69

Notice

Directors’ Report

(69-103)

Management Discussion & Analysis

Corporate Governance

Secretarial Audit Report

BUSINESS OVERVIEW

India’s GDP growth continues to remain weak, at 4.7% in FY 2013-14

(advance estimates) after growing at 4.5% in FY 2012-13. Industrial

activity continues to remain weak. Index of Industrial production

(IIP) was negative at 0.1% during FY 2013-14. The stagnation in

the industrial activity was broad-based. While mining output

registered a negative of 1.1%, manufacturing output registered a

negative of 0.7% during the same period. FY 2013-14 witnessed a

decline in investments in new projects in line with slowdown in

overall growth.

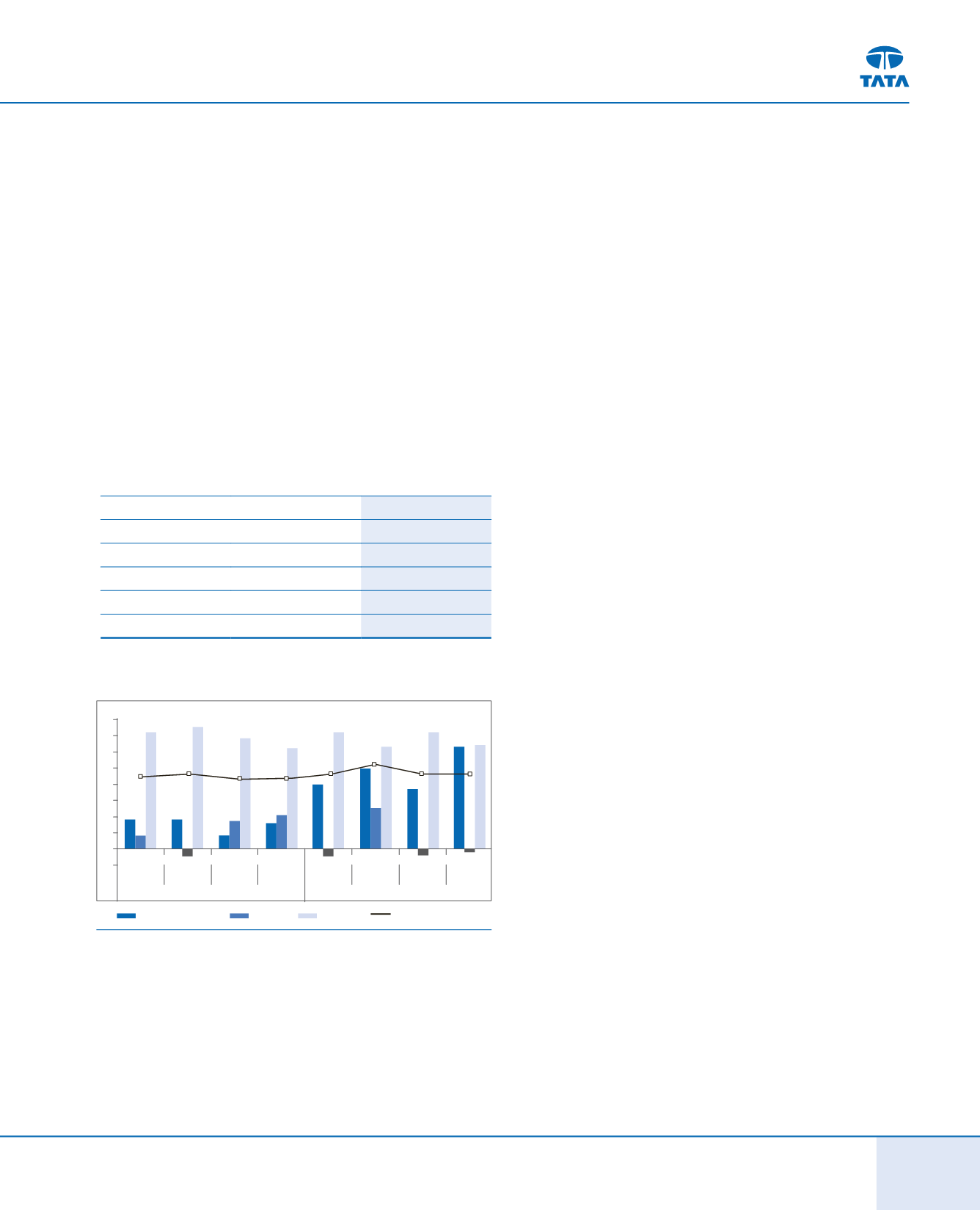

Growth rate in GDP

FY 2012-13

FY 2013-14

Q1

4.5

4.7

Q2

4.6

5.2

Q3

4.4

4.6

Q4

4.4

4.6

4.5

4.7

Source: Ministry of Statistics and Programme implementation

MANAGEMENT DISCUSSION AND ANALYSIS

As a result, the domestic auto industry saw decline after a long time.

With the continued high interest rates and inflation, households

were forced to spend more on essentials and discretionary spend

reduced, leading to deferring of purchase decisions. The consistent

stagnation of the industrial growth mainly in the areas of mining and

quarrying, manufacturing and infrastructure adversely impacted the

domestic auto industry.

On the global economy front, it was still a struggle, with the Euro

zone in recession for much of 2013. However, in the developed

world which had started as an uneven and patchy, recovery began

to strengthen. The US economy, despite having to cope with feuding

over its budget, seems to have sped up. It has been creating jobs

and its housing market and stock indicator have moved up sharply.

By the end of the year 2013, the UK had become, on some counts

the fastest growing large developed economy. UK labour market

conditions improved as employment increased. Rising consumer

