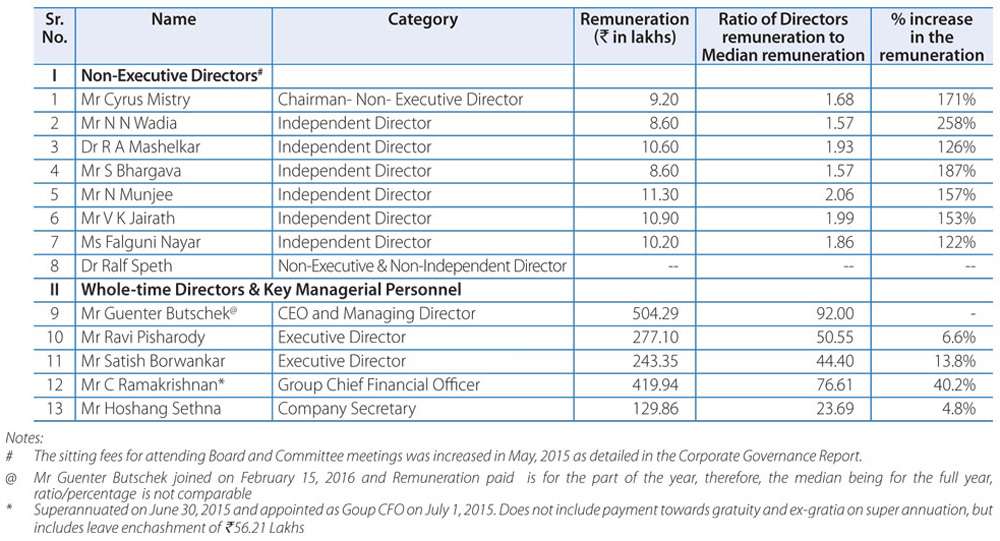

- The ratio of the remuneration of each Director to the median remuneration of the employees of the Company and the percentage increase in remuneration of each Director, Chief Executive Officer, Chief Financial Officer and Company Secretary in the Fiscal 2016:

- A break-up of median remuneration for employees and the percentage increase in the median remuneration of employees in the Fiscal 2016 are given below:

Note: 1) The Median Remuneration of employees for the Fiscal year 2016 is Rs. 5.48 Lakhs

- The ratio of the remuneration of each Director to the median remuneration of the employees of the Company and the percentage increase in remuneration of each Director, Chief Executive Officer, Chief Financial Officer and Company Secretary in the Fiscal 2016:

- The number of permanent employees on the rolls of Company as at March 31, 2016: 26,569

- The explanation on the relationship between average increase in remuneration and Company performance:

The Gross revenues of the Company during Fiscal 2016 was Rs. 46,647 crores, higher by 18.0% over the previous year. Operating profit (EBITDA) for Fiscal 2016 stood at Rs. 2,740 crores with operating margin at 6.5% and the Profit After Tax was Rs. 234 crores. The total employee cost for Fiscal 2016 was Rs. 3,027 crores against Rs. 3,091 crores for Fiscal 2015, indicating a marginal decrease of 2.1%. The average increase in the remuneration during Fiscal 2016 is as mentioned in point no.1 above as compared to the previous Fiscal Year.

Average increase in the remuneration is guided by factors like economic growth, inflation, mandatory increases, external competitiveness and talent retention. Whilst the Company endeavors on cost effective initiatives including employees cost being one of the key areas of cost monitoring and control, the results of any structural initiatives needs to be measured over a long term horizon and cannot be strictly compared with annual performance indicators.

On an average an employee receives an annual increase of 10.1%. The wage increments for blue collar are governed by plant-wise settlements which are held every 3-5 years. The wage revision for white collar employees is done annually. In order to ensure that remuneration reflects Company's performance, the performance pay & annual increments are also linked to organization performance, apart from an individual's performance. The individual increments for white collar employees varied from 0% to 20% on Total Fixed Pay and the performance pay varied from 0% to 30% of the Total Fixed Pay. The increase in remuneration is in line with the market trends.

The Company remains committed to pursuing the long term interest of all stakeholders, which includes recruiting and retaining an industry proven management team and ensuring that the Company's leadership and talent base is appropriately remunerated, notwithstanding cyclical phases. This is especially imperative when the Company has ongoing significant turnaround and growth strategies under execution.

