Statutory Reports

Corporate Overview

69th Annual Report 2013-14

144

Financial Statements

(Standalone)

(

`

in crores)

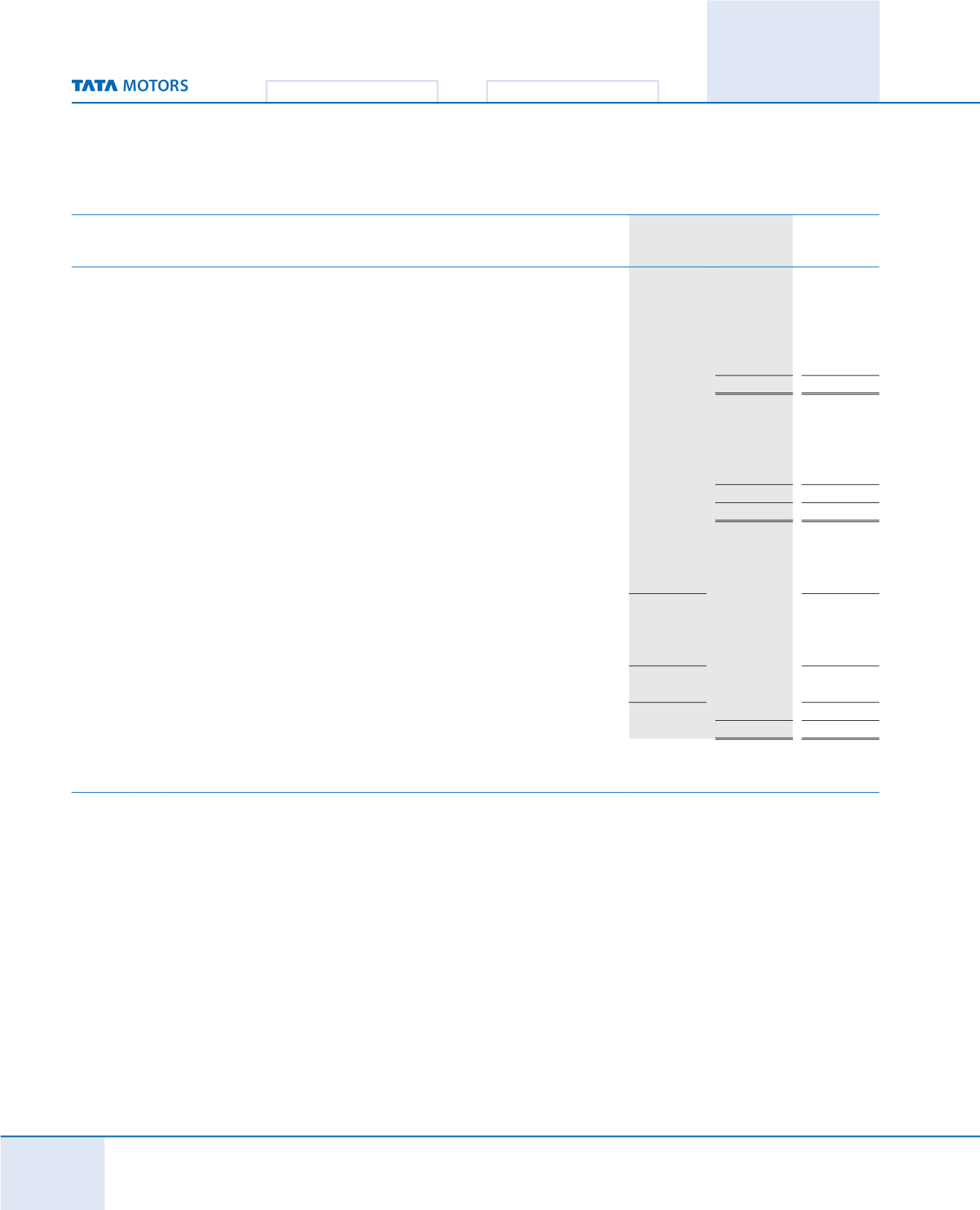

6. Deferred tax liabilities (Net)

As at

As at

March 31,

March 31,

2014

2013

(a) Major components of deferred tax arising on account of timing differences are:

Liabilities:

Depreciation

(1,438.25)

(1,395.69)

Product development cost

(2,512.05)

(2,128.49)

Others

(16.22)

(40.37)

(3,966.52)

(3,564.55)

Assets:

Employee benefits / expenses allowable on payment basis

109.99

133.11

Provision for doubtful debts

278.77

193.36

Unabsorbed depreciation and business losses

3,514.87

1,248.16

Others

19.78

26.01

3,923.41

1,600.64

Net deferred tax liability

(43.11)

(1,963.91)