and business confidence helped to underpin stronger retail sales

and investment spending, while the recovery in house prices helped

shore up household wealth. This was led by higher consumption, in

turn leading to fears of overheating in the housing market.

Germany had a solid year, reducing unemployment and boosting

living standards. However, across the Mediterranean the pattern

was more disappointing, with Italy, Spain, Portugal and Greece all

enduring a year of rising unemployment. Europe and the euro are

not out of trouble, but the acute phase of their difficulties may be

past. However, there is still a long way to go: deflation risks remain,

the sovereign and banking crisis is not fully resolved, and there

is a considerable gulf in performance between the core and the

periphery.

The structural shift from the developed world towards the emerging

world continued but at a slightly slower pace than before. Industrial

activity picked up pace throughout the year, supporting continued

employment growth. With asset prices buoyant and confidence

returning, the pillars of support for consumer spending fell back into

place during 2013. In the emerging markets due to announcement

by the US Federal Reserve in May, that it would soon begin

reducing its monthly asset purchases (so-called “tapering”), caused

currencies to depreciate, stock markets to fall and borrowing costs

to rise. Countries with large current account and fiscal deficits were

worst affected.

On the back of tight monetary policy, limited Fiscal spending, rising

Inflation and slowing investments, over the previous year, FY 2013-

14 saw many of the same challenges continuing into the year.

FY 2013-14 was marked by the challenge to the Government to

contain the fiscal deficit, and the Government expenditure on

infrastructure and other key sectors suffered. Current account

deficit was brought in control .

