Statutory Reports

Corporate Overview

69th Annual Report 2013-14

120

Financial Statements

Name of Shareholder

No. of

shares held

% to paid-

up capital

Matthews Asia Dividend Fund

3,33,95,515

6.93

HSBC Global Investment Funds A/C

HSBC Gif Mauritius Limited

2,90,86,664

6.04

HDFC Trustee Company Limited –

HDFC Top 200 Fund

2,18,45,457

4.53

HDFC Trustee Company Limited -

HDFC Equity Fund

2,14,22,875

4.44

Government of Singapore

1,68,38,040

3.49

Merrill Lynch Capital Markets

Espana S.A. S.V.

1,53,08,008

3.18

Government Pension Fund Global

1,32,06,117

2.74

Swiss Finance Corporation (Mauri-

tius) Limited

1,13,34,646

2.35

HDFC Trustee Company Limited -

HDFC Prudence Fund

90,04,027

1.87

Pioneer Asset Management S.A.

A/C Pioneer Asset Management

S.A. on Behalf of Pioneer Funds-

Emerging Markets Equity

89,10,575

1.85

Skagen Global Verdipapirfond

82,26,456

1.71

The Master Trust Bank of Japan, Ltd.

A/C HSBC Indian Equity Mother

Fund

81,92,143

1.70

SBI Magnum Taxgain Scheme

80,00,000

1.66

Citigroup Global Markets Mauritius

Private Limited

78,14,300

1.62

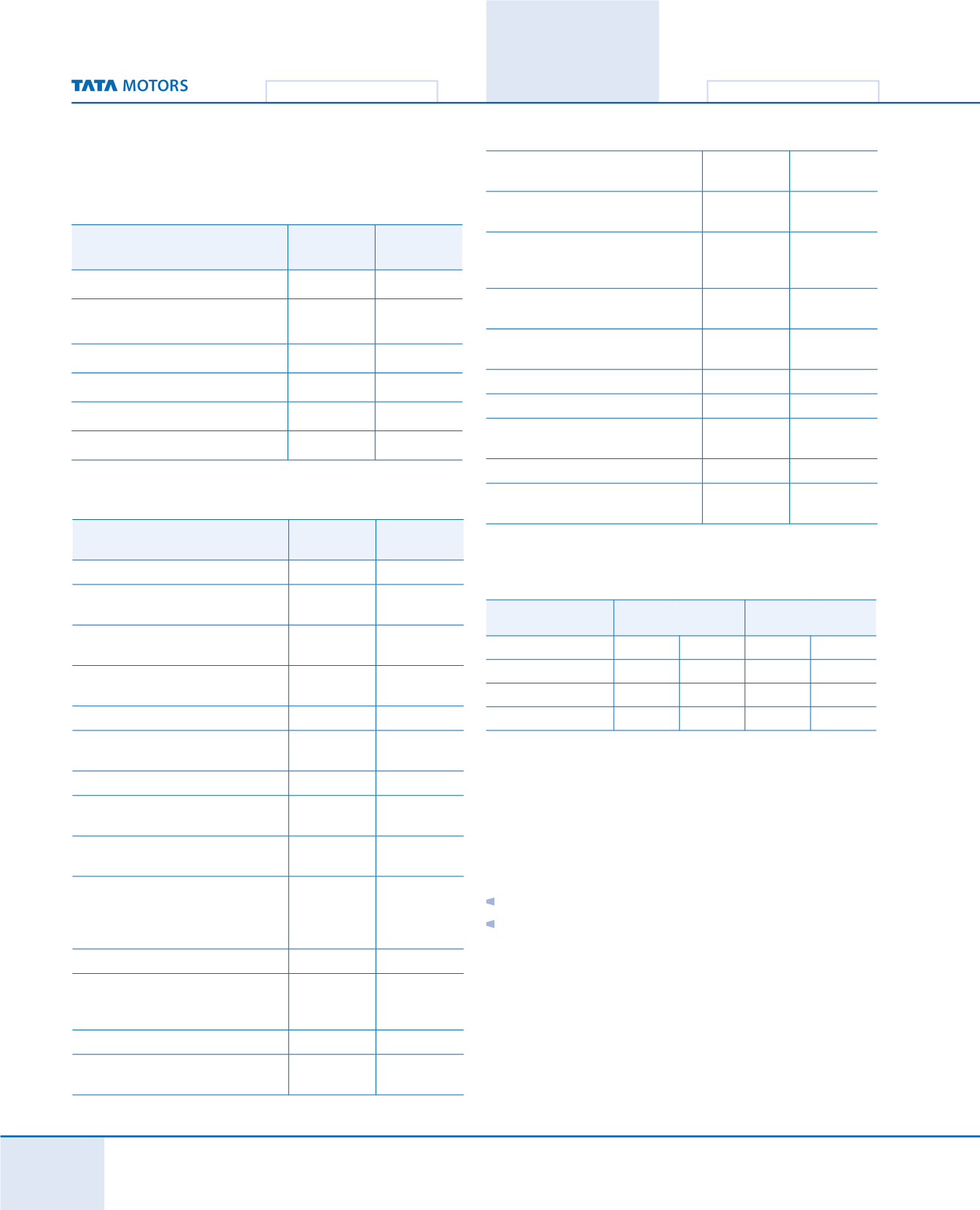

Particulars

Ordinary Shares

(%)

‘A’ Ordinary Shares

(%)

2014 2013 2014 2013

NSDL

97.75 97.28 98.17 97.78

CDSL

0.91

1.17

1.78

2.16

Total

98.66 98.56 99.95 99.94

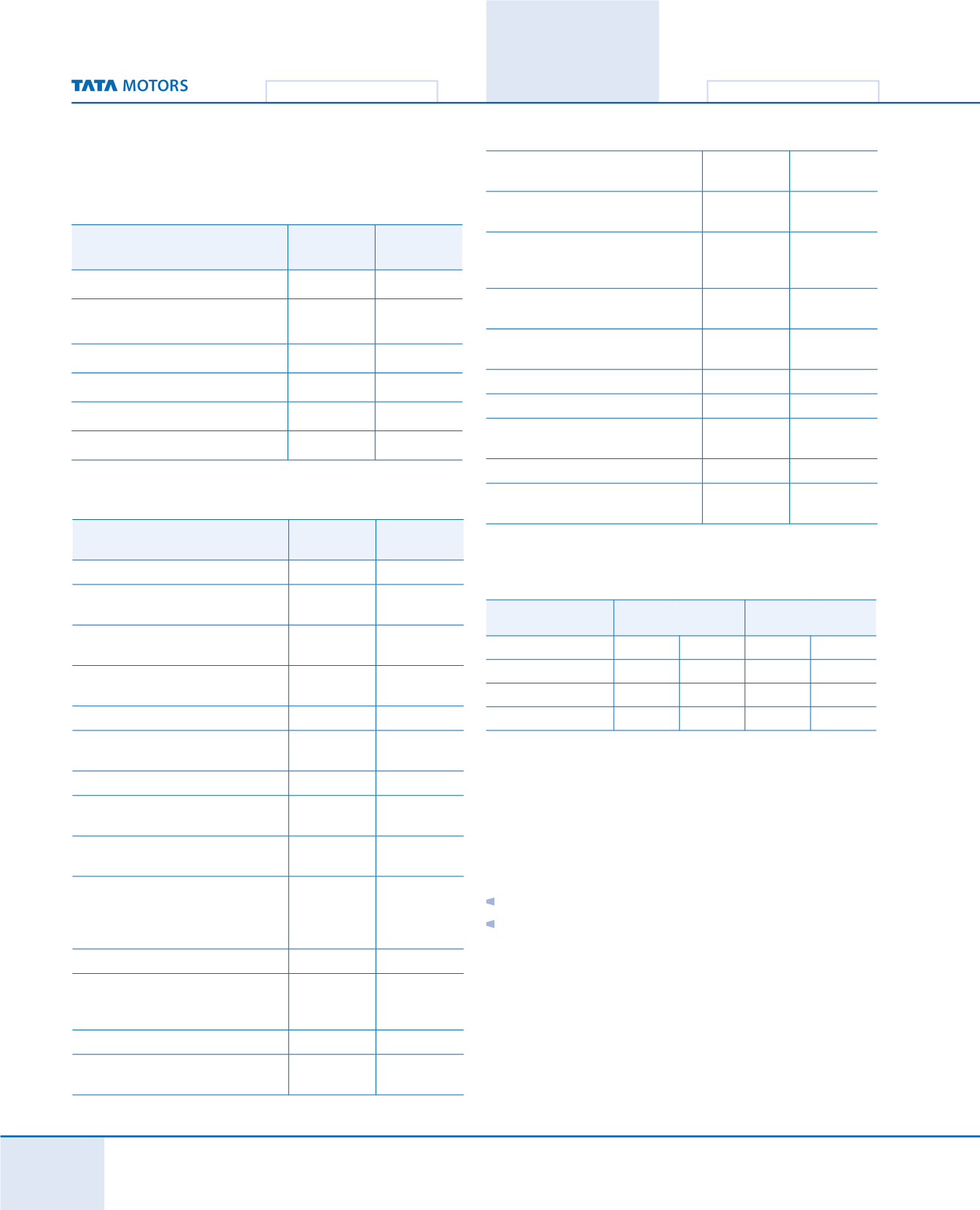

Name of Shareholder

No. of

shares held

% to paid-

up capital

Tata Sons Limited

70,23,33,345

25.66

Citibank N.A. New York, NYADR

Department

58,16,30,185

21.25

Tata Steel Limited

14,78,10,695

5.40

Life Insurance Corporation of India 10,77,84,195

3.94

Europacific Growth Fund

6,87,63,243

2.51

Tata Industries Limited

6,84,36,485

2.50

Top shareholders (holding in excess of 1% of capital) as on

March 31, 2014

Ordinary Shares

‘A’ Ordinary Shares

Eastspring Investments India Equi-

ty Open Limited

70,32,614

1.46

HDFC Trustee Company Limited –

HDFC Tax Saverfund

66,85,418

1.39

HSBC Global Investment Funds A/C

HSBC Global Investment Funds

BRIC Equity

66,46,455

1.38

D. E. Shaw Oculus Investments Bi-Fi

1 Mauritius Limited

65,00,000

1.35

Franklin Templeton Investment

Funds

63,50,000

1.32

Robeco Capital Growth Funds

59,90,000

1.24

Goldman Sachs (Singapore) Pte.

58,02,961

1.20

ICICI Prudential Focused Bluechip

Equity Fund

57,18,791

1.19

Monetary Authority of Singapore

55,44,813

1.15

Goldman Sachs Investments

(Mauritius) I Ltd.

48,58,981

1.01

Dematerialisation of shares

The electronic holding of the shares as on March 31, 2014 through

NSDL and CDSL are as follows:

Outstanding Securities:

OutstandingDepositary Receipts/Warrants or Convertible instruments,

conversion date and likely impact on equity as on March 31, 2014:

Depositary Receipts (Each Depository Receipts represents 5 underlying

Ordinary Shares of

`

2/- each post subdivision of face value of shares in

September 2011)

116,321,835 ADSs listed on the NewYork Stock Exchange.

8,872 GDSs listed on the Luxembourg Stock Exchange.

Foreign Currency Convertible Notes

741 - 4% Convertible Notes (due 2014) of US$100,000 each

aggregating US$74.1 million issued in October 2009 may, at the

option of the Note holders, be converted into Ordinary Shares

of

`

2/- each at

`

120.119 per share or ADS/GDS of

`

10/- each

(each ADS represents 5 Ordinary Shares of

`

2/- each) at

`

600.595

(Reset Price) at any time into GDSs during November 25, 2009 to