F-155

(Amount in

R

)

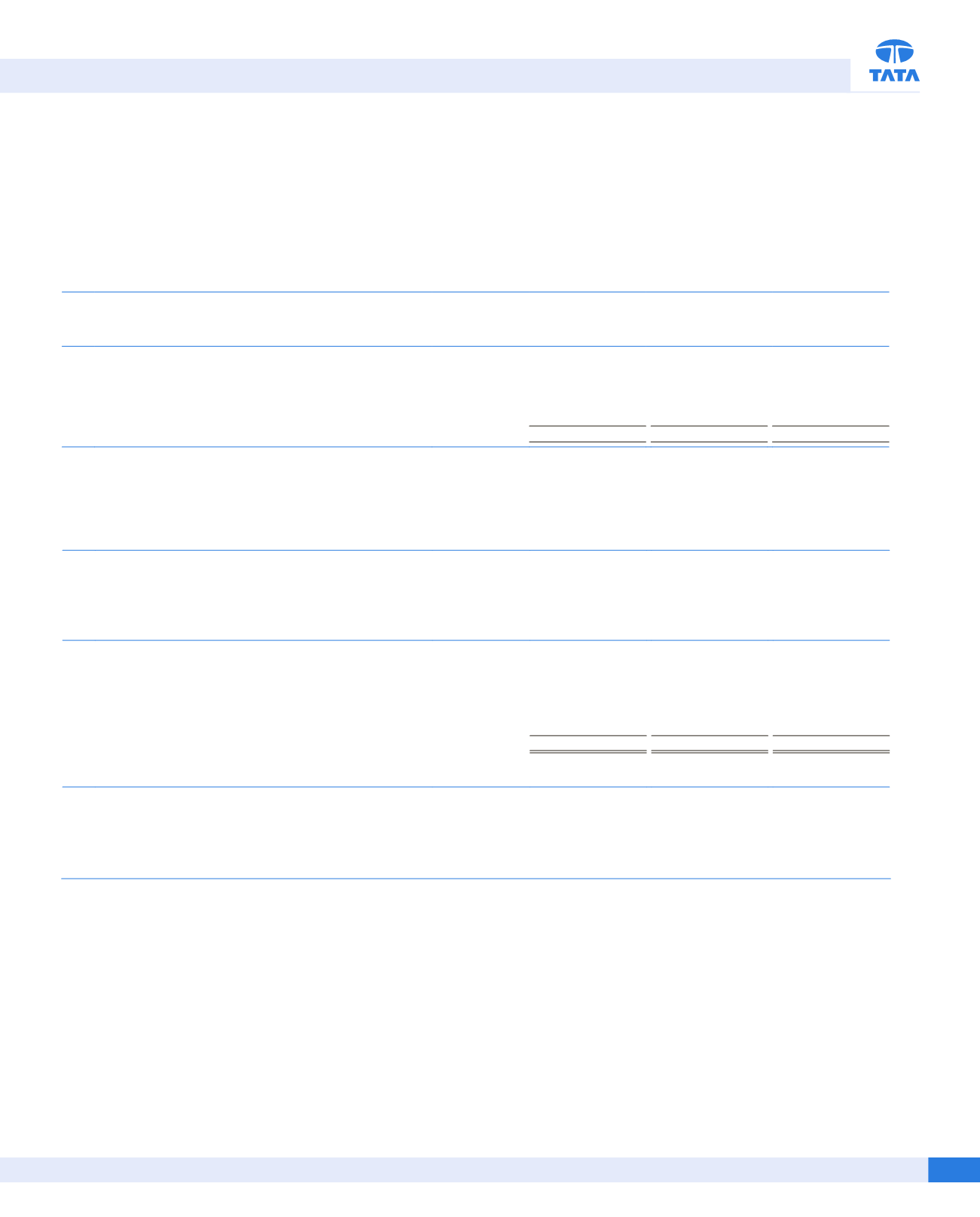

Particulars

SBNs

Other

denomination

notes

Total

Closing cash in hand as on November 8, 2016

9,59,50,250

1,07,28,889

10,66,79,139

(+) Non-permitted receipts

79,500

-

79,500

(+) Permitted receipts

-

1,85,09,67,818

1,85,09,67,818

(-) Permitted payments

4,99,500

2,61,55,712

2,66,55,212

(-) Amount deposited in banks

9,55,30,250

1,72,69,17,216

1,82,24,47,466

Closing cash in hand as on December 30, 2016

-

10,86,23,779

10,86,23,779

(b)

“Exceptional itemVI (b)”of

R

147.93 crores

for the year ended March 31, 2017, relates to provision for inventory of BS III vehicles as at March 31, 2017. This

does not include higher level of customer discounts and variablemarketing expenses inMarch 2017, to support higher level of retail sales which have been

netted off against“Income from operations”.

(c)

The following subsidiaries have been considered on Unaudited basis. Details for the same as per individual entity’s financials are as under :

(

R

in crores)

Particulars

Net Worth

As at

March 31, 2017

Total Revenue for

the year ended

March 31, 2017

Net Increase /

(Decrease) in Cash

& Cash equivalent

during

2016-2017

Subsidiaries :

Tata Motors European Technical Centre Plc

306.12

216.33

(36.86)

Trilix S.r.l

52.09

119.26

8.66

Tata Precision Industries Pte Ltd

0.94

-

(0.16)

Tata Hispano Motors Carrocera S.A

(647.95)

0.56

(0.29)

Tata Hispano Motors Carroceries Maghreb S.A

(22.46)

0.36

(17.46)

Total

(311.26)

336.51

(46.11)

For the year ended/as at March 31, 2016

(406.42)

398.72

41.83

45. Other Notes

(a) Disclosure on Specified Bank Notes (SBNs)

As required by MCA notification G.S.R. 308 (E) dated March 30, 2017, details in respect of Specified Bank Notes (SBNs) held and transacted during the period

fromNovember 8, 2016 to December 30, 2016 are given below:

NOTES FORMING PART OF CONSOLIDATED FINANCIAL STATEMENTS

For and on behalf of the Board

R AMASHELKAR

[DIN:00074119]

NMUNJEE

[DIN:00010180]

V K JAIRATH

[DIN:00391684]

OP BHATT

[DIN:00548091]

R SPETH

[DIN:03318908]

Directors

NCHANDRASEKARAN

[DIN:00121863]

Chairman

GUENTER BUTSCHEK

[DIN:07427375]

CEO&ManagingDirector

R PISHARODY

[DIN:01875848]

ExecutiveDirector

S B BORWANKAR

[DIN:01793948]

ExecutiveDirector

C RAMAKRISHNAN

GroupChiefFinancialOfficer

HK SETHNA

[FCS:3507]

CompanySecretary

Mumbai, May 23, 2017

(d)

The Company has a process whereby periodically all long term contracts (including derivative contracts) are assessed for material foreseeable losses. At

the year end, the Company has reviewed and ensured that adequate provision are required under any law/accounting standards for material foreseeable

losses on such long term contracts (including derivative contracts) has been made in the books of account.

(e)

Current period figures are shown in bold prints.