Statutory Reports

Corporate Overview

69th Annual Report 2013-14

108

Financial Statements

l.

Look into the reasons for any substantial defaults in payment to

the depositors, debenture holders, shareholders (in case of non-

payment of declared dividend) and creditors, if any.

m. Reviewing the effectiveness of the system for monitoring

compliance with laws and regulations.

n. Approving the appointment of CFO after assessing

the qualification, experience and background etc. of

the candidate.

o. Engage a registered valuer in case valuations are required in

respect of any property, stocks, shares, debentures, securities,

goodwill, assets, liabilities or net worth of the Company.

p. Reviewand suitably reply to the report(s) forwardedby the auditors

on the matters where auditors have sufficient reason to believe

that an offence involving fraud, is being or has been committed

against the Company by officers or employees of the Company.

q. Review the system of storage, retrieval, display or printout of

books of accounts maintained in electronic mode during the

required period under law.

r. Approve all or any subsequent modification of transactions with

related parties.

During the year, the Committee reviewed key audit findings

covering operational, financial and compliance areas. Management

personnel presented their risk mitigation plan to the Committee.

It also reviewed the internal control system in subsidiary

companies, status on compliance of its obligations under the

Charter and confirmed that it fulfilled its duties and responsibilities.

The Committee, through self-assessment, annually evaluates

its performance. The Chairman of the Audit Committee briefs

the Board members about the significant discussions at Audit

Committee meetings.

During the year under review, the Committee comprised of four

Independent Directors, all of whom are financially literate and have

relevant finance and/or audit exposure. Mr S M Palia, who was the

Financial Expert, stepped down as Director with effect from April

25, 2013. Mr Munjee has been appointed as the Financial Expert in

his place. The quorum of the Committee is two members or one-

third of its members, whichever is higher. The Chairman of the Audit

Committee also attended the last Annual General Meeting of the

Company. During the period under review, ten Audit Committee

meetings were held on April 3, 2013, May 27, 2013, July 9, 2013,

August 6, 2013, September 16, 2013, October 8, 2013, November

7, 2013, January 16/17, 2014, February 8, 2014 and March 25, 2014.

Each Audit Committee meeting which considers financial results

is preceded by a meeting which is attended only by the Audit

Committee members and the Auditors.

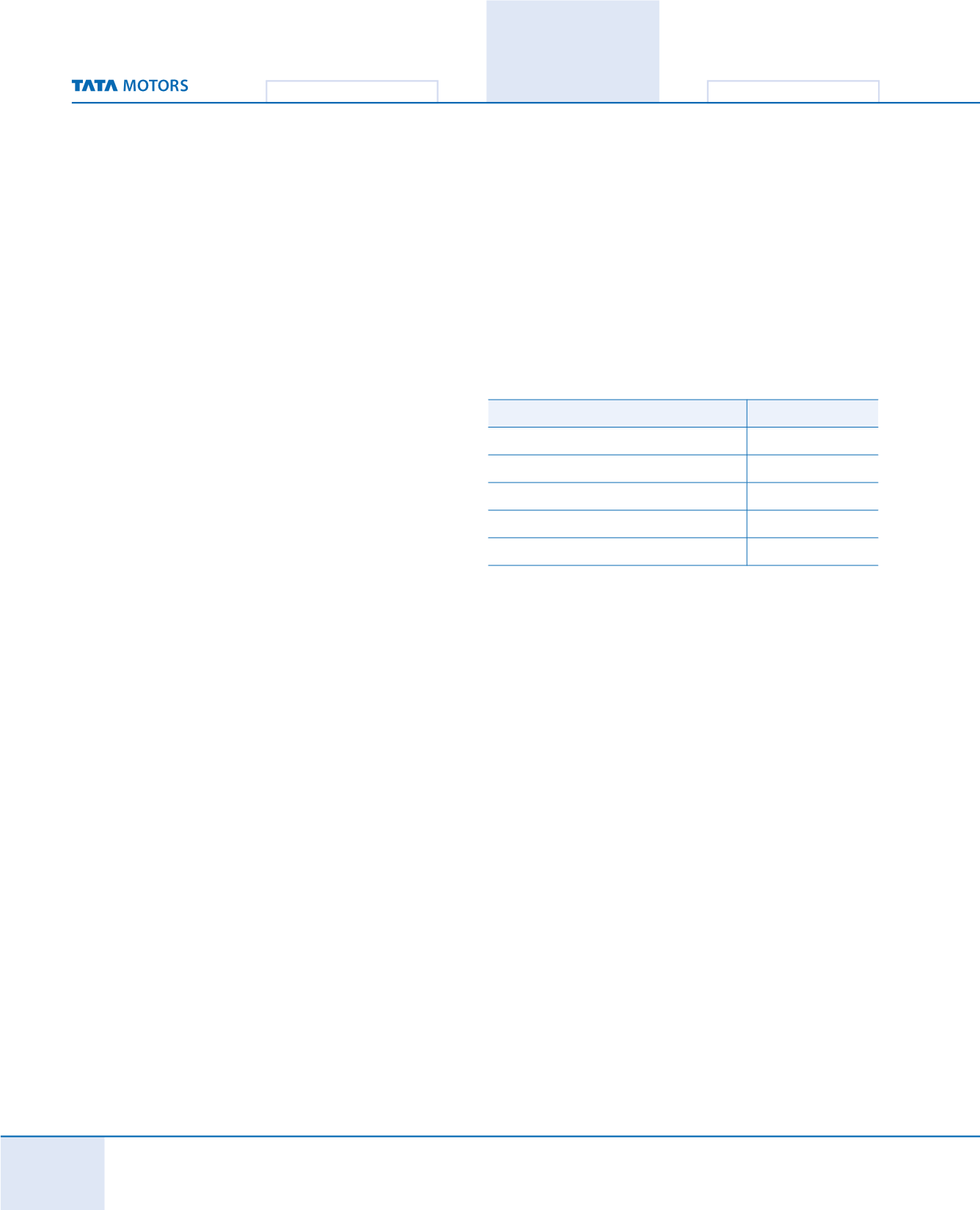

The composition of the Audit Committee and attendance at its

meetings is as follows:

Composition

Meetings attended

N Munjee (Chairman)

10

S M Palia

(1)

1

R A Mashelkar

8

V K Jairath

10

Falguni Nayar

(2)

8

(1) Ceased to be member w.e.f. April 25, 2013

(2) Appointed as member w.e.f. May 29, 2013

The Committee meetings are held at the Company’s Corporate

Headquarters or at its plant locations and are attended by

Managing Director, Executive Directors, Chief Financial Officer,

Chief Internal Auditor, Statutory Auditors and Cost Auditors. The

Business and Operation Heads are invited to the meetings, as and

when required. The Company Secretary acts as the Secretary of the

Audit Committee. The Chief Internal Auditor reports to the Audit

Committee to ensure independence of the Internal Audit function.

The Committee relies on the expertise and knowledge of

the management, the internal auditors and the independent

Statutory Auditor in carrying out its oversight responsibilities.

It also uses external expertise, if required. The management is

responsible for the preparation, presentation and integrity of

the Company’s financial statements including consolidated

statements, accounting and financial reporting principles. The

management is also responsible for internal control over financial

reporting and all procedures are designed to ensure compliance

with accounting standards, applicable laws and regulations

as well as for objectively reviewing and evaluating the

adequacy, effectiveness and quality of the Company’s system of

internal control.