79

Notice

Directors’ Report

(69-103)

Management Discussion & Analysis

Corporate Governance

Secretarial Audit Report

10.2% from 10.1% of net revenue. While a part of revenue

relates to volumes, the major increases were in IT costs,

warranty and engineering expenses at JLR, partly offset by

exchange gain on trading activities at JLR.

Amount capitalised represents

expenditure transferred to capital

and other accounts allocated out of employee cost and other

expenses, incurred in connection with product development

projects and other capital items. The expenditure transferred to

capital and other accounts has increased to

`

13,537.85 crores from

`

10,193.45 crores of FY 2012-13, mainly on account of various

product development projects undertaken by the Company and

JLR, for introduction of new products, development of engine and

products variants.

Other Income

was

`

828.59 crores from

`

815.59 crores in

FY 2012-13 and mainly includes interest income of

`

675.45 crores

(FY 2012-13

`

694.06 crores) and profit on sale of investment of

`

114.58 crores (FY 2012-13

`

80.09 crores). The increase is due to

profit on sale of mutual funds, mainly at TML.

Profit before Interest, Depreciation, Exceptional Items and Tax

has increased from

`

27,433.16crores in FY 2012-13 to

`

38,231.50

crores in FY 2013-14, and represented 16.4% of revenue.

Depreciation

and

Amortization

(including

product

development / engineering expenses written off):

During

FY 2013-14, expenditure increased to

`

13,643.37 crores from

`

9,622.87 crores in FY 2012-13. The increase in depreciation

of

`

1,496.84 crores is on account of plant and equipment and

tooling (mainly towards capacity and new products)

installed in

last year, the full effect of which is reflected in the current year.

The amortization expenses have gone up from

`

3,593.90 crores

in FY 2012-13 to

`

5,573.94 crores in FY 2013-14, attributable to

new product introduced during the last year. The expenditure on

product development / engineering cost written off has increased

by

`

543.62 crores. As explained above, there was an element of

increase representing translation impact.

Finance Cost

increased by 33.0% to

`

4,733.78 crores from

`

3,560.25

crores in FY 2012-13. The increase mainly represented borrowings

for the short term and long term needs of the Group. The increase

is partly attributable to prepayment of 2011 Senior notes by JLR.

