Statutory Reports

Corporate Overview

69th Annual Report 2013-14

32

Financial Statements

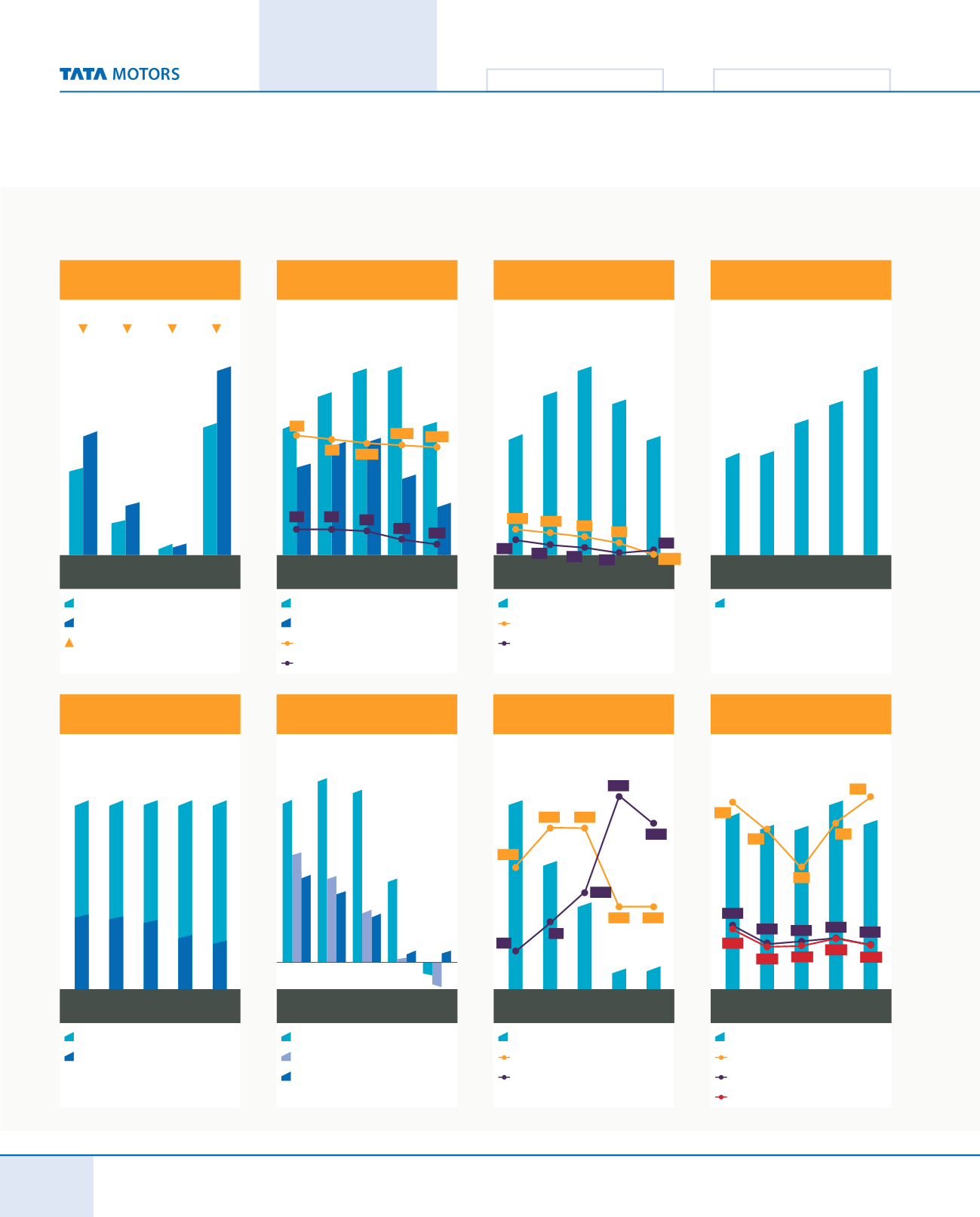

FINANCIAL

PERFORMANCE

CV

Domestic

PV

Domestic

Export

2014 (in thousands)

2013 (in thousands)

GROWTH

142

570

816

50

51

229

536

-29.5% -38.1% -2.0% -30.2%

378

Total

CV VOLUMES (in thousands)

PV VOLUMES (in thousands)

CV MARKET SHARE (%)

PC MARKET SHARE (%)

Vehicle Sales (Domestic)

and Market Share

2010 2011 2012 2013 2014

530

333

536

229

378

142

459

320

260

374

64

14 14

62 59.8

59.6 54.1

R&D EXPENDITURE (

`

crores)

R&D Expenditure

2010 2011 2012 2013 2014

1,549

1,759

2,144

1,187

1,167

NET INCOME* (

`

crores)

EBITDA MARGIN (%)

PAT AS A % OF TURNOVER

* Excludes Other Income

Net Income, EBITDA

Margin, Net Margin

2010 2011 2012 2013 2014

54,307

44,766

34,288

47,088

34,835

Volume Growth

13

9.0 5.8

12.0 10.2 8.1 4.8

1.0

0.7

2.3

(1.4)

3.8

6.4

CV (%)

PV (%)

60

Product Mix (Volumes)

2010 2011 2012 2013 2014

74

26

71

29

63

37

61

39

40

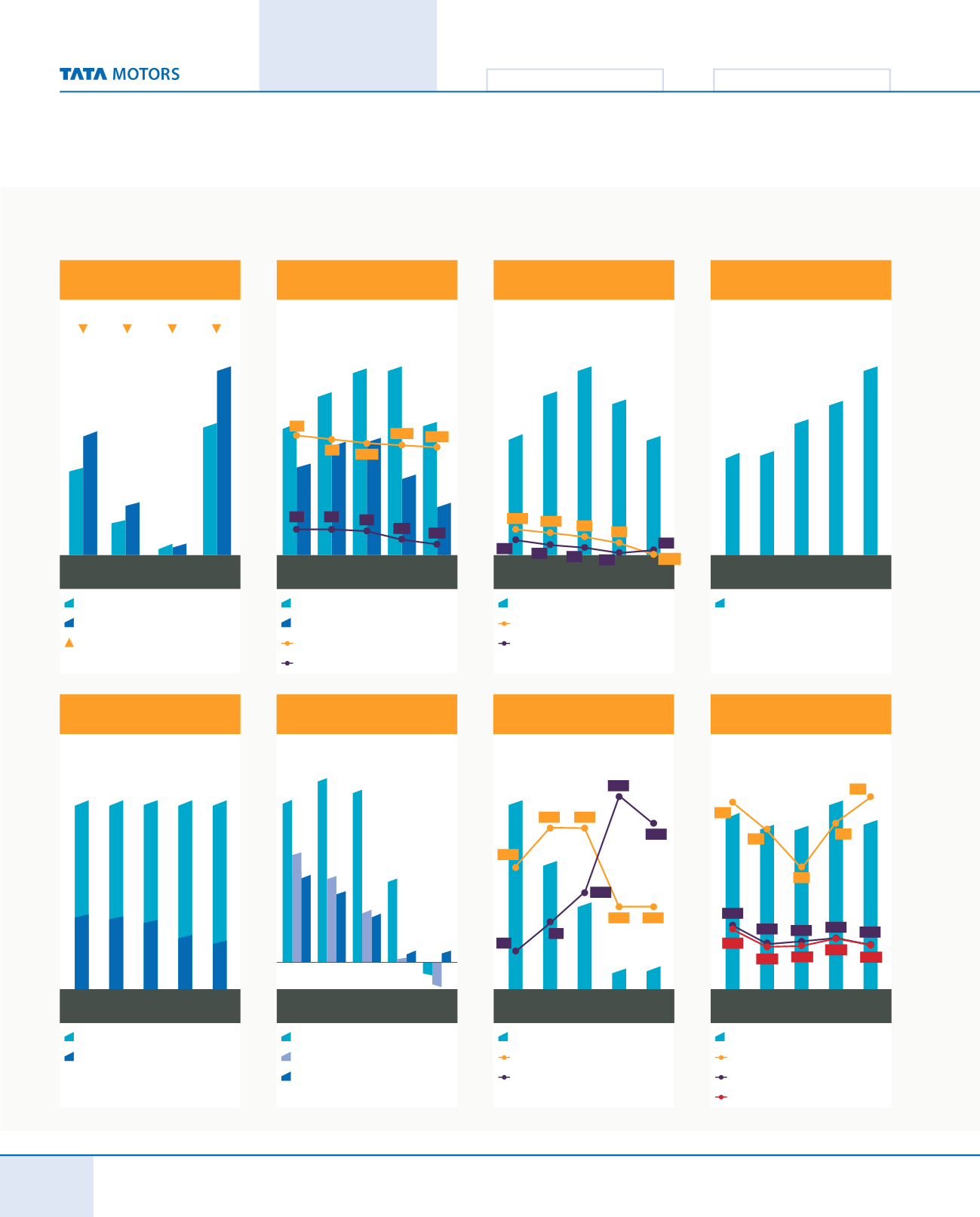

EBITDA (

`

crores)

PBT (

`

crores)

PAT (

`

crores)

2010 2011 2012 2013 2014

4,412

2,144

1,242

302

(482)

335

4,806

1,812

2,240

2,830

175

(1,026)

1,341

2,197

4,178

EPS (

`

)

DIVIDEND %

DIVIDEND PAYOUT AS % TO PAT

Dividend & EPS

2010 2011 2012 2013 2014

3.90

0.93

1.03

6.06

8.47

BORROWINGS (NET ) (

`

crores)

INTEREST AS A % OF TOTAL INCOME

DEBT EQUITY RATIO

DEBT (NET OF SURPLUS CASH) EQUITY RATIO

Borrowings (Net of surplus

cash) & Interest as%of Sales

2010 2011 2012 2013 2014

14,361

16,593

14,854

14,440

15,488

Profits

(EBITDA, PBT, PAT)

150

200 200

100

3.4

2.9

2.2

3.0

3.5

100

222

1.12

0.79 0.82

1.05

0.72 0.74

0.85

0.77

240

118

81

44

0.88 0.78

(COMPANY STANDALONE)