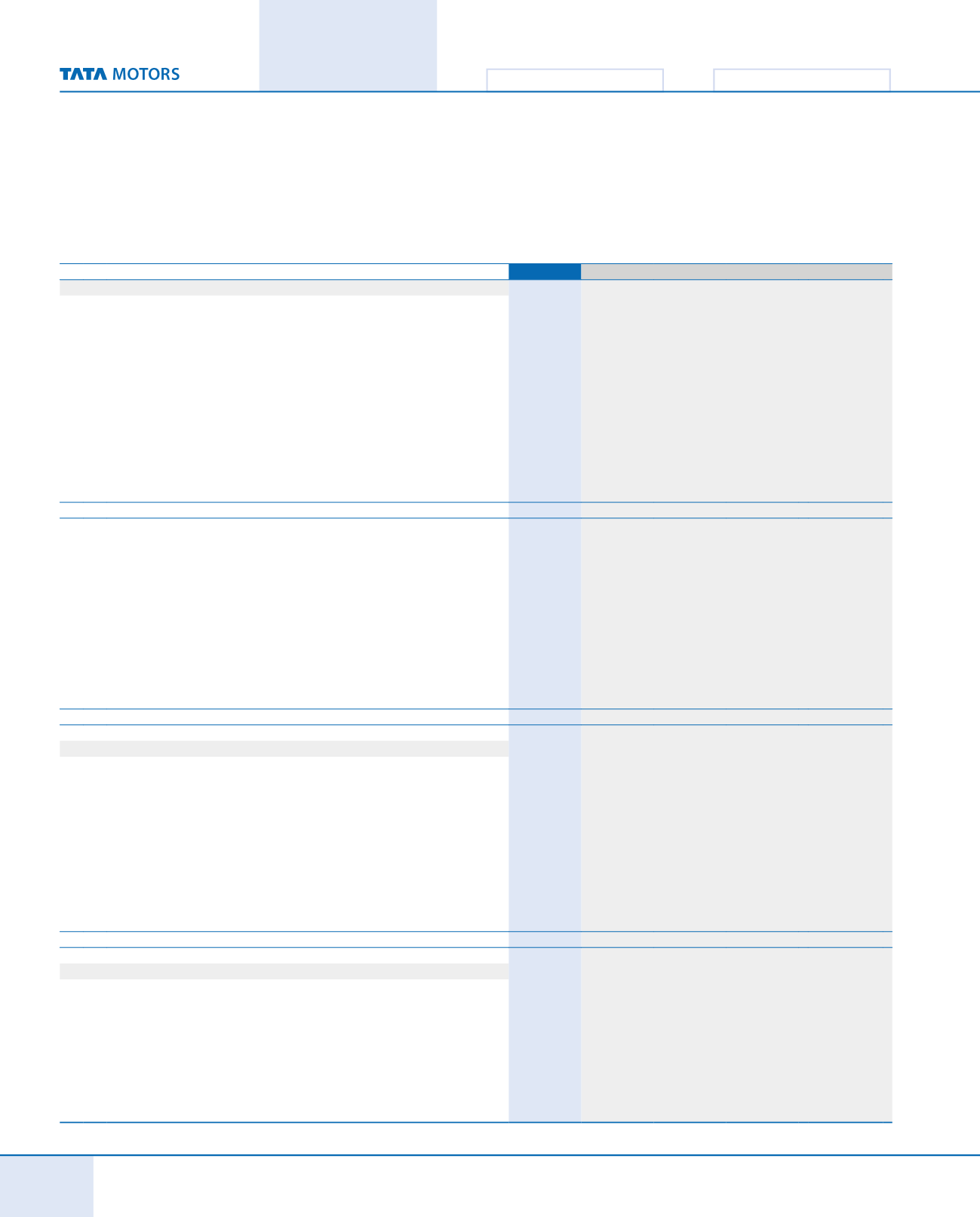

Statutory Reports

Corporate Overview

69th Annual Report 2013-14

40

Financial Statements

(

`

crores)

FY 2013-14

FY 2012-13 FY 2011-12 FY 2010-11 FY 2009-10

SOURCES OF FUNDS

1 Funds generated from operations

A.

Profit after tax

334.52

301.81

1,242.23

1,811.82

2,240.08

B.

Depreciation (including Lease Equalisation)

2,065.78

1,813.10

1,602.23

1,356.26

1,029.36

C.

Provision / (Reversal) for diminution in value of investments (net)

19.43

(9.67)

-

34.00

61.05

D.

Net deferred tax charge / (credit)

(1,920.32)

(127.44)

98.24

376.30

589.46

E.

Credit for Dividend Distribution Tax of Subsidiary Companies

-

1.48

1.48

-

-

F.

Exchange gain (net) on Long term Foreign currency monetary

items deferred consequent to amendment to AS-11

13.77

43.35

(258.35)

161.69

(325.81)

G.

Marked to Market Exchange loss on Forward contracts transferred

to Hedging Reserve Account on adoption of principles of hedge

accounting under AS30 [Note b(iii)]

-

-

-

-

132.57

H.

Profit on sale of division

-

(82.25)

Total

513.78

1,940.38 2,685.83 3,740.07

3,726.71

2 Proceeds from issue of Global Depository Shares

-

-

-

-

1,794.19

3 Proceeds from QIP issue

-

-

-

3,351.01

-

4 Proceeds from FCCN, Warrants and Convertible Debentures

converted into Ordinary Shares and premium thereon

413.43

233.00

0.02

1,493.32

1,555.76

5 (a) Decrease in Working Capital

4,069.76

292.96

-

-

2,145.94

(b) Decrease in Finance receivables

14.99

64.77

144.96

366.41

1,393.58

6 Increase in Borrowings (net of repayments)

-

918.38

-

-

3,460.35

7 Investment sold (net of investment made)

1,456.54

568.83

2,130.66

-

-

8 Decrease in short term deposits with banks

223.87

576.08

525.86

-

-

9 Proceeds from sale of division

-

110.00

-

-

-

6,691.77

4,704.40 5,487.33 8,950.81 14,076.53

APPLICATION OF FUNDS

10 Capital Expenditure (net)

3,568.10

2,952.38

3,346.88

2,396.29

2,873.33

11 Repayment of Borrowings (net of additional borrowings)

1,746.15

-

34.86

695.79

-

12 Investments made (net of sales)

-

-

-

321.31

9,429.82

13 Payment of Redemption Premium on NCD

658.05

96.55

-

71.96

-

14 Increase in short term deposits with banks

-

-

-

804.66

490.67

15 Increase in Working Capital

-

-

571.38

3,000.57

-

16 Dividends (including tax thereon)

666.27

724.23

1,463.72

1,467.03

991.94

17 Premium paid on redemption of CARS

-

843.37

-

-

-

18 Miscellaneous Expenditure (to the extent not written off or adjusted)

and utilisation of Securities Premium Account [Note (a) below]

53.20

87.87

70.49

193.20

290.77

6,691.77

4,704.40 5,487.33 8,950.81 14,076.53

-

NOTES :

(a) Utilisation of Securities Premium Account includes

FCCN / CARS / Rights issue expenses and premium

on redemption of Debentures

53.20

87.87

70.49

193.20

292.79

(b) The Sources and Application of funds does not include

(i) Provision for premium on redemption of CARS / FCCN

(0.46)*

83.19*

929.46*

941.08 *

1,001.46 *

(ii) Liability towards premium on redemption of NCD

(919.23)

(1,577.28)

1,673.83

1,673.83

1,745.79

(iii) Deferred Tax on account of item 1(G)

-

-

-

-

(45.06)

* net of deferred tax

(c) Figures for the previous years have been regrouped wherever necessary.

FUNDS FLOW - LAST FIVE YEARS