81

Notice

Directors’ Report

(69-103)

Management Discussion & Analysis

Corporate Governance

Secretarial Audit Report

current maturities of long term debt (explained above), increase in

liability for capital expenditure and derivative financial instruments.

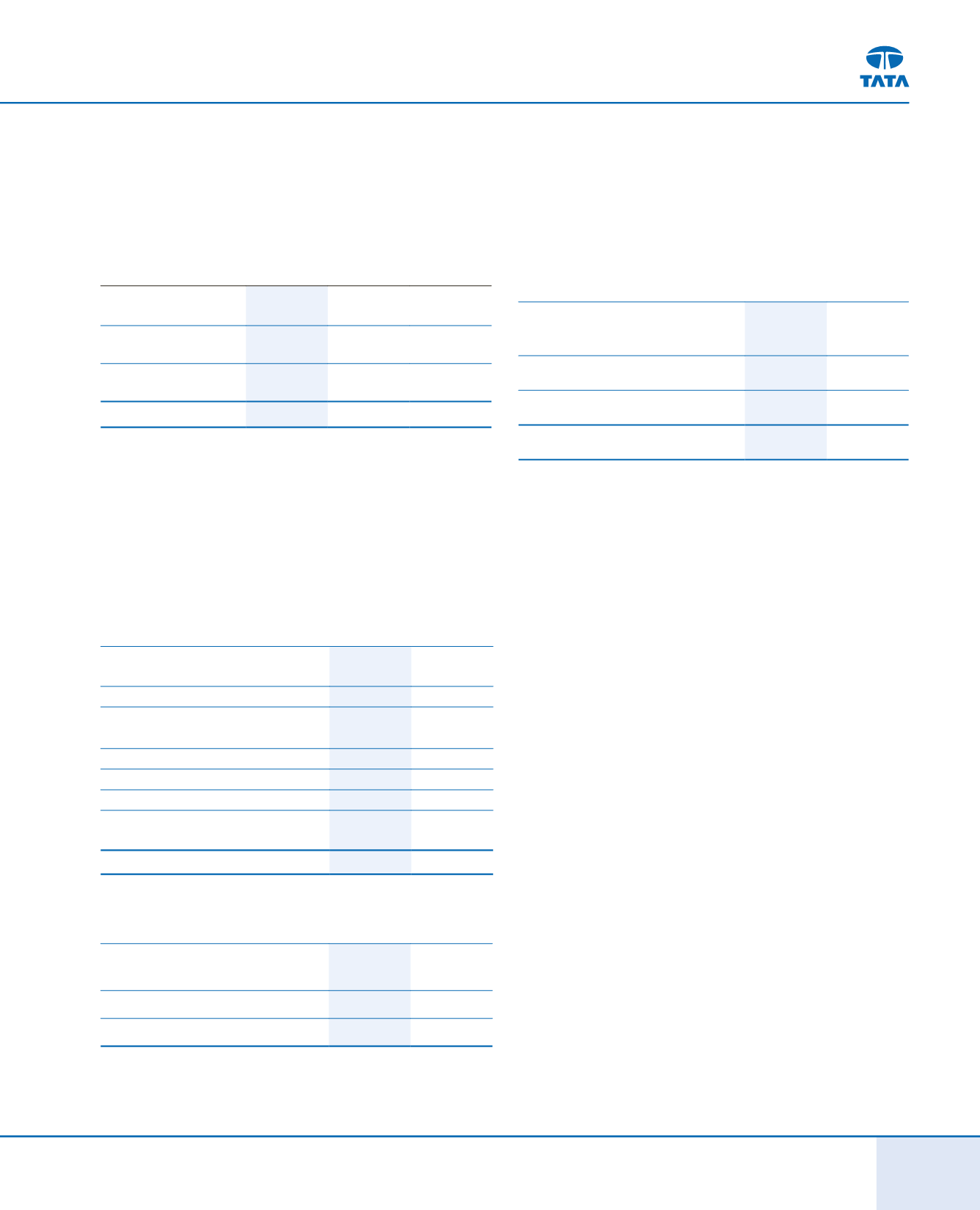

Fixed Assets:

(

`

in crores)

As at March

31, 2014

As at March

31, 2013

Change

Tangible assets (including

capital work-in-progress)

50,831.59

37,074.06

13,757.53

Intangible assets (including

assets under development)

46,543.81

32,788.85

13,754.96

Total

97,375.40 69,862.91 27,512.49

The increase (net of depreciation) in the tangible assets mainly

represented additions towards capacity / new product plans of

the Company. The increase (net of amortization) in the intangible

assets was

`

13,754.96 crores, mainly attributable to new product

developments projects at TML and JLR.

