85

Notice

Directors’ Report

(69-103)

Management Discussion & Analysis

Corporate Governance

Secretarial Audit Report

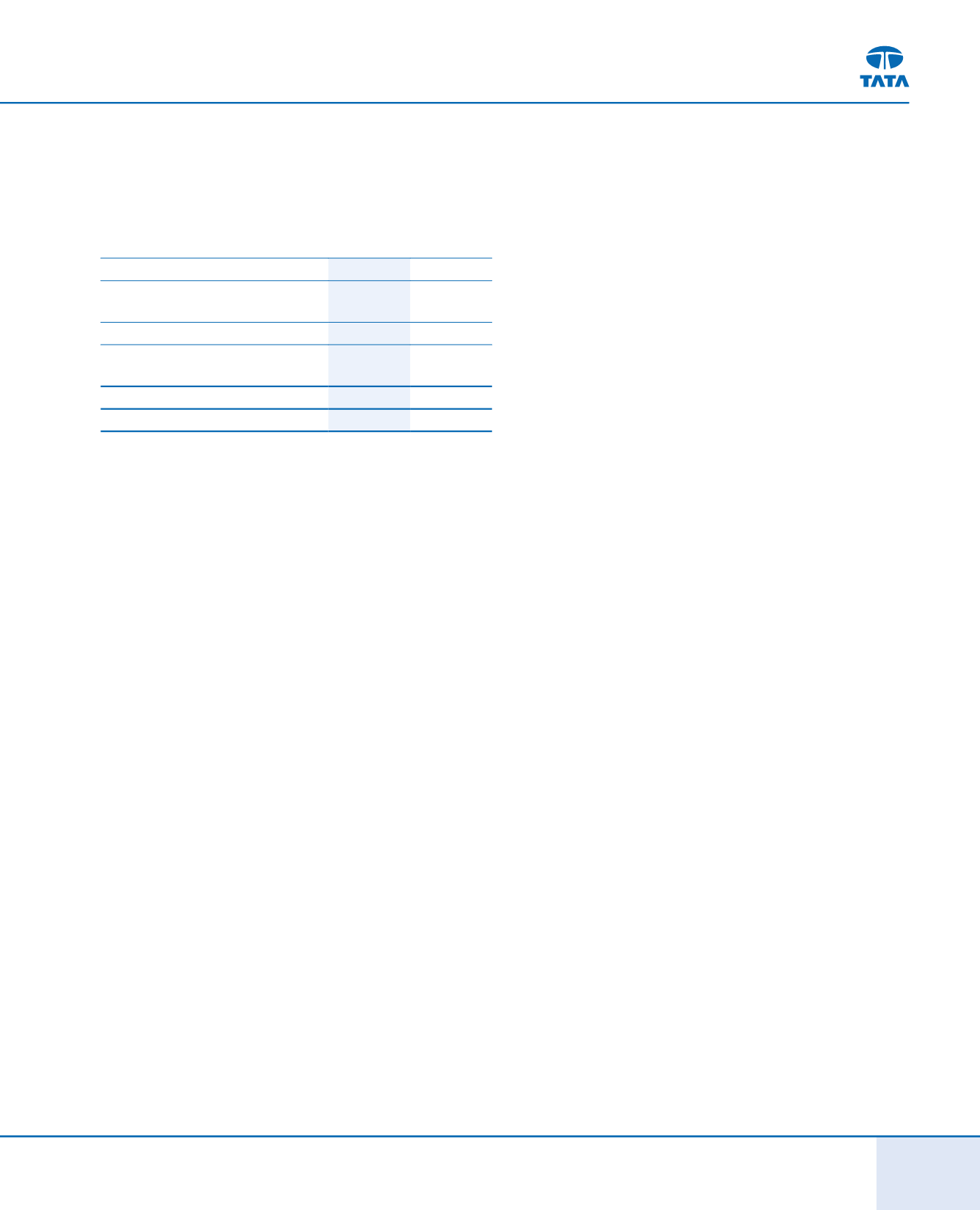

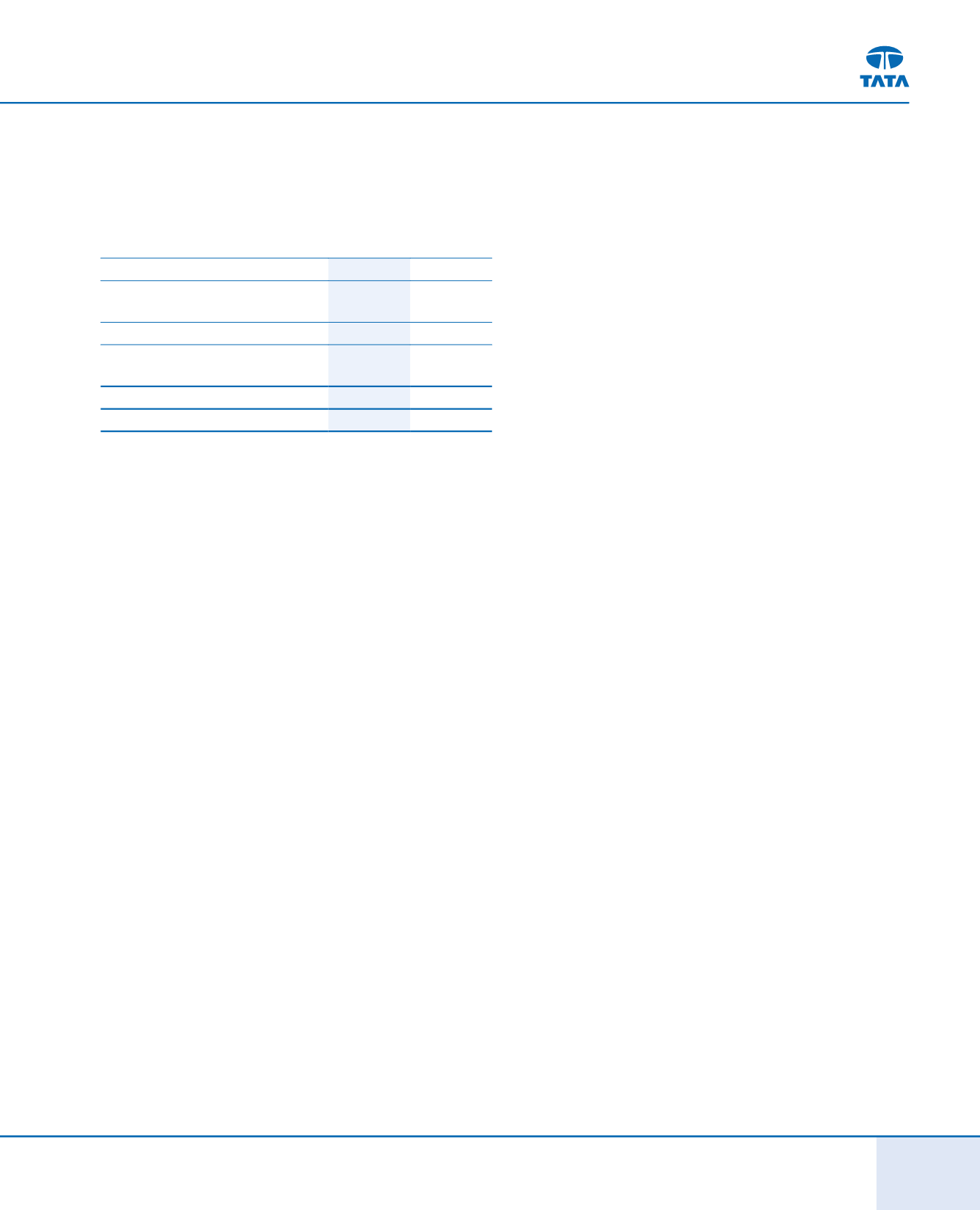

Cost of materials consumed (including change in stock):

