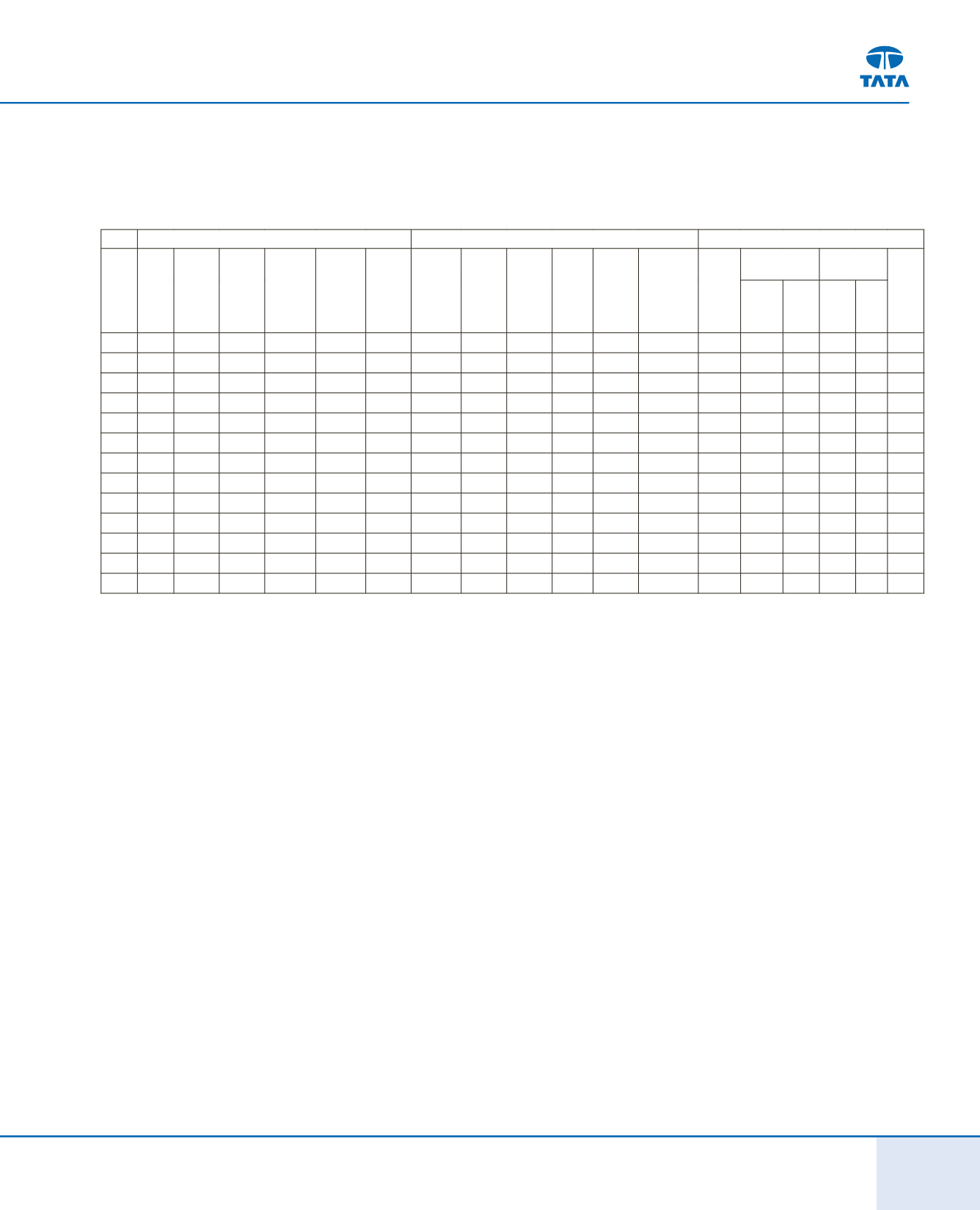

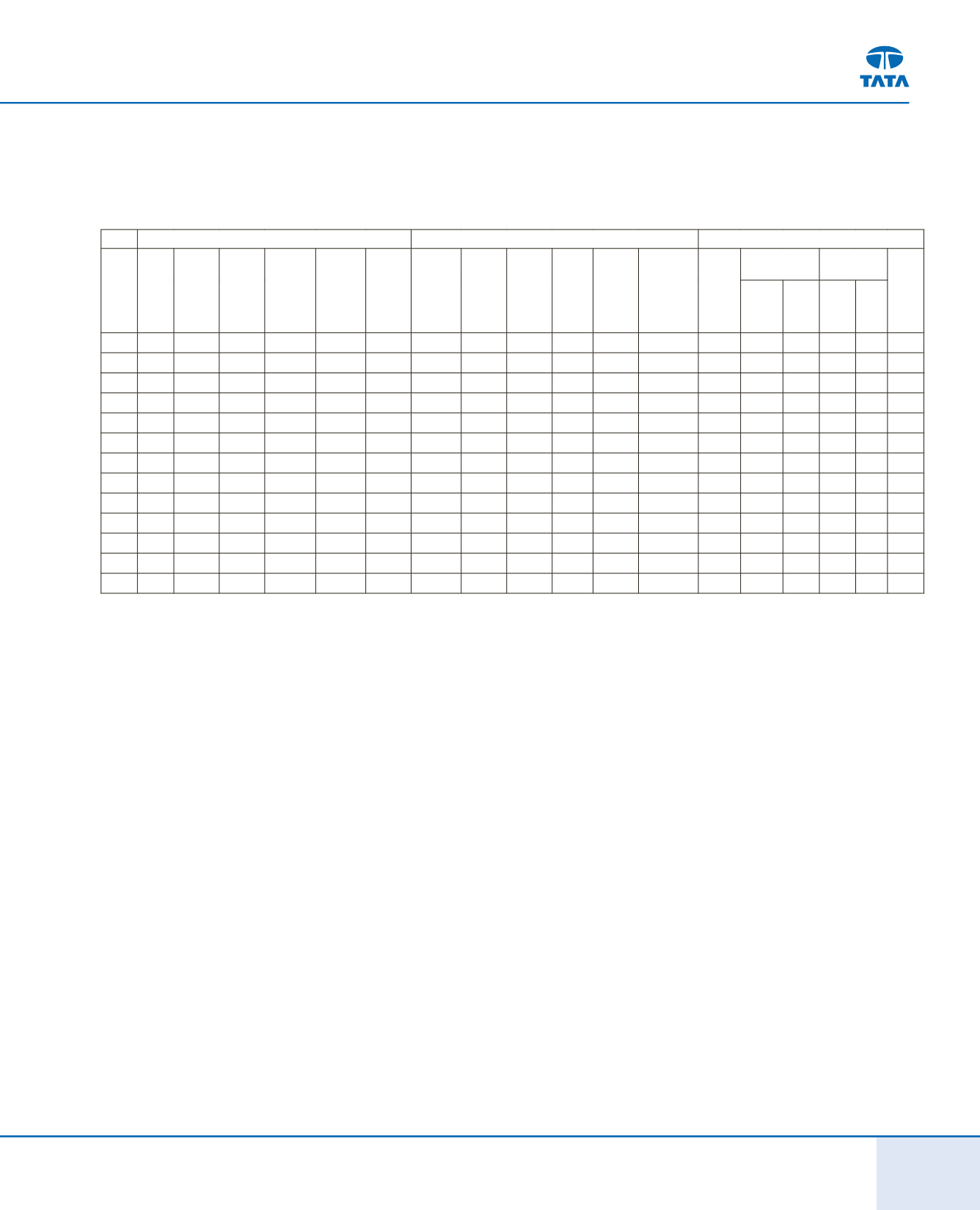

Financial Statistics

(41-43)

43

CAPITAL ACCOUNTS (

`

in lakhs)

REVENUE ACCOUNTS (

`

in lakhs)

RATIOS

Year

Capital

Reserves

and Surplus

Borrowings Gross Block

(including

CWIP)

