87

Notice

Directors’ Report

(69-103)

Management Discussion & Analysis

Corporate Governance

Secretarial Audit Report

compared to

`

8,455.02 crores as at March 31, 2013. There has

been increase in acceptances due to increase in the term.

Provisions (current and non-current)

as at March 31, 2014 and

2013 were

`

2,708.11crores and

`

2,200.77 crores, respectively. The

provisions are mainly towards warranty, employee retirement

benefits, delinquency and proposed dividends. The increase is

mainly in the provision for delinquency by

`

680.37 crores.

Fixed Assets:

The tangible assets (net of depreciation and

including capital work in progress) increased marginally from

`

13,795.55 crores as at March 31, 2013 to

`

13,850.35 crores. The

intangible assets (net of amortisation, including the projects under

development), increased from

`

6,412.99 crores as at March 31,

2013 to

`

7,745.29 crores. The intangible assets under development

were

`

4,638.22 crores as at March 31, 2014, which relate to new

products planned in the future.

Investments (Current + Non-current)

decreased to

`

18,458.42

crores as at March 31, 2014 as compared to

`

19,934.39 crores as at

March 31, 2013.

There was redemption of 6.25% Cumulative Redeemable

Preference Shares of US$ 100 each at par of TML Holdings

Pte Ltd, Singapore, of

`

1,403.26crores and sale of Mutual

funds of

`

359.42 crores. The Company has also divested

Equity shares of certain foreign subsidiary companies to

TML Holdings Pte Ltd, Singapore of

`

463.11 crores.

This was partly offset by increase in investments in subsidiaries

and associates of

`

706.72 crores (Tata Motors Finance Ltd

`

300 crores, Tata Motors European Technical Centre Plc

`

13.07

crores, PT Tata Motors, Indonesia of

`

53.65 crores, Fiat India

Automobiles Ltd

`

325 crores and Concorde Motors (India) Ltd.

`

15 crores).

Inventories

stood at

`

3,862.53 crores as compared to

`

4,455.03 crores as at March 31, 2013. Though the Company

achieved reduction in inventory of

`

592.50 crores, the total

inventory has increased to 44 days of sales as compared to 37

days in last year.

Trade Receivables (net of allowance for doubtful debts)

were

`

1,216.70 crores as at March 31, 2014, as compared to

`

1,818.04 crores as at March 31, 2013. The reduction reflects

lower volumes and steps taken by the Company to control

the credit. The receivable represented 16 days as at March 31,

2014, compared to 18 days as at March 31, 2013. However, the

amount outstanding for more than six months (gross) has gone

up to

`

786.21 crores as at March 31, 2014 from

`

682.82 crores

as at March 31, 2013. These represented dues from Government

owned transport companies and some of the dealers. The

overdues are monitored and the Company has taken steps

to recover these dues. However, based on the Company’s

assessment on non-recoverability of these overdues, these have

been provided and accordingly the allowances for doubtful debts

were

`

511.36 crores as at March 31, 2014 against

`

240.59 crores

as at March 31, 2013.

Cash and bank balances

were

`

226.15 crores as at March 31, 2014

compared to

`

462.86 crores as at March 31, 2013. The decrease was

due to lower volumes.

