77

Notice

Directors’ Report

(69-103)

Management Discussion & Analysis

Corporate Governance

Secretarial Audit Report

FINANCIAL PERFORMANCE ON A

CONSOLIDATED BASIS

The financial information discussed in this section is derived from

the Company’s Audited Consolidated Financial Statements.

Tata Motors Group primarily operates in the automotive segment.

The acquisition of JLR enabled the Company to enter the premium

car market. The Company continues to focus on profitable growth

opportunities in global automotive business, through new products

and market expansion. The Company and JLR, continue to focus

on integration, and synergy through sharing of resources, platforms,

facilities for product development and manufacturing, sourcing

strategy, mutual sharing of best practices.

The business segments are (i) automotive operations and (ii) all

other operations. The automotive operations include all activities

relating to development, design, manufacture, assembly and sale

of vehicles including financing thereof, as well as sale of related

parts and accessories. The Company provides financing for vehicles

sold by the dealers in India. The vehicle financing is intended

to drive sale of vehicles by providing financing to the dealers’

customers and as such, is an integral part of automotive business.

Automotive operations segment accounted for 98.9% and 98.8% of

total revenues in FY 2013-14 and FY 2012-13, respectively. For FY

2013-14, revenue from automotive operations before inter-segment

eliminations was

`

231,601.80 crores compared to

`

187,623.91crores

for FY 2012-13.

The automotive operations segment is further divided into Tata

Motors and other brand vehicles (including spares and vehicle

financing) and Jaguar Land Rover. (A reference may be made to

review of performance of TML and Jaguar Land Rover business as

discussed above). For FY 2013-14, Jaguar Land Rover contributed

82.2% (72.9% for FY 2012-13) of the total automotive revenue

(before intra segment elimination) and the remaining 17.8%

(27.1% for FY 2012-13) was contributed by Tata and other brand

vehicles. Revenue and segment results for automotive operations

are given below:

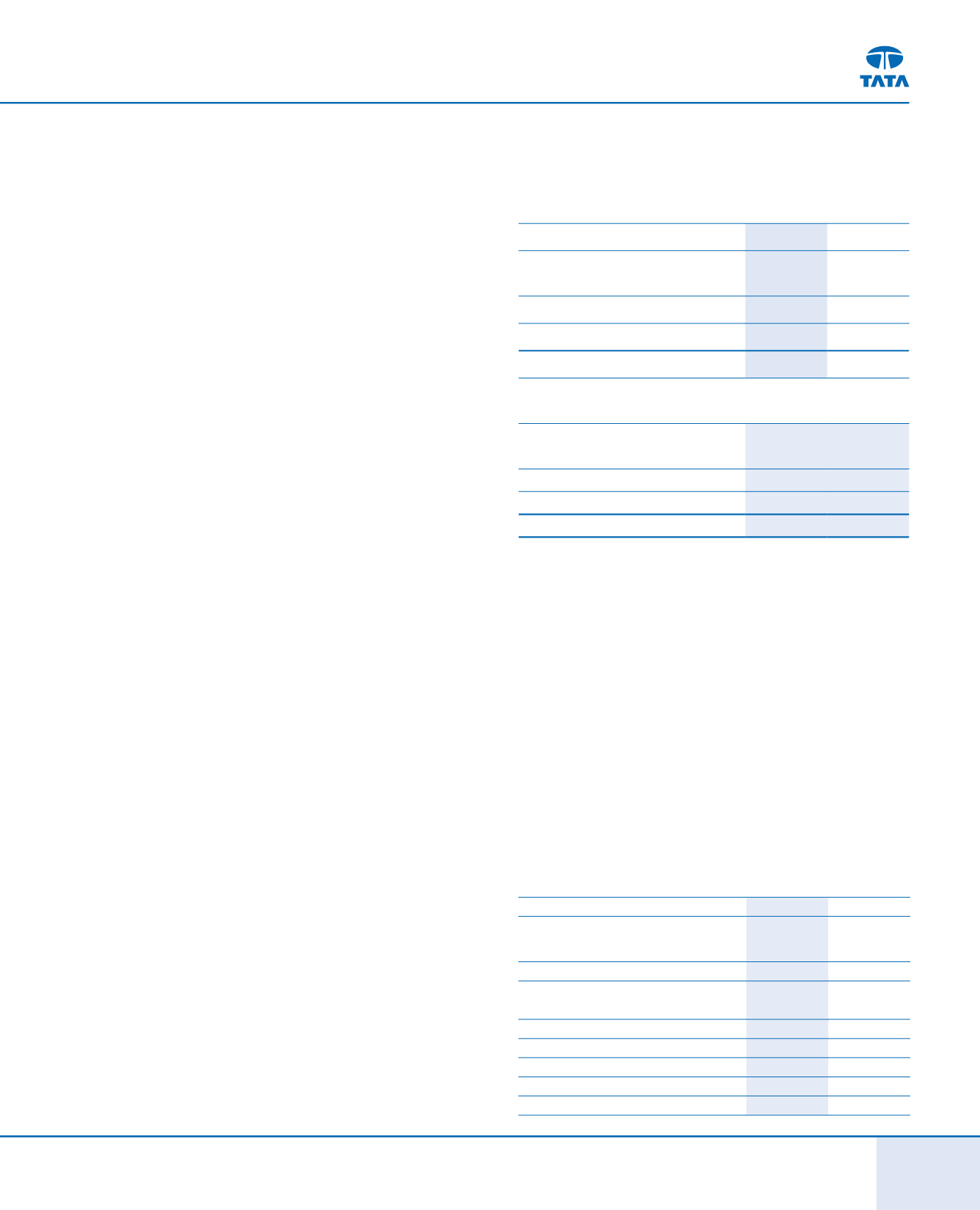

Total Revenues

(

`

in crores)

