year, Company may declare dividend out of free reserves,

subject to fulfilment of conditions specified under the Act, as

amended from time to time.

C. Company may, in certain cases, declare dividend using a

combination of A and B above.

6) PARAMETERS

TO

BE

CONSIDERED

WHILE

RECOMMENDING/DECLARING DIVIDEND

The Board while determining quantum of the dividend payout

to the shareholders, will consider following internal and external

factors:

Internal Factors:

•

Profits earned and available for distribution during the

financial year

•

Accumulated reserves, including retained earnings

•

Mandatory transfer of Profits earned to specific reserves, such

as Debenture Redemption Reserve, etc.

•

Past dividend trends – rate of dividend, EPS and payout ratio,

etc.

•

Earning Stability

•

Future Capital Expenditure requirement of the Company

•

Growth plans, both organic and inorganic

•

Capital restructuring, Debt reduction, Capitalisation of shares

•

Crystallization of contingent liabilities of the Company

•

Profit earned under the Consolidated Financial Statement

•

Cash Flows

•

Current and projected Cash Balance and Company’s working

capital requirements.

•

Covenants in loan agreements, Debt servicing obligations

and Debt maturity profile.

External Factors:

•

Economic environment, both domestic and global.

•

Unfavorable market conditions

•

Changes in Government policies and regulatory provisions

•

Cost of raising funds from alternate sources

•

Inflation rates

•

Sense of shareholders’ expectations

•

Cost of external financing

7) CIRCUMSTANCES UNDERWHICHTHE SHAREHOLDERS

OF THE COMPANY MAY OR MAY NOT EXPECT

DIVIDEND

The decision regarding dividend payout is a crucial decision

as it determines the amount of profit to be distributed among

shareholders and amount of profit to be retained in business.

Hence, the shareholders of the Company may expect dividend

only if the Company is having surplus funds after providing for

all the expenses, depreciation, etc., and after complying with the

statutory requirements under the Applicable Laws.

The shareholders of the Company may not expect dividend in

the following circumstances, subject to the discretion of the

Board of Directors:

•

the Company has inadequacy of profits or incurs losses for

the Financial Year;

•

the Company undertakes /proposes to undertake a

significant expansion project requiring higher allocation of

capital;

•

the Company undertakes /proposes to undertake any

acquisitions or joint arrangements requiring significant

allocation of capital.

•

the Company has significantly higher working capital

requirement affecting free cash flow.

•

the Company proposes to utilize surplus cash for buy- back

of securities;

•

the Company is prohibited to recommend/declare dividend

by any regulatory body.

The Board may also not recommend a dividend on considering

any compelling factors/parameters mentioned in point 6 above.

8) QUANTUM, MANNER AND TIMELINES FOR DIVIDEND PAYOUT

Quantum:

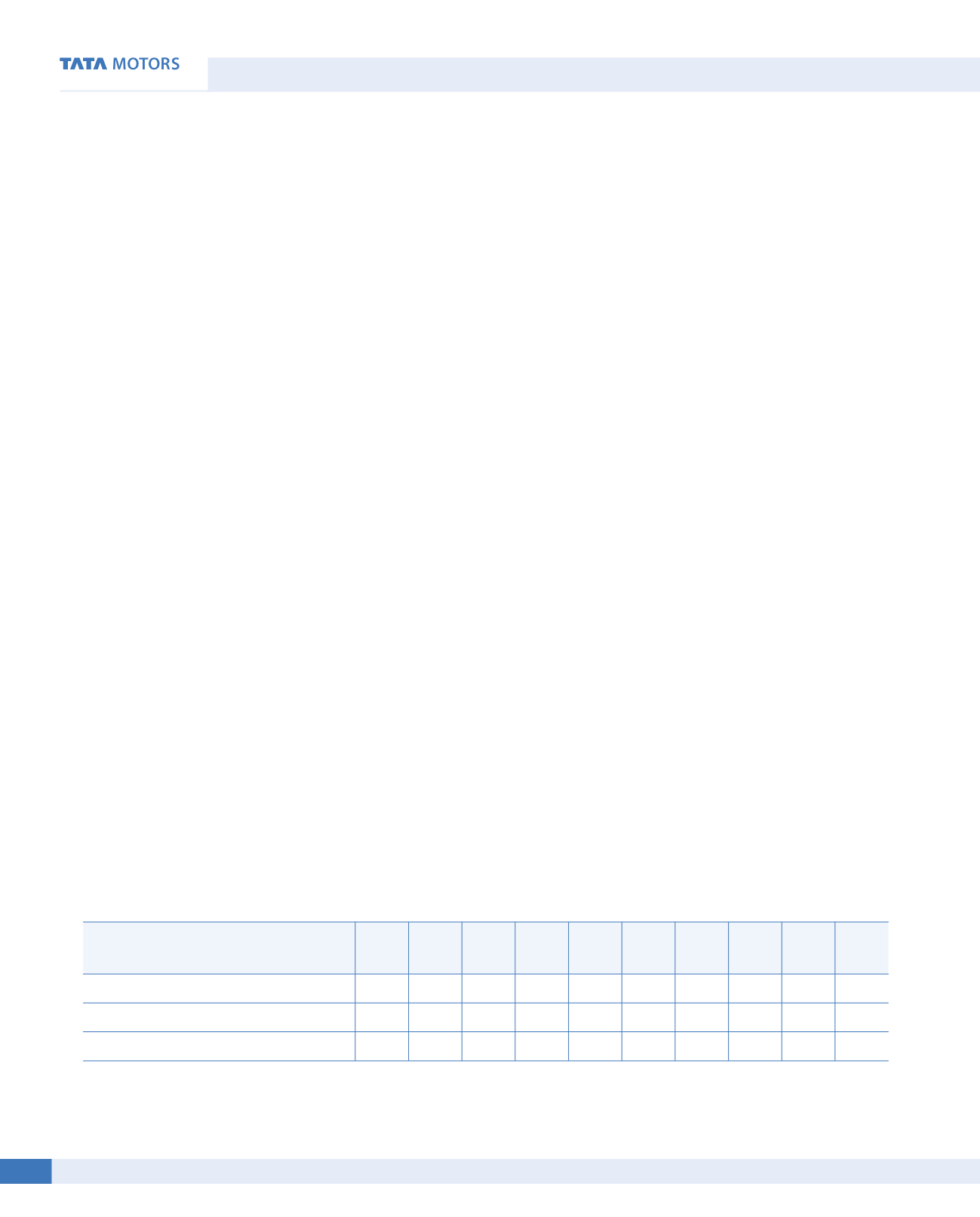

The dividend history of the Company over the past 10 years is as follows:

Particulars

FY

06-07

FY

07-08

FY

08-09

FY

09-10

FY

10-11

FY

11-12

FY

12-13

FY

13-14

FY

14-15

FY

15-16

Dividend paid per share on Ordinary shares

15

15

6

15 20*

4

2

2

-

.20

Dividend payout (as a % to Standalone PAT)

35

33

35

44 81*

118 240 222

-

31

Dividend Payout (as % to Consolidated PAT)

32

31

-15

39 16*

11

8

5

-

1

*subdivision of shares on September 13, 2011(record date) from face value of Rs.10/- each to face value of Rs 2/- each.

The ‘A’ Ordinary Shares issued in 2008 are paid a higher dividend of 5% i.e Rs.0.10 per share of Rs 2/- each as per the terms of Issue.

Corporate Overview

Financial Statements

Statutory Reports

72nd Annual Report 2016-17