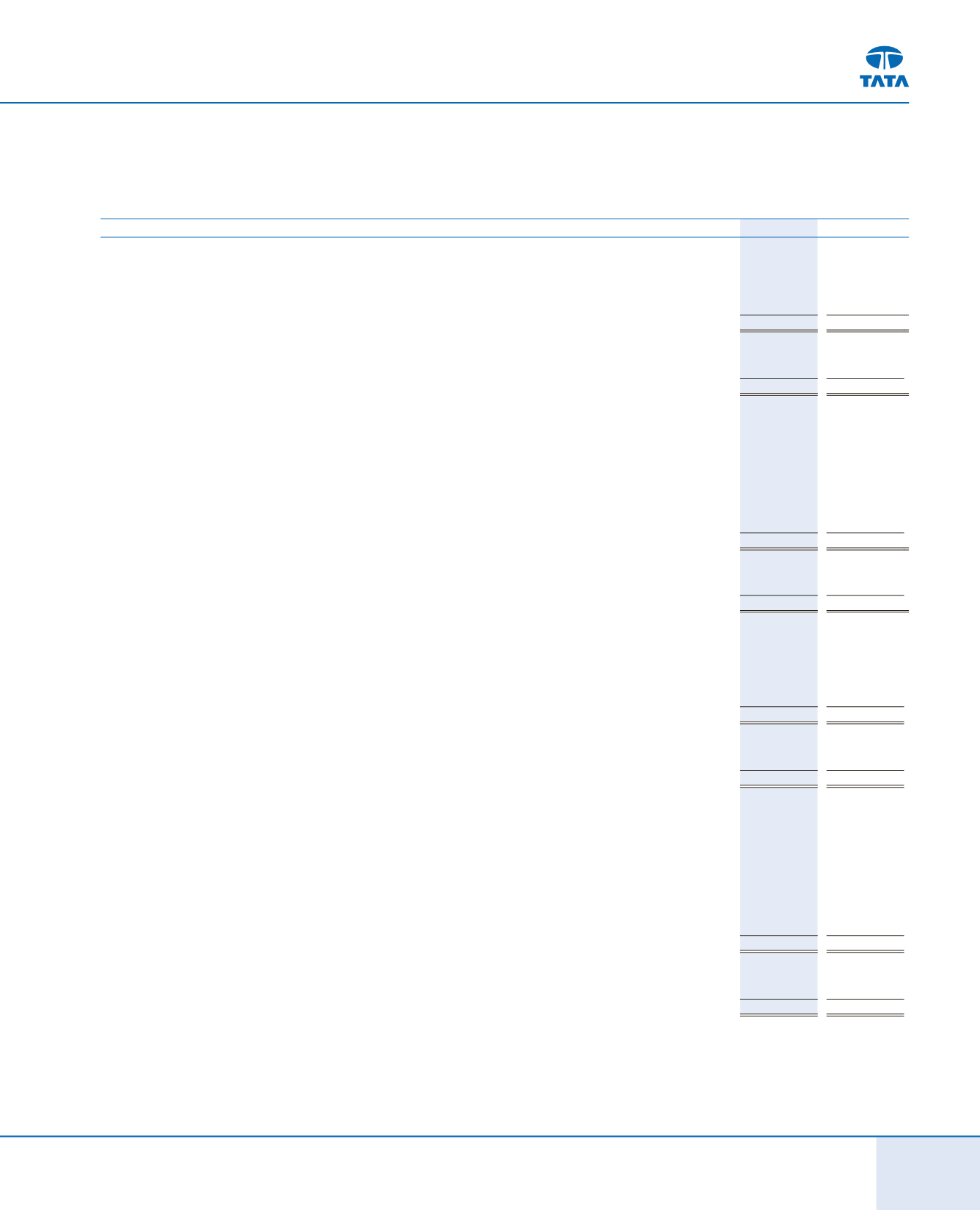

205

(

`

in crores)

2013 - 2014

2012 - 2013

34. (i)

Movement of provision for warranty and product liability

Opening balance

6,719.10

5,299.73

Add: Provision for the year (net) (including additional provision for earlier years)

6,207.44

4,203.91

Less: Payments / debits (net of recoveries from suppliers)

(4,760.36)

(2,756.43)

Foreign currency translation

1,316.04

(28.11)

Closing balance

9,482.22

6,719.10

Current portion

3,976.69

3,145.50

Non-current portion

5,505.53

3,573.60

9,482.22

6,719.10

The provision is expected to be utilized for settlement of warranty claims within a period of 5 years.

(ii)

Movement of provision for redemption of FCCN / CARS

Opening balance

34.21

912.50

Foreign currency exchange loss

0.94

82.97

Premium on redemption of FCCN / CARS (including withholding tax)

(35.15)

(843.37)

Reversal of provision for premium due to conversion of FCCN / CARS

-

(19.92)

Provision / (reversal of provision) for withholding tax upon conversion /

redemption / foreign currency exchange of FCCN / CARS

-

(97.97)

Closing balance

-

34.21

Current portion

-

-

Non-current portion

-

34.21

-

34.21

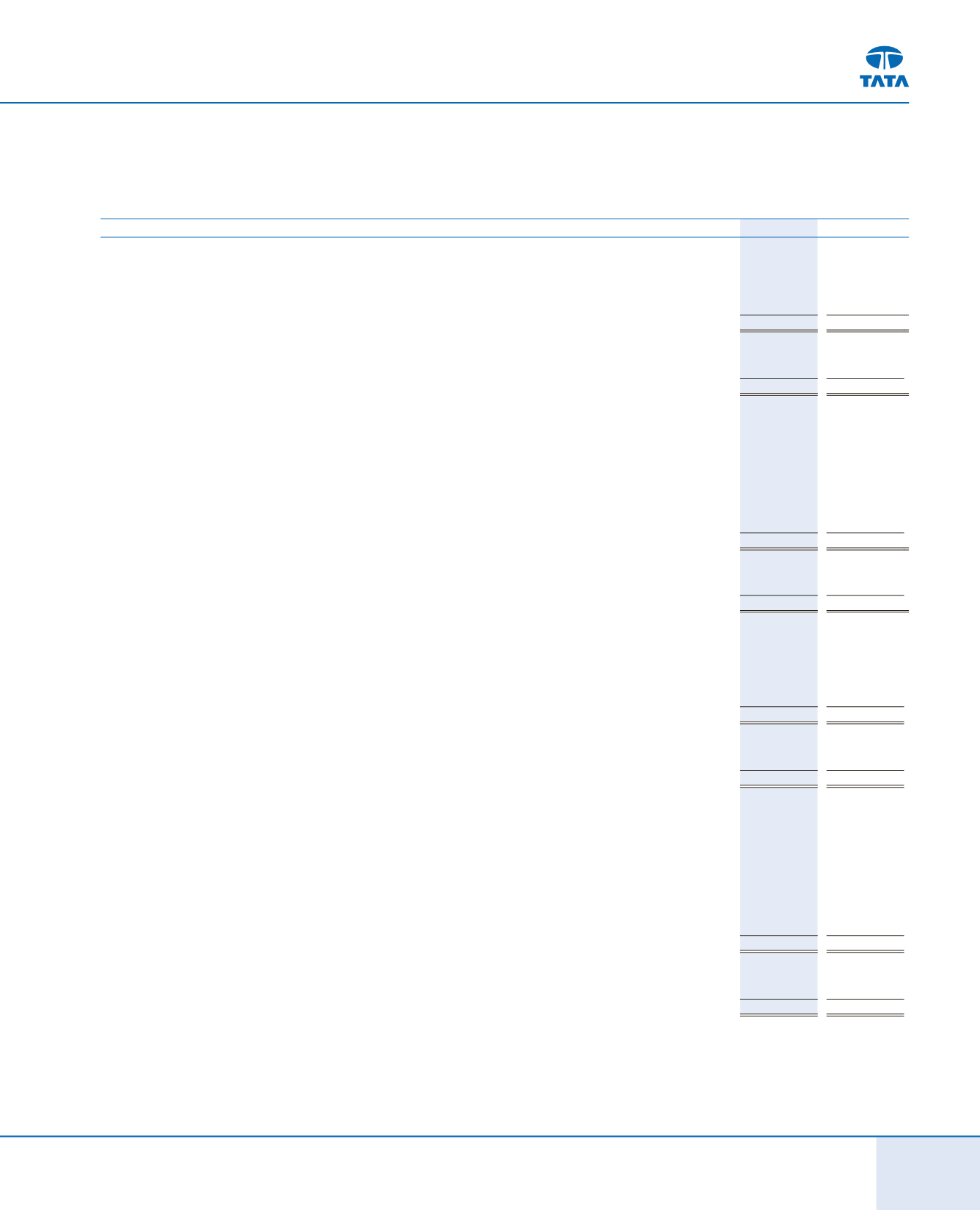

(iii) Movement of provision for residual risk

Opening balance

119.67

130.98

Add: Provision / (reversal of provision) for the year

27.19

(6.02)

Less: Payments / debits

-

(7.74)

Foreign currency translation

2.08

2.45

Closing balance

148.94

119.67

Current portion

17.95

13.40

Non-current portion

130.99

106.27

148.94

119.67

In certain markets, some subsidiaries are responsible for the residual risk arising on vehicles sold by

dealers on a leasing arrangement. The provision is based on the latest available market expectations of

future residual value trends. The timing of the outflows will be at the end of the lease arrangements –

being typically up to three years.

(iv) Movement of provision towards environmental cost

Opening balance

179.32

164.86

Add: Provision for the year (net)

0.96

25.79

Less: Payments

(12.50)

(12.04)

Foreign currency translation

38.90

0.71

Closing balance

206.68

179.32

Current portion

-

-

Non-current portion

206.68

179.32

206.68

179.32

This provision relates to various environmental remediation costs such as asbestos removal and land clean up. The timing of when these costs

will be incurred is not known with certainty.

NOTES FORMING PART OF CONSOLIDATED FINANCIAL STATEMENTS

Independent Auditors’Report

Balance Sheet

(176-206)

Statement of Profit and Loss

Cash Flow Statement

Notes to Accounts