143

NOTES FORMING PART OF FINANCIAL STATEMENTS

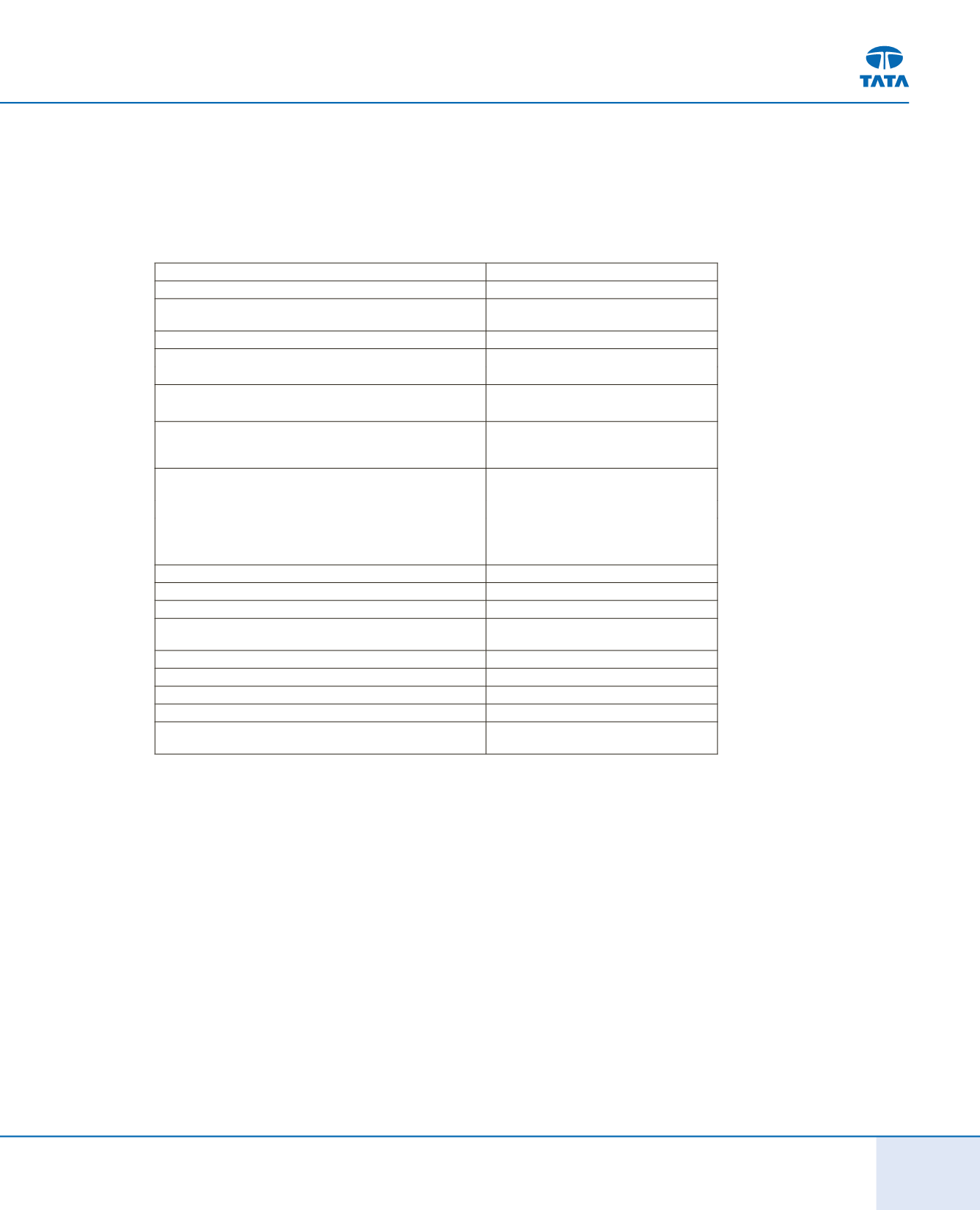

(iv) Foreign Currency Convertible Notes (FCCN) :

The Company issued the FCCN which are convertible into Ordinary shares or ADSs. The particulars, terms of issue and the status of conversion as at

March 31, 2014 are given below :

Issue

4% FCCN (due 2014)*

Issued on

October 15, 2009

Issue Amount (in INR at the time of the issue)

US $ 375 million

(

`

1,794.19 crores)

Face value

US $ 100,000

Conversion Price per share

`

623.88

at fixed exchange rate

US $ 1 =

`

46.28

Reset Conversion Price (Due to Rights Issue,GDS Issue and

subdivision of shares)

`

120.12

US $ 1 =

`

46.28

Exercise period

November 25, 2009 (for conversion into

shares or GDSs) and October 15, 2010 (for

conversion into ADSs) to October 9, 2014

Early redemption at the option of the Company subject to

certain conditions

i) any time on or after October 15, 2012 (in

whole but not in part) at our option

or

ii) any time (in whole but not in part) in

the event of certain changes affecting

taxation in India

Redeemable on

October 16, 2014

Redemption percentage of the principal amount

108.505%

Amount converted

US $ 375 million

Aggregate conversion into ADRs (in terms of equivalent

shares) and shares

14,21,87,437

Aggregate notes redeemed

Nil

Aggregate notes bought back

Nil

Notes outstanding as at March 31, 2014

Nil

Amount outstanding as at March 31, 2014

Nil

Aggregate amout of shares that could be issued on

conversion of outstanding notes

Nil

* All FCCNs were fully converted into Ordinary shares or ADSs as on March 31, 2014

(v)

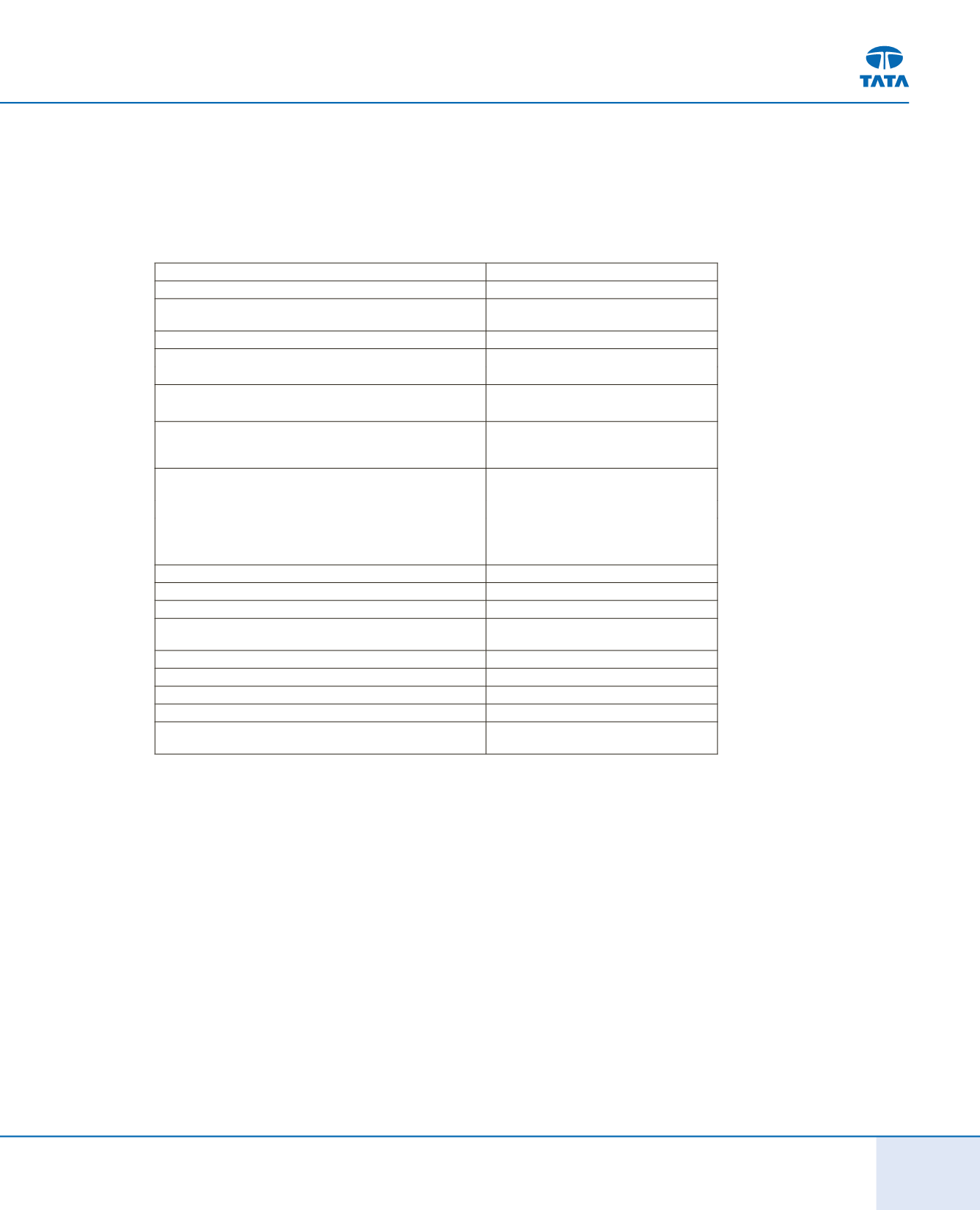

During the year 2011-12, the Company raised Syndicated Foreign currency term loans of US$ 500 million in two tranches with tenors between four to

seven years, in accordance with guidelines on External Commercial Borrowings (ECB) issued by the Reserve Bank of India. Schedule of repayment of ECB

is as under :

Date

Repayment Amount

Repayment Amount

(USD Million)

(

`

in crores)*

September 12, 2018

150

898.50

September 12, 2017

150

898.50

September 12, 2016

100

599.00

September 14, 2015

100

599.00

* at exchange rate of 1 US $ =

`

59.9000 as at March 31, 2014

(vi) Fixed deposits from public and shareholders :

These are unsecured deposits for a fixed tenor of up to three years from the date of acceptance / renewal bearing interest rates ranging from 8% to

12.5%. These fixed deposits were matured before March 31, 2014 and thus the entire balance was classified as current liabilities as on March 31, 2013.

II.

Information regarding short-term borrowings

Loans, cash credits, overdrafts and buyers line of credit from banks and Foreign Currency Non Repatriable Borrowings (FCNR(B)) are secured by

hypothecation of existing current assets of the Company viz. stock of raw materials, stock in process, semi-finished goods, stores and spares not relating

to plant and machinery (consumable stores and spares), bills receivable and book debts including receivable from hire purchase / leasing and all other

moveable current assets except cash and bank balances, loans and advances of the Company both present and future.

Independent Auditors’Report

Balance Sheet

(134-169)

Statement of Profit and Loss

Cash Flow Statement

Notes to Accounts