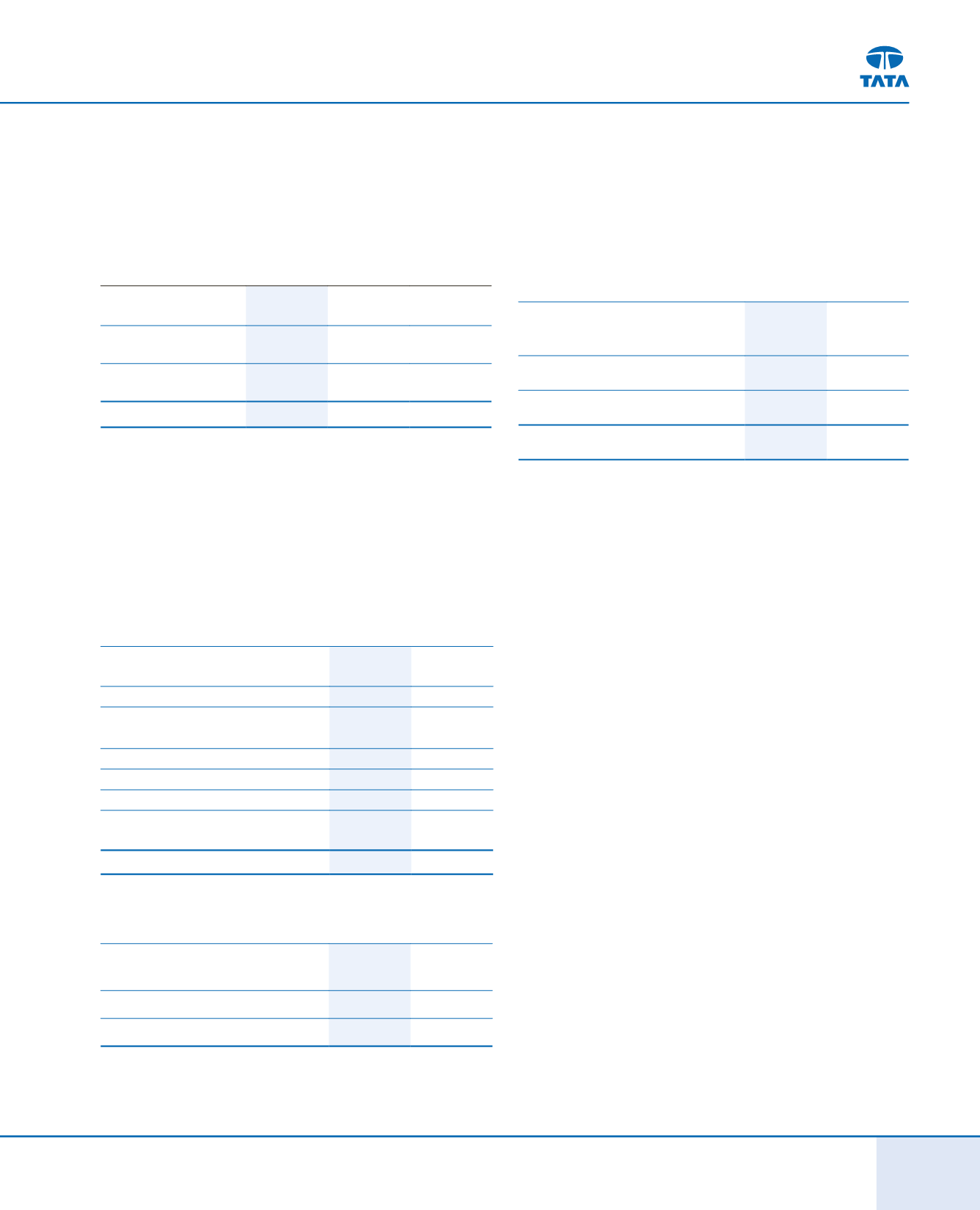

Investments (Current + Non-current)

were

`

10,686.67 crores as

at March 31, 2014, as compared to

`

8,764.73 crores as at March 31,

2013. The break-up is as follows:

(

`

in crores)

As at March

31, 2014

As at March

31, 2013

Mutual Funds

9,494.06

7,509.50

Investments

in

equity

accounted

investees (associate companies)

382.98

451.74

Quoted Equity shares

318.71

299.11

Unquoted Equity shares

386.38

383.03

Others

112.63

129.85

Provision for diminution in value of

investments (net)

(8.09)

(8.50)

Total

10,686.67

8,764.73

Deferred tax assets / liability:

(

`

in crores)

As at March

31, 2014

As at March

31, 2013

Deferred tax assets

2,347.08

4,428.93

Deferred tax liability

(1,572.33)

(2,048.21)

Deferred tax assets, represents timing differences for which there

will be future current tax benefits by way of unabsorbed tax losses

and expenses allowable on payment basis in future years.

Deferred tax liabilities represent timing differences where current

benefit in tax will be off-set by debit in the Statement of Profit and Loss.

Loans and Advances

(

`

in crores)

As at March

31, 2014

As at March

31, 2013

Long term loans and advances

13,268.84

15,584.12

Short term loans and advances

14,055.24

12,667.05

Total

27,324.08 28,251.17

Loans and advances include

i.

Credit entitlement of Minimum Alternate Tax (MAT) of

`

787.59

crores as at March 31, 2014 (

`

1,516.40 crores as at March 31,

2013), relating to Tata Motors. The credit / refund will be

against tax paid at normal rate, within time limit as per the

Income Tax Act.

ii.

Receivables towards vehicle financing by Tata Motors Finance

Ltd was almost same at

`

18,294.32 crores as at March 31,

2014, as compared to

`

18,226.78 crores as at March 31, 2013;

and

iii.

VAT, other taxes recoverable, statutory deposits and dues

of

`

4,274.57 crores as at March 31, 2014, as compared to

`

5,015.31 crores as at March 31, 2013.

Inventories

as of March 31, 2014, stood at

`

27,270.89 crores as

compared to

`

21,036.82 crores as at March 31, 2013. Inventory at

TML was

`

3,862.53 crores as compared to

`

4,455.03 crores as at

March 31, 2013. Inventory at JLR was

`

21,634.06 crores as compared

to

`

14,726.76 crores as at March 31, 2013. The increase at JLR is

consistent with the volume growth. (In terms of number of days of

sales, finished goods represented 30 inventory days in FY 2013-14

as compared to 29 days in FY 2012-13).

Trade Receivables

(net of allowance for doubtful debts) were

`

10,574.23 crores as at March 31, 2014, representing a decrease of

`

385.37 crores. Trade Receivables have decreased in TML by

`

601.34

crores. The allowances for doubtful debts were

`

621.70 crores as at

March 31, 2014 against

`

321.71 crores as at March 31, 2013.