Statutory Reports

Corporate Overview

69th Annual Report 2013-14

202

Financial Statements

(Consolidated)

(a)

Defined contribution plans-

The Company’s contribution to defined contribution plan aggregated

`

271.62

crores

(2012-13

`

235.60 crores) for the year ended March 31, 2014 has been recognised in the Statement of Profit

and Loss in note 25 on page 196.

(b) The expected rate of return on plan assets is based on market expectation, at the beginning of the year, for returns over the entire life of the related obligation.

(c)

The assumption of future salary increases, considered in actuarial valuation, take account of inflation, seniority, promotion and other relevant factors, such as supply and demand in the employment

market.

(d) The Company expects to contribute

`

102.77

crores

to the funded pension plans in the year 2014-2015.

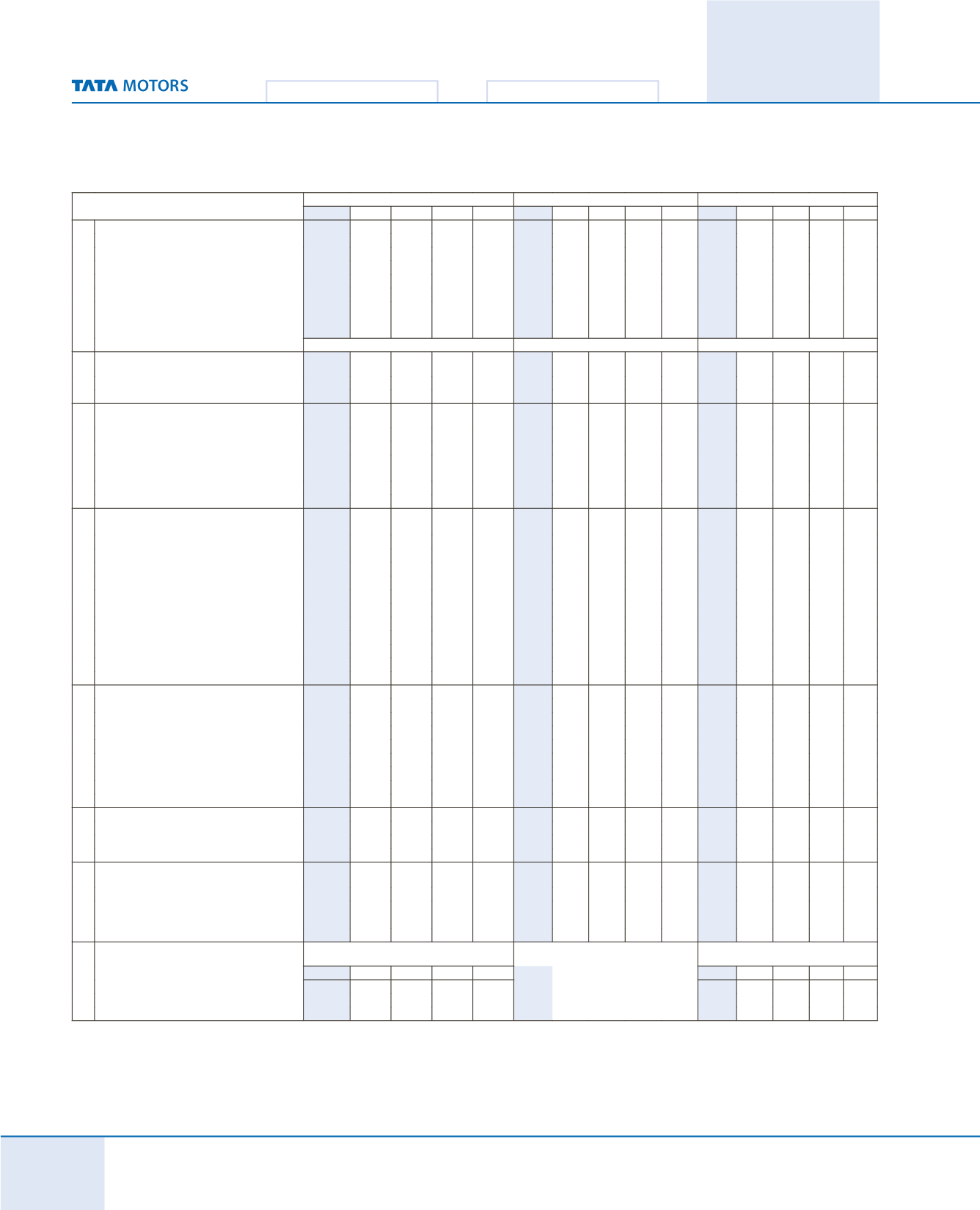

NOTES FORMING PART OF CONSOLIDATED FINANCIAL STATEMENTS

33. (a) Defined benefit plans / Long term compensated absences

(

`

in crores)

As at / for the year ended on March 31,

Gratuity, Superannuation and BKY / PSY

Compensated Absences

Post-retirement Medicare scheme

2014

2013 2012 2011 2010

2014

2013 2012 2011 2010

2014

2013 2012 2011 2010

(i) Components of employer expense

Current service cost

58.53

52.66 46.97 35.98 31.78

38.30

34.43 27.95

22.29

18.66

5.18

4.06

4.22

3.67

3.27

Interest cost

63.81

60.09 55.48 48.11 45.09

21.75

20.59

17.83

14.07

12.16

9.06

8.34

8.14

7.23