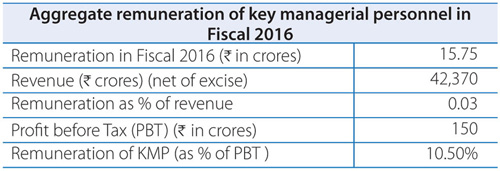

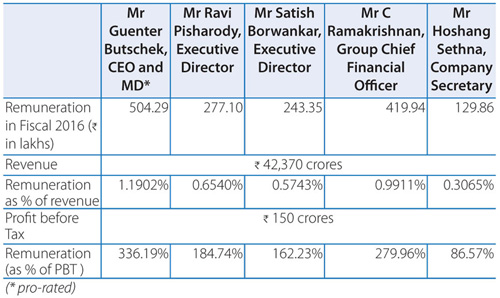

- Comparison of the remuneration of the key managerial personnel against the performance of the Company:

Employee cost and other significant internal and external factors impacting performance of the Company are explained in detail in the Management Discussion & Analysis Report.

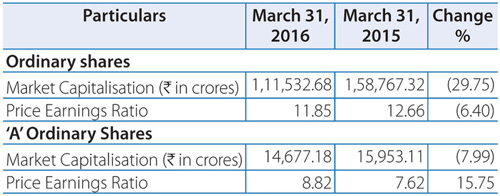

- Variation in the market capitalization of the Company, price earnings ratio as at the closing date of the current Fiscal 2016 and previous Fiscal 2015:

- Percentage increase over decrease in the market quotations of the shares of the Company in comparison to the rate at which the Company came out with the last public offer:

Note: Closing share price of Ordinary Shares at BSE Ltd. has been used for the above table.

- The Company had made a public Issue of 11% Convertible Bonds in Fiscal 1980 when the face value of equity share was Rs. 100/- each. Considering the stock split of equity shares from Rs. 100/- to Rs. 2/- each, conversion price works out to be Rs. 3.214 per share. This does not include the impact of Bonus, rights and dividends declared since 1980.

- The Company had issue 'A' Ordinary Shares (AOS) with Differential Voting Rights as to the dividend and voting rights in Fiscal 2009, hence it is not comparable. The above data does not include AOS.

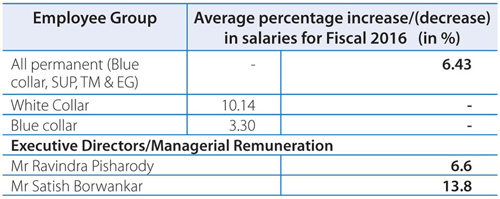

- Average percentile increase already made in the salaries of employees other than the managerial personnel in the last financial year and its comparison with the percentile increase in the managerial remuneration and justification thereof and point out if there are any exceptional circumstances for increase in the managerial remuneration:

Note:

- Salaries for SUP, TM & EG include Total Fixed Pay (TFP) plus the performance pay paid in Fiscal 2016.

- Salaries for blue collar includes only TFP (as they are not given any performance linked bonus but have plant-wise wage revision at a set frequency). The annual variable/performance pay and the salary increment of managers is linked to the Company's performance in general and their individual performance for the relevant year is measured against major performance areas which are closely aligned to Company's objectives

- Mr Butschek joined on February 15, 2016 and the above details pertaining to him are not given as the same are not comparable.

- Comparison of each remuneration of the key managerial personnel against the performance of the Company:

- The key parameters for any variable component of remuneration availed by the directors:

The Members, have at the AGM held on August 21, 2013 approved the payment of commission to Non-Executive Directors within the ceiling of 1% of the net profits of the Company as computed under Section 198 of the Act. The NRC will recommend to the Board (a) the aggregate commission payable to all the NEDs based on Company performance, profits, return to investors, shareholder value creation and any other significant qualitative parameters decided by the Board and (b) the quantum of commission for each Director, based upon the outcome of the evaluation process which is driven by various factors including attendance and time spent on Board and Committee meetings, individual contributions at the meetings and contributions made by Directors other than in meetings. No commission was paid to the Non-Executive Directors for Fiscal 2016 in view of inadequacy of profits as computed under Section 198 of the Act.

