F-19

(w)

Transition to Ind AS

The Company has prepared the opening balance sheet as per Ind AS as at April 1, 2015 (the transition date) by recognizing all assets and liabilities whose

recognition is required by Ind AS, not recognizing items of assets or liabilities which are not permitted by Ind AS, by reclassifying items from previous GAAP

to Ind AS as required by Ind AS, and applying Ind AS in measurement of recognized assets and liabilities. However, this principle is subject to the certain

exception and certain optional exemptions availed by the Company as detailed below.

Fair valuation as deemed cost for certain items of Property, Plant and Equipment and Other intangible assets

The Company has elected to measure certain items of its Property, Plant and Equipment and its related intangible assets at its fair value and use that fair

value as its deemed cost at the date of transition to Ind AS. Other items of Property, Plant and Equipment and Other intangible assets have been measured

as per Ind AS 16 and Ind AS 38, respectively.

Derecognition of financial assets

The Company has choosen to apply derecognition criteria retrospectively. Accordingly certain trade receivables have been re-recognised under Ind AS as

at April 1, 2015.

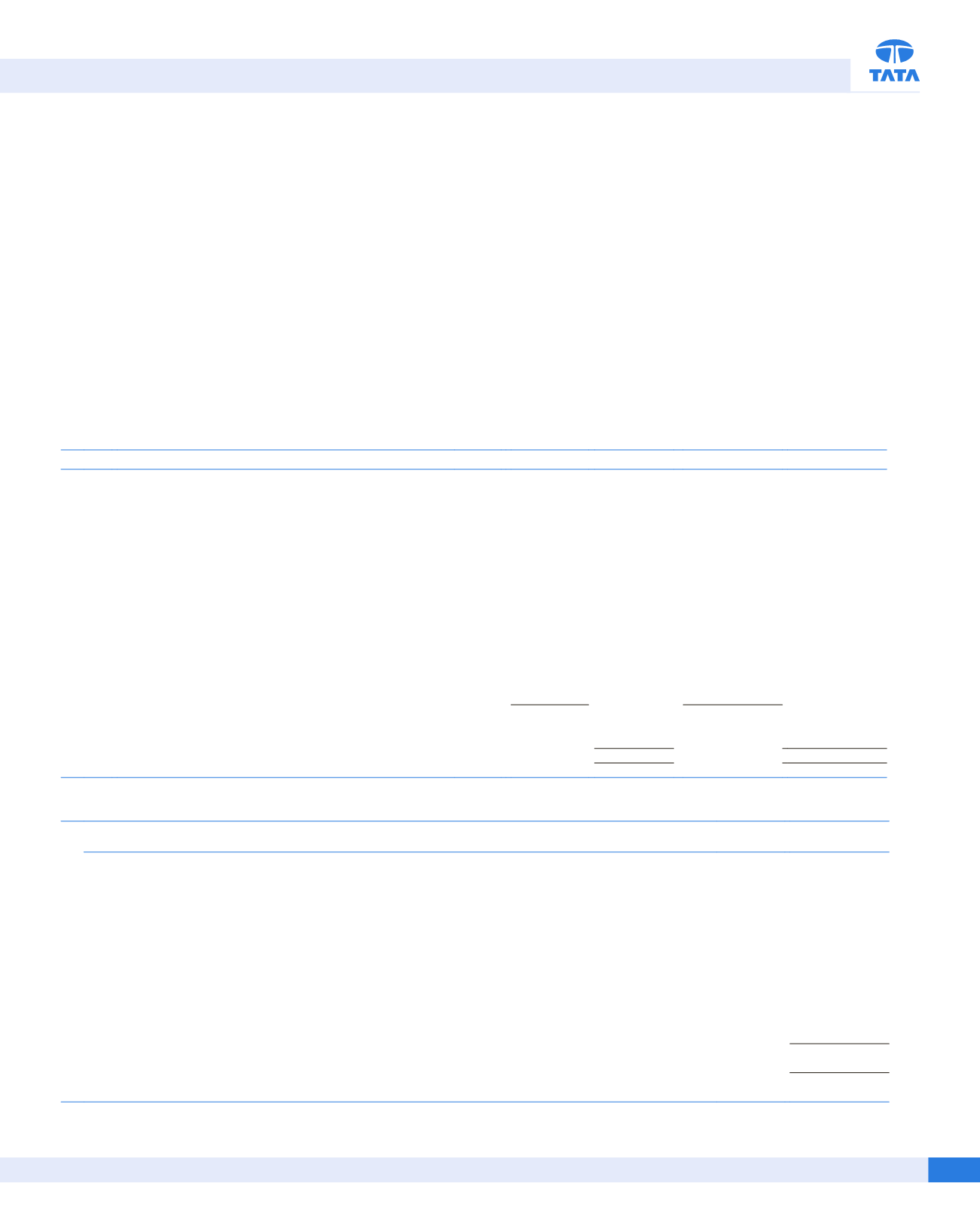

Reconciliation between Previous GAAP and Ind AS

(

R

in crores)

a) Equity Reconciliation

Particulars

Note

As at March 31, 2016

As at April 1, 2015

Equity as reported under previous GAAP

22,368.08

14,862.59

(a) Equity of Joint operations

(h)

177.82

(62.45)

(b) Movement of financial instruments classified as fair value through

Other Comprehensive Income

(a)

(100.95)

(101.78)

(c) Proposed Dividend

(b)

73.00

-

(d) Provision for expected credit losses

(c)

(2,130.87)

(2,112.87)

(e) Gain on fair value of below market interest loan (net of effective

interest rate adjustment)

(d)

447.48

396.98

(f) Property, plant and equipment and intangible assets:

(e)&(f)

(i)

Fair valuation as deemed cost for Property, Plant and

Equipment and intangible assets

2,609.67

2,343.98

(ii)

Foreign exchange

(764.93)

(741.94)

(iii)

Pre-operative expenses

(47.89)

(50.89)

(iv)

Interest capitalized

193.94

186.79

(v)

Government Grant (EPCG licenses)

515.46

2,506.25

514.68

2,252.62

(g) Fair value gain on investments in mutual funds

(a)

9.34

-

(h) Others (net)

(51.16)

(49.71)

(i) Tax effect on above adjustments

(g)

(36.88)

(36.02)

Equity under Ind AS

23,262.11

15,149.36

b) Total Comprehensive Income Reconciliation

Particulars

Note

Year ended

March 31, 2016

Net profit after tax as reported under previous GAAP

234.23

(a) Profits of Joint operations (net of tax)

(h)

239.29

(b) Reversal of exchange loss accumulated in foreign currency monetary item translation difference account

(f)

(82.50)

(c) Effect of adoption of fair value as deemed cost relating to property, plant and equipment and intangibles (net of

depreciation and amortization)

(e) & (f)

253.63

(d) Gain on fair value of below market interest loan (net of effective interest rate adjustment)

(d)

50.50

(e) Reversal of gain on sale of Investment in Equity instruments classified as fair value through Other Comprehensive

Income

(a)

(80.38)

(f) Fair value gain on investment in mutual funds

(a)

9.34

(g) Provision for expected credit losses

(c)

(18.00)

(h) Reversal of Profit on sale of investments on common control transactions

(656.36)

(i) Others (net)

(12.91)

(j) Tax effect on above adjustments

(g)

0.86

Net loss after tax as per Ind AS

(62.30)

Other Comprehensive Income (net of tax)

85.47

Total Comprehensive Income after tax as per Ind AS

23.17

NOTES FORMING PART OF FINANCIAL STATEMENTS