Statutory Reports

Corporate Overview

69th Annual Report 2013-14

42

Financial Statements

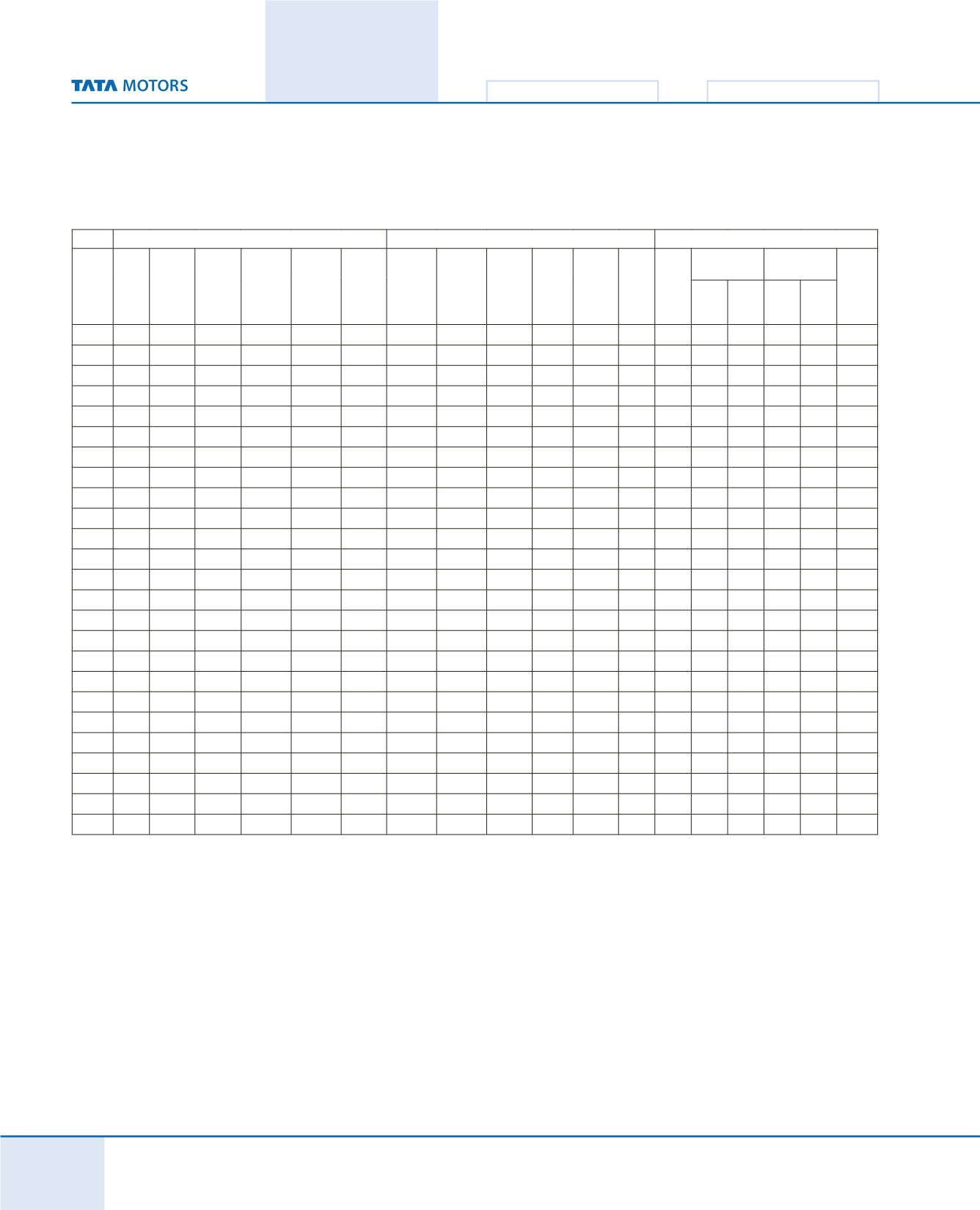

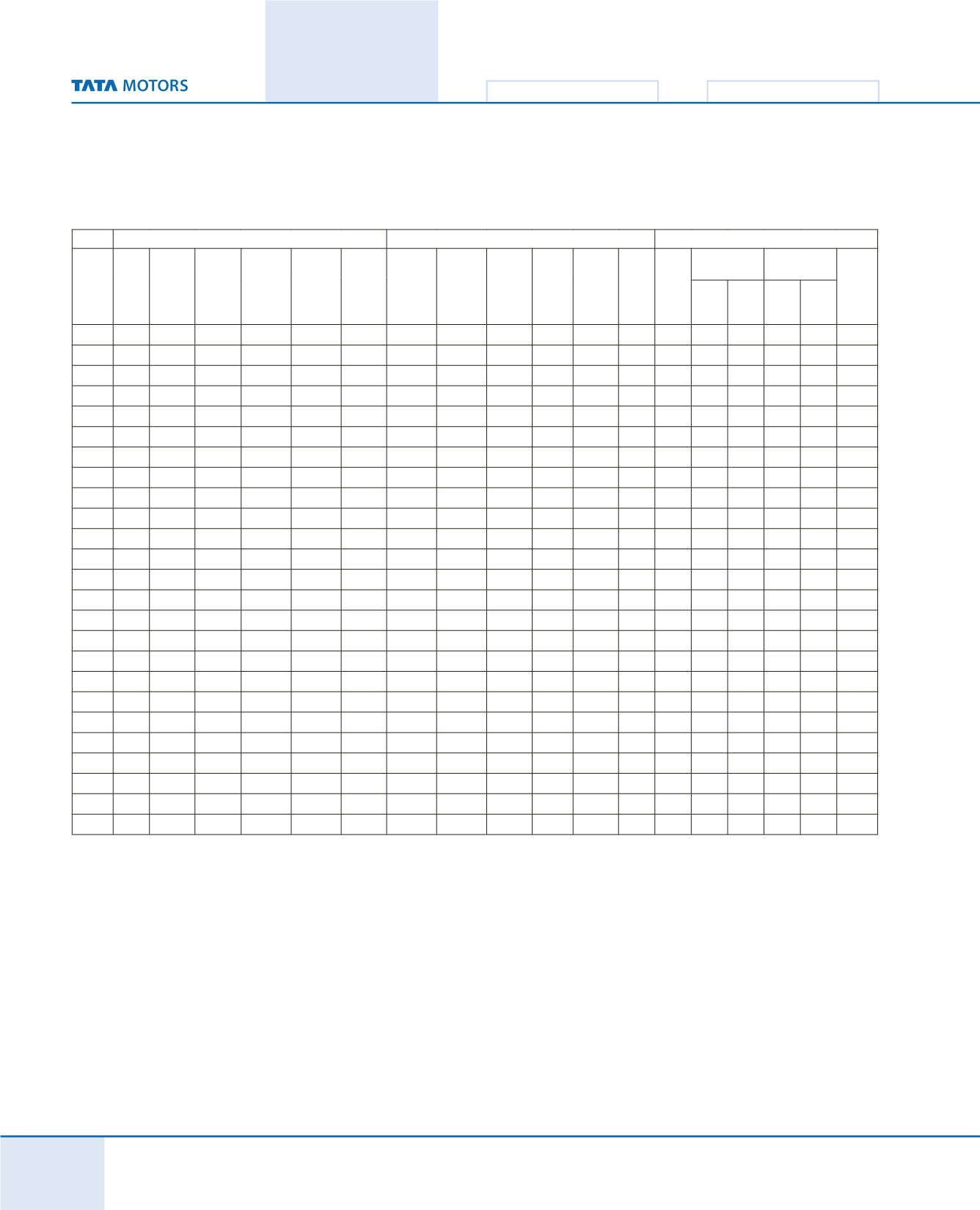

CAPITAL ACCOUNTS (

`

in lakhs)

REVENUE ACCOUNTS (

`

in lakhs)

RATIOS

Year

Capital

Reserves

and Surplus

Borrowings Gross Block Depreciation Net Block Turnover Depreciation Profit/ (Loss)

Before

Taxes

Taxes Profit/ (Loss)

After Taxes

Dividend

including

tax

PAT to

Sales

Earnings Per Share

(Basic)* (

`

)

Dividend Per

Share*(#)

Net Worth

Per Share*

(

`

)

Ordinary

Share

'A'

Ordinary

Share

Ordinary

Share

'A'

