AUDIT COMMITTEE

The Audit Committee functions according to its Charter that defines its composition, authority, responsibility and reporting functions in accordance with Section 177 of the Act, Regulation 18(3) read with Part C of Schedule II of the SEBI Listing Regulations and US regulations applicable to the Company and is reviewed from time to time. Whilst, the full Charter is available on the Company’s website, given below is a gist of the responsibilities of the Audit Committee:

- Reviewing with the management, quarterly/annual financial statements before submission to the Board, focusing primarily on:

- The Company’s financial reporting process and the disclosure of its financial information, including earnings, press release, to ensure that the financial statements are correct, sufficient and credible;

- Reports on the Management Discussion and Analysis of financial condition, results of operations and the Directors’ Responsibility Statement;

- Major accounting entries involving estimates based on exercise of judgment by Management;

- Compliance with accounting standards and changes in accounting policies and practices as well as reasons thereof;

- Draft Audit Report, qualifications, if any and significant adjustments arising out of audit;

- Scrutinise inter corporate loans and investments;

- Disclosures made under the CEO and CFO certification; and

- Approval or any subsequent modification of transactions with related parties, including omnibus related party transactions.

- Reviewing with the management, external auditor and internal auditor, adequacy of internal control systems and recommending improvements to the management.

- Review Management letters/Letters of internal control weakness issued by the statutory auditors.

- Recommending the appointment/removal of the statutory auditor, cost auditor, fixing audit fees and approving nonaudit/ consulting services provided by the statutory auditors’ firms to the Company and its subsidiaries; evaluating auditors’ performance, qualifications, experience, independence and pending proceedings relating to professional misconduct, if any.

- Reviewing the adequacy of internal audit function, including the structure of the internal audit department, staffing and seniority of the chief internal auditor, coverage and frequency of internal audit, appointment, removal, performance and terms of remuneration of the chief internal auditor.

- Discussing with the internal auditor and senior management, significant internal audit findings and follow-up thereon.

- Discussing with the statutory auditor before the audit commences, the nature and scope of audit, as well as conduct post-audit discussions to ascertain any area of concern.

- Reviewing the findings of any internal investigation by the internal auditor into matters involving suspected fraud or irregularity or a failure of internal control systems of a material nature and report the matter to the Board.

- Discussing with the statutory auditor before the audit commences, the nature and scope of audit, as well as conduct post-audit discussions to ascertain any area of concern.

- Establish and review the functioning of the Vigil Mechanism under the Whistle-Blower Policy of the Company.

- Reviewing the financial statements and investments made by subsidiary companies and subsidiary oversight, relating to areas such as adequacy of the internal audit structure and function of the subsidiaries, their status of audit plan and its execution, key internal audit observations, risk management and the control environment.

- Look into the reasons for any substantial defaults in payment to the depositors, debenture holders, shareholders (in case of non-payment of declared dividend) and creditors, if any.

- Reviewing the effectiveness of the system for monitoring compliance with laws and regulations.

- Approving the appointment of CFO after assessing the qualification, experience and background etc. of the candidate.

- Review the system of storage, retrieval, display or printout of books of accounts maintained in electronic mode during the required period under law.

- Approve all or any subsequent modification of transactions with related parties.

- To approve policies in relation to the implementation of the Tata Code of Conduct for Prevention of Insider Trading and Code of Corporate Disclosure Practices (“Code”) and to supervise implementation of the Code.

- To note and take on record the status reports, detailing the dealings by Designated Persons in Securities of the Company, as submitted by the Compliance Officer on a quarterly basis and to provide directions on any penal action to be initiated, in case of any violation of the Code, by any person

During the year, the Committee inter alia reviewed key audit findings covering operational, financial and compliance areas. It also reviewed the internal control system in subsidiary companies. The Chairman of the Audit Committee briefs the Board on significant discussions at Audit Committee meetings.

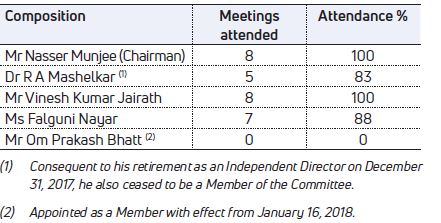

The Committee comprises of 4 Independent Directors, all of whom are financially literate and have relevant finance and/or audit exposure. Mr Munjee is the Financial Expert. The quorum of the Committee is two members or one-third of its members, whichever is higher. The Chairman of the Audit Committee also attended the last Annual General Meeting of the Company. During the period under review, 8 Audit Committee meetings were held on April 18, 2017, May 22, 2017, July 4, 2017, August 7, 2017, September 18, 2017, November 7, 2017, a two-day meeting on January 11-12, 2018 and February 2, 2018. Each Audit Committee meeting which considers financial results is preceded by a meeting of the Audit Committee members and the Auditors.