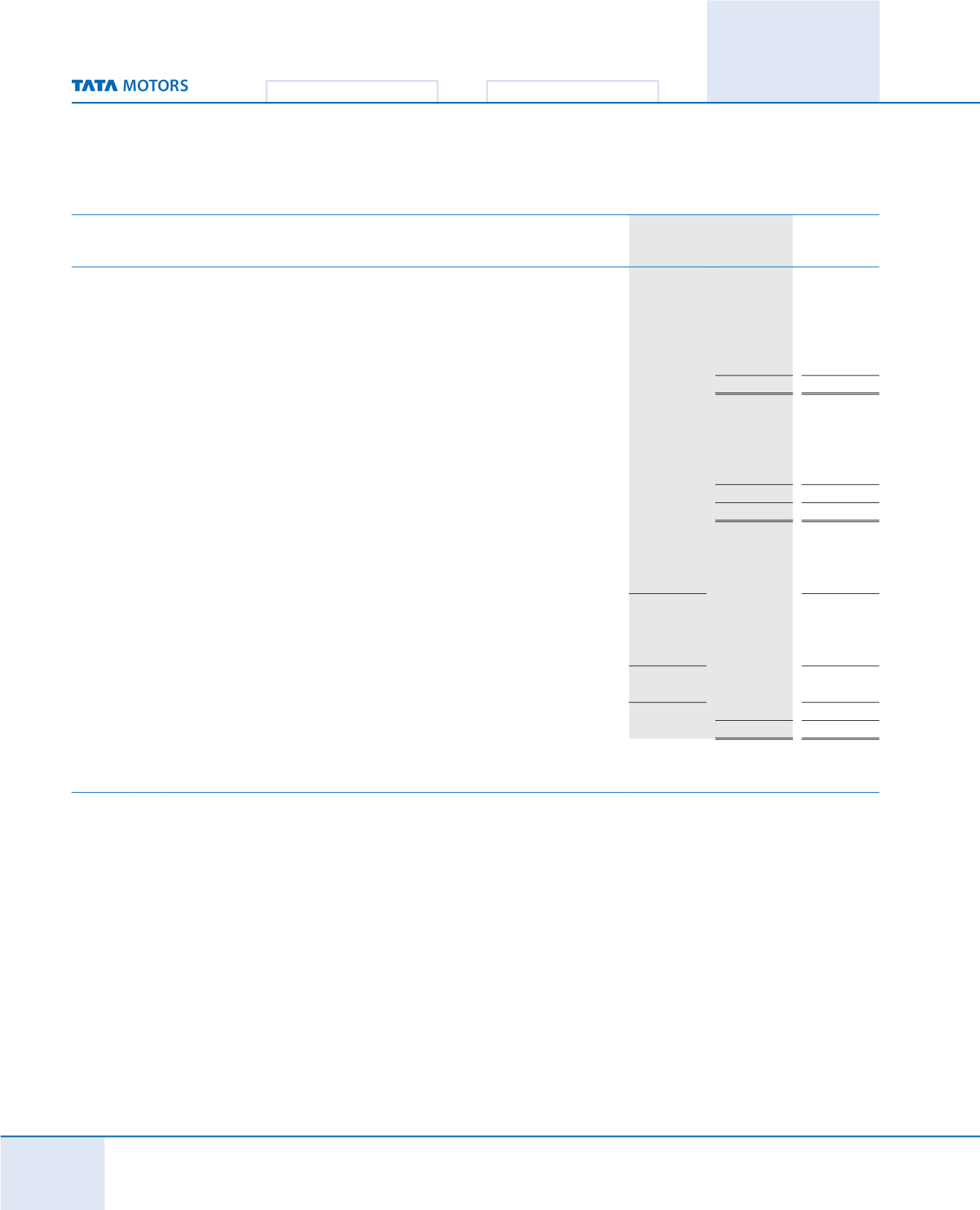

(

b) Tax expense :

(i)

Current tax

Current tax

(171.80)

62.50

Less : Minimum Alternate Tax / (credit)

731.80

(61.94)

560.00

0.56

(ii)

Deferred tax

Opening deferred tax

1,963.91

2,105.41

Debited / (credited) to Securities Premium Account

(0.48)

(14.06)

1,963.43

2,091.35

Closing Deferred tax

43.11

1,963.91

Deferred tax charge for the period

(1,920.32)

(127.44)

Total

(1,360.32)

(126.88)

The Company has recognised deferred tax asset of

`

1,525.09 crores

(as at March 31, 2013

`

1,003.12 crores) on unabsorbed depreciation and

`

1,989.78 crores

(as at March 31, 2013

`

245.04 crores) on brought forward business losses, considering the deferred tax liability on timing

differences that will reverse in the future

NOTES FORMING PART OF FINANCIAL STATEMENTS