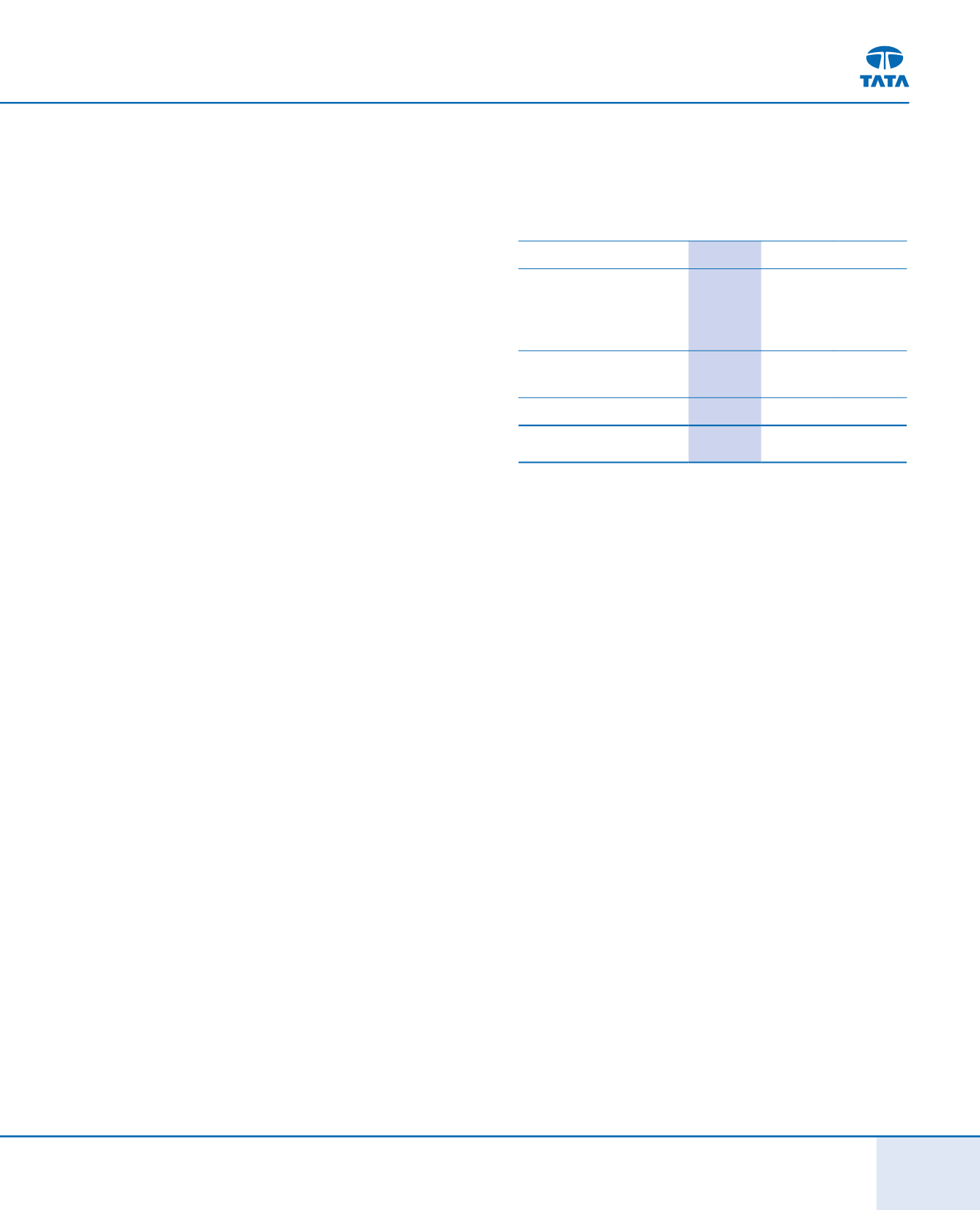

Exceptional Items

(

`

in crores)

Exchange loss (net) including

on revaluation of foreign

currency borrowings, deposits

and loans

FY 2013-14

FY 2012-13 Change

707.72

515.09

192.63

Impairment of intangibles and

other costs

224.16

87.62

136.54

Employee separation cost

53.50

-

53.50

Total

985.38

602.71

382.67

i.

Foreign exchange loss (net) represents impact on account

of revaluation of foreign currency borrowings, deposits and

loans, and amortisation of loss / gain, on such foreign currency

monetary items which was deferred in previous years.

ii.

Impairment of intangibles and other costs are in respect

of subsidiary companies, triggered by continuous under

performance, mainly attributed by challenging market

conditions in which the subsidiaries operate.

iii.

Employee separation cost -To address the challenges, business

downturn, the Company had rolled out organization wide

cost optimization programme, which included employee

cost as an important pillar, Accordingly, based on requests

from employees for early retirement, the Company has given

early retirement with a lump sum amount of

`

53.50 crores to

various employees.

Consolidated Profit Before Tax (PBT)

increased to

`

18,868.97

crores in FY 2013-14, compared to

`

13,647.33 crores in FY 2012-

13, representing an increase of

`

5,221.64 crores. Due to severe

contraction in domestic volumes, TML’s contribution to PBT was

negative. JLR by virtue of its strong performance, contributed to

PBT. The increase also includes translation impact.

Tax Expense

represents a net charge of

`

4,764.79 crores in FY

2013-14, as compared to net charge of

`

3,776.66 crores in FY 2012-

13. The tax expense is not comparable with the profit before tax,

since it is consolidated on a line-by-line addition for each subsidiary

company and no tax effect is recorded in respect of consolidation

adjustments. Effective tax rate in FY 2013-14 is 25.3% as compared

to 27.7% in FY 2012-13.