The composition of the Audit Committee and attendance at its meetings is as follows:

Ms Hanne Sorensen, Additional and Independent Director, also attends Audit Committee meetings as a special invitee with effect from January 16, 2018. The Committee meetings are held at the Company’s Corporate Headquarters or at its plant locations and are attended by the CEO & Managing Director, Executive Directors, CFO, Chief Internal Auditor, Statutory Auditors and Cost Auditors on a need based basis. The Business and Operation Heads are invited to the meetings, as and when required. The Chief Internal Auditor reports directly to the Audit Committee to ensure independence of the Internal Audit function.

The Committee relies on the expertise and knowledge of the management, the internal auditors and the Statutory Auditor, in carrying out its oversight responsibilities. It also uses external expertise, if required. The management is responsible for thepreparation, presentation and integrity of the Company’s financial statements including consolidated statements, accounting and financial reporting principles. The management is also responsible for internal control over financial reporting and all procedures are designed to ensure compliance with accounting standards, applicable laws and regulations as well as for objectively reviewing and evaluating the adequacy, effectiveness and quality of the Company’s system of internal controls.

B S R & Co. LLP, Chartered Accountants (ICAI Firm Registration No.101248 W/W – 100022), the Company’s Statutory Auditor, is responsible for performing an independent audit of the Financial Statements and expressing an opinion on the conformity of those financial statements with accounting principles generally accepted in India.

The Audit Commiittee reviews on a quarterly basis the confirmation of the Independence made by the Auditors, as also approves of the fees paid to the Auditors by the Company, or any other company in the Tata Motors Group as per the Policy for Approval of Services to be rendered by the Auditors. The said Policy is also available on our website http://www.tatamotors.com/investors/pdf/auditfeepolicy. pdf. The Company rotates its Audit Partners responsible for its audit every five years, apart from the requirement of the Act of rotating the Audit Firm every ten years, to ensure independence in the audit function.

NOMINATION AND REMUNERATION COMMITTEE

The Nomination and Remuneration Committee (NRC) of the Company functions according to its Charter, that defines its objective, composition, meeting requirements, authority and power, responsibilities, reporting and evaluation functions in accordance with Section 178 of the Act and the SEBI Listing Regulations. The broad terms of reference of the NRC are as follows:

- Recommend to the Board the set up and composition of the Board and its Committees including the “formulation of the criteria for determining qualifications, positive attributes and independence of a director”. The Committee periodically reviews the composition of the Board with the objective of achieving an optimum balance of size, skills, independence, knowledge, age, gender and experience.

- Devise a policy on Board diversity.

- Recommend to the Board the appointment or reappointment of Directors, including Independent directors, on the basis of the performance evaluation report of Independent Directors.

- Support the board in matters related to set-up, review and refresh of the Committees.

- Recommend to the Board on voting on resolutions for appointment and remuneration of Directors on the Boards of its material subsidiary companies and provide guidelines for remuneration of Directors on material subsidiaries.

- Identify and recommend to the Board appointment of Key Managerial Personnel (“KMP” as defined by the Act) and executive team members of the Company (as defined by this Committee). The Committee shall consult the Audit Committee before recommending the appointment of the CFO.

- Carry out evaluation of every Director’s performance and support the Board, its Committees and individual Directors, including “formulation of criteria for evaluation of Independent Directors and the Board”

- Oversee the performance review process for the KMP and the executive team of the Company with a view that there is an appropriate cascading of goals and targets across the Company and on an annual basis, recommend to the Board the remuneration payable to the Directors, KMP and executive team of the Company.

- Recommend the Remuneration Policy for Directors, KMP, executive team and other employees.

- Review matters related to voluntary retirement and early separation schemes for the Company.

- Oversee familiarization programmes for Directors.

- Oversee HR philosophy, HR and people strategy and efficacy of HR practices including those for leadership development, rewards and recognition, talent management and succession planning (specifically for the Board, KMP and executive team).

- Performing such other duties and responsibilities as may be consistent with the provisions of the Committee Charter.

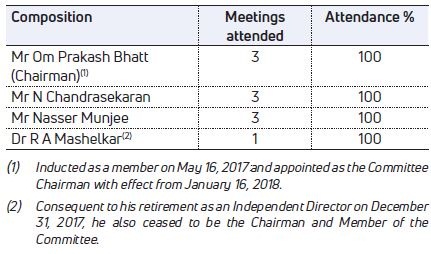

The Committee presently comprises of 2 Independent Directors and 1 Non-Executive Director. During the year under review, three meetings of the Committee were held on May 23, 2017, January 16, 2018 and March 22, 2018. The decisions are taken by the Committee, at meetings or by passing circular resolutions. The composition of the NRC and attendance at its meetings is as follows:

Remuneration Policy

The Company has in place a Remuneration Policy for Directors, KMP and other employees, in accordance with the provisions of the Act and the SEBI Listing Regulations. For details on Remuneration Policy for Directors, KMP and other employees, kindly refer to Annexure 4 to the Board’s Report.