163

NOTES FORMING PART OF FINANCIAL STATEMENTS

31.

The Company has joint ventures with (a) Fiat Group Automobiles S.p.A., Italy, Fiat India Automobiles Limited (FIAL), for manufacturing passenger cars, engines and

transmissions at Ranjangaon in India and (b) Cummins Inc, USA, Tata Cummins Limited (TCL), for manufacturing engines in India. The Company has an investment of

`

1,567.04 crores

as at March 31, 2014, representing 50% shareholding in FIAL and

`

90.00 crores

as at March 31, 2014 represting 50% shareholding in TCL.

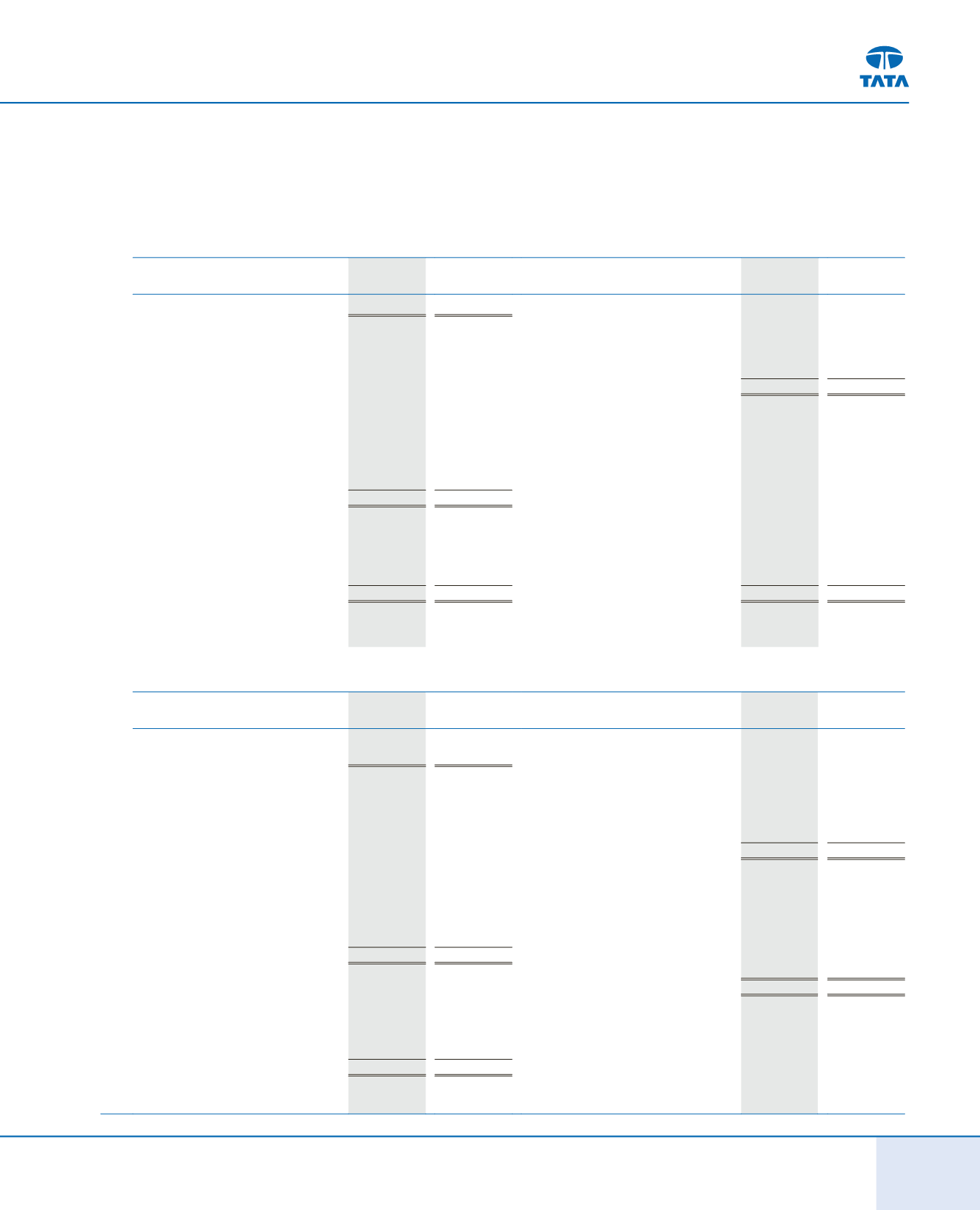

(a) The proportionate share of assets and liabilities as at March 31, 2014 and income and expenditure for the year 2013-2014 of FIAL as per their unaudited financial

statement are given below :

(

`

in crores)

As on

March 31,

2014

As on

March 31,

2013

2013-2014

2012-2013

RESERVES AND SURPLUS

(189.92)

(298.23)

INCOME

Revenue from operations

1,931.54

1,862.27

NON-CURRENT LIABILITIES

Less : Excise duty

(238.96)

(251.78)

Long-term Borrowings

496.39

634.12

Other operating income

160.92

144.29

Other Long term Liabilities

59.88

41.38

Other Income

28.93

89.49

Long-term Provisions

2.35

5.35

1,882.43

1,844.27

CURRENT LIABILITIES

Short-term Borrowings

197.70

108.01

Trade Payables

247.51

627.58

Other Current Liabilities

224.66

263.18

Short-term Provisions

1.66

3.40

EXPENDITURE

1,230.15

1,683.02

Manufacturing and other expenses

1,460.79

1,340.91

NON-CURRENT ASSETS

Depreciation

132.33

165.67

Fixed Assets

1,281.23

1,386.20

Finance Cost

101.19

179.65

Other long-term Loans and Advances

98.55

81.67

Exchange Loss (net) on revaluation of foreign

Other Non-Current Assets

12.40

20.77

currency borrowings, deposits and loan given

69.28

12.74

Current Assets

870.62

793.71

Tax expenses / (credit)

10.53

(0.39)

