Statutory Reports

Corporate Overview

69th Annual Report 2013-14

140

Financial Statements

(Standalone)

NOTES FORMING PART OF FINANCIAL STATEMENTS

(

`

in crores)

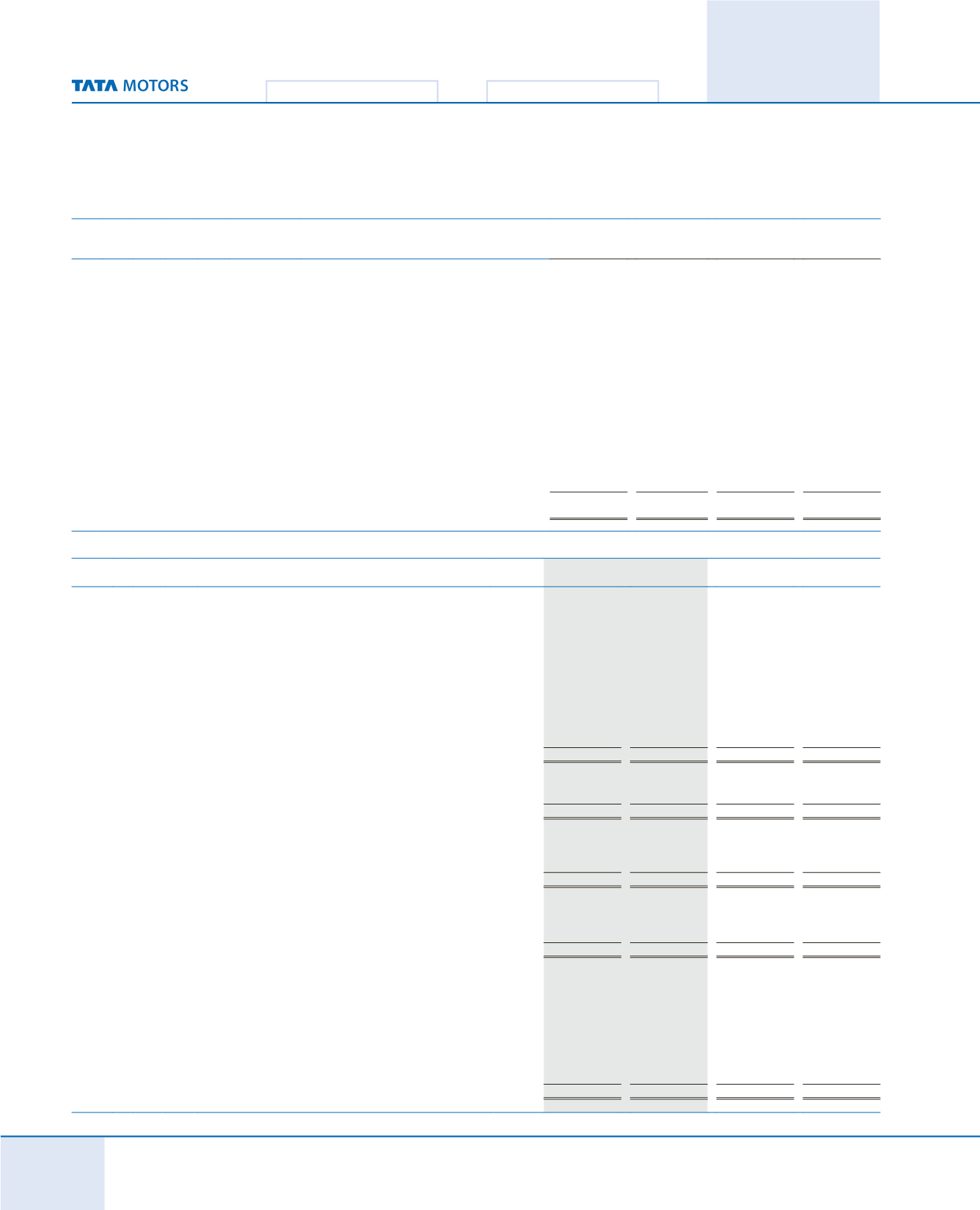

3. Reserves and surplus

As at

Additions

Deductions

As at

March 31,

March 31,

2013

2014

(a) Capital Redemption Reserve

2.28

-

-

2.28

2.28

-

-

2.28

(b) Securities Premium Account [Note (i) and (ii)]

11,328.57

441.93

87.41

11,683.09

11,186.76

233.31

91.50

11,328.57

(c) Debenture Redemption Reserve

1,042.15

-

-

1,042.15

1,172.15

-

130.00

1,042.15

(d) Revaluation Reserve [Note (iii)]

23.31

-

0.44

22.87

23.75

-

0.44

23.31

(e) Amalgamation Reserve

0.05

-

-

0.05

0.05

-

-

0.05

(f) General Reserve [Note (iv)]

4,972.62

33.45

-

5,006.07

4,942.36

30.26

-

4,972.62

(g) Foreign Currency Monetary Item Translation Difference

(215.00)

(100.34)

(114.11)

(201.23)

Account (net) [Note (v)]

(258.35)

(355.02)

(398.37)

(215.00)

(h) Profit and Loss Account (Surplus) [Note (vi)]

1,342.79

413.55

778.75

977.59

1,663.91

433.29

754.41

1,342.79

18,496.77

788.59

752.49

18,532.87

18,732.91

341.84

577.98

18,496.77

Notes

2013-2014

2012-2013

Additions

Deductions

Additions

Deductions

(i) The opening and closing balances of Securities Premium Account are net of calls in

arrears of

`

0.03 crores

(ii)

Securities Premium Account :

(a) Premiumon shares issued on conversion of Foreign Currency Convertible Notes

(FCCN) / Convertible Alternative Reference Securities (CARS) and held in

abeyance out of rights issue of shares

407.72

-

229.68

-

(b) Share issue expenses and brokerage, stamp duty and other fees on Non

Convertible Debentures [net of tax

`

0.48 crore

(2012-13

`

1.75 crore)]

-

87.41

-

91.50

(c) Premiumon redemption of FCCN / CARS, exchange differences andwithholding

tax. [net of tax

`

Nil

(2012-13

`

12.31 crores)]

34.21

-

3.63

-

441.93

87.41

233.31

91.50

(iii)

Revaluation Reserve :

Depreciation on revalued portion of assets taken over on amalgamation of a

company

-

0.44

-

0.44

-

0.44

-

0.44

(iv)

General Reserve :

(a) Amount recovered (net) towards indemnity relating to business amalgamated

in prior year

-

-

0.08

-

(b) Amount transferred from Profit and Loss Account (Surplus)

33.45

-

30.18

-

33.45

-

30.26

-

(v)

Foreign Currency Monetary ItemTransalation

Difference Account (net) :

(a) Exchange loss during the year (net)

(100.34)

-

(355.02)

-

(b) Amortisation of exchange fluctuation for the year

-

(114.11)

-

(398.37)

(100.34)

(114.11)

(355.02)

(398.37)

(vi)

Profit and Loss Account (Surplus)

:

(a) Profit after tax for the year

334.52

-

301.81

-

(b) Credit for dividend distribution tax

-

-

1.48

-

(c) Proposed dividend

-

648.56

-

645.20

(d) Dividend paid (2012-13)

-

3.34

-

-

(e) Tax on proposed dividend

-

93.40

-

79.03

(f) Reversal of dividend distribution tax of earlier year

79.03

-

(g) Debenture Redemption Reserve

-

-

130.00

-

(h) General Reserve

-

33.45

-

30.18

413.55

778.75

433.29

754.41