(

`

in crores)

FY 2013-14

FY 2012-13

Consumption of raw materials and

components

20,492.87

27,244.28

Purchase of product for sale

5,049.82

5,864.45

Change in Stock-in-trade, finished goods

and Work-in-progress

371.72

(143.60)

Total

25,914.41 32,965.13

% of revenue

75.6% 73.6%

The increase in terms of % to revenue was mainly due to adverse

product mix and higher Variable Marketing Expenses (netted off in

revenue)

Employee Cost:

There was marginal increase to

`

2,877.69 crores

from

`

2,837.00 crores in FY 2012-13 (1.4% over last year). The

increase was mainly attributable to normal yearly increases,

promotions, and wage agreements. The Company has taken steps

to contain the manpower cost, by reduction in head count both

permanent and temporary. However, due to lower volumes, the

employee cost to revenue has increased from 6.3% to 8.4%.

Manufacturing and Other Expenses:

These expenses relate to

manufacturing, operations and incidental expenses other than raw

materials and employee cost. This expenditure mainly included

job work charges, advertisement & publicity and other selling and

administrative costs. The expenses were

`

6,987.53 crores during

current fiscal, as compared to

`

7,783.32 crores for FY 2012-13,

representing 20.3% of revenue for FY 2013-14 (17.4% for FY 2012-13).

There been decrease in expenses in terms of absolute terms on

account of lower volumes and cost reduction initiative taken by

the Company. However, due to lower volumes, these costs were

under absorbed.

Amount capitalised represents

expenditure transferred to capital

and other accounts allocated out of employee cost and other

expenses incurred in connectionwith product development projects

and other capital items. The expenditure transferred to capital and

other accounts increased to

`

1,009.11 crores from

`

953.80 crores of

FY 2012-13, and mainly related to ongoing product development

for new products and variants.

Other Income

was

`

3,833.03 crores (

`

2,088.20 crores for FY 2012-

13). For FY 2013-14, it includes dividends from subsidiary companies

of

`

1,573.98 crores (including dividend from JLR), as compared

to

`

1,583.58 crores for FY 2012-13. During the year, the Company

has divested its investments in certain foreign subsidiaries to TML

Holdings Pte Ltd, Singapore, a wholly owned subsidiary resulting

in a profit of

`

1,966.12 crores. Other income also includes interest

income of

`

178.02 crores as compared to

`

383.64 crores for FY

2012-13. (The dividend from subsidiary companies and profit on

divestment are eliminated in the consolidated income statement,

being income from subsidiaries).

Profit before Exceptional Item, Depreciation, Interest and Tax

(PBDIT)

was

`

3,350.62 crores in FY 2013-14, compared to

`

4,222.27

crores in FY 2012-13. Lower volumes and adverse product mix,

resulted in negative operating profit. This was offset by dividend

from subsidiaries and profit from divestment of investments in

certain foreign subsidiaries.

Depreciation

and

Amortization

(including

product

development / engineering expenses written off)

increased

by

`

255.66crores (11.4% increase over last year) to

`

2,499.04crores

from

`

2,243.38 crores in FY 2012-13.

a)

Depreciation increased by

`

36.25 crores, reflecting impact

of additions to fixed assets towards plant and facilities for

expansion and new products introduction.

b)

Amortization increased by

`

216.43 crores related to product

development projects capitalized for products launched in

recent years.

Finance Costs

decreased marginally to

`

1,337.52 crores from

`

1,387.76 crores in FY 2012-13.

Exceptional Items

a)

During FY 2013-14, the Company further provided

`

202

crores for the cost associated with the closure of operations

of subsidiary company, Hispano Carrocera SA.

b)

As per the accounting policy followed by the Company the

exchange gain / loss on foreign currency long term monetary