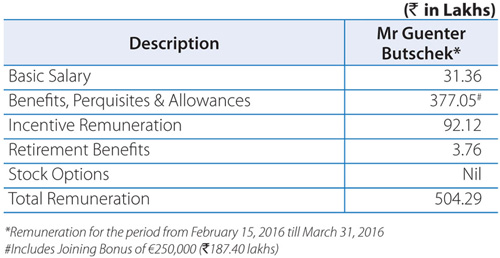

As per the terms of appointment and remuneration approved by the Board at its meeting held on January 18, 2016, Mr Butschek is entitled to incentive remuneration in the form of performance linked bonus and long-term incentives. The proposal for the appointment of Mr Butschek and the payment of his remuneration has been recommended by the Board for approval by the Members at this AGM and the details of the long-term incentives and the criteria for this payment is included in the said Resolution.

The Members have, at the AGM held on August 10, 2012, approved of the appointment of Mr Pisharody and Mr Borwankar as Executive Directors, which inter alia included the payment of commission and incentive remuneration as may be decided by the Board of Directors based on certain performance criteria as laid down by the Board. A proposal for the re-appointment of the 2 Executive Directors, including the payment of remuneration has been recommended by the Board for approval by the Members at this AGM. As per the said recommendation, commission would be payable to the Executive Directors subject to the overall ceiling stipulated under Section 197 of the Act, but in any case would not exceed 400% of their basic salary. In case of inadequacy of profits to pay a commission in any Financial Year, an incentive remuneration not exceeding 200% of their basic salary would be paid. The said commission/incentive remuneration may be recommended by the Board based on criteria such as Company performance on certain defined qualitative and quantitative parameters, industry benchmarks, performance of the individual.

For further details, please refer to Annexure 6 of the Boards' Report on remuneration Policy for Directors, KMPs and other Employees.

- The ratio of the remuneration of the highest paid director to that of the employees who are not directors but receive remuneration in excess of the highest paid director during the year:

Mr Guenter Butschek is the highest paid Director of the Company. In Fiscal 2016, none of the employees have received remuneration in excess of the highest paid Director.

- Affirmation that the remuneration is as per the remuneration policy of the Company:

The remuneration for MD/ED/KMP/rest of the employees is as per the remuneration policy of the Company.

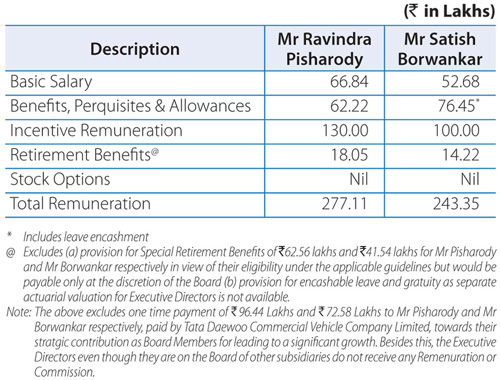

- Details of Remuneration to Directors pursuant to Schedule V, Part II, proviso of Section II B(iv)IV of the Act and Regulation 34(3) read along with schedule V of SEBI Listing Regulations

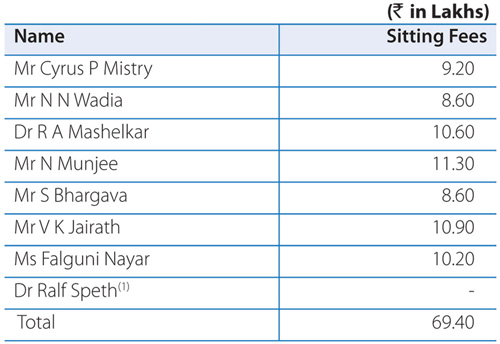

- Non-Executive Directors

The Non-Executive Directors' remuneration and sitting fees paid/payable by the Company in the Fiscal 2016, are given below:

(1) Dr Ralf Speth is a Non-Executive Director and is not paid any commission or sitting fees for attending Board meetings of the Company in view of his appointment as Chief Executive Offi cer and Director of Jaguar Land Rover Automotive PLC.

No Commission was paid to any Non-Executive Director for Fiscal 2016 in view of inadequacy of profits.

Some of the aforementioned Directors are also on the Board of the Company's subsidiaries and associates, in a non-executive capacity and are paid remuneration and sitting fees for participating in their meetings. Other than the above, the Non-Executive Directors have no pecuniary relationship or transactions with the Company, its subsidiaries and associates.The Company has increased sitting fees to be paid to Non-Executive Directors w.e.f. May 26, 2015, the details of which are given in the Corporate Governance Report.

