121

Notice

Directors’Report

(104-124)

Management Discussion & Analysis

Corporate Governance

Secretarial Audit Report

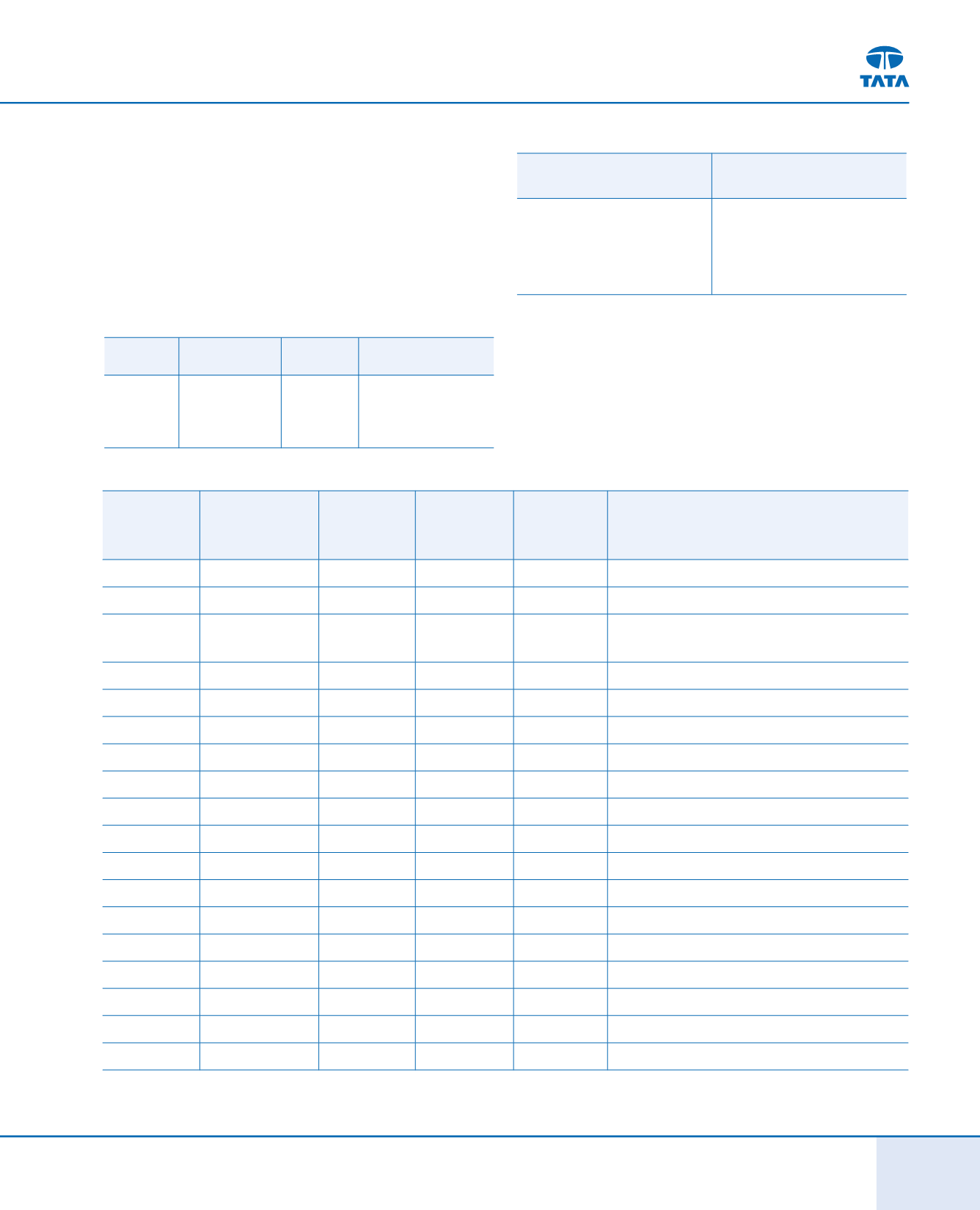

Series No.

ISIN

Principal

Amount

(

`

crores)

Redemption

Premium

(

`

crores)

Yield to

Maturity (%)

Date of Maturity

E 21

INE155A07193

1,250

919.23

10.03

March 31, 2016

E 22

INE155A07219

200

Nil

9.95

March 2, 2020

E 22A

INE155A07227

500

Nil

10.25

`

100 crores on April 30, 2022, April 30, 2023,

`

150 crores on April 30, 2024, April 30, 2025

E 23A

INE155A08043

150

Nil

9.90

May 7, 2020

E 23B

INE155A08050

100

Nil

9.75

May 24, 2020

E 23C

INE155A08068

150

Nil

9.70

June18, 2020

E 24A

INE155A08076

250

Nil

10.00

May 26, 2017

E 24B

INE155A08084

250

Nil

10.00

May 28, 2019

E 24C

INE155A08092

300

Nil

9.85

March 30, 2015

E 24D

INE155A08100

300

Nil

9.84

March 10, 2017

E 24E

INE155A08118

200

Nil

9.69

March 29, 2019

E 24F

INE155A08126

200

Nil

9.45

March 29, 2018

E 25A

INE155A08134

300

Nil

9.22

December 1, 2015

E 25B

INE155A08142

300

Nil

9.15

June 3, 2015

E 25C

INE155A08159

300

Nil

9.05

October 30, 2015

E 25D

INE155A08167

300

Nil

8.95

April 29, 2016

E 25E

INE155A08175

300

Nil

8.73

May 17, 2016

E26A

INE155A08183

200

Nil

10.30

November 30, 2018

*Detailed information on the above debentures is included in the ‘Notes to Accounts’.

October 16, 2014 and ADSs at anytime during October 15, 2010 to

October 16, 2014.

Pursuant to the April 16, 2013 announcement on early redemption of

outstanding notes on June 10, 2013 at a redemption price equal to

US$106,572.52 for every note of US$100,000 each, on the conversion

option being received by the Noteholders, the Company converted, all

the balance 741 Notes.

The following are the relevant details of the Notes:

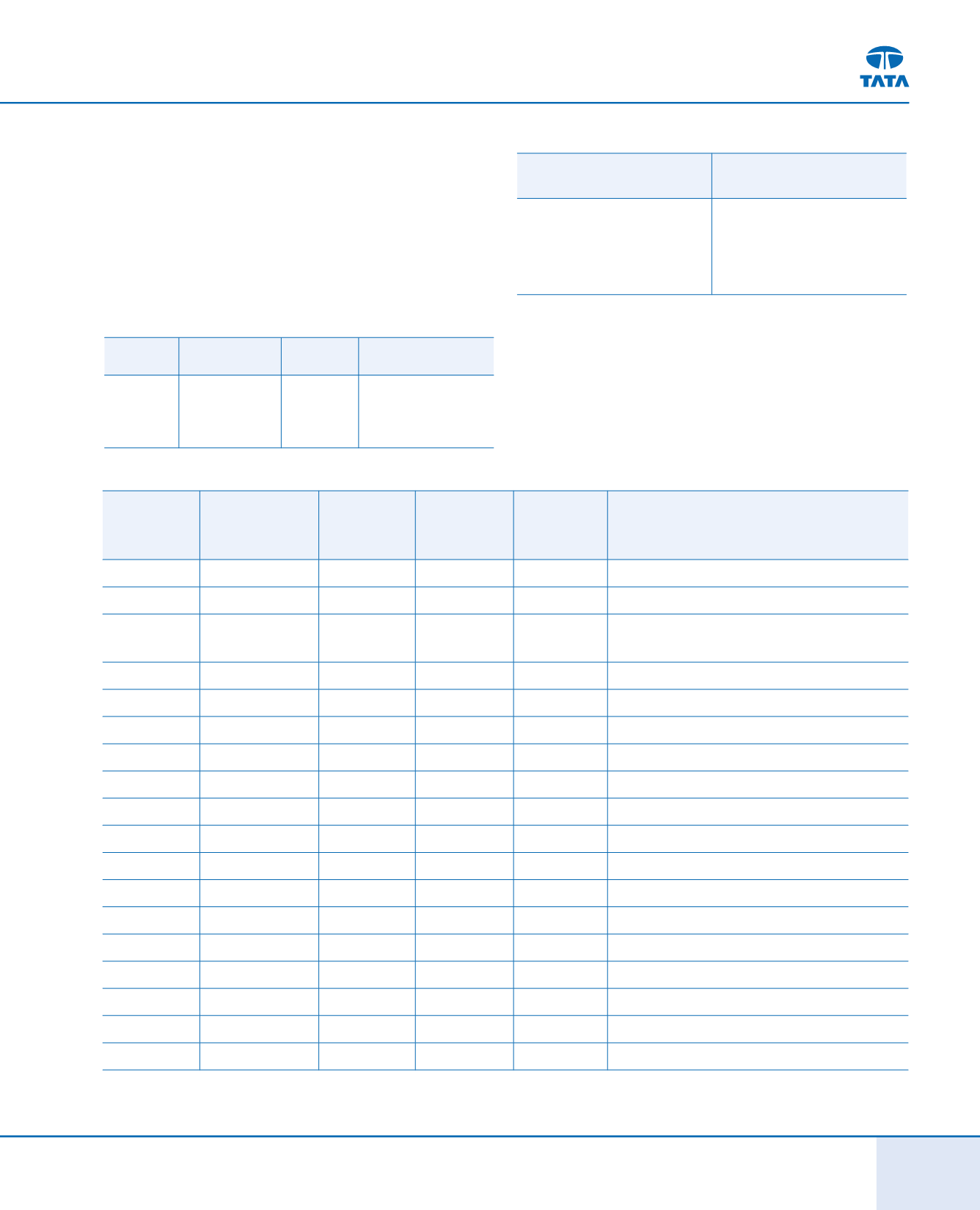

Security

Type

ISIN

CUSIP

Listing at

4% Notes

(due 2014)

XS0457793510 045779351 Luxembourg Stock

Exchange, 1, Avenue

de la porte – Neuve,

L–2227, Luxembourg

Overseas Depositary

Domestic Custodian

Citibank N.A., 388 Greenwich

Street, 14th Floor, New York,

NY 10013

Citibank N.A., Trent House, 3rd

Floor, G-60, Bandra Kurla

Complex, Bandra (East),

Mumbai 400 051

There are no outstanding warrants issued by the Company.

Apart from Shares and Convertible Instruments, the following Non-

Convertible Debentures (NCDs) are listed on the National Stock

Exchange under Wholesale Debt Market segment*: