COMPANY'S PHILOSOPHY ON CORPORATE GOVERNANCE

As a Tata Company, the Company’s philosophy on Corporate Governance is founded upon a rich legacy of fair, ethical and transparent governance practices, many of which were in place even before they were mandated by adopting the highest standards of professionalism, honesty, integrity and ethical behavior. As a global organization, the Corporate Governance practices followed by the Company and its subsidiaries are compatible with international standards and best practices. Through the Governance mechanism in the Company, the Board along with its Committees undertakes its fiduciary responsibilities to all its stakeholders by ensuring transparency, fairplay and independence in its decision making.

The Corporate Governance mechanism is further strengthened with the adherence to the Tata Business Excellence Model as a means to drive excellence and the Balanced Scorecard methodology for tracking progress on long-term strategic objectives. The Tata Code of Conduct, which articulates the values, ethics and business principles, serves as a guide to the Company, its directors and employees and is supplemented with an appropriate mechanism to report any concerns pertaining to non-adherence to the said Code. The Company has adopted the Governance Guidelines on Board Effectiveness based on current and emerging best practices from both within and outside the Tata Group of companies. The Company is in full compliance with the requirements of Corporate Governance under the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements), Regulations, 2015 (“SEBI Listing Regulations”). The Company’s Depositary Programme is listed on the New York Stock Exchange and the Company also complies with US regulations as applicable to Foreign Private Issuers (non-US companies listed on a US Exchange) which cast upon the Board of Directors and the Audit Committee, onerous responsibilities to ensure higher standards of the Company’s operating efficiencies. Risk management and the internal control process are focus areas that continue to meet the progressive governance standards.

BOARD OF DIRECTORS

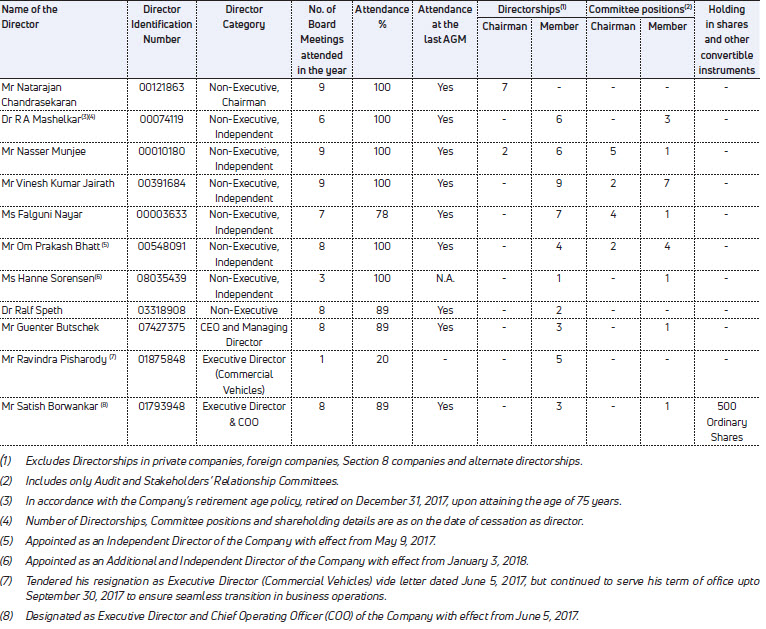

The Board of Directors is the apex body constituted by shareholders for overseeing the Company’s overall functioning. It provides strategic direction, leadership and guidance to the Company’s management as also monitors the performance of the Company with the objectives of creating long term value for the Company’s stakeholders. The Board currently comprises of 9 Directors, out of which 7 Directors (78%) are Non-Executive Directors, including 2 women directors. The Company has a Non-Executive Chairman and 5 Independent Directors, comprising more than half of the total strength of the Board. All the Independent Directors have confirmed that they meet the ‘independence’ criteria as mentioned under Regulation 16(1) (b) of the SEBI Listing Regulations and Section 149(6) of the Companies Act, 2013 (“Act”) and the Rules framed thereunder.

All the Directors have made necessary disclosures regarding their directorships and other interests as required under Section 184 of the Act and on the Committee positions held by them in other companies. None of the Directors on the Company’s Board hold the office of Director in more than 20 companies, including not more than 10 public companies and none of the Directors of the Company are related to each other. In accordance with Regulation 26 of the SEBI Listing Regulations none of the Directors are members in more than 10 committees or act as chairperson of more than 5 committees [the committees being, Audit Committee and Stakeholders’ Relationship Committee] across all pulic limited companies in which he/she is a Director. All Non-Executive Non-Independent Directors, are liable to retire by rotation.

The required information, including information as enumerated in Regulation 17(7) read together with Part A of Schedule II of the SEBI Listing Regulations is made available to the Board of Directors, for discussions and consideration at Board Meetings. The Board reviews the declaration made by the CEO & Managing Director and the Group Chief Financial Officer (“CFO”) regarding compliance with all applicable laws on a quarterly basis, as also steps taken to remediate instances of non-compliance, if any.