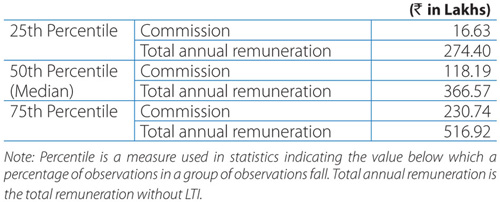

Industry comparative data for 10 similar sized companies:

- CEO & Managing Director and Executive Directors

The remuneration paid to the CEO & Managing Director and Executive Directors commensurate with industry standards and Board level positions held in similar sized companies, taking into consideration the individual responsibilities shouldered by them, their individual and Company's performance. The remuneration of the Executive Directors is in consonance with the terms of their appointment approved by the Members.

The NRC reviews and recommends to the Board the changes in the managerial remuneration of the CEO & MD and Executive Directors on a yearly basis. This review is based on the Balance Score Card that includes the performance of the Company and the individual director on certain defined qualitative and quantitative parameters such as volumes, EBITDA, cash flows, cost reduction initiatives, safety, strategic initiatives and special projects as decided by the Board vis-a-vis targets set in the beginning of the year. This review also takes into consideration the benchmark study undertaken by reputed independent agencies on comparative industry remuneration and practices.

Incentive remuneration paid/payable is subject to the achievement of certain performance criteria and such other parameters as may be considered appropriate from time to time by the Board. An indicative list of factors that may be considered for determining the extent of incentive remuneration, by the Board and as recommended by the NRC are, the Company's performance on certain defined qualitative and quantitative parameters as may be decided by the Board from time to time, industry benchmarks of remuneration and performance of the individual.

The Board at its meeting held on January 18, 2016 (based on recommendation of NRC) approved of the appointment of Mr Butschek as CEO & MD w.e.f. February 15, 2016, including the terms of remuneration. Members' approval is being sought at this AGM in respect of the above.

The Board at its meeting held on May 30, 2016 (based on the recommendation of NRC) revised the remuneration payable to Mr Pisharody and Mr Borwankar w.e.f. April 1, 2016 and also proposed their re-appointment w.e.f July 1, 2016 upon termination of their existing contract. Members' approval is being sought at this AGM for revision in their remuneration and terms of re-appointment.

- Non-Executive Directors

The terms of remuneration of CEO & Managing Director and Executive Directors for Fiscal 2016.

Notice period and Severance Fees

- The Contract with the MD may be terminated earlier, without any cause by either giving to the other party six months' notice of such termination or the Company paying six months' remuneration which shall be limited to provision of basic salary, benefits, perquisites and allowances (including Living Allowance) and any pro-rated incentive remuneration, in lieu of such notice. Additionally, in case of termination initiated by the Company before the end of the term for the reasons other than Tata Code of Conduct ("TCoC"), the MD shall be entitled to severance pay for a period of 12 months or balance term of the agreement whichever is less and which shall be limited to provision of basic salary, living allowance and any pro-rated incentive remuneration.

- This appointment may not be terminated by the Company without notice or payment in lieu of notice except for reasons of breach of TCoC. In case of breach of TCoC, MD shall not be entitled to Severance.

- In the event the MD is not in a position to discharge his official duties due to any physical or mental incapacity, he shall be entitled to receive notice pay and the severance as mentioned above and this contract shall stand terminated.

Notice period and Severance Fees

- This appointment may be terminated by either party by giving to the other party six months' notice of such termination or the Company paying six months' remuneration in lieu of the Notice.

- The employment of the Executive Director, may be terminated by the Company without notice or payment in lieu of notice:

- if the Executive Director, is found guilty of any gross negligence, default or misconduct in connection with or affecting the business of the Company or any subsidiary or associated company to which he is required by the Agreement to render services; or

- in the event of any serious repeated or continuing breach (after prior warning) or non-observance by the Executive Director, of any of the stipulations contained in the Agreement to be executed between the Company and the Executive Director; or

- in the event the Board expresses its loss of confidence in the Executive Director.

- In the event the Executive Director is not in a position to discharge his official duties due to any physical or mental incapacity, the Board shall be entitled to terminate his contract on such terms as the Board may consider appropriate in the circumstances.

On behalf of the Board of Directors

CYRUS P MISTRY

Chairman

Mumbai,

May 30, 2016