71

Notice

Directors’ Report

(69-103)

Management Discussion & Analysis

Corporate Governance

Secretarial Audit Report

The Company’s commercial vehicle sales in the domestic and

international markets at 420,992 units were 27.5% lower than the

previous year.

Even under these difficult conditions, the Company has been able

to gain market share in the critical M&HCV segment. The Company

has been focusing intensely on market and customer activities

to stimulate the buying sentiments. Activities included the Prima

Truck Racing Championship event in March, 2014 the first of its kind

initiative in the Indian trucking history. The Prima LX series of trucks –

a combination of economy &technology - were launched in FY2013-

14 which included – 2523T, 3123T, 4028S (Single reduction and Hub

reduction) and 4928S (Single reduction and Hub reduction), 4923.S

LX, Prima 4938 Tractor, 3138K Tipper, LPT 3723 - India’s first 5 axle

truck and LPK 3118, and Prima LX series of Tippers – 2523K, 3123K,

2528K & 3128K. One of the successful marketing initiatives was the

Power of Five campaign for M&HCV trucks which was conducted

across various locations across the country to counter competition.

The campaign focuses on five advantages of the Company’s

vehicles – 1) Better KMPL, 2) Best Vehicle Uptime 3) Highest Resale

Value, 4) Best in class four year warranty, 5) Lowest maintenance

cost and five powerful offerings – i) Triple benefit insurance, ii)

Increased Oil change interval, iii) 4 Year AMC, iv) Tata Alert, v)

Fleetman. The bus segment also witnessed growthin market share

for the Company, due to intensive sales efforts coupled with launch

of buses with mechanical FIP, introduction of Starbus Ultra in Stage

carriage, marketing initiatives such as ‘Humare Bus Ki Baat Hain’ and

‘Dream it to win it’ program. The warranty for M&HCV buses and

trucks were increased to three years and four years respectively

symbolizing improvement in quality. The Tata Alert service, to

return a vehicle back on road within 48 hours, has been expanded

across all national highways.

The Company registered a decline in the market share of LCV

segment due to the sharp fall in volumes of the high share SCV

segment. The newly launched Ultra trucks have started to receive

good response from the market. There have been various other

initiatives such as the Freedom campaign and Triumph through

trials campaign of back-to-back and standalone fuel trials to

establish the superior fuel efficiency of vehicles. The Company tied

up with various PCGs (Public sector, Co-operative & Gramin banks)

and has brought out several lucrative financing schemes to ease the

financing situation. The Companyalso launched a major initiative

called, ‘Saathi’, a Parts retailers’ customer referral program for entire

SCV range, to leverage their customer base. Some of launches this

year were the Ace, Magic DICOR and facelifts.

Passenger Vehicles:

The Passenger Vehicle Industry contracted for the first time in the

last five years, in FY 2013-14 with decline of 4.7%. The last such

instance was during the economic slowdown of FY 2008-09 when

it remained close to flat at negative 0.5%. The decline in sales

volumes is seen across segments, but sedans bore the biggest

brunt. Hatchbacks and UV’s continue to be the volume segments.

The high growth in UV segment last year, with the onset of Soft

Roaders could not be repeated this year. The premium and luxury

vehicles segment however has seen a growth even in an otherwise

declining year.

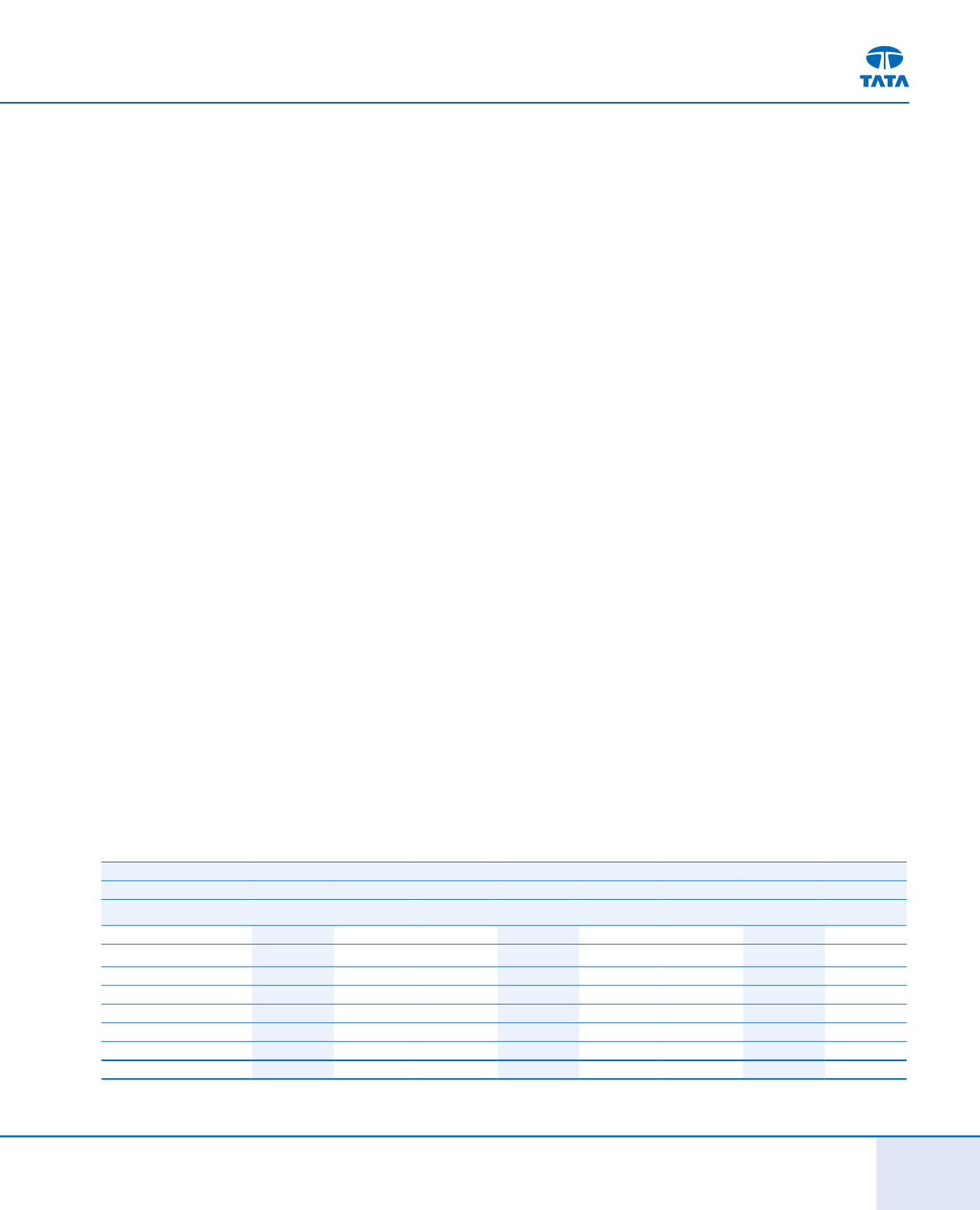

The domestic performance in passenger vehicle segment is given

below:

Category

Industry Sales

Company Sales

Market Share

FY 2013-14 FY 2012-13

Growth FY 2013-14 FY 2012-13

Growth FY 2013-14

FY 2012-13

Units

Units

Units

Units

Micro

21,130

53,847

-60.8%

21,130

53,847

-60.8% 100.0% 100.0%

Compact

786,888

794,284

-0.9%

84,141

117,377

-28.3%

10.7%

14.8%

Midsize

154,981

200,013

-22.5%

2,414

7,410

-67.4%

1.6%

3.7%

Executive

18,272

23,537

-22.4%

164

1,061

-84.5%

0.9%

4.5%

Premium & Luxury

3,973

5,214

-23.8%

1,430

825

73.3%

36.0%

15.8%

Utility Vehicles

532,963

560,892

-5.0%

29,409

45,841

-35.8%

5.5%

8.2%

Vans

118,618

123,254

-3.8%

3,158

2,964

6.5%

2.7%

2.4%

Total

2,438,502

2,557,566

-4.7%

141,846

229,325

-38.1%

5.8%

9.0%

Source: Society of Indian Automobile Manufacturers report and Company Analysis

Note (a): excludes V2 Van sales

Note (b): Total industry nos. includes sale in other segments