F-9

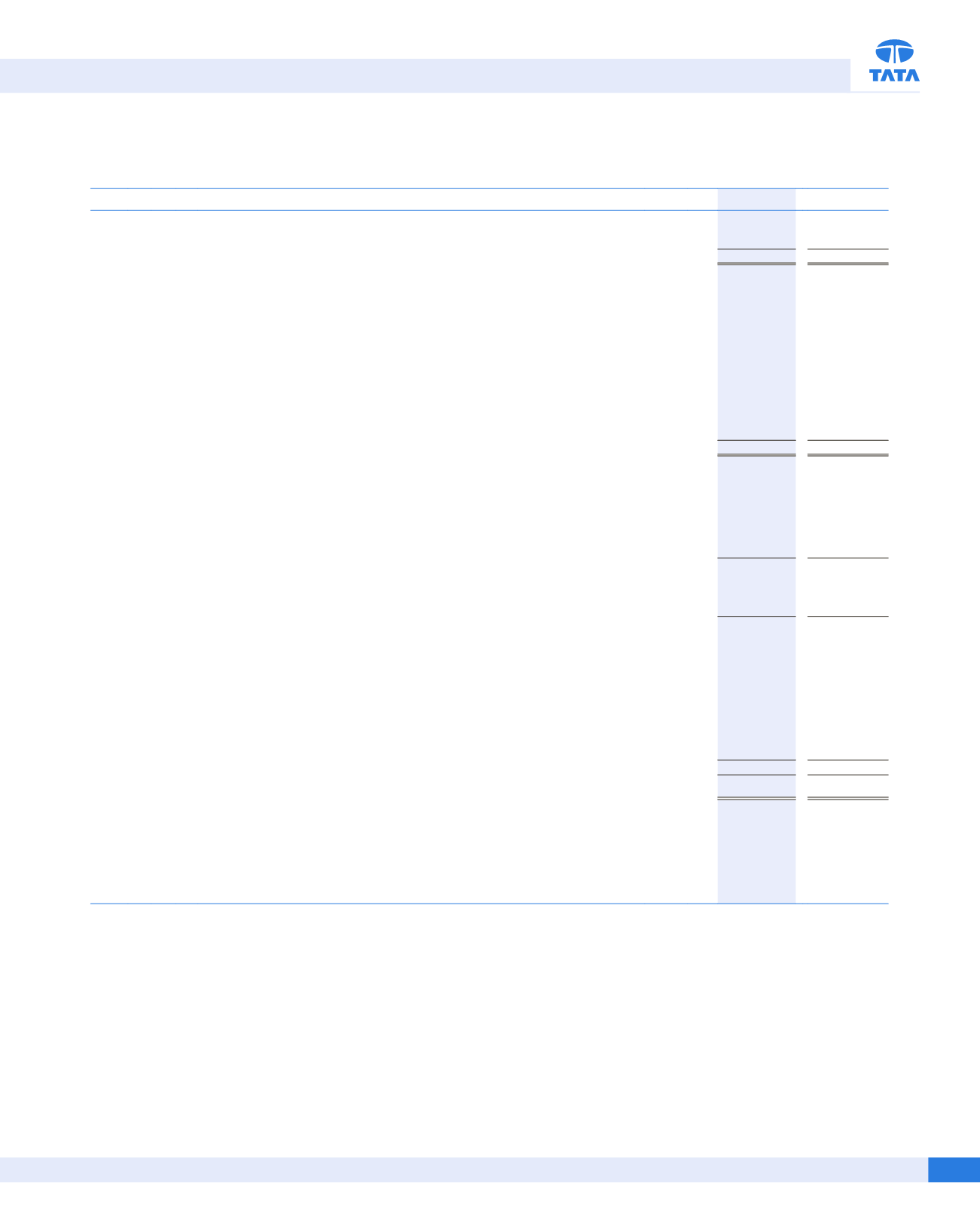

STATEMENT OF PROFIT AND LOSS

(

R

in crores)

Year ended March 31,

Note

2017

2016

I.

