Statutory Reports

Corporate Overview

69th Annual Report 2013-14

78

Financial Statements

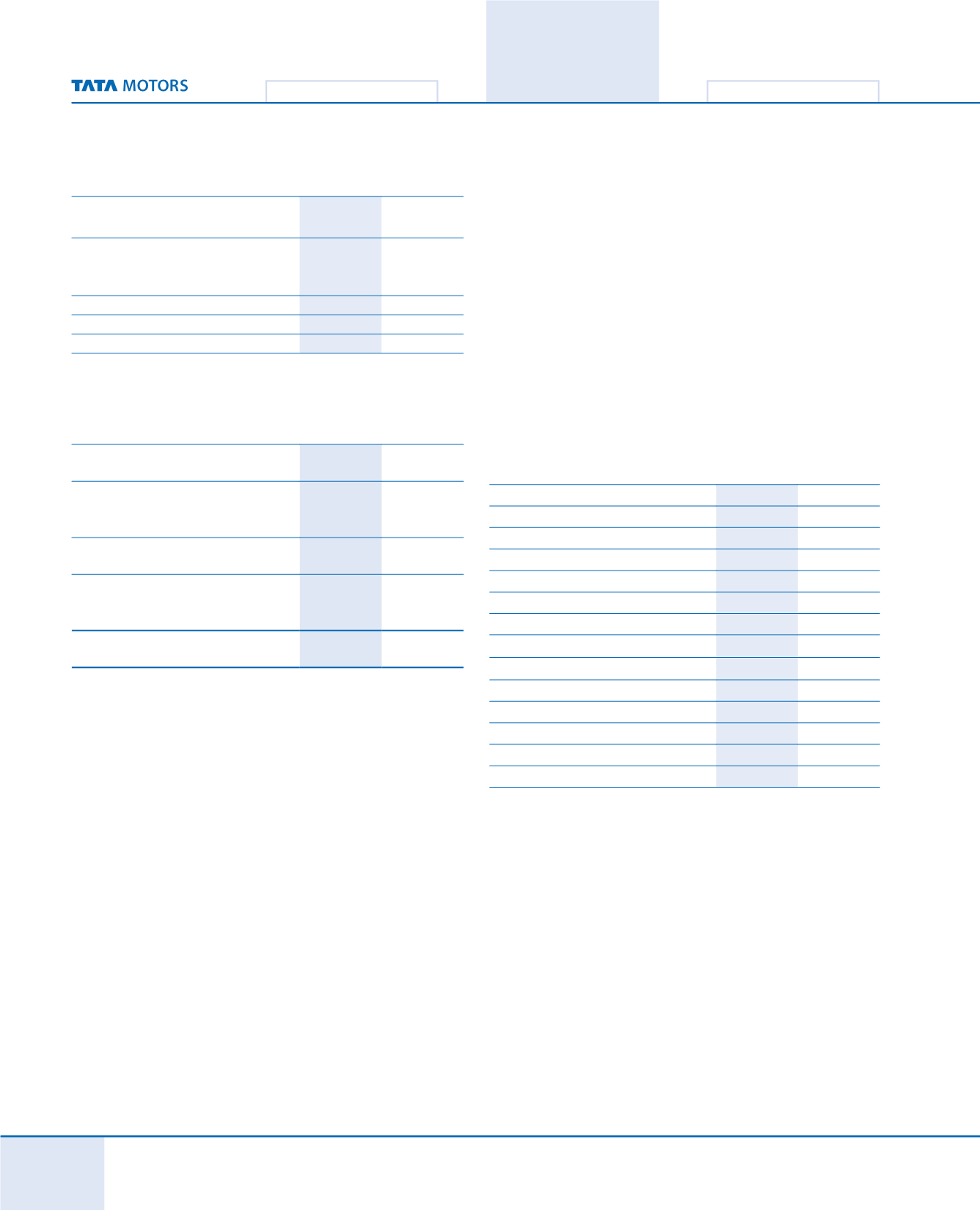

Profit

before

Exceptional

Items,

Depreciation, Interest and Tax

16.4

14.5

Depreciation and Amortisation (including

product development / engineering

expenses written off)