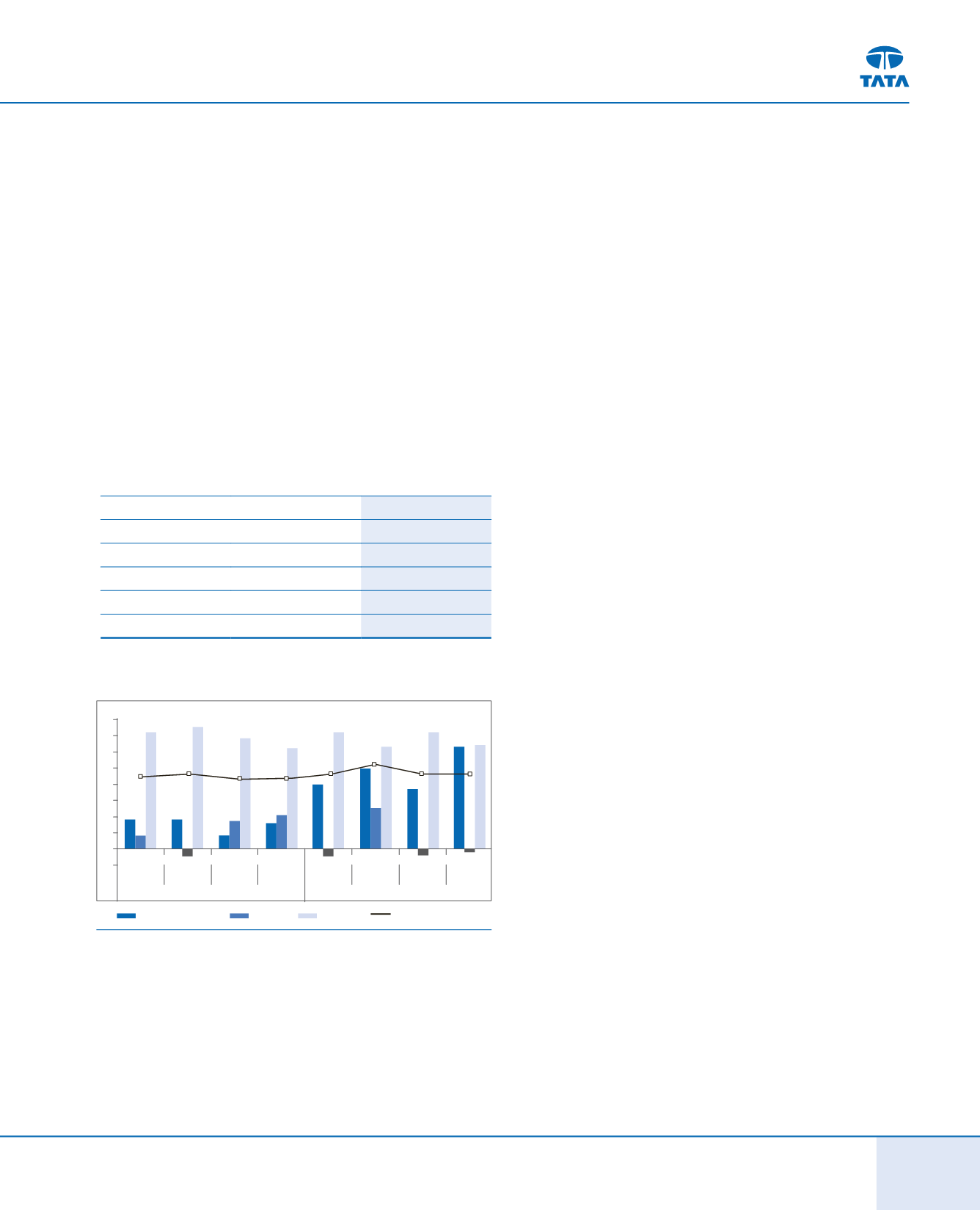

7.2

Q1

Q2

Agriculture & Allied

Industry

Services

GDP at factor cost

2013-14

Q3

Q4

Q1

Q2

Q3

Q4

6.4

7.2

63

7.2

6.3

6.9

7.6

4.5

6.3

4.6

4.7

4.4

4.4

4.6

1.8

4.6

3.7

4.0

2.1

1.7

1.8

0.3

2.6

1.6

0.8

-0.4

-0.4

-0.4

-0.2

5.2

5.0

8.0

7.0

6.0

5.0

4.0

3.0

2.0

1.0

0.0

-1.0

2012-13