Remuneration of Directors

Non-Executive Directors

- A sitting fee of Rs.60,000/- for attendance at each meeting of the Board, Audit Committee, Executive Committee of the Board, NRC and for Independent Directors Meeting; Rs.20,000/- for attendance at each meeting of Stakeholders’ RelationshipCommittee; Safety, Health & Sustainability Committee, the Corporate Social Responsibility Committee, Risk Management Committee and other special need based committees, is paid to its Members (excluding Managing Director and Executive Directors) and also to Directors attending by invitation. The sitting fees paid/payable to the Non Whole-time Directors is excluded whilst calculating the limits of remuneration in accordance with Section 197 of the Act. The Company also reimburses out-of-pocket expenses to Directors attending meetings held at a city other than the one in which the Directors reside.

- The remuneration by way of commission to the Non-Executive Directors is decided by the Board of Directors and distributed to them based on their participation and contribution at the Board and certain Committee meetings as well as time spent on matters other than at meetings.The Members had, at the Annual General Meeting held on August 21, 2013, approved the payment of remuneration by way of commission to the Non Whole-time Directors of the Company, of a sum not exceeding 1% per annum of the net profits of the Company, calculated in accordance with the provisions of the Act for a period of 5 years commencing April 1, 2013, respectively.

No Commission was paid to any Non-Executive Director for FY 2017-18 in view of inadequacy of profits.

The performance evaluation criteria for Non-Executive Directors, including Independent Directors, is determined by the NRC. An indicative list of factors that were evaluated include participation and contribution by a director, commitment, effective deployment of knowledge and expertise, effective management of relationship with stakeholders, integrity and maintenance of confidentiality and independence of behaviour and judgement.

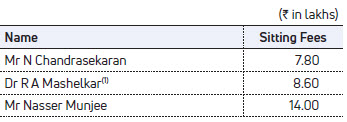

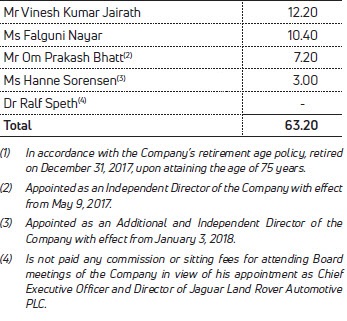

Given below are the Sitting Fees paid/ payable by the Company to Non-Executive Directors during FY 2017-18:

Some of the aforementioned Directors are also on the Board of the Company's subsidiaries and associates, in a nonexecutive capacity and are paid remuneration and sitting fees for participating in their meetings. Other than the above, the Non-Executive Directors have no pecuniary relationship or transactions with the Company, its subsidiaries and associates.

Managing and Executive Directors

The remuneration paid to the CEO & Managing Director and the Executive Directors is commensurate with industry standards and Board level positions held in similar sized companies, taking into consideration the individual responsibilities shouldered by them and is in consonance with the terms of appointment approved by the Members, at the time of their appointment.

The NRC, reviews and recommends to the Board the changes in the managerial remuneration, generally being increment in basic salary and commission/incentive remuneration of the Managing and Executive Directors on a yearly basis. This review is based on the Balanced Score Card that includes the performance of the Company and the individual director on certain defined qualitative and quantitative parameters such as volumes, EBITDA, market share, cashflows, cost reduction initiatives, safety, strategic initiatives and special projects as decided by the Board vis-a-vis targets set in the beginning of the year. This review also takes into consideration the benchmark study undertaken by reputed independent agencies on comparative industry remuneration practices.

The variable portion of the CEO & Managing Director’s remuneration comprises of incentive remuneration in the form of performance linked bonus and long-term incentive. The target performance linked bonus would be €550,000/- per annum upto a maximum of €825,000/- per annum. With the objective of achieving long-term value creation, through retention and continuity in leadership, a long term incentive plan is provided with a value intended target of €550,000/- per annum upto a maximum of €825,000/- per annum.

The variable portion of the Executive Directors remuneration comprises of a profit-linked commission and/or merit based incentive remuneration. The profit-linked commission is awarded at the discretion of the NRC and the Board of Directors, based on the net profits of the Company for that financial year, subject to the overall ceiling limits stipulated in Section 197 of the Act, but in any case not exceeding 400% of the basic salary. In case the Net Profits of the Company are inadequate for payment of profit-linked commission in any financial year, an incentive remuneration, not exceeding 200% of the basic salary, may be paid at the discretion of the Board.