7.05

Expected return on plan assets

(57.02)

(53.64)

(49.95)

(44.86)

(42.32)

-

-

-

-

-

-

-

-

-

-

Past service cost

-

-

-

0.07

0.57

-

-

-

-

-

0.55

-

-

-

-

Actuarial losses / (gains)

(0.19)

5.00 21.96 60.26 50.92

(25.53)

6.07

23.23

40.45

29.16

2.65

2.00

(6.02)

3.80 (0.14)

Total expense recognised in the Statement of

Profit and Loss in note 25, page 196 :

65.13

64.11 74.46 99.56 86.04

34.52

61.09

69.01

76.81

59.98

17.44

14.40

6.34 14.70 10.18

(b) & (c)

(a)

(c)

(ii) Actual contribution and benefit

payments

Actual benefit payments

85.85

81.62 56.42 64.62 64.08

49.22

41.29

32.26

33.00

23.60

3.90

4.07

3.90

4.13

4.38

Actual contributions

42.38

67.98 68.34 85.05 86.98

49.22

41.29

32.26

33.00

23.60

3.90

4.07

3.90

4.13

4.38

(iii) Net asset / (liability) recognised in

Balance Sheet

Present value of Defined Benefit Obligation

826.27

813.35 756.58 691.32 608.93

267.06

282.53 262.73 225.76 181.95

124.05

110.51 100.18 97.74 87.17

Fair value of plan assets

720.63

737.38 676.74 618.02 550.07

-

-

-

-

-

-

-

-

-

-

Net asset / (liability) recognised in

Balance Sheet

(105.64)

(75.97)

(79.84)

(73.30)

(58.86)

(267.06)

(282.53)

(262.73)

(225.76)

(181.95)

(124.05)

(110.51)

(100.18) (97.74) (87.17)

Experience adjustment on plan liabilities

23.55

(23.57)

(7.35)

(36.91)

(4.29)

N/A

N/A

N/A

N/A

N/A

3.46

8.76

(2.83)

5.32

0.39

Experience adjustment on plan assets

23.38

20.94

(3.16)

2.72

(5.11)

N/A

N/A

N/A

N/A

N/A

-

-

-

-

-

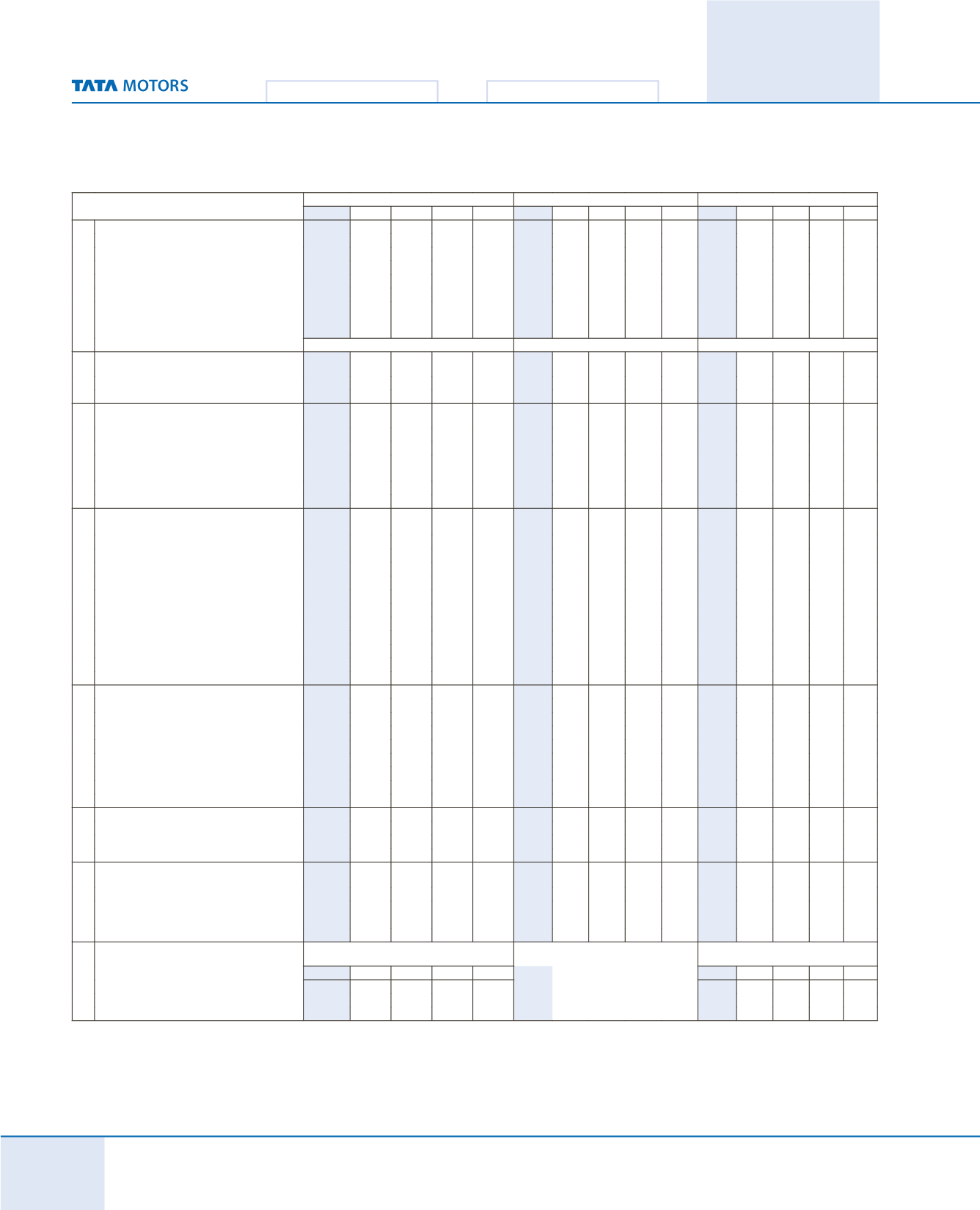

(iv) Change in Defined Benefit Obligations (DBO)

Present value of DBO at beginning of year

813.35

756.58 691.32 608.93 575.75

282.53

262.73 225.76 181.95 154.81

110.51

100.18

97.74 87.17 85.18

Liability on acquisitions

-

0.04

0.43

-

-

-

-

0.22

-

-

-

-

-

-

-

Current service cost

58.53

52.66 46.97 35.98 31.78

38.30

34.43

27.95

22.29

18.66

5.18

4.06

4.22

3.67

3.27

Past service cost

-

-

-

-

-

-

-

-

-

-

0.55

-

-

-

-

Interest cost

63.81

60.09 55.48 48.11 45.09

21.75

20.59

17.83

14.07

12.16

9.06

8.34

8.14

7.23

7.05

Plan amendments

-

-

-

-

0.65

-

-

-

-

-

-

-

-

-

-

Settlement cost / (credit)

-

-

-

-

-

(0.77)

-

-

-

-

-

-

-

-

-

Actuarial (gains) / losses

(23.57)

25.60

18.80

62.92

46.17

(25.53)

6.07

23.23

40.45

29.16

2.65

2.00

(6.02)

3.80 (0.14)

Benefits paid

(85.85)

(81.62)

(56.42)

(64.62)

(64.08)

(49.22)

(41.29) (32.26) (33.00) (23.60)

(3.90)

(4.07)

(3.90) (4.13) (4.38)

Sale of stake in subsidiary

-

-

-

-

(26.43)

-

-

-

-

(9.24)

-

-

-

- (3.81)

Present value of DBO at the end of year

826.27

813.35 756.58 691.32 608.93

267.06

282.53 262.73 225.76 181.95

124.05

110.51 100.18 97.74 87.17

(v) Change in fair value of assets

Plan assets at beginning of year

737.38

676.74 618.02 550.07 517.28

-

-

-

-

-

-

-

-

-

-

Liability on acquisitions

-

0.04

-

-

-

-

-

-

-

-

-

-

-

-

-

Actual return on plan assets

33.65

74.24 46.80 47.52 37.57

-

-

-

-

-

-

-

-

-

-

Actual Company contributions

42.38

67.98 68.34 85.05 86.98

49.22

41.29

32.26

33.00

23.60

3.90

4.07

3.90

4.13

4.38

Benefits paid

(85.85)

(81.62)

(56.42)

(64.62)

(64.08)

(49.22)

(41.29) (32.26) (33.00) (23.60)

(3.90)

(4.07)

(3.90) (4.13) (4.38)

Sale of stake in subsidiary

-

-

-

-

(27.68)

-

-

-

-

-

-

-

-

-

-

Others

(6.93)

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Plan assets at the end of year

720.63

737.38 676.74 618.02 550.07

-

-

-

-

-

-

-

-

-

-

(vi) Actuarial assumptions

Discount rate (%)

6.75-9.30

6.75-8.35 6.75-8.90 6.75-8.50 6.75-8.70

9.20

8.35

8.50

8.50

8.50

9.20

8.35

8.50

8.50

8.50

Expected return on plan assets (%)

8.00-9.25

8.00-9.25 8.00-9.25 8.00-9.25 8.00-9.25

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

Medical cost inflation (%)

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

6.00

5.00

4.00

4.00

4.00

(vii) The major categories of plan assets as

percentage to total plan assets

Debt securities

71%

73% 77% 75% 76%

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

Balance with approved insurance companies

28%

24% 19%

-

-

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

Balances with banks

1%

4% 4% 25% 24%

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

(viii) Effect of one percentage point change in

assumed medical inflation rate

One percentage point increase in

medical inflation rate

One percentage point decrease in

medical inflation rate

2014

2013 2012 2011 2010

2014

2013 2012 2011 2010

Revised DBO

137.03

121.00

108.44

104.57

100.15

111.55

101.33

81.62 88.49 82.98

Revised service cost

6.05

4.86

4.88

4.30

3.78

4.47

3.41

3.04

3.16

2.80

Revised interest cost

9.94

9.30

8.85

7.97

7.78

8.30

7.54

6.81

6.59

6.42