Statutory Reports

Corporate Overview

69th Annual Report 2013-14

70

Financial Statements

Growth in China was at 7.5% and Africa, encouragingly, grew by more than 5%.

Tata Motors Business:

Consequent to the macro economic factors as explained above, the Indian automobile industry posted a decline of 9.3% in FY 2013-14, as

compared to 1.1% growth in the last fiscal. The commercial vehicles declined by 22.4% (last year growth of 1.7%) and passenger vehicles

declined by 4.7% (last year growth of 0.9%).

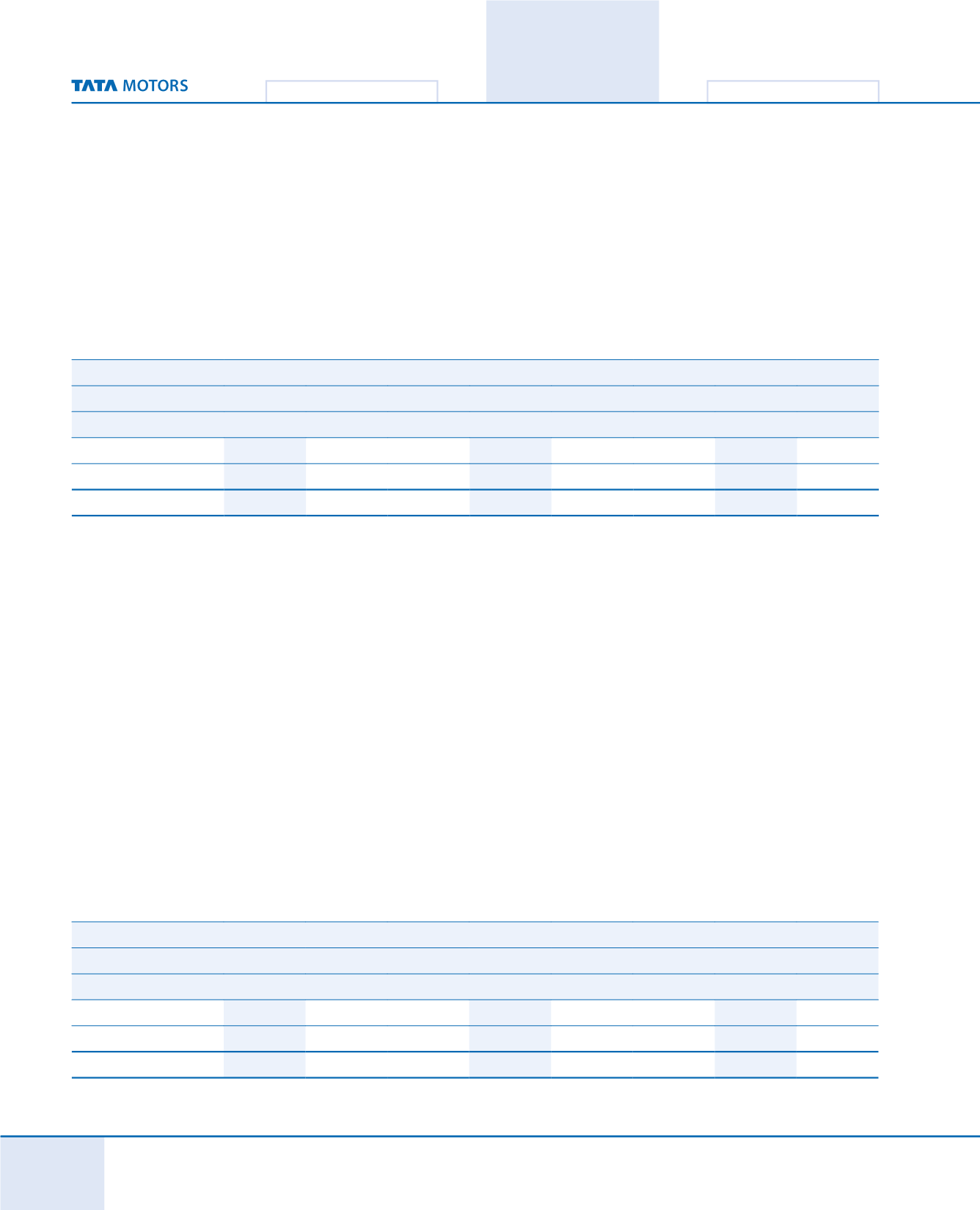

The industry performance in the domestic market during FY 2013-14 and the Company’s market share are given below:-

Category

Industry Sales

Company Sales

Market Share

FY 2013-14 FY 2012-13 Growth FY 2013-14 FY 2012-13 Growth FY 2013-14

FY 2012-13

Units

Units

Units

Units

Commercial vehicles

698,907

900,433

-22.4%

377,909

536,232

-29.5%

54.1%

59.6%

Passenger vehicles

2,438,502

2,557,566

-4.7%

141,846

229,325

-38.1%

5.8%

9.0%

Total

3,137,409

3,457,999

-9.3% 519,755

765,557

-32.1% 16.6% 22.1%

Source: Society of Indian Automobile Manufacturers report and Company Analysis

Commercial vehicles include V2 Van sales.

Passenger vehicles include Fiat and Jaguar Land Rover branded cars

INDUSTRY STRUCTURE AND DEVELOPMENTS

Commercial Vehicles:

The demand for Commercial vehicles remained depressed throughout the year. For FY 2013-14 the Commercial vehicle industry volumes

at 698,907 reflect a decline of 22.4% over FY 2012-13. The Medium and Heavy Commercial Vehicles (M&HCV) segment recorded a further

negative of 25.2% on the back of 23.3% decline in the last fiscal. The ban on mining, fleet underutilization, fall in resale value and low

economic activities contributed to the fall. However, over the last few months, the decline has slowed down and volumes have stabilized

through efforts taken by the Government to revive the sector by 4% reduction in excise duty, partial lifting of mining bans and increase in

freight rates, indicating that the economy may be nearing the end of the down-cycle. While the M&HCV segment had declined in the last

fiscal, the contraction of the Light Commercial Vehicles (LCV) segment by 21.2% is more significant because it was the growth driver in the

past, growing by 17.9% in the last fiscal. The fall in this segment has been led by the drop in the Small Commercial Vehicle (SCV) volumes

where fund availability is the most critical element. The high default rates in loans coupled with early delinquencies prompted the financiers

to tighten lending norms, reduce the Loan-to-value (LTV) ratio and go into a collection mode impacting the SCV segment quite sharply.

The Company registered a decline of 29.5% to 377,909 units, primarily due to fall in LCV volumes coupled with the falling demand in M&HCV.

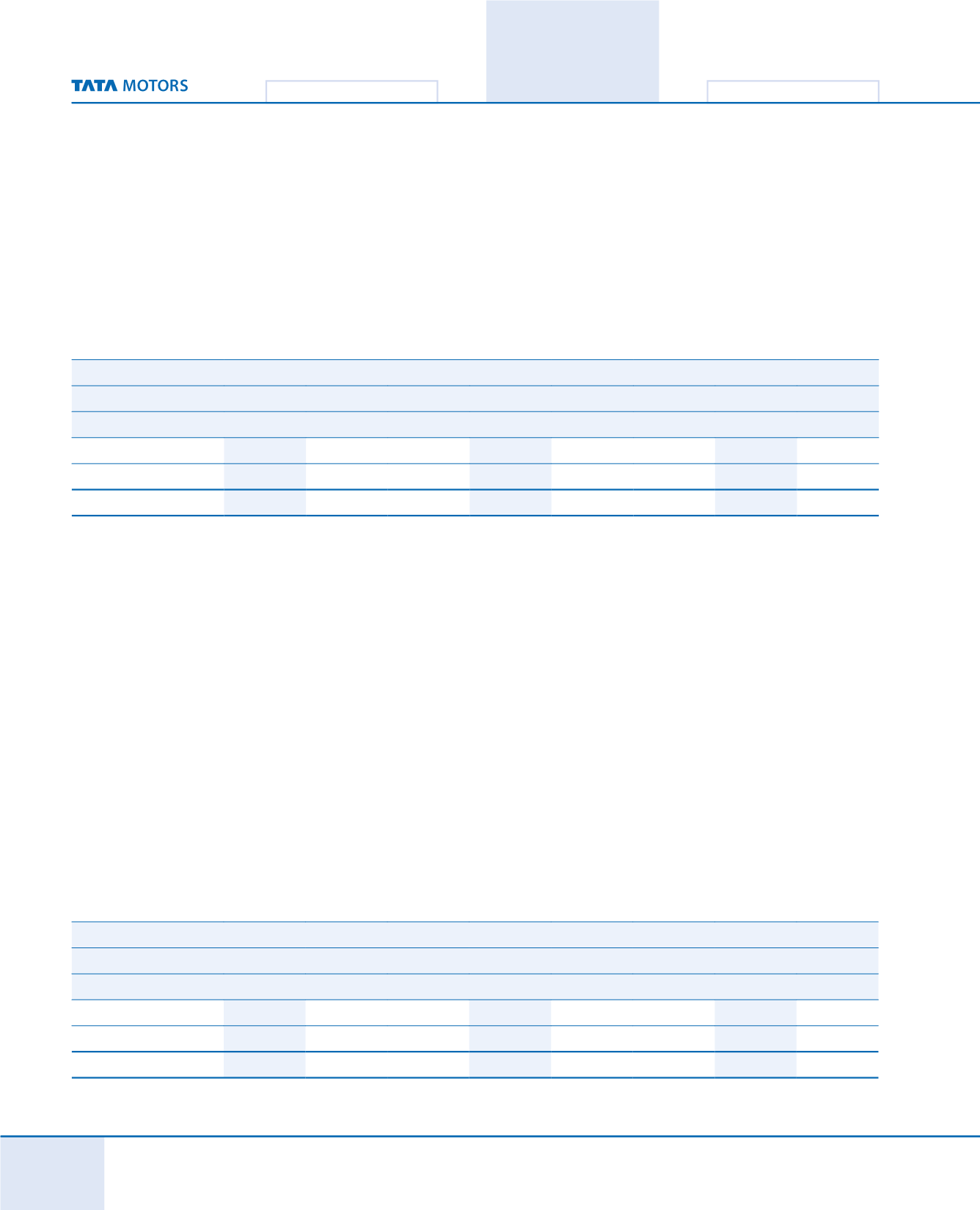

The domestic industry performance during FY 2013-14 and the Company’s market share are given below:-

Category

Industry Sales

Company Sales

Market Share

FY 2013-14 FY 2012-13

Growth FY 2013-14 FY 2012-13

Growth FY 2013-14

FY 2012-13

Units

Units

Units

Units

M&HCV

200,424

267,983

-25.2%

109,984

142,764

-23.0%

54.9%

53.3%

LCV

498,483

632,450

-21.2%

267,925

393,468

-31.9%

53.7%

62.2%

Total

698,907

900,433

-22.4%

377,909

536,232

-29.5%

54.1% 59.6%

Source: Society of Indian Automobile Manufacturers report and Company Analysis

LCVs include V2 Van sales