FY 2014-13

FY 2012-13

Tata vehicles / spares and financing

thereof

41,299.44

50,895.05

Jaguar and Land Rover

190,378.50 136,822.17

Intra-segment eliminations

(76.14)

(93.31)

Total

231,601.80 187,623.91

Segment results before other income, finance cost, tax and exceptional

items

Tata vehicles / spares and financing

thereof

(966.93)

1,753.59

Jaguar and Land Rover

24,561.20

14,975.61

Intra-segment eliminations

-

-

Total

23,594.27 16,729.20

The other operations business segment includes information

technology, machine tools and factory automation solutions, and

investment business. For FY 2013-14, revenue from other operations

before inter-segment eliminations was

`

2,518.99 crores compared

to

`

2,265.92 crores for FY 2012-13. Segment results before other

income, finance cost, tax and exceptional items (before inter-

segment eliminations) were

`

282.66 crores as compared to

`

375.68

crores for FY 2012-13.

The revenue from operations net of excise duty on a consolidated

basis has grown by 23.3% in FY 2013-14 to

`

232,833.66 crores. The

increase is mainly attributable to growth in automotive revenue

mainly at Jaguar Land Rover business. The analysis of performance

on consolidated basis is given below:-

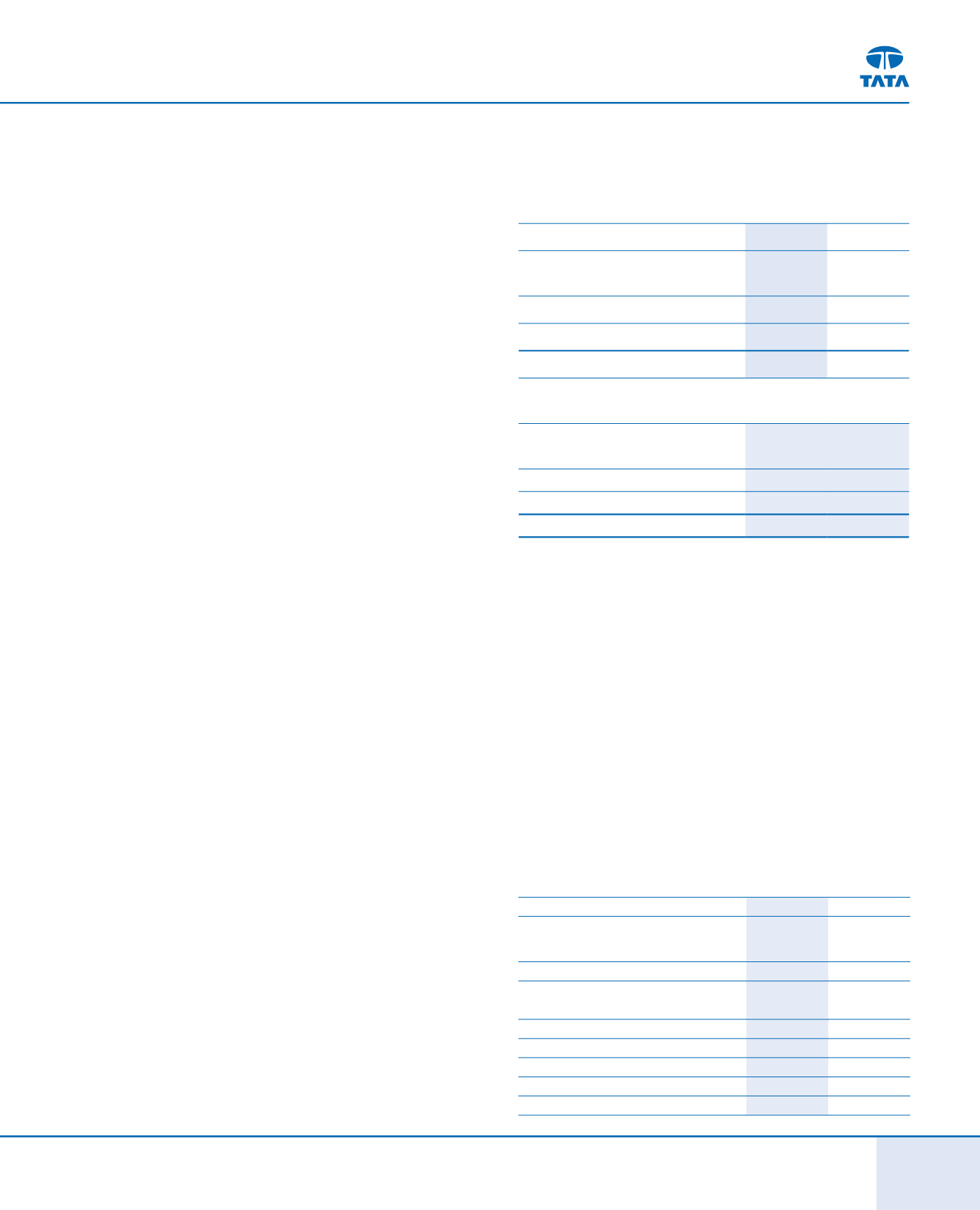

Percentage to Revenue from operations

FY 2013-14

FY 2012-13

Revenue from operations net of excise

duty

100

100

Expenditure:

Cost of material consumed (including

change in stock)

61.7

63.6

Employee Cost

9.3

8.8

Manufacturing and other expenses (net)

18.8

18.9

Amount Capitalised

(5.8)

(5.4)

Total Expenditure

84.0

85.9

Other Income

0.4

0.4