F-75

In terms of our report attached

For and on behalf of the Board

For

DELOITTE HASKINS & SELLS LLP

CharteredAccountants

B P SHROFF

Partner

Mumbai, May 23, 2017

R AMASHELKAR

[DIN:00074119]

NMUNJEE

[DIN:00010180]

V K JAIRATH

[DIN:00391684]

OP BHATT

[DIN:00548091]

R SPETH

[DIN:03318908]

Directors

NCHANDRASEKARAN

[DIN:00121863]

Chairman

GUENTER BUTSCHEK

[DIN:07427375]

CEO&ManagingDirector

R PISHARODY

[DIN:01875848]

ExecutiveDirector

S B BORWANKAR

[DIN:01793948]

ExecutiveDirector

C RAMAKRISHNAN

GroupChiefFinancialOfficer

HK SETHNA

[FCS:3507]

CompanySecretary

Mumbai, May 23, 2017

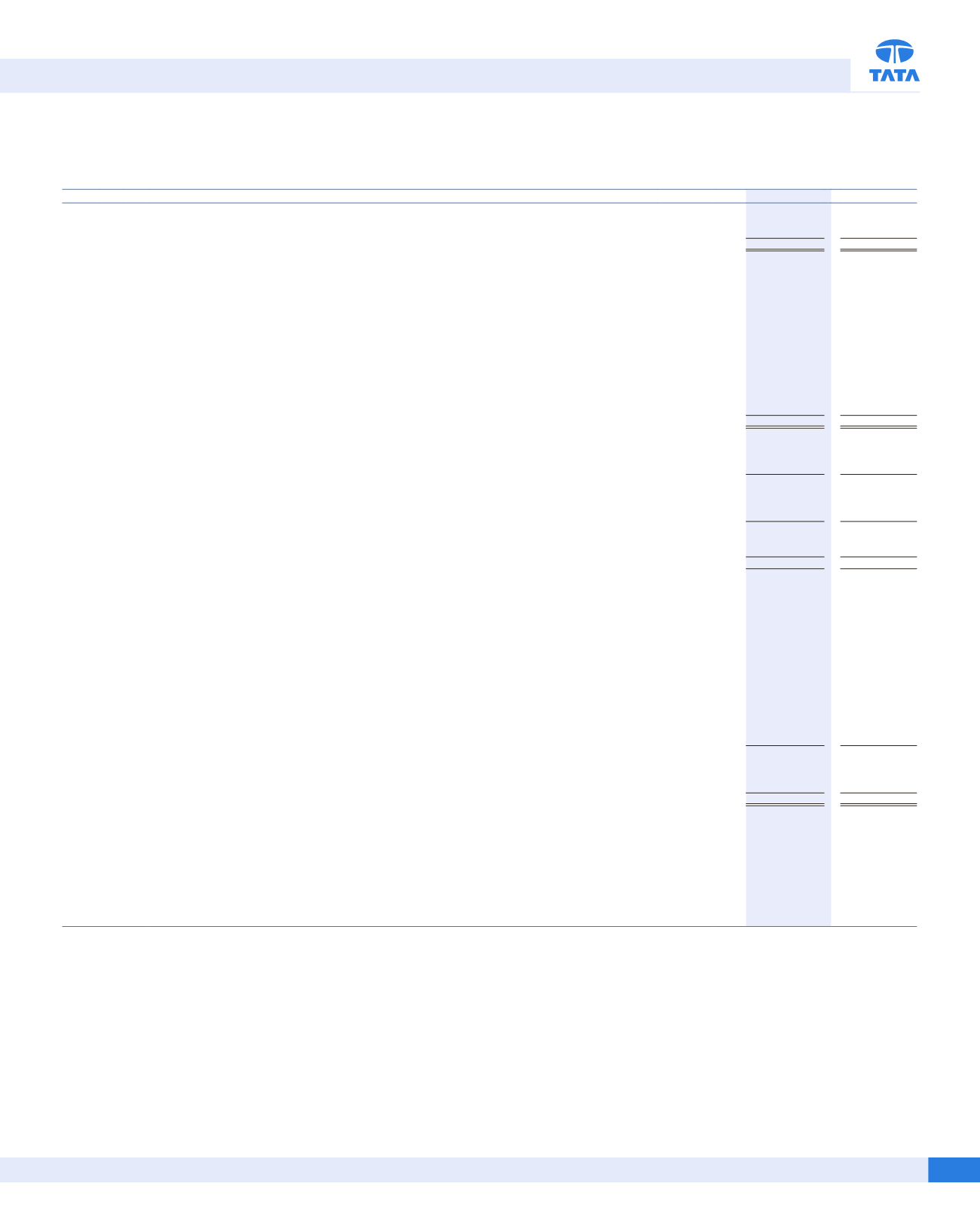

CONSOLIDATED STATEMENT OF PROFIT AND LOSS

(

R

in crores)

Year ended March 31,

Note

2017

2016

I.

Income from operations

31

274,492.12

277,660.59

II.

Other income

32

754.54

885.35

III.

Total Income (I+II)

275,246.66

278,545.94

IV.

Expenses:

(a) Cost of materials consumed

(i) Cost of materials consumed

160,147.12

151,065.61

(ii) Basis adjustment on hedge accounted derivatives

(777.57)

2,226.88

(b) Purchase of products for sale

13,924.53

12,841.52

(c) Changes in inventories of finished goods, work-in-progress and products for sale

(7,399.92)

(2,750.99)

(d) Excise duty

4,799.61

4,614.99

(e) Employee benefits expense

33

28,332.89

28,880.89

(f) Finance costs

34

4,238.01

4,889.08

(g) Foreign exchange (gain)/loss (net)

3,910.10

1,616.88

(h) Depreciation and amortisation expense

17,904.99

16,710.78

(i)

Product development/Engineering expenses

3,413.57

3,468.77

(j)

Other expenses

35

55,430.06

55,683.75

(k) Amount capitalised

(16,876.96)

(16,678.34)

Total Expenses (IV)

267,046.43

262,569.82

V.

Profit before exceptional items and tax (III-IV)

8,200.23

15,976.12

VI.

Exceptional Items:

(a) Employee separation cost

67.61

32.72

(b) Others

12(iv) & 45(b)

(1,182.17)

1,817.63

VII.

Profit before tax (V-VI)

9,314.79

14,125.77

VIII.

Tax expense

20

(a) Current tax

3,137.66

1,862.05

(b) Deferred tax

113.57

1,163.00

Total tax expense

3,251.23

3,025.05

IX.

Profit/(loss) for the year from continuing operations (VII-VIII)

6,063.56

11,100.72

X.

Share of profit/(loss) of joint ventures and associates (net)

7

1,493.00

577.47

XI.

Profit for the year (IX+X)

7,556.56

11,678.19

Attributable to:

(a) Shareholders of the Company

7,454.36

11,579.31

(b) Non-controlling interests

102.20

98.88

XII.

Other comprehensive income/(loss):

(A) (i)

Items that will not be reclassified to profit or loss:

(a) Remeasurement gains and (losses) on defined benefit obligations (net)

(7,823.75)

4,867.37

(b) Quoted equity instruments at fair value through other comprehensive income

83.15

68.79

(c) Share of other comprehensive income in equity accounted investees (net)

(6.08)

(1.34)

(d) Gains and (losses) in cash flow hedges of forecast inventory purchases

2,026.77

2,430.04

(ii)

Income tax (expense)/credit relating to items that will not be reclassified to profit or loss:

867.35

(1,514.57)

(B) (i)

Items that will be reclassified to profit or loss:

(a) Exchange differences in translating the financial statements of foreign operations

(9,678.58)

1,687.11

(b) Gains and (losses) in cash flow hedges of forecast sales

(15,565.66)

(5,371.92)

(c) Share of other comprehensive income in associates and joint ventures (net)

(304.70)

29.00

(ii)

Income tax (expense)/credit relating to items that will be reclassified to profit or loss:

2,906.93

962.98

Total Other comprehensive income/(loss) for the year (net of tax)

(27,494.57)

3,157.46

Attributable to:

(a)

Shareholders of the Company

(27,460.30)

3,145.33

(b)

Non-controlling interests

(34.27)

12.13

XIII.

Total comprehensive income/(loss) for the year (net of tax) (XI+XII)

(19,938.01)

14,835.65

Attributable to:

(a)

Shareholders of the Company

(20,005.94)

14,724.64

(b)

Non-controlling interests

67.93

111.01

XIV.

Earnings per equity share (EPS)

43

(A) Ordinary shares (face value of

`

2 each):

(i)

Basic EPS

`

21.94

34.25

(ii)

Diluted EPS

`

21.93

34.24

(B) ‘A’Ordinary shares (face value of

`

2 each):

(i)

Basic EPS

`

22.04

34.35

(ii)

Diluted EPS

`

22.03

34.34

See accompanying notes to the consolidated financial statements