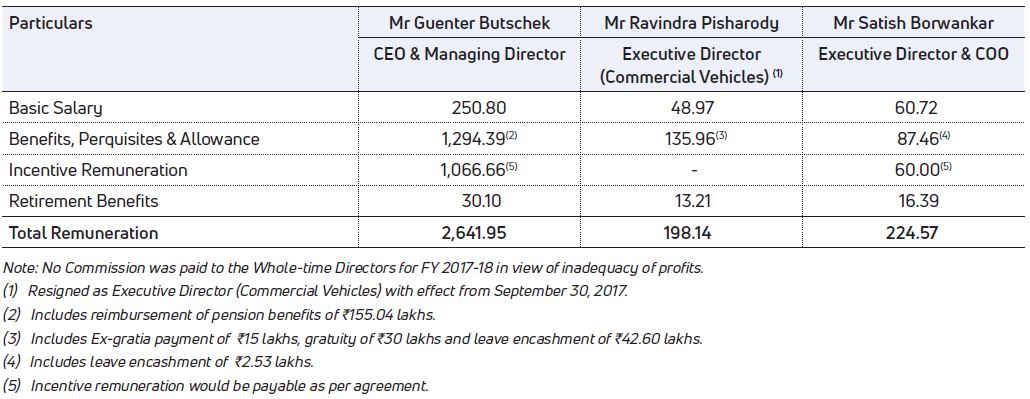

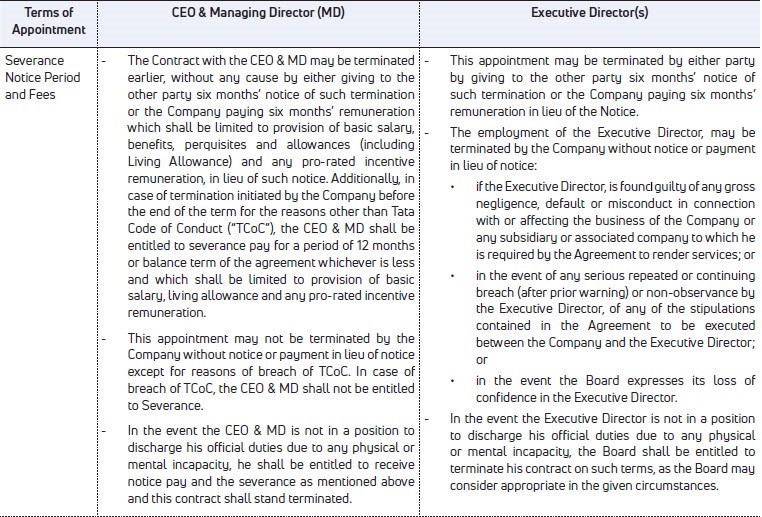

Given below are details pertaining to certain terms of appointment and payment of Managerial Remuneration to the CEO & Managing Director and Executive Directors for FY 2017 -18:

The Company has received approval from the shareholders and the Central Government for appointment and payment of remuneration to Mr Guenter Butschek, a foreign national, who is functioning in a professional capacity as its CEO and Managing Director for a period of 5 years from February 15, 2016 in accordance with Section 197 read together with Schedule V of the Act.

During the year under review, the Company did not have an Employee Stock Option Scheme for any of its employees or directors.

Retirement Policy for Directors

As per the retirement age policy adopted by the Company, the Managing and Executive Directors retire at the age of 65 years. The Executive Director, who have been retained on the Company’s Board beyond the age of 65 years as Non-Executive Directors for special reasons may continue as Directors at the discretion of the Board but in no case beyond the age of 70 years. The Company has also adopted a Policy for Managing and Executive Directors (except where he is an expat), which has also been approved by the Members of the Company, offering special retirement benefits, viz. pension, ex-gratia and medical. In addition to the above, the retiring Managing Director is entitled to residential accommodation or compensation in lieu of accommodation on retirement. The quantum and payment of the said benefits are subject to an eligibility criteria of the retiring director and is payable at the discretion of the Board in each individual case on the recommendation of the NRC. In line with the said Policy, payments are made to former Managing Directors / Whole-time Directors / their heirs, namely, the spouses of Late Mr J E Talaulicar and Late Mr V M Raval, Mr F J Da’Cunha, Mr Ravi Kant, Mr P M Telang and Mr R Pisharody.

Section 149 of the Act provides that an Independent Director shall hold office for a term of upto 5 consecutive years on the Board of a Company and would not be liable to retire by rotation. An Independent Director would be eligible to be re-appointed for another 5 years on passing of a Special Resolution by the Company. However, no Independent Director shall hold office for more than 2 consecutive terms, but would be eligible for appointment after the expiration of 3 years of ceasing to become an Independent Director. Provided that, during the said period of 3 years, he/she is not appointed in or associated with the Company in any other capacity, either directly or indirectly. The retirement age for Independent Directors is 75 years as per the Company’s Policy. Accordingly, all Independent Directors have a tenure of 5 years each or upon attaining the retirement age of 75 years, whichever is earlier, as approved by the Members at the Annual General Meeting held on July 31, 2014.

STAKEHOLDERS' RELATIONSHIP COMMITTEE

The Stakeholders’ Relationship Committee functions in accordance with Section 178 of the Act and Regulation 20 read with Part D of Schedule II of the SEBI Listing Regulations. The Committee comprising of 2 Independent Directors and the CEO & Managing Director, is empowered to:

- Review statutory compliances relating to all security holders.

- Consider and resolve the grievances of security holders of the Company, including complaints related to transfer of securities, non-receipt of annual report/ declared dividends/ notices/ balance sheet.

- Oversee compliances in respect of dividend payments and transfer of unclaimed amounts and shares to and from the Investor Education and Protection Fund.

- Oversee and review all matters related to the transfer of securities of the Company.

- Approve issue of duplicate certificates of the Company.

- Review movements in shareholding and ownership structures of the Company.

- Ensure setting of proper controls and oversee performance of the Registrar and Share Transfer Agent.

- Recommend measures for overall improvement of the quality of investor services.

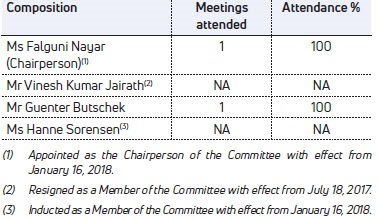

During the year under review, 1 Committee meeting was held on January 11, 2018. The composition of the Stakeholders’ Relationship Committee and attendance at its meeting is as follows: