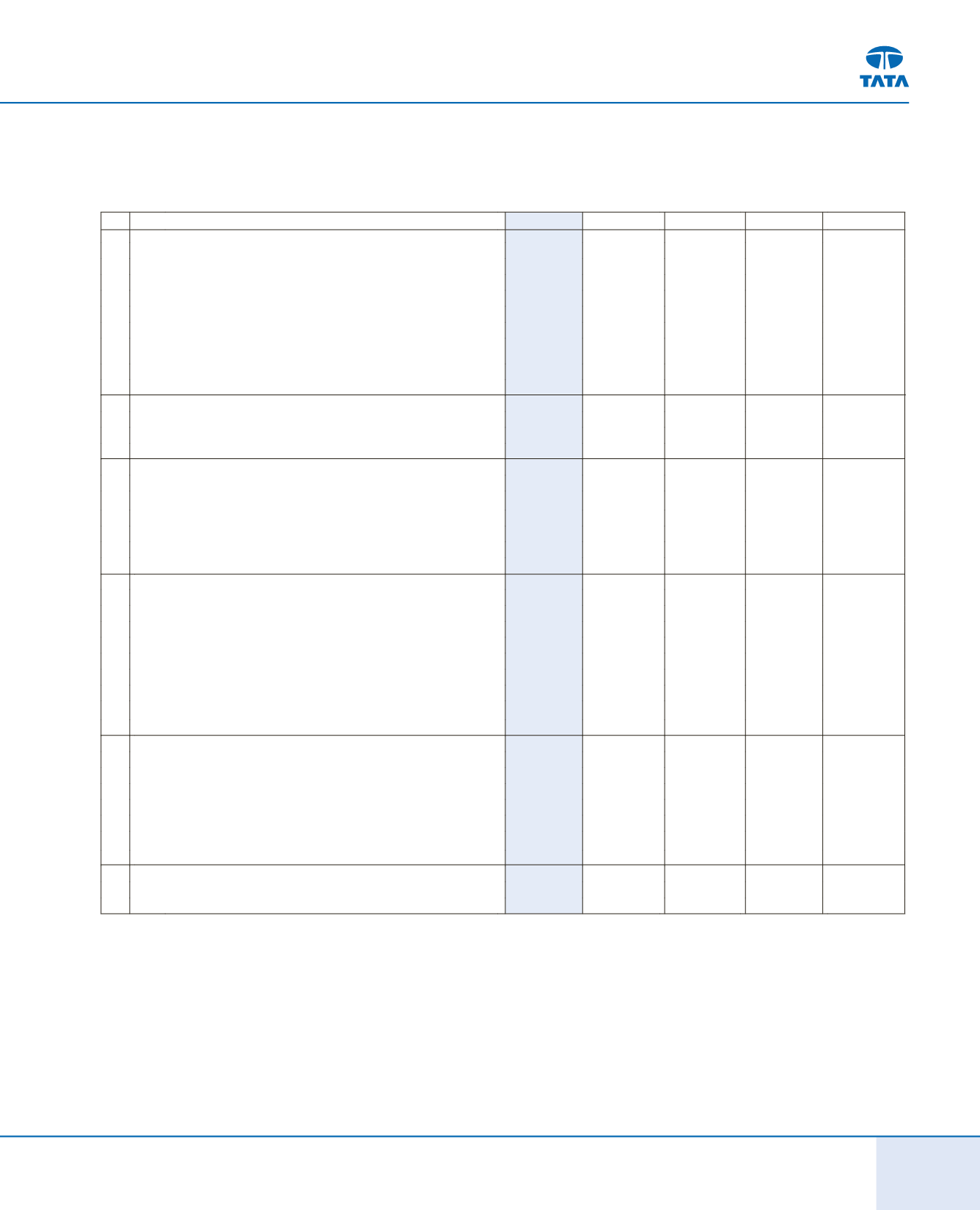

203

As at / for the year ended on March 31,

2014

2013

2012

2011

2010

i

Components of employer expense

Current service cost

38.75

37.24

21.18

20.32

17.54

Interest cost

5.64

9.30

10.26

10.28

8.85

Past service cost

-

(6.17)

-

-

-

Expected return on plan assets

(0.04)

-

-

-

-

Actuarial losses / (gains)

(7.14)

(62.40)

(8.39)

(23.38)

19.75

Total expense recognised in the Statement of Profit and Loss

in Note 25, page 196 :

37.21

(22.03)

23.05

7.22

46.14

ii

Actual Contribution and Benefit Payments

Actual benefit payments

6.83

87.97

14.64

8.96

16.26

Actual contributions

135.03

87.97

14.64

8.96

16.26

iii

Net liability recognised in Balance Sheet

Present value of Defined Benefit Obligation

219.54

164.44

252.58

220.62

217.23

Fair value of plan assets

129.43

-

-

-

-

Net liability recognised in Balance Sheet

(90.11)

(164.44)

(252.58)

(220.62)

(217.23)

Experience adjustment on plan liabilities

6.54

79.62

19.01

5.56

(20.09)

Experience adjustment on plan assets

-

-

-

-

-

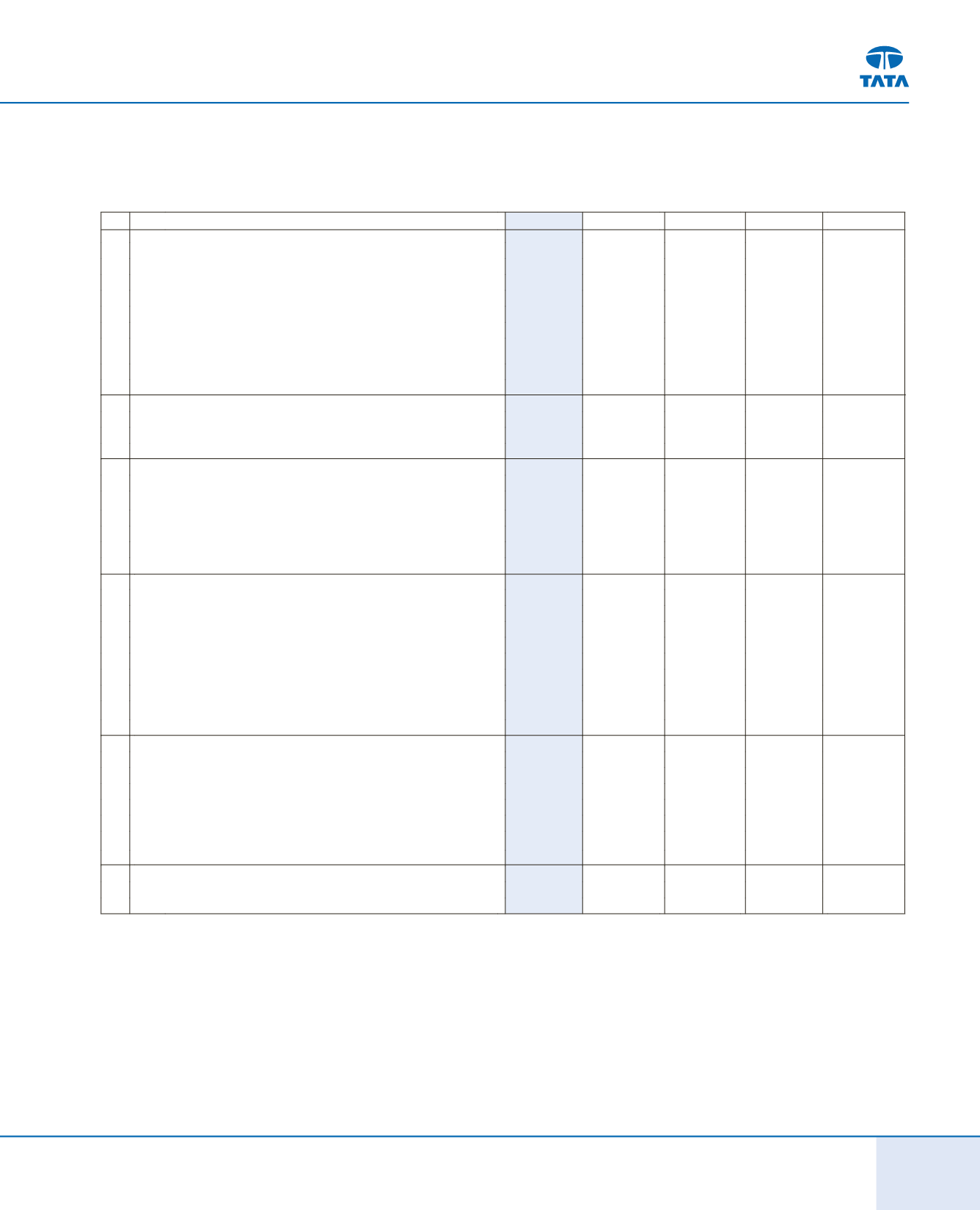

iv Change in Defined Benefit Obligations

Present Value of DBO at the beginning of the year

164.44

252.58

220.62

217.23

174.83

Current service cost

38.75

37.24

21.18

20.32

17.54

Interest cost

5.64

9.30

10.26

10.28

8.85

Past service cost

-

(6.17)

-

-

-

Actuarial losses

(7.14)

(62.40)

(8.39)

(23.38)

19.75

Benefits paid

(6.83)

(87.97)

(14.64)

(8.96)

(16.26)

Exchange fluctuation

24.68

21.86

23.55

5.13

12.52

Present Value of DBO at the end of the year

219.54

164.44

252.58

220.62

217.23

v Change in fair value of assets

Plan assets at the beginning of the year

-

-

-

-

-

Actual return on plan assets

0.04

-

-

-

-

Actual Company contributions

135.03

87.97

14.64

8.96

16.26

Benefits paid

(6.83)

(87.97)

(14.64)

(8.96)

(16.26)

Exchange fluctuation

1.19

-

-

-

-

Plan assets at the end of the year

129.43

-

-

-

-

vi

Actuarial assumptions

Discount rate

3.60%

3.07%

4.03%

4.53%

4.84%

Expected return on plan assets

N/A

N/A

N/A

N/A

N/A

Medical cost inflation

N/A

N/A

N/A

N/A

N/A

33. (b) Details of Severance Indemnity plan applicable to Tata Daewoo Commercial Vehicle Co. Ltd. and Tata Daewoo Commercial Vehicle Sales and Distribution

Co. Ltd., Korea.

(

`

in crores)

The assumption of future salary increases, considered in actuarial valuation, take account of inflation, seniority, promotion and other relevant factors, such as supply and demand in

the employment market.

NOTES FORMING PART OF CONSOLIDATED FINANCIAL STATEMENTS

Independent Auditors’Report

Balance Sheet

(176-206)

Statement of Profit and Loss

Cash Flow Statement

Notes to Accounts