Income from operations

32

49,100.41

47,383.61

II.

Other Income

33

978.84

1,402.31

III.

Total Income (I + II)

50,079.25

48,785.92

IV.

Expenses:

(a)

Cost of materials consumed

27,654.40

24,997.40

(b) Purchases of products for sale

3,945.97

4,101.97

(c)

Changes in inventories of finished goods, work-in-progress, and products for sale

(251.43)

10.05

(d) Excise duty

4,736.41

4,538.14

(e)

Employee benefits expense

34

3,558.52

3,188.97

(f)

Finance costs

35

1,590.15

1,592.00

(g) Foreign exchange (gain)/loss (net)

(252.45)

222.91

(h)

Depreciation and amortisation expense

2,969.39

2,329.22

(i)

Product development/Engineering expenses

454.48

418.27

(j)

Other expenses

36

8,697.42

8,216.65

(k)

Amount capitalised

(941.55)

(1,034.40)

Total Expenses (IV)

52,161.31

48,581.18

V.

Profit/(loss) before exceptional items and tax (III-IV)

(2,082.06)

204.74

VI.

Exceptional Items

(a)

Provision for impairment of investments and cost associated with closure of operations of a subsidiary

-

97.86

(b) Provision for impairment of investment in a subsidiary

123.17

-

(c)

Impairment of capitalised property, plant and equipment and other intangible assets

-

163.94

(d) Employee separation cost

67.61

10.04

(e)

Others

37

147.93

-

VII.

Profit/(loss) before tax (V-VI)

(2,420.77)

(67.10)

VIII.

Tax expense/(credit) (net)

29

(a)

Current tax

44.52

(7.34)

(b) Deferred tax

14.70

2.54

Total Tax Expense/(credit)

59.22

(4.80)

IX.

Profit/(loss) for the year from continuing operations (VII-VIII)

(2,479.99)

(62.30)

X.

Other comprehensive income/(loss):

A.

(i) Items that will not be reclassified to profit or loss:

a.

Remeasurement gains and (losses) on defined benefit obligations (net)

10.18

20.77

b.

Equity instruments fair value through other comprehensive income

73.84

81.19

(ii) Income tax (expense)/credit relating to items that will not be reclassified to profit or loss

(3.79)

(7.19)

B.

(i) Items that will be reclassified to profit or loss - gains and (losses) in cash flow hedges

23.32

(13.98)

(ii) Income tax (expense)/credit relating to items that will be reclassified to profit or loss

(8.07)

4.68

Total other comprehensive income/(loss), net of taxes

95.48

85.47

XI

Total comprehensive income/(loss) for the year (IX+X)

(2,384.51)

23.17

XII.

Earnings per equity share (EPS)

39

A.

Ordinary shares (face value of

R

2 each) :

(i) Basic

R

(7.30)

(0.18)

(ii) Diluted

R

(7.30)

(0.18)

B.

‘A’Ordinary shares (face value of

R

2 each) :

(i) Basic

R

(7.30)

(0.18)

(ii) Diluted

R

(7.30)

(0.18)

See accompanying notes to financial statements

In terms of our report attached

For and on behalf of the Board

For

DELOITTE HASKINS & SELLS LLP

CharteredAccountants

B P SHROFF

Partner

Mumbai, May 23, 2017

R AMASHELKAR

[DIN:00074119]

NMUNJEE

[DIN:00010180]

V K JAIRATH

[DIN:00391684]

OP BHATT

[DIN:00548091]

R SPETH

[DIN:03318908]

Directors

NCHANDRASEKARAN

[DIN:00121863]

Chairman

GUENTER BUTSCHEK

[DIN:07427375]

CEO&ManagingDirector

R PISHARODY

[DIN:01875848]

ExecutiveDirector

S B BORWANKAR

[DIN:01793948]

ExecutiveDirector

C RAMAKRISHNAN

GroupChiefFinancialOfficer

HK SETHNA

[FCS:3507]

CompanySecretary

Mumbai, May 23, 2017