Statutory Reports

Corporate Overview

69th Annual Report 2013-14

84

Financial Statements

Some of the Company’s financing agreements and debt

arrangements set limits on and / or require prior lender consents

for, among other things, undertaking new projects, issuing new

securities, changes in management, mergers, sale of undertakings

and investment in subsidiaries. In addition, certain financial

covenants may limit the Company’s ability to borrow additional

funds or to incur additional liens. Certain of the Company financing

arrangements also include various covenants to maintain certain

debt-to-equity ratios, debt-to-earnings ratios, liquidity ratios,

capital expenditure ratios and debt coverage ratios all of which,

except one, have been met by the Company. The breach of the

single covenant has also been waived by the lenders and has not

resulted in any 'Default' or penalties.

The cash and liquidity is located at various locations in its

subsidiaries along with balances in India. Jaguar Land Rover’s

subsidiary in China is subject to foreign exchange controls and

thereby has some restrictions on transferring cash to other

companies of the group outside of China.

There may also be legal or economic restrictions on the ability

of subsidiaries to transfer funds to the Company in the form of

cash dividends, loans, or advances, however such restrictions have

not had and are not estimated to have significant impact on the

ability of the Company to meet its cash obligations.

FINANCIAL PERFORMANCE ON

A STANDALONE BASIS

The financial information discussed in this section is derived from

the Company’s Audited Standalone Financial Statements.

As explained in the business section, the domestic economic

environment deteriorated further, in the current fiscal. As a result,

the automotive industry shrunk significantly.

Revenues (net of excise duty) were

`

34,288.11 crores in FY2013-

14, as compared to

`

44,765.72 crores, representing a decrease

of 23.4%. As explained above, the total number of vehicles sold

during the year decreased by 30.2%. The domestic volumes

decreased significantly by 32.1% to 519,755 vehicles from 765,557

vehicles in FY 2013-14 and export volumes decreased marginally

by 2% to 49,922 vehicles from 50,938 vehicles in FY 2013-14. The

sale of spare parts / aggregates has also decreased by 8.2% to

`

3,006.31 crores from

`

3,273.80 crores in FY 2012-13.

Significant volumes reduction, adverse product mix, more

particularly in the commercial vehicles, and intense competition

amongst all product segments, impacted the operating margin,

recording a negative margin of 1.4% of sales (positive 4.8% for

FY 2012-13). As a result the Loss before tax was

`

1,025.80 crores,

as compared to Profit before tax of

`

174.93 crores in FY 2012-13.

There was a tax credit of

`

1,360.32 crores in FY 2013-14 due to

significant loss from operations. The Profit after tax was

`

334.52

crores as compared to

`

301.81 crores in FY 2012-13.

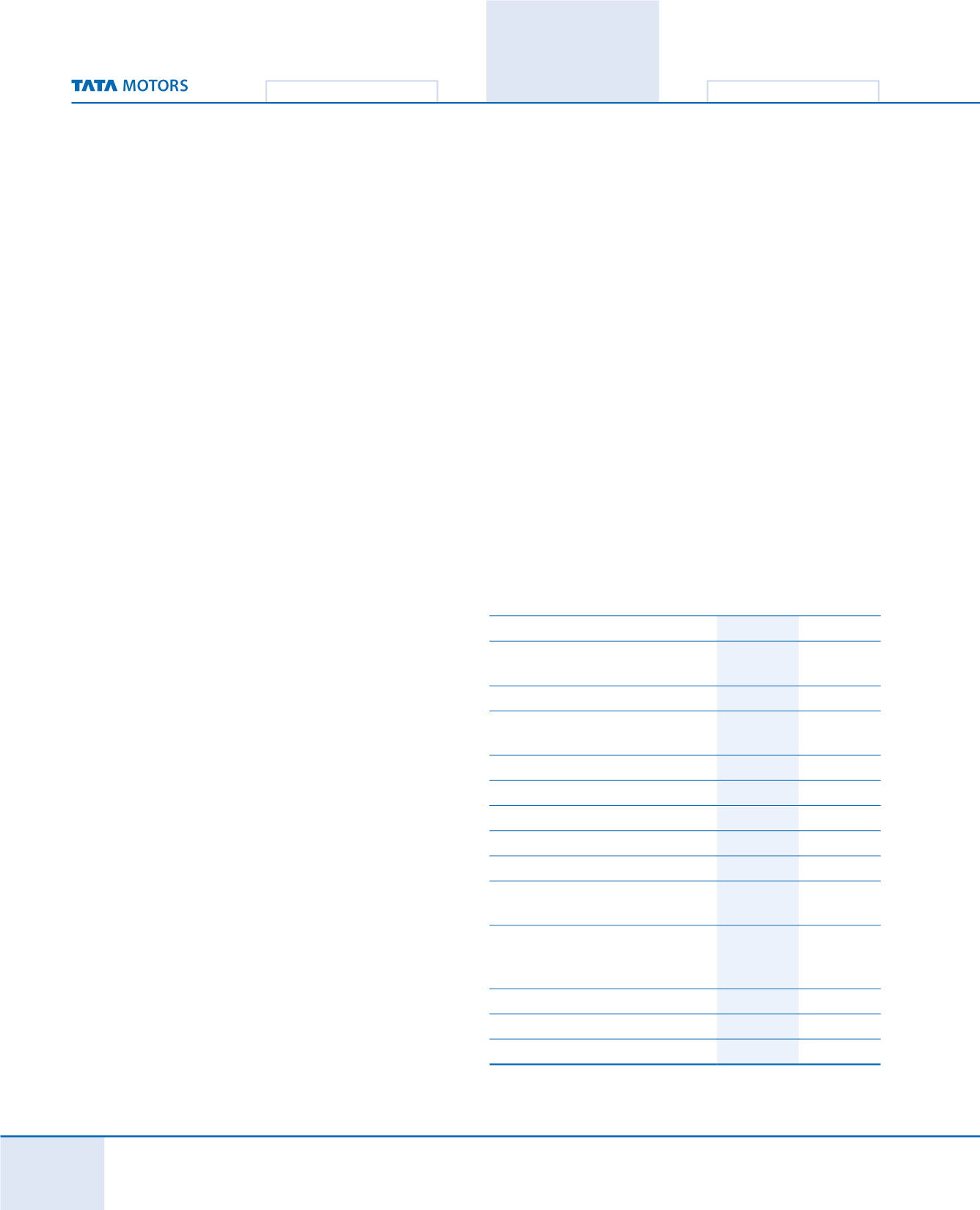

The analysis of performance is given below:-

Percentage to revenue from operations

FY 2013-14

FY 2012-13

Revenue from operations net of excise

duty

100

100

Expenditure:

Cost of material consumed (including

change in stock)

75.6

73.6

Employee Cost

8.4

6.3

Manufacturing and other expenses (net)

20.3

17.4

Amount Capitalised

(2.9)

(2.1)

Total Expenditure

101.4

95.2

Other Income

11.2

4.7

Profit

before

Exceptional

Item,

Depreciation, Interest and Tax

9.8

9.5

Depreciation and Amortisation (including

product

development/

engineering

expenses written off)

7.3

5.0

Finance costs

3.9

3.1

Exceptional Item – Loss

1.6

1.0

Profit / (Loss) before Tax

(3.0)

0.4