185

(

`

in crores)

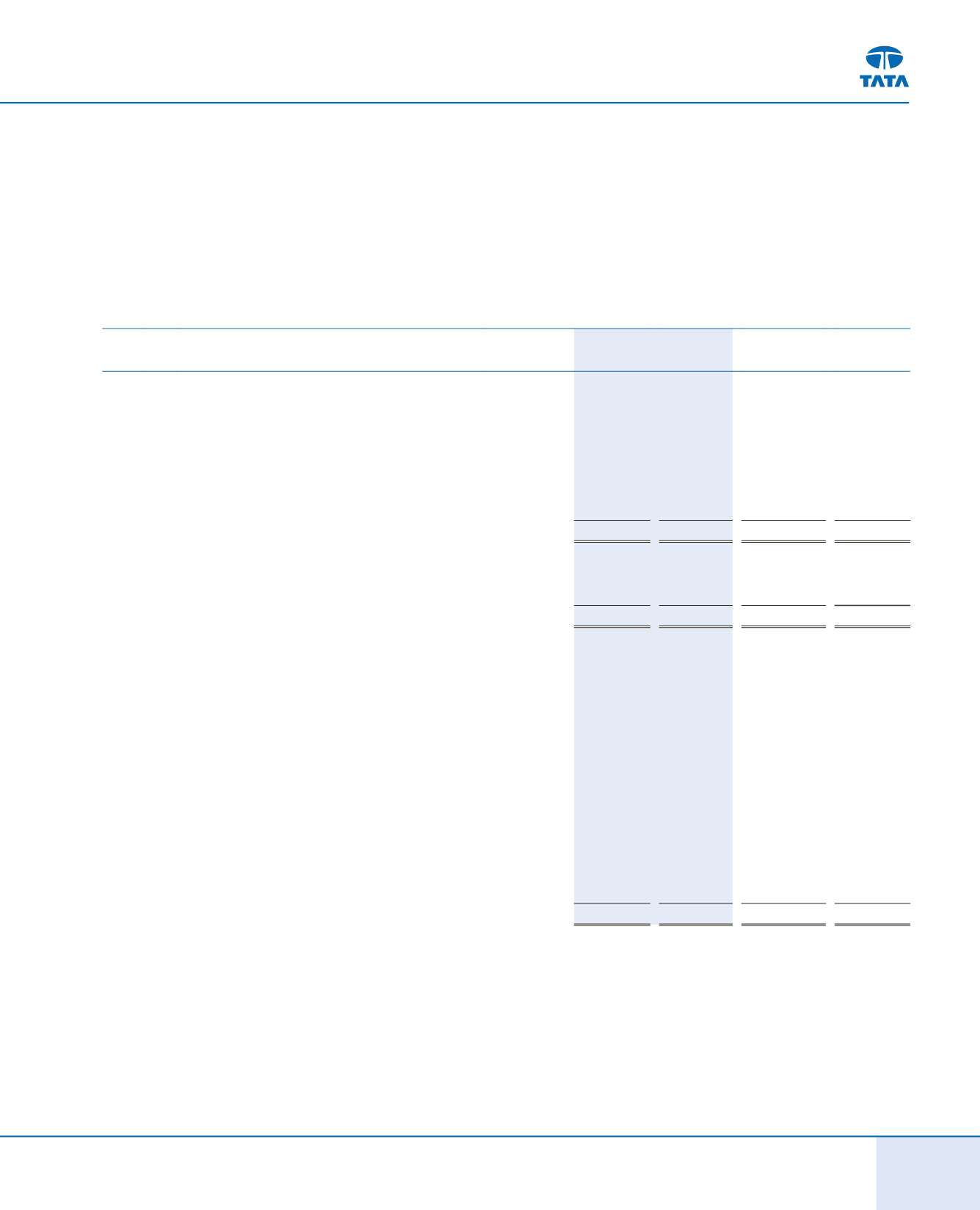

2013 - 2014

2012 - 2013

Additions

Deductions

Additions

Deductions

(xi)

General Reserve :

(a)

Amount recovered (net) towards indemnity relating to business

amalgamated in prior year

-

-

0.08

-

(b)

Amount written off / written back by a subsidiary against

Securities Premium Account

-

-

0.02

-

(c)

Government grants / incentives received

24.67

-

24.21

-

(d)

Amount transferred from Profit and Loss Account / Surplus

54.45

-

59.48

-

79.12

-

83.79

-

(xii)

Foreign Currency Monetary Item Translation Difference Account :

(a)

Exchange gain / (loss) during the year (net)

1,795.86

-

1,245.17

(b)