2,262.80

2,282.35

1,774.12

1,698.58

Claims not acknowledged as debts

7.36

10.46

Capital Commitments

41.65

21.07

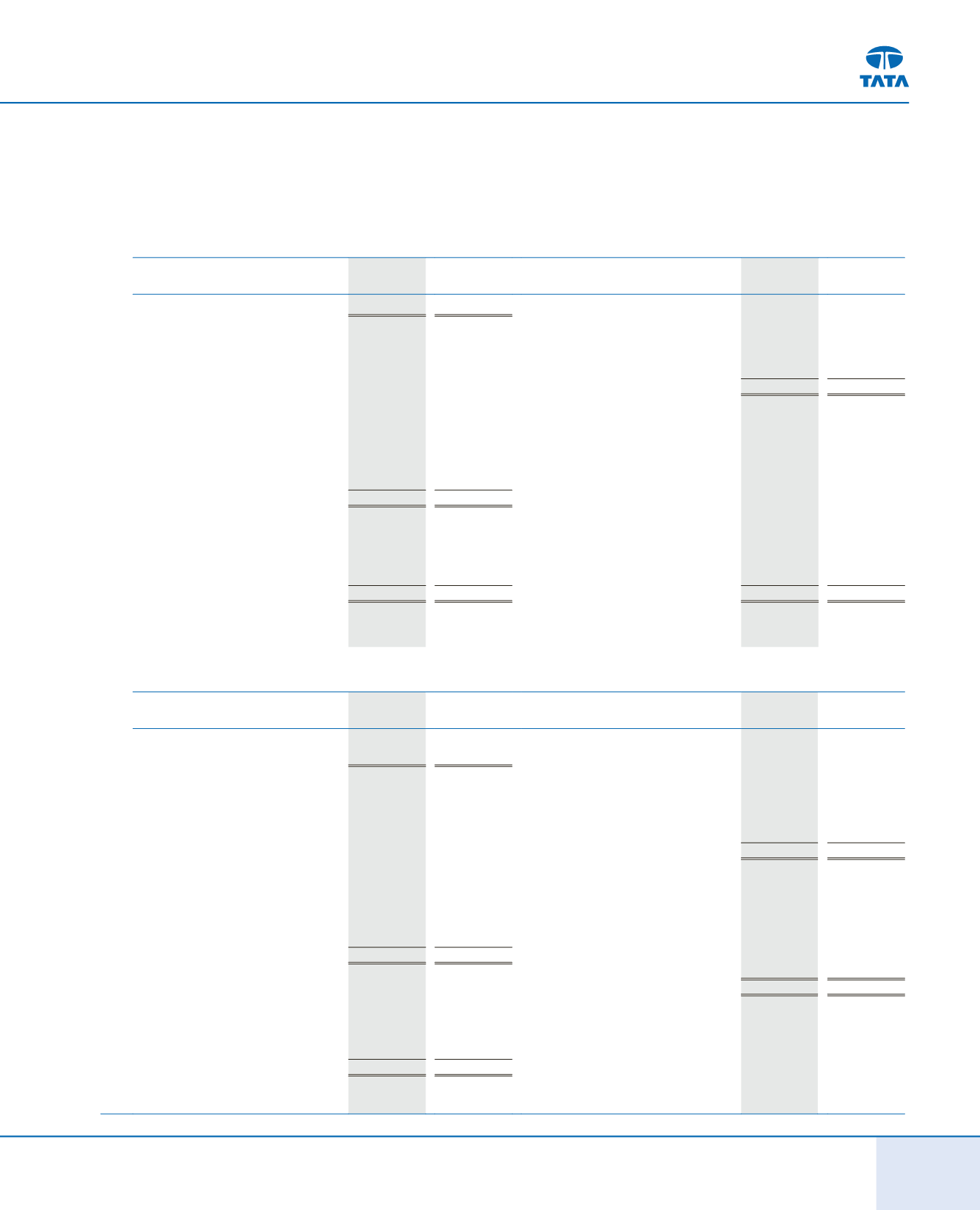

(b)The proportionate share of assets and liabilities as at March 31, 2014 and income and expenditure for the year 2013-2014 of TCL as per their audited financial

statement are given below :

(

`

in crores)

As on

March 31,

2014

As on

March 31,

2013

2013-2014

2012-2013

RESERVES AND SURPLUS

Reserves and Surplus

243.15

204.56

INCOME

Revenue from operations

1,046.28

1,258.76

NON-CURRENT LIABILITIES

Less : Excise duty

(110.41)

(139.46)

Long-term Borrowings

52.87

45.22

Other operating income

4.30

5.21

Deferred tax liabilities

30.47

28.72

Other Income

3.49

4.06

Other Long term Liabilities

0.65

-

Long-term Provisions

19.30

18.09

943.66

1,128.57

CURRENT LIABILITIES

Short-term Borrowings

18.72

8.00

Trade Payables

184.07

150.64

EXPENDITURE

Other Current Liabilities

127.88

83.99

Manufacturing and other expenses

896.33

1,074.20

Short-term Provisions

31.06

35.57

Depreciation

31.06

31.98

465.02

370.23

Finance Cost

2.66

6.91

NON-CURRENT ASSETS

Tax expenses / (credit)

(0.31)

5.68

Fixed Assets

555.93

379.30

929.74

1,118.77

Other Long-term Loans

and Advances

72.67

110.56

Othe Non-Current Assets

9.43

8.10

Current Assets

160.13

166.82

798.16

664.78

Claims not acknowledged as debts

240.40

160.74

Capital Commitments

50.19

147.07

Independent Auditors’Report

Balance Sheet

(134-169)

Statement of Profit and Loss

Cash Flow Statement

Notes to Accounts