Accumulated

Depreciation

Net Block Turnover DepreciationProfit/ (Loss)

Before

Taxes

Taxes Profit/ (Loss)

After Taxes

Dividend

including tax

(including

group’s share

of Subsidiaries

dividend tax)

PAT to Sales Earnings Per Share

(Basic)* (

`

)

Dividend Per

Share*# (

`

)

Net Worth

Per

Share*

(

`

)

Ordinary

Share

‘A’

Ordinary

Share

Ordinary

Share

‘A’

Ordinary

Share

2001-02 31,982

183,617

282,031

634,984

252,475

382,509

932,220

39,222 (18,015) (6,740) (10,719)

45

-1.1% (3.95)

-

-

-

66@

2002-03 31,983

190,018

178,965

648,959

284,038

364,921 1,144,801

40,190

54,350

22,640

29,712

14,497

2.6% 9.29

-

4.00

-

66

2003-04 35,683

329,884

169,842

728,468

323,749

404,719 1,634,104

42,556

144,487

53,077

91,529

32,099

5.6% 27.88

-

8.00

-

104@

2004-05 36,179

403,537

271,420

834,162

375,933

458,229 2,284,217

53,101

184,809

49,062

138,534

52,346

6.1% 38.50

-

12.50!

-

121@

2005-06 38,287

574,860

337,914 1,027,949

484,356

543,593 2,750,725

62,331

234,898

64,000

172,809

58,439

6.3% 45.86

-

13.00

-

160@

2006-07 38,541

733,626

730,190 1,294,083

542,665

751,418 3,707,579

68,809

308,800

88,321

216,999

68,822

5.9% 56.43

-

15.00

-

200@

2007-08 38,554

831,198 1,158,487 1,892,393

606,049 1,286,344 4,060,827

78,207

308,629

85,154

216,770

67,674

5.3% 56.24

-

15.00

-

225@

2008-09 51,405

542,659 3,497,385 6,900,238 3,326,905 3,573,333 7,489,227

250,677 (212,925)

33,575 (250,525)

36,458

-3.3% (56.88) (56.88)

6.00

6.50 114++

2009-10 57,060

763,588 3,519,236 7,291,985 3,441,352 3,850,633 9,736,054

388,713

352,264 100,575

257,106

100,185

2.6% 48.64

49.14

15.00 15.50

144^

2010-11 63,771 1,853,376 3,281,055 8,291,975 3,969,870 4,322,105 12,684,370

465,551 1,043,717 121,638

927,362

148,130

7.3% 155.25 155.75

20.00 20.50 302^^

2011-12 63,475 3,206,375 4,714,896 10,572,497 4,951,247 5,621,250 17,133,935

562,538 1,353,387

(4,004) 1,351,650

148,862

7.9% 42.58** 42.68** 4.00** 4.10**

103

2012-13 63,807 3,699,923 53,71,571 121,58,556 5,172,265 6,986,291 19,451,406

760,128 1,364,733 377,666

989,261

75,614

5.1% 31.02

31.12

2.00

2.10

118@

2013-14 64,378 6,495,967 6,064,228 16,619,078 6,881,538 9,737,540 23,745,502 1,107,816 1,886,897 476,479 1,399,102

69,008

5.9% 43.51

43.61

2.00

2.10

204@

Notes :

@

On increased capital base due to conversion of Bonds / Convertible Debentures / Warrants / FCCN into shares.

*

Equivalent to a face value of

`

10/- per share.

#

Includes Interim Dividend where applicable.

!

Includes a special dividend of

`

2.50 per share for the Diamond Jubilee Year.

++

On increased capital base due to Rights issue and conversion of FCCN into shares.

^ On increased capital base due to GDS issue and conversion of FCCN into shares.

^^ On increased capital base due to QIP issue and conversion of FCCN into shares.

**

Consequent to sub-division of shares, figures for previous years are not comparable

FINANCIAL STATISTICS

COMPANY (CONSOLIDATED)