Amortisation of exchange fluctuation for the year

-

88.11

562.73

1,795.86

88.11

562.73

1,245.17

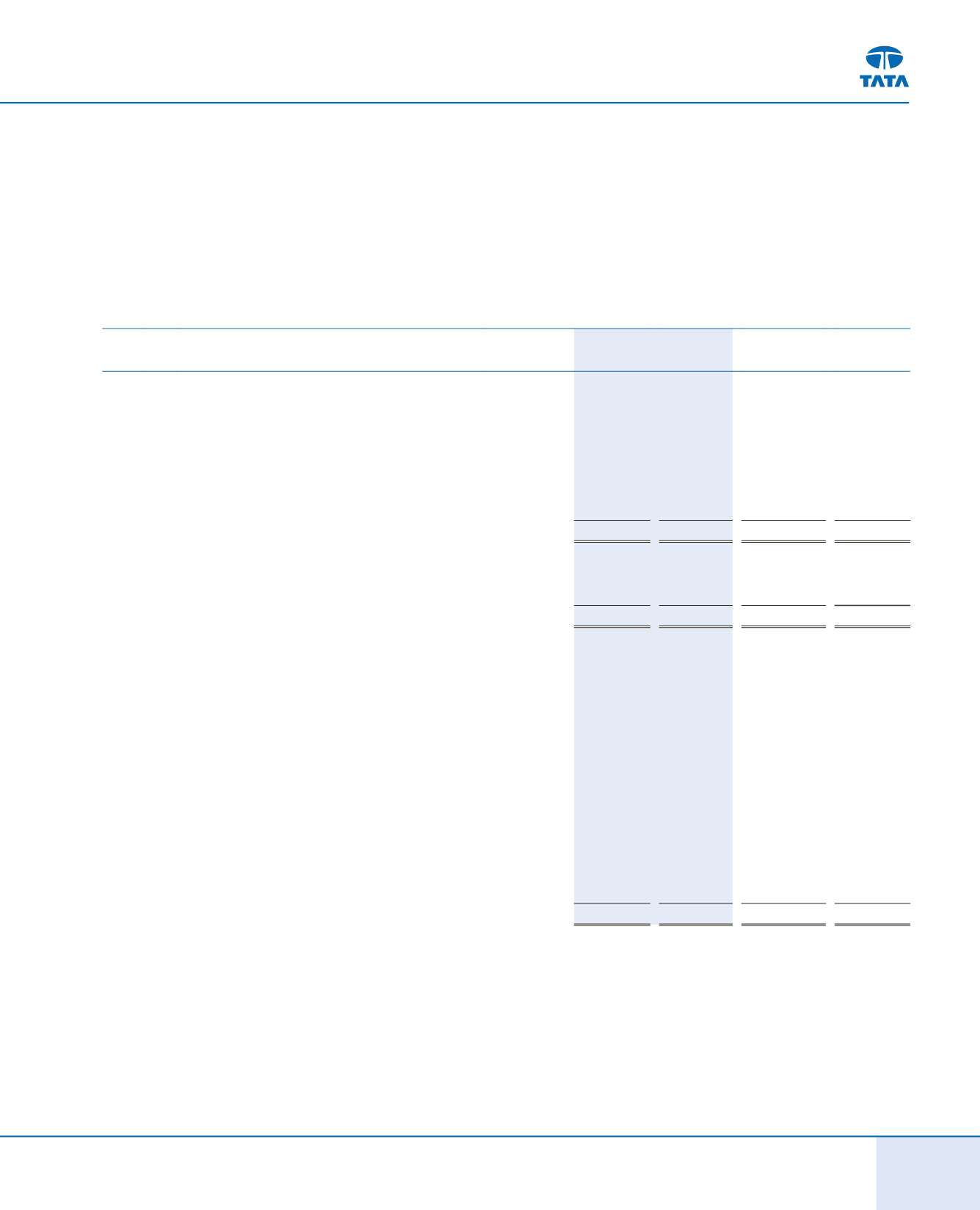

(xiii)

Profit and Loss Account / Surplus :

(a)

Profit for the period

13,991.02

-

9,892.61

-

(b)

Tax on interim dividend by subsidiaries

(including Group’s share of subsidiaries’dividend tax)

-

6.35

-

4.54

(c)

Proposed dividend

-

648.56

-

645.20

(d)

Dividend paid (2012-13)

-

3.34

-

-

(e)

Tax on proposed dividend

(including Group’s share of subsidiaries’dividend tax)

-

110.86

-

106.40

(f)

Reversal of dividend distribution tax of earlier year

79.03

-

-

-

(g)

Debenture Redemption Reserve

-

-

130.00

-

(h)

General Reserve

-

54.45

-

59.48

(i)

Special Reserve

-

21.78

-

63.14

(j)

Legal Reserve

-

0.10

-

-

14,070.05

845.44

10,022.61

878.76

(vii) Under the Korean Commercial Code, Tata Daewoo Commercial Vehicle Company Ltd. (TDCV), an indirect subsidiary, is required to appropriate annually at least

10% of cash dividend declared each year to a legal reserve, Earned Surplus Reserve until such reserve equals 50% of capital stock of TDCV. This reserve may not be

utilized for cash dividends but may only be used to offset against future deficit, if any, or may be transferred to capital stock of TDCV.

(viii) Under the Special Tax Treatment Control Law, TDCV appropriated retained earnings for research and human resource development. The reserve, which was used

for its own purpose, is regarded as ‘Discretionary Appropriated Retained Earnings’.

(ix)

The addition to Legal Reserve is on account of Legal Reserve transferred on acquisition of one indirect subsidiary.

(x)

Translation Reserves represents conversion of balances in functional currency of foreign subsidiaries (net of minority share) and associates. [Note (f)(i)(3), page 179]

Independent Auditors’Report

Balance Sheet

(176-206)

Statement of Profit and Loss

Cash Flow Statement

Notes to Accounts

NOTES FORMING PART OF CONSOLIDATED FINANCIAL STATEMENTS