5.9

5.1

Finance costs

2.0

1.9

Exceptional Item – Loss

0.4

0.3

Profit before Tax

8.1

7.2

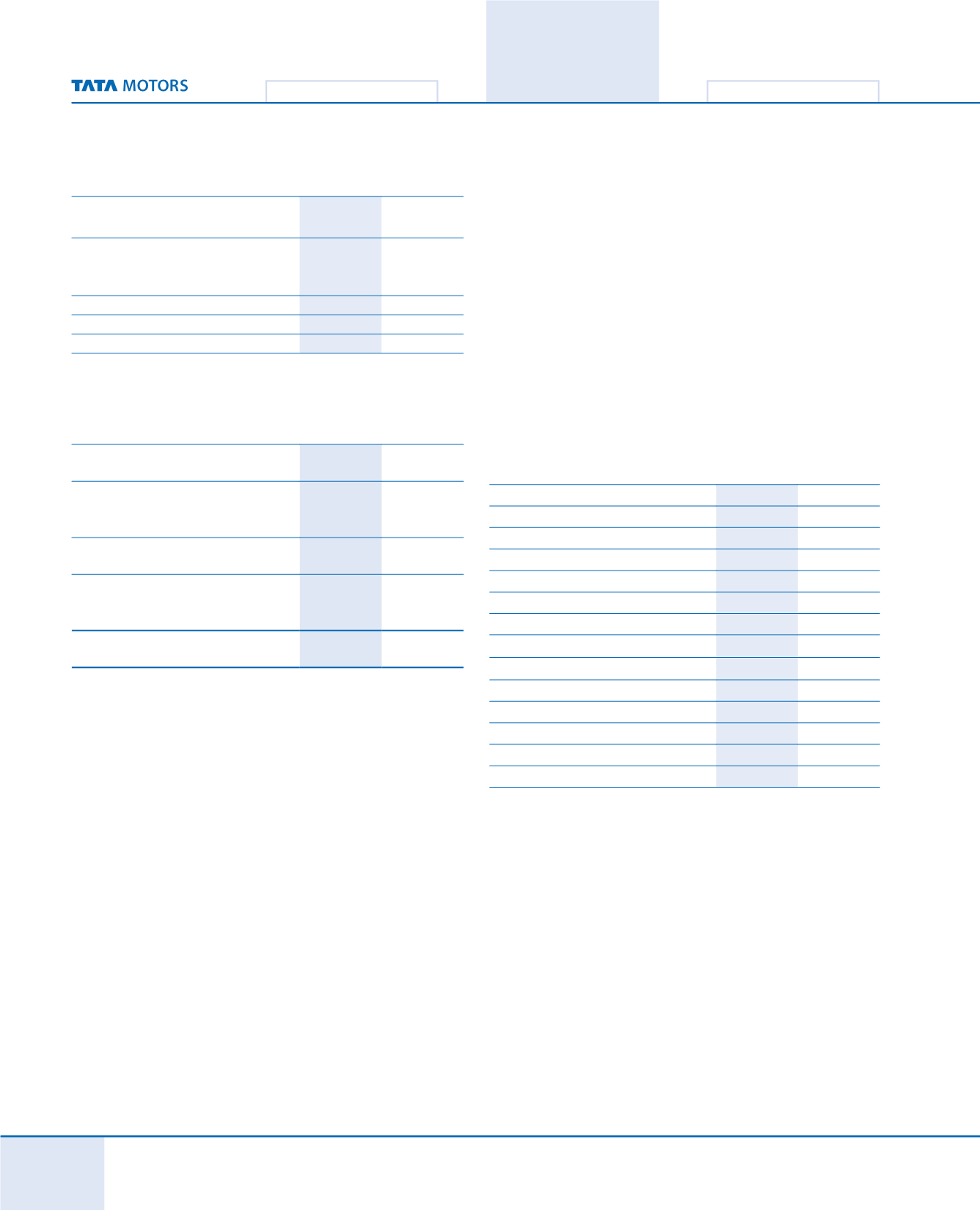

Cost of materials consumed (including change in stock)

(

`

in crores)

FY 2013-14

FY 2012-13

Consumption of raw materials and

components

135,550.04 113,851.34

Purchase of product for sale

10,876.95

9,266.00

Change in finished goods and Work-in-

progress

(2,840.58)

(3,029.29)

Total

143,586.41 120,088.05

Cost of material consumed decreased from 64.6% to 62.4% of

total revenue (excluding income from vehicle financing). At

TML RM cost was 75.6% of net revenue as compared to 73.6%,

representing an increase of 200 basis points, mainly attributable to

product mix (reduction in M&HCV sales). For JLR the RM cost was

60.9% of revenue (FY 2012-13 62.5%), representing a reduction of

160 basis points. The reduction is mainly attributable to product

mix, cost reduction programmes and reduction in input price of

major metals consumed. On a consolidated basis, JLR operations

have significantly contributed to reduction in material cost in

terms of % to revenue.

Employee Cost

was

`

21,556.42 crores in FY 2013-14 as compared

to

`

16,632.19 crores in FY 2012-13; an increase of

`

4,924.23

crores. Of the increase

`

1,823.07 crores (approximately) relates to

translation impact of JLR from UK Pounds to Indian Rupee. At JLR

the increase in employee cost is attributable to increases in the

permanent and contractual head count to support the volume

increases/new launches and product development projects. At

TML the employee cost marginally increased to

`

2,877.69 crores

as compared to

`

2,837.00 crores in FY 2012-13.

Manufacturing and Other Expenses

include all works operation,

indirect manufacturing expenses, freight cost, fixed marketing costs

and other administrative costs. These expenses have increased to

`

43,825.77 crores from

`

35,648.33 crores in FY 2012-13. As explained

above, each line item includes the element of translation impact of

JLR (approximately

`

3,704 crores).

The breakup is given below-

(

`

in crores)

FY 2013-14

FY 2012-13

Processing charges

1,093.53

1,450.56

Stores, spare parts and tools

consumed

1,682.34

1,424.12

Freight, transportation, port charges, etc.

6,879.75

4,803.67

Repairs to buildings

93.58

120.84

Repairs to plant, machinery, etc.

261.45

202.24

Power and fuel

1,128.69

1,077.77

Rent

465.86

317.55

Rates and taxes

265.51

203.07

Insurance

278.75

225.91

Publicity

8,064.10

6,607.14

Works operation and other expenses

23,660.54

19,098.97

Excise Duty on change in Stock-in-trade

(48.33)

116.49

Manufacturing and Other Expenses

43,825.77 35,648.33

The increases are mainly driven by volumes, size of operations

and also include inflation impact however this has remained same

at 18.8% as compared to 18.9% in FY 2012-13, in terms of % to

revenue.

i.

Processing charges were mainly incurred by TML, where

mainly due to volume contraction, the expenditure was lower.

ii.

Freight, transportation, port charges etc. have increased,

mainly at JLR, in view of increase in volumes in the overseas

markets.

iii.

The publicity expenses increase, mainly related to new

product launches (Range Rover Sport and the F-Type launch)

and ongoing product / brand campaigns.

iv.

The works operation and other expenses have increased to