Statutory Reports

Corporate Overview

69th Annual Report 2013-14

82

Financial Statements

Cash and bank balances

were

`

29,711.79 crores, as at

March 31, 2014 compared to

`

21,114.82 crores as at March 31,

2013. The Company holds cash and bank balances in Indian Rupees,

GB£, and Chinese Renminbi etc. The cash balances include bank

deposits maturing within one year of

`

21,628.97 crores; compared

to

`

12,763.93 crores as at March 31, 2013. It included

`

3,354 crores

as at March 31, 2014 (

`

4,320 crores as at March 31, 2013) held by

a subsidiary that operates in a country where exchange control

restrictions potentially restrict the balances being available for

general use by Tata Motors Limited and other subsidiaries.

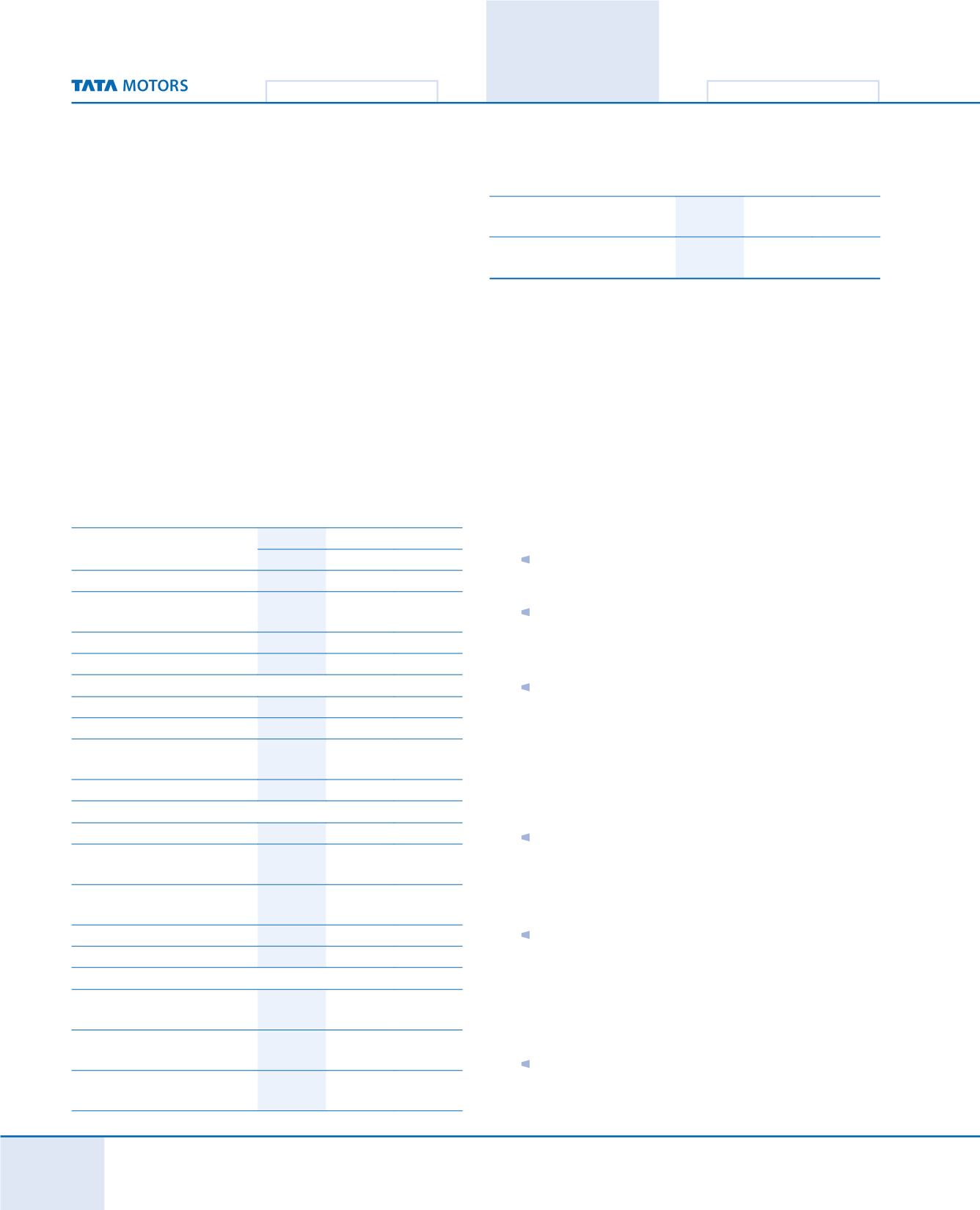

Consolidated Cash Flow

The following table sets forth selected items from consolidated

cash flow statement:

(

`

in crores)

FY 2013-14

FY 2012-13

Change

Cash from Operating Activities

36,151.16

22,162.61

13,988.55

Profit for the year

13,991.02

9,892.61

Adjustments for cash flow from

operations

20,694.06

14,512.93

Changes in working capital

5,774.41

(2.86)

Direct taxes paid

(4,308.33)

(2,240.07)

Cash used in Investing Activities

(29,893.02) (23,491.37)

(6,401.65)

Payment for Assets

(26,925.20)

(18,825.88)

Net investments, short term deposit,

margin money and loans given

(3,661.09)

(5,473.03)

Dividend and interest received

693.27

807.54

NetCashused inFinancingActivities (3,883.24)

(1,692.08)

(2,191.16)

Proceeds from issue of share to

minority shareholders

-

0.56

Dividend Paid (including paid to

minority shareholders

(721.97)

(1,550.57)

Interest paid

(6,170.56)

(4,665.57)

Net Borrowings (net of issue expenses)

3,009.29

4,523.50

Net increase / (decrease) in cash

and cash equivalent

2,374.90 (3,020.84)

Cash and cash equivalent, begining of

the year

12,350.97

14,849.89

Effect of exchange fluctuation on cash

flows

1,861.60

521.92

Cash and cash equivalent on

acquisition of subsidiary

40.51

-

Cash and cash equivalent, end of

the year

16,627.98

12,350.97

Analysis:

a.

Cash generated from operations before working capital

changes was

`

34,685.08 crores as compared to

`

24,405.53

crores in the previous year, representing an increase in cash

generated through consolidated operations, consistent

with the growth in revenue on a consolidated basis. After

considering the impact of working capital changes and

net movement of vehicle financing portfolio, the net cash

generated from operations was

`

40,459.59 crores as compared

to

`

24,402.66 crores in the previous year. The following factors

contributed to net increase in working capital for the year:-

Increase in trade and other assets amounting

`

3,254.09

crores mainly due to increase in sales to importers at JLR.

The above increases were offset by increase in trade

and other payables by

`

4,552.24 crores (due to revenue

growth) and net increase in provisions of

`

888.18 crores.

Decrease in inventories amounting to

`

2,852.55 crores

(mainly in finished goods) due to higher volumes /

activity at JLR.

b.

The net cash outflow from investing activity increased during

the current year to

`

29,893.02 crores from

`

23,491.38 crores

for the last year.

Capital expenditure was at

`

26,925.20 crores during the

year as against

`

18,825.88 crores for the last year, related

mainly to capacity / expansion of facilities, quality and

reliability projects and product development projects.

The change in net investments mainly represents

fixed/restricted deposits (net)

`

4,389.07 crores against

`

6,135.57 crores in the last year.

c.

The net change in financing activity was an outflow of

`

3,883.24 crores as compared to

`

1,692.09 crores for last year.

During FY 2013-14,

`

5,925.53 crores were raised from

long term borrowings (net) as compared to

`

5,525.25

crores. (Refer discussion below).