Pursuant to Regulation 27(2) of the SEBI Listing Regulations, the Company also submits a quarterly compliance report on Corporate Governance to the Indian Stock Exchanges, including details on all material transactions with related parties, within 15 days from the close of every quarter. The CEO & Managing Director and the CFO have certified to the Board on inter alia, the accuracy of the financial statements and adequacy of internal controls for financial reporting, in accordance with Regulation 17(8) read together with Part B of Schedule II of the SEBI Listing Regulations, pertaining to CEO and CFO certification for the Financial Year ended March 31, 2018.

During the year under review, 9 Board Meetings were held on April 4, 2017, May 23, 2017, May 31, 2017, July 5, 2017, August 9, 2017, November 9, 2017, January 16, 2018, February 5, 2018 and March 22, 2018. All the agenda papers for the Board and Committee meetings are disseminated electronically on a realtime basis, by uploading them on a secured online application, specifically designed for this purpose, thereby eliminating circulation of printed agenda papers. The composition of the Board, attendance at Board Meetings held during the Financial Year under review and at the last Annual General Meeting, number of directorships (including Tata Motors), memberships/ chairmanships of the Board and Committees of public companies and their shareholding as at March 31, 2018 in the Company are as follows:

The Company actively uses the facility of video conferencing, permitted under Section 173(2) of the Act read together with Rule 3 of the Companies (Meetings of Board and its Powers) Rules, 2014.

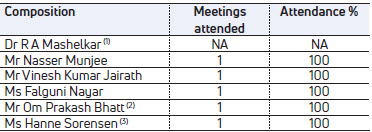

Independent Directors' Meeting: As per Regulation 25(1) of the SEBI Listing Regulations, none of the Independent Directors serve as Independent Directors in more than 7 listed entities and in case they are whole-time directors in any listed entity, then they do not serve as Independent Directors in more than 3 listed entities. During the year, 1 Meeting of Independent Directors was held on March 22, 2018 the attendance whereat is as follows:

An Independent Directors meeting in accordance with the provisions of Section 149(8) read with Schedule IV of the Act and Regulation 25(3) and 25(4) of the SEBI Listing Regulations was convened on March 22, 2018, to review the performance of Non-Independent Directors and the Board as a whole, the performance of the Chairman, taking into account the views of Executive and Non-Executive Directors. The quality, quality and timeliness of flow of information between the management and the Board is also assessed.

Board Effectiveness Evaluation: Pursuant to provisions of Regulation 17(10) of the SEBI Listing Regulations and the provisions of the Act, Board evaluation involving evaluation of the Board of Directors, its Committees and individual Directors, including the role of the Board Chairman, was conducted during the year. For details pertaining to the same, kindly refer to the Board’s Report.

Board Diversity: To ensure that a transparent Board nomination process is in place that encourages diversity of thought, experience, knowledge, perspective, age and gender, the Board has adopted a Diversity Policy, formulated by the Nomination & Remuneration Committee (“NRC”), wherein it is expected that the Board has an appropriate blend of functional and industry expertise. Whilst recommending the appointment of a Director, the NRC considers the manner in which the function and domain expertise of the individual contributes to the overall skill-mix of the Board and is supported by the Group Human Resources in this regard.

Familiarisation Programme: Kindly refer to the Company’s website for details of the familiarisation programme for Independent Directors on their roles, rights, responsibilities in the Company, nature of the industry in which the Company operates, business model of the Company and related matters.

COMMITTEES OF THE BOARD

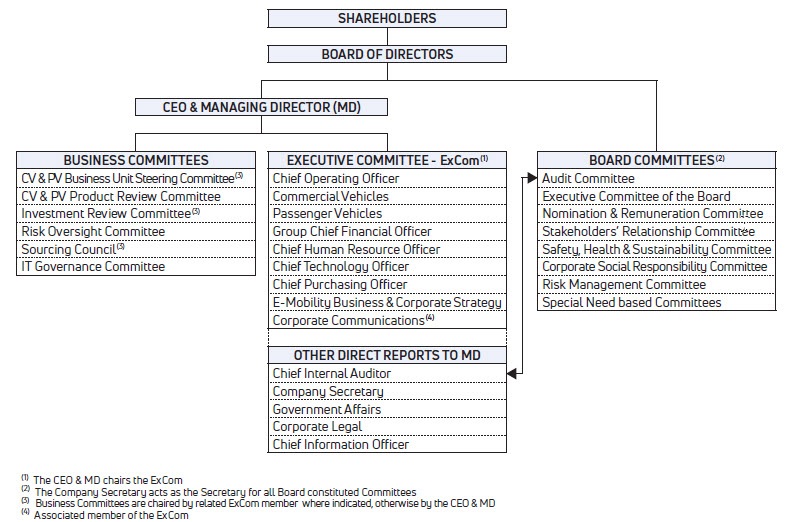

The Board has constituted a set of Committees with specific terms of reference/scope, to focus effectively on the issues and ensure expedient resolution of diverse matters. The Committees operate as empowered agents of the Board as per their Charter/terms of reference. Targets set / actions directed by them, as agreed with the management are reviewed periodically and mid-course corrections are also carried out. The Board of Directors and the Committees also take decisions by circular resolutions which are noted at the next meeting. The minutes of the meetings of all Committees of the Board are placed before the Board for discussions/noting. An Organisation Chart depicting the relationship between the Board of Directors, the Committees and the senior management functions is illustrated below: