193

NOTES FORMING PART OF CONSOLIDATED FINANCIAL STATEMENTS

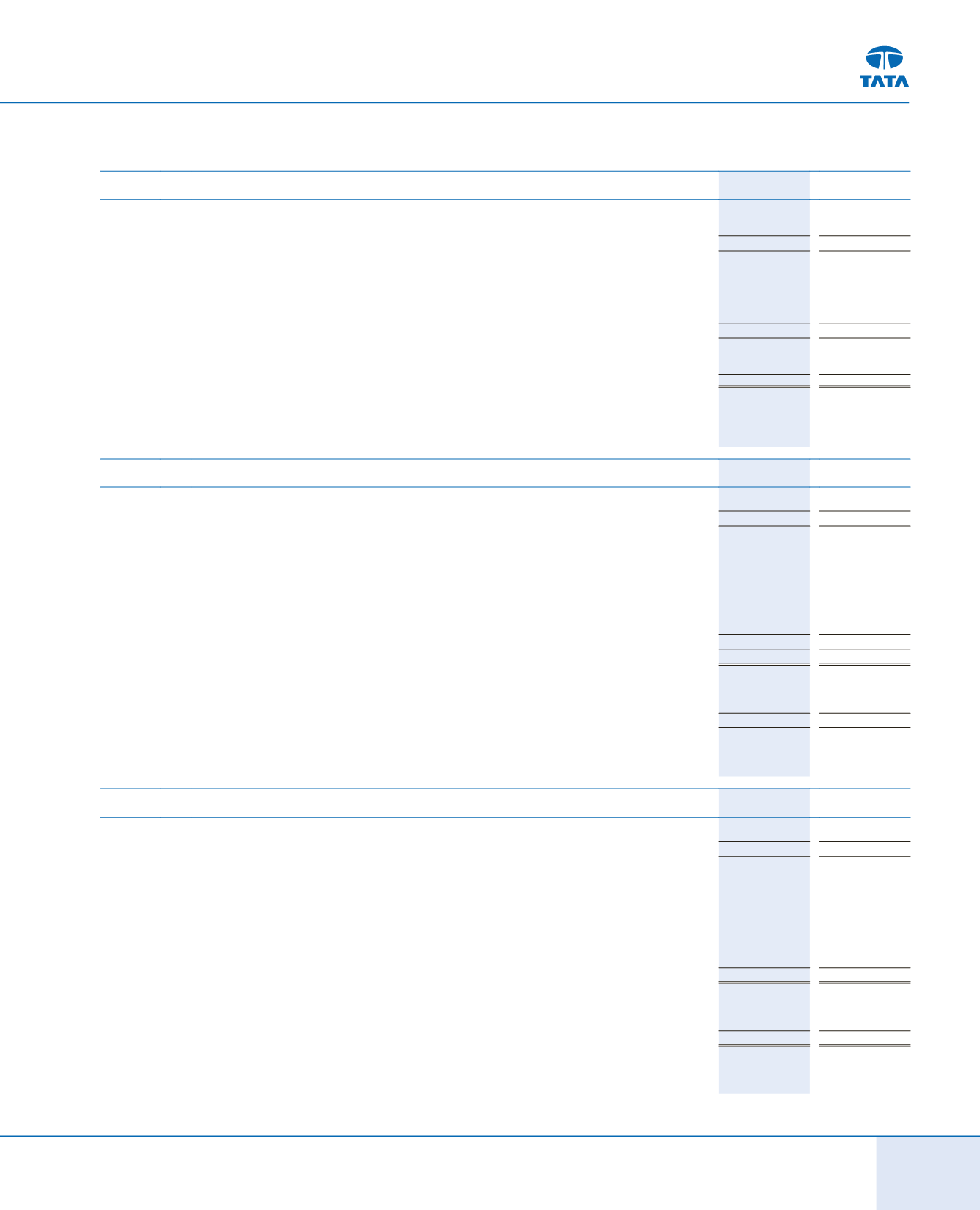

16.

Current investments

As at

March 31, 2014

As at

March 31, 2013

(at cost or fair value whichever is lower) (fully paid)

(A) Quoted

(a) Equity shares

19.60

-

(b) Bonds

2.25

-

21.85

-

(B) Unquoted

(a) Cumulative redeemable preference shares

3.00

3.00

(b) Mutual funds

9,494.06

7,497.00

(c) Optionally convertible debentures

1.66

2.44

(d) Equity shares

0.93

0.93

(e) Retained interest in securitisation transactions

54.71

43.29

9,554.36

7,546.66

(C) Provision for diminution in value of Investments (net)

(3.93)

(4.34)

Total (A+B+C)

9,572.28

7,542.32

Note:

(1) Book value of quoted investments

21.85

-

(2) Book value of unquoted investments

9,550.43

7,542.32

(3) Market value of quoted investments

27.90

-

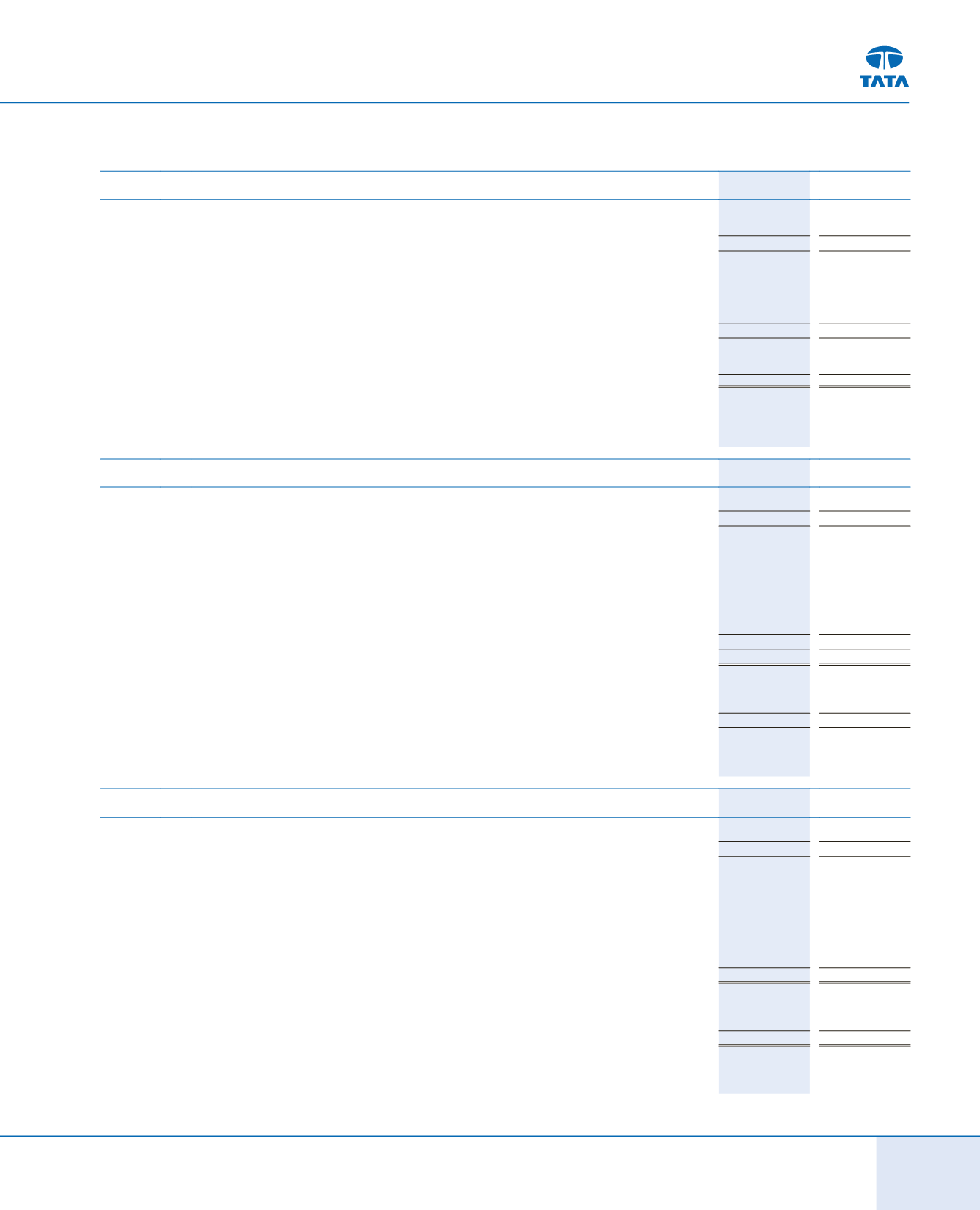

17

.

Long-term loans and advances

As at

March 31, 2014

As at

March 31, 2013

(A) Secured :

Finance receivables [Note below]

9,788.93

11,825.93

Total

9,788.93

11,825.93

(B) Unsecured:

(a) Loans to employees

44.80

44.86

(b) Loan to Joint Venture (FIAT India Automobile Ltd)

132.50

132.50

(c) Taxes recoverable, statutory deposits and dues from government

988.87

711.70

(d) Capital advances

321.55

220.41

(e) Credit entitlement of Minimum Alternate Tax (MAT)

787.59

1,516.40

(f) Non-current income tax assets (net of provision)

855.96

694.36

(g) Others

348.64

437.96

Total

3,479.91

3,758.19

Total (A + B)

13,268.84

15,584.12

Note :

Finance receivables (Gross) *

10,589.61

12,145.36

Less : Allowances for doubtful loans **

(800.68)

(319.43)

Total

9,788.93

11,825.93

* Loans are secured against hypothecation of vehicles

Includes on account of overdue securitised receivables

4.65

35.38

** Includes on account of securitised receivables

(4.35)

(7.02)

18.

Short-term loans and advances

As at

March 31, 2014

As at

March 31, 2013

(A) Secured :

Finance receivables [Note below]

8,505.39

6,400.85

Total

8,505.39

6,400.85

(B) Unsecured:

(a) Advances and other receivables

803.21

956.96

(b) Inter corporate deposits

0.30

0.30

(c) Fixed deposit with Financial Institutions

37.50

-

(d) VAT, other taxes recoverable, statutory deposits

and dues from government

4,274.57

5,015.31

(e) Current income tax assets (net of provisions)

385.28

269.11

(f) Others

48.99

24.52

Total

5,549.85

6,266.20

Total (A + B)

14,055.24

12,667.05

Note :

Finance receivables (Gross) *

9,343.73

7,041.06

Less : Allowances for doubtful loans **

(838.34)

(640.21)

Total

8,505.39

6,400.85

* Loans are secured against hypothecation of vehicles

Includes on account of overdue securitised receivables

9.47

37.25

** Includes on account of securitised receivables

(4.25)

(12.97)

(

R

in crores)

Independent Auditors’Report

Balance Sheet

(176-206)

Statement of Profit and Loss

Cash Flow Statement

Notes to Accounts