Ordinary

Share

1989-90 10,444

37,870

48,883

91,488

43,070

48,418

196,910

4,891

14,829

4,575

10,254

3,126

5.2% 9.87

-

3.00

-

47

1990-91 10,387 47,921 48,323 100,894

48,219 52,675 259,599

5,426 23,455 9,250 14,205 4,154 5.5% 13.69

-

4.00

-

56

1991-92 11,765

61,863

105,168

123,100

54,609

68,491

317,965

6,475

20,884

7,800

13,084

4,389

4.1% 12.45

-

4.00

-

67@

1992-93 12,510

64,207

144,145

153,612

61,710

91,902

309,156

7,456

3,030

26

3,004

3,642

1.0% 2.47

-

3.00

-

63

1993-94 12,867

70,745

141,320

177,824

70,285

107,539

374,786

9,410

10,195

20

10,175

5,020

2.7% 7.91

-

4.00

-

65

1994-95 13,694

128,338

115,569

217,084

81,595

135,489

568,312

11,967

45,141

13,246

31,895

8,068

5.6% 23.29

-

6.00

-

104

1995-96 24,182

217,400

128,097

294,239

96,980

197,259

790,967

16,444

76,072

23,070

53,002 14,300

6.7% 21.92

-

6.00

-

100

1996-97 25,588

339,169

253,717

385,116

117,009

268,107 1,012,843

20,924

100,046

23,810

76,236 22,067

7.5% 30.40

-

8.00

-

143

1997-98 25,588

349,930

330,874

487,073

141,899

345,174

736,279

25,924

32,880

3,414

29,466 15,484

4.0% 11.51

-

5.50

-

147

1998-99 25,590

350,505

344,523

569,865

165,334

404,531

659,395

28,132

10,716

970

9,746

8,520

1.5% 3.81

-

3.00

-

147

1999-00 25,590

349,822

300,426

581,233

182,818

398,415

896,114

34,261

7,520

400

7,120

7,803

0.8% 2.78

-

2.50

-

147

2000-01 25,590

299,788

299,888

591,427

209,067

382,360

816,422

34,737 (50,034)

- (50,034)

-

- (18.45)

-

-

-

127

2001-02 31,982

214,524

230,772

591,006

243,172

347,834

891,806

35,468 (10,921) (5,548)

(5,373)

-

-

(1.98)

-

-

-

77@

2002-03 31,983

227,733

145,831

608,114

271,307

336,807 1,085,874

36,213

51,037

21,026

30,011 14,430

2.8% 9.38

-

4.00

-

81

2003-04 35,683

323,677

125,977

627,149

302,369

324,780 1,555,242

38,260

129,234

48,200

81,034 31,825

5.2% 24.68

-

8.00

-

102@

2004-05 36,179

374,960

249,542

715,079

345,428

369,651 2,064,866

45,016

165,190

41,495

123,695 51,715

6.0% 34.38

-

12.50!

-

114@

2005-06 38,287

515,420

293,684

892,274

440,151

452,123 2,429,052

52,094

205,338

52,450

152,888 56,778

6.3% 40.57

-

13.00

-

145@

2006-07 38,541

648,434

400,914 1,128,912

489,454

639,458 3,206,467

58,629

257,318

65,972

191,346 67,639

6.0% 49.76

-

15.00

-

178 @

2007-08 38,554

745,396

628,052 1,589,579

544,352 1,045,227 3,357,711

65,231

257,647

54,755

202,892 65,968

6.0% 52.64

-

15.00

-

203 @

2008-09 51,405 1,171,610 1,316,556 2,085,206

625,990 1,459,216 2,949,418

87,454

101,376

1,250

100,126 34,570

3.4% 22.70

23.20

6.00

6.50

238++

2009-10 57,060 1,439,487 1,659,454 2,364,896

721,292 1,643,604 4,021,755

103,387

282,954

58,946

224,008 99,194

5.6% 42.37

42.87

15.00

15.50

262^

2010-11 63,771 1,937,559 1,591,543 2,568,235

846,625 1,721,610 5,160,692

136,077

219,652

38,470

181,182 146,703

3.5% 30.28

30.78

20.00

20.50

315^^

2011-12 63,475 1,899,126 1,588,057 2,902,206

996,587 1,905,619 5,979,502

160,674

134,103

9,880

124,223 146,372

2.5% 3.90** 4.00** 4.00** 4.10**

62

2012-13 63,807 1,849,677 1,679,895 3,181,998 1,161,144 2,020,854 5,140,793

181,762

17,493 (12,688)

30,181 72,423

0.6% 0.93

1.03

2.00

2.10

60@

2013-14 64,378 1,853,287 1,505,280 3,514,652 1,355,088 2,159,564 4,159,103

207,030 (102,580) (136,032)

33,452 66,627 0.8% 1.03

1.13

2.00

2.10

62@

Notes :

@

On increased capital base due to conversion of Bonds / Convertible Debentures / Warrants / FCCN into shares.

$

On increased capital base due to issue of Bonus Shares. Net Worth excludes ordinary dividends.

*

Equivalent to a face value of

`

10/- per share.

#

Includes Interim Dividend where applicable.

+

Including on Bonus Shares issued during the year.

!

Includes a special dividend of

`

2.50 per share for the Diamond JubileeYear.

++ On increased capital base due to Rights issue and conversion of FCCN into shares.

^

On increased capital base due to GDS issue and conversion of FCCN into shares.

^^ On increased capital base due to QIP issue and conversion of FCCN into shares.

**

Consequent to sub-division of shares, figures for previous years are not comparable.

FINANCIAL STATISTICS

COMPANY (STANDALONE)