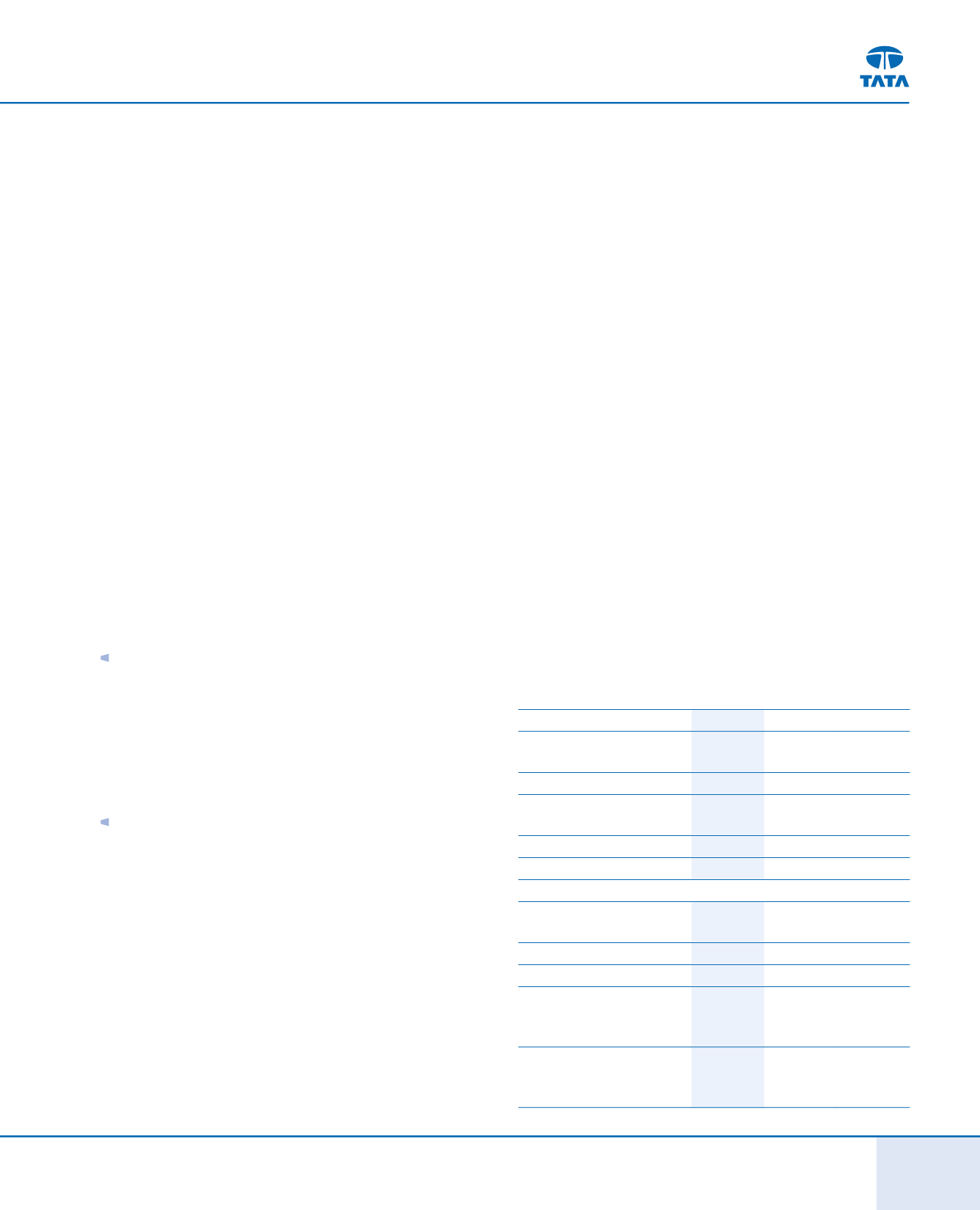

Standalone Cash Flow

(

`

in crores)

FY 2013-14

FY 2012-13 Change

Net Cash from Operating

Activities

2,463.46

2,258.44

205.02

Profit for the year

334.52

301.81

Adjustment for cash flow from

operations

(1,273.34)

1,346.51

Change in working capital

3,458.34

502.79

Direct taxes paid / (credit)(net)

(56.06)

107.33

Net Cash from Investing

Activities

2,552.91

991.50

1,561.41

Payments for fixed assets (net)

(3,094.05)

(2,588.44)

Proceeds from sale of a division

-

110.00

Net investments, short term

deposit, margin money and

loans given

635.88

403.42

Sale

/

redemption

of

investments in subsidiary /

associate